Decrypt • May 06, 24

Grayscale's Ethereum Fund Discount Steadies as ETF Deadline Looms

Grayscale hopes to convert its Ethereum Trust to a spot ETH ETF, and current investors see opportunity in the uncertainty.

Read more

Create a Coinbase account to buy and sell Ethereum on the most secure crypto exchange.

Ethereum is a decentralized computing platform that uses ETH (also called Ether) to pay transaction fees (or “gas”). Developers can use Ethereum to run decentralized applications (dApps) and issue new crypto assets, known as Ethereum tokens.

Ethereum (ETH) is a decentralized, open-source blockchain that aims to become a global platform for decentralized applications and strives to enable users worldwide to write and run software resistant to censorship, downtime, and fraud. As the nonprofit Ethereum Foundation puts it, it "Is for more than payments. It's a marketplace of financial services, games, and apps that can't steal your data or censor you." Ethereum is the second-biggest cryptocurrency by market cap after Bitcoin as of 2023 and a decentralized computing platform that can run a wide variety of applications — including a universe of decentralized finance (or DeFi) apps and services. This platform is powered by its native cryptocurrency, Ether, which is used within the Ethereum network for various operations, making it an integral part of the system.

Ethereum operates through a blockchain network, which serves as a decentralized, immutable ledger to record transaction histories. At its core, it uses Ether (ETH), the platform's native digital currency, to enable computations and transaction validation within the ecosystem. In contrast to its predecessor, Bitcoin, Ethereum's blockchain aims to support a diverse range of applications on its network, from decentralized applications (DApps) to decentralized finance (DeFi) services. Initially using a proof-of-work (PoW) system, Ethereum shifted to a proof-of-stake (PoS) model with 'The Merge,' with the goal of enhancing efficiency and reducing environmental impact. Validators now stake ETH to secure the network, moving away from energy-intensive mining.

Ethereum's potential use cases extend beyond the simple transfer of value. Its platform enables the development of a wide range of decentralized applications (dApps) that operate on its blockchain. These dApps can offer services ranging from games to digital identity systems and from supply chain tracking to complex financial instruments. Ethereum also enables the creation and exchange of non-fungible tokens (NFTs), unique digital assets that can represent ownership of a variety of items and content.

In 2013, a 19-year-old computer programmer (and Bitcoin Magazine co-founder) named Vitalik Buterin released a whitepaper proposing a highly flexible blockchain that could support virtually any kind of transaction. Buterin, along with other co-founders, including Gavin Wood, secured funding for the project with the sale of $18 million in pre-launch tokens in 2014. In July 2015, the first public version of the Ethereum blockchain was launched, and smart contract functionality began to roll out on the Ethereum blockchain. Since its launch, Ethereum has undergone several planned protocol upgrades, known as milestones, which improve the system's functionality, performance, and security. These upgrades are decided by consensus within the community and aim to represent the ongoing development and forward-thinking nature of the Ethereum project. In 2022, Ethereum went through a major upgrade, switching from proof-of-work to proof-of-stake to become a more secure and energy-efficient blockchain.

Ethereum, like Bitcoin, is an open-source project that is not owned or operated by a single individual. Anyone with an internet connection can run an Ethereum node or interact with the network. However, Ethereum differs from Bitcoin in its ability to build and execute smart contracts. Smart contracts enable a vast ecosystem of applications on Ethereum, such as stablecoins (which are pegged to the dollar by smart contract), decentralized finance apps (collectively known as DeFi), and other decentralized apps (or dApps). Until recently, Ethereum and Bitcoin were both secured by "miners" running specialized hardware to solve difficult math problems. In September 2022, Ethereum mining was phased out, and Ethereum transitioned to Proof-of-Stake. Ethereum is now secured by a global network of validators running Ethereum's software while staking (understand "locking") a certain amount of ETH tokens. Validators earn rewards generated in Ether (ETH) for participating in the process and can have their stake slashed if they violate the rules of the protocol. Anyone with an ETH stake and computer meeting the requirements can become a validator.

Coinbase makes it easy and secure to stake your ETH. Through Coinbase's built-in staking feature, anyone can stake their ETH (as much or as little as you'd like) in just a few taps. In your Coinbase app, navigate to the ETH asset page. You'll see a prompt to stake your ETH. If you want to sell or send your ETH staked on Coinbase, you can do so by converting it to cbETH, Coinbase's Wrapped Staked ETH token. The price of cbETH is determined by the market and may lose value. cbETH is available in select regions.

Like Bitcoin, Ethereum's price is based on a global marketplace of supply and demand. Its price can be volatile in the short term as demand overwhelms supply and vice versa.

