Tokenomics 101

From token supply to market cap, a beginner’s guide to basic crypto economics

Definition

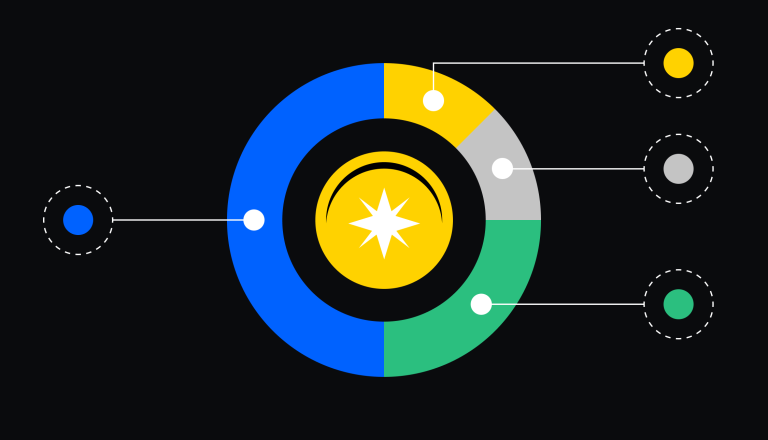

Tokenomics is the analysis of a cryptocurrency’s fundamental characteristics, which can help you compare tokens with each other and make better informed decisions. It takes into account attributes like market capitalization, supply, inflation or deflation, how new tokens are distributed, utility, and many other factors.

Ever wondered why one Yearn.finance (YFI) token is worth 800 million times more than 1 Shiba Inu (SHIB) token — even though SHIB’s current market capitalization is vastly higher than YFI’s?

One factor you’d probably consider in thinking about whether a cryptocurrency’s price makes sense is the usefulness — or utility — of that cryptocurrency. A token might be used to pay the gas fees required to execute smart contracts on a blockchain network, or provide the owner with a say in the future of a protocol, among countless other functions. But utility is just one aspect that influences a token’s price. Among a huge range of other factors are some basic attributes baked into each cryptocurrencies’ design, like token supply (both how much of it there is currently and how much there will be in the future). If you’re pondering where to look to understand the bigger picture of factors that impact token price, the answer lies in each project’s’ “token economics,” commonly referred to as tokenomics.

Every cryptocurrency has a unique tokenomic structure, which plays a key role in determining its market price. Understanding the factors that make up a cryptocurrency’s tokenomic structure is essential to understanding the fundamental value of any crypto — and thus is fundamental to making smart trades. Fortunately, we have you covered.

Token supply

A cryptocurrency’s supply is a powerful factor that can influence token price, especially over time. Some cryptocurrencies — like Bitcoin — have a maximum, fixed supply. Other cryptocurrencies have an unlimited supply.

The initial circulating supply, upon the token’s launch, varies greatly among cryptocurrencies. Once the initial token supply is circulating, the inflation rate (or rate of supply distribution) may remain linear or vary over time. Beyond miner and staking rewards driving supply inflation, there may be a token unlock schedule that determines when eligible investors receive tokens in exchange for their initial investment. Other supply inflation factors include distribution of tokens used as incentives to grow the cryptocurrency’s ecosystem. The most important takeaway here is that supply inflation rates vary greatly among cryptocurrencies, as all cryptocurrencies have different initial supplies and factors driving inflation to various degrees.

Beyond supply inflation, some cryptocurrencies have a burning mechanism, where a portion of the token’s supply is removed from circulation. Burning mechanisms have the opposite effect of inflation, as they are used by cryptocurrencies to reduce total token supply over time, otherwise known as a deflationary cryptocurrency. Avalanche (AVAX) is an example of a deflationary cryptocurrency, as it has a maximum supply of 720 million AVAX tokens, and each AVAX transaction burns a portion of a supply.

What is market capitalization?

A cryptocurrency’s current market capitalization is calculated by taking the current market price and multiplying it by the circulating supply. Fully-diluted market capitalization differs from current market capitalization because it is calculated using the maximum possible supply multiplied by the current market price. (There’s a difference between the fully diluted and current market capitalization values, because many cryptocurrencies do not have all of their tokens in circulation.)

Here's an example — using a token with a fixed supply — that will help illustrate this concept:

Current Market Capitalization: If token X is trading at $1 with a circulating supply of 1 million tokens, the current market capitalization equals $1 million.

Fully Diluted Market Capitalization: Now let’s say token X has a maximum supply capped at 5,000,000 tokens, which represents a five-fold increase from the current circulating supply. In this scenario, Token X’s fully diluted market capitalization would be equal to $5 million if it were currently trading at $1.

In order to maintain a $1 price once the maximum supply is circulating, the market value of token X must increase by 5x to offset the effect of the token supply dilution.

Why does the fully diluted market capitalization matter?

Simply put, fully diluted market capitalizations matter because they underscore the potential for your investment to be diluted by token supply increases if the market demand for the token does not equal or outpace the rate of inflation. Aside from a few exceptions, when a cryptocurrency’s supply increases, current owners are affected by supply dilution, meaning they own proportionally less of the token’s circulating supply.

Let’s say you purchased 100 XYZ tokens, which represented 1% of XYZ circulating supply at the time of purchase. Over the following year, the inflation rate doubled the supply. Instead of owning 1% of the circulating supply, you would own 0.5%, demonstrating the effect of supply dilution.

Traditional commodities, such as gold, share this property with cryptocurrency. Gold owners worldwide would find their initial investment significantly less valuable if an enormous gold mine was recently found, as their investment is diluted by the increase of total gold supply from the mine. This example underscores why understanding the ratio of current to fully diluted market capitalization, or circulating to maximum token supply, is of the utmost importance when evaluating a cryptocurrency.

Researching Tokenomics

Tokenomic information can generally be found within a cryptocurrency project’s whitepaper. You can also get a lot of