By creating an account on Coinbase or an increasing number of other reputable financial technology companies, you can buy, send, and receive Ethereum.

Smart contracts are digital contracts stored on a blockchain that are automatically executed when predetermined terms and conditions are met. Essentially, they are programs stored on a blockchain that activate when specific conditions are fulfilled. They are commonly used to automate the execution of an agreement, enabling all participants to anticipate the potential outcome, without the need for an intermediary or time delay. They can also automate a workflow, initiating the next action when conditions are met. Smart contracts operate by following simple “if/when…then…” statements that are written into code on a blockchain. A network of computers carries out the actions when predetermined conditions have been met and verified. These actions could include executing the agreed-upon actions, registering a vehicle, sending notifications, or issuing a ticket. The blockchain is then updated when the transaction is completed. This means that the transaction is typically immutable, and typically, only parties who have been granted permission may have access to the results.

Yes, Ethereum is a type of blockchain. It is a decentralized global software platform powered by blockchain technology. Ethereum is known for its native digital asset, ether (ETH), but it has functionalities beyond being a digital currency. It's a platform that allows developers to build and deploy smart contracts and decentralized applications (dApps). These smart contracts aim to execute transactions when certain conditions are met, with the intention of reducing the need for a third party. Ethereum's blockchain is designed with scalability, programmability, and decentralization in mind, which is why some developers and enterprises consider using it for blockchain technology applications. Ethereum, while having its own digital asset, primarily serves to facilitate and host blockchain-based applications.

Ethereum is closely associated with decentralized applications (dApps) as it provides the foundational infrastructure for their development and operation. Decentralized applications are software programs that run on a blockchain or peer-to-peer network of computers, rather than on a single computer. They are often built on the Ethereum platform, which provides an open-source, decentralized environment that is designed to operate without centralized control or interference. Ethereum's smart contract technology is a key component in the functioning of dApps, enabling automated, self-executing contracts with the terms of the agreement directly written into code. This approach seeks to reduce dependency on third-party facilitators, with an intention to maintain efficiency and trust. Ethereum's flexibility and robust infrastructure have made it a choice for developers creating dApps for a range of applications.

Ethereum 2.0, also known as Eth2, is a multi-phased revision with the intention of enhancing the Ethereum network's scalability, security, and sustainability. A notable change is the shift from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) model. This transition seeks to make the network more energy-efficient and accessible. The revision is divided into several phases, including the Beacon Chain, the Merge, and Shard Chains. The Beacon Chain, launched in 2020, introduced staking and marked the beginning of the transition to PoS. The Merge, which was completed in September 2022, integrated the Beacon Chain with the Ethereum mainnet, officially transitioning to PoS. Ethereum 2.0 intends to enhance the network's speed, accessibility, and security, and seeks to lessen its environmental impact.

ERC-20 tokens are a type of digital asset created on the Ethereum blockchain, adhering to a specific set of rules or standards known as ERC-20. This standard ensures that these tokens can interact seamlessly with other products, services, and tokens within the Ethereum ecosystem. ERC-20 tokens are fungible, meaning they can be exchanged on a one-for-one basis with other tokens of the same type. They can represent a variety of assets or rights, including ownership, access, or even other cryptocurrencies. Developers use ERC-20 to create tokens that can be used in decentralized applications (dApps), interacted with on various platforms, or used in token distribution events. The standardization provided by ERC-20 has streamlined the process of creating and managing tokens on the Ethereum blockchain.

Ethereum achieves consensus through a mechanism known as Proof-of-Stake (PoS). In this system, validators are chosen to create new blocks based on the amount of Ethereum's native cryptocurrency, Ether (ETH), they hold and are willing to 'stake' as collateral. Validators propose blocks and validate transactions, and their influence is proportional to the amount of ETH they have staked. This system encourages validators to act honestly, as they have a participatory stake in the network and stand to lose their staked ETH if they attempt to validate fraudulent transactions. Ethereum's PoS system is designed with energy efficiency and network integrity in mind. It strives to uphold a decentralized structure by providing participants holding ETH the potential to become validators, thereby diffusing control across a broad network of participants.

Earn free crypto after making your first purchase. Terms apply.

Sum of median estimated savings and rewards earned, per user in 2021 across multiple Coinbase programs (excluding sweepstakes). This amount includes fee waivers from Coinbase One (excluding the subscription cost), rewards from Coinbase Card, and staking rewards.

Market cap

$369.6B

Volume (24h)

$13.2B

Circulating supply

120.1M ETH

Typical hold time

44 days

Popularity

#2

All time high

$4,721.07

Price change (1h)

+0.39%

Price change (1d)

-1.99%

Price change (1w)

-3%

Price change (2w)

-3.45%

Price change (1m)

-9.65%

Price change (1y)

+63.49%

Decrypt • May 06, 24

Grayscale's Ethereum Fund Discount Steadies as ETF Deadline Looms

Grayscale hopes to convert its Ethereum Trust to a spot ETH ETF, and current investors see opportunity in the uncertainty.

Read more

The Block • May 06, 24

SEC delays making a decision on the proposed Invesco Galaxy spot Ethereum ETF

The U.S. SEC is delaying making a decision on next steps for the Invesco Galaxy Ethereum exchange-traded fund.

Read more

BeInCrypto • May 06, 24

Arbitrum Becomes the First Layer 2 to Surpass $150 Billion on Uniswap

Arbitrum has marked a significant milestone as the first Layer 2 to exceed $150 billion in trading volume on Uniswap, reflecting its growing dominance and potential in the decentralized finance landscape.The post Arbitrum Becomes the First Layer 2 to Surpass $150 Billion on Uniswap appeared first...

Read more

CoinDesk • May 06, 24

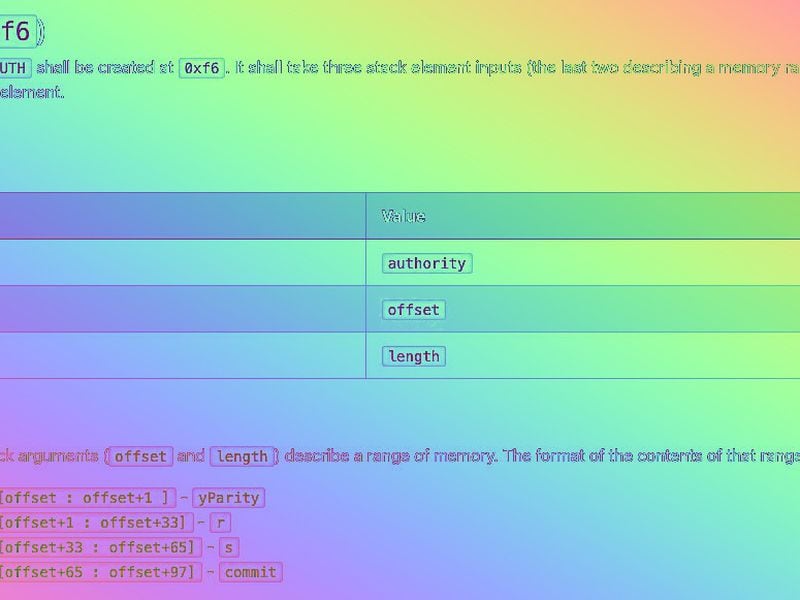

Ethereum Developers Target Ease of Crypto Wallets With 'EIP-3074'

EIP-3074 has drawn both support and concern from the Ethereum community, a code change that is supposed to improve the user experience with wallets on the blockchain.

Read more

BeInCrypto • May 06, 24

Ethereum Investors Are Holding as ETH Surges Past $3,000

Ethereum's price is attempting to hold above a key support level, losing which could extend the losses witnessed by investors.The post Ethereum Investors Are Holding as ETH Surges Past $3,000 appeared first on BeInCrypto.

Read more

Bitcoin Magazine • May 06, 24

The Weekly Re-Org: Finishing Satoshi's Work

Some outlines of rough consensus are shaping up

Read more

A selection of conversions from different assets to top cryptocurrencies.

A selection of conversions for different assets and currencies.

KRL - YER

Kryll - Yemeni Rial

GFI - GIP

Goldfinch Protocol - Gibraltar Pound

CLV - KHR

Clover Finance - Cambodian Riel

ARPA - CHF

ARPA Chain - Swiss Franc

AUCTION - BAM

Bounce Token - Bosnia and Herzegovina Convertible Mark

USDC - SZL

USDC - Swazi Lilangeni

SPELL - BRL

Spell Token - Real

MTL - MAD

Metal DAO - Moroccan Dirham

KARRAT - MVR

Karrat - Maldivian Rufiyaa

OXT - KES

Orchid - Kenyan Shilling

WAXL - IQD

Wrapped Axelar - Iraqi Dinar

SAFE - KGS

Safe - Kyrgyzstani Som

People who viewed Ethereum tend to also view the following cryptocurrencies.

Assets with the biggest change in unique page views on coinbase.com over the past 24 hours.

A selection of cryptocurrencies in the top 50 by market cap.

A selection of the most recently added cryptocurrencies.

Of all the assets on Coinbase, these 12 are the closest to Ethereum in market cap.

Here is a selection of spot and futures markets that people watch

A selection of other relevant cryptocurrencies

433,442 unique individuals are talking about Ethereum and it is ranked #3 in most mentions and activity from collected posts. In the last 24 hours, across all social media platforms, Ethereum has an average sentiment score of 3.4 out of 5. Finally, Ethereum is becoming less newsworthy, with 13 news articles published about Ethereum. This is a 13.33% decrease in news volume compared to yesterday.

On Twitter, people are mostly neutral about Ethereum. There were 36.58% of tweets with bullish sentiment compared to 5.99% of tweets with a bearish sentiment about Ethereum. 57.43% of tweets were neutral about Ethereum. These sentiments are based on 239854 tweets.

On Reddit, Ethereum was mentioned in 3132 Reddit posts and there were 5496 comments about Ethereum. On average, there were more upvotes compared to downvotes on Reddit posts and more upvotes compared to downvotes on Reddit comments.

Powered by LunarCrush

Contributors

433,442 people

Posts

221,799 posts

Dominance

1.73%

Volume rank

#3

Average Sentiment

3.4 out of 5

News Articles

13

Tweet Count

239,854 people

Sentiment

36.58%

Bullish

57.43%

Neutral

5.99%

Bearish

Posts

3,132

Comments

5,496

Post Score

39,335

Comment Score

42,085

Conversion Table

ETH/USD (United States Dollar)

$3,083.24

ETH/CAD (Canadian Dollar)

CA$4,214.83

ETH/GBP (British Pound)

£2,455.35

ETH/JPY (Japanese Yen)

¥473,807.00

ETH/INR (Indian Rupee)

₹257,360.56

ETH/BRL (Real)

R$15,651.66

ETH/EUR (Euro)

€2,864.06

ETH/NGN (Nigerian Naira)

NGN 4,262,574.28

ETH/KRW (South Korean Won)

₩4,188,161.75

ETH/SGD (Singapore Dollar)

S$4,167.14

Coinbase

How to Buy Ethereum

Good news! You can buy Ethereum on Coinbase's centralized exchange. We've included detailed instructions to make it easier for you to buy Ethereum.

Read more

Coinbase

How to Stake Ethereum

Ethereum is currently available to stake on Coinbase’s centralized exchange, subject to locations where staking is allowed.

Read more

Alt weekly: ETH, DOGE, and other tokens surge following bitcoin rally

COINBASE BYTES • MAR 14, 2024

Fork it over: Ethereum’s Dencun upgrade has arrived

COINBASE BYTES • MAR 18, 2024

Learn how we collect your information by visiting our Privacy Policy.

The price of Ethereum has increased by 0.39% in the last hour and decreased by 1.99% in the past 24 hours. Ethereum’s price has also fallen by 3.00% in the past week. The current price is $3,083.24 per ETH with a 24-hour trading volume of $13.20B. Currently, Ethereum is valued at 34.69% below its all time high of $4,721.07. This all-time high was the highest price paid for Ethereum since its launch.

The current circulating supply of Ethereum is 120,101,536.932 ETH which means that Ethereum has as total market cap of 120,101,536.932.

We update our Ethereum to USD currency in real-time. Get the live price of Ethereum on Coinbase.

The current market cap of Ethereum is $369.64B. A high market cap implies that the asset is highly valued by the market.

The all-time high of Ethereum is $4,721.07. This all-time high is highest price paid for Ethereum since it was launched.

Over the last 24 hours, the trading volume of Ethereum is $13.20B.

Assets that have a similar market cap to Ethereum include Bitcoin, Tether, BNB, and many others. To see a full list, see our comparable market cap assets.

The current circulating supply of Ethereum is 120 million.

The median time that Coinbase customers hold Ethereum before selling it or sending it to another account or address is 44 days.

Ethereum ranks 2 among tradable assets on Coinbase. Popularity is currently based on relative market cap.

Currently, 84% of Coinbase users are buying Ethereum. In other words, 84% of Coinbase customers have increased their net position in Ethereum over the past 24 hours through trading.

Yes, Ethereum is currently available on Coinbase’s centralized exchange. For more detailed instructions, check out our helpful how to buy Ethereum guide.

Certain content has been prepared by third parties not affiliated with Coinbase Inc. or any of its affiliates and Coinbase is not responsible for such content. Coinbase is not liable for any errors or delays in content, or for any actions taken in reliance on any content. Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset. Prices shown are for illustrative purposes only. Actual cryptocurrency prices and associated stats may vary. Data presented may reflect assets traded on Coinbase’s exchange and select other cryptocurrency exchanges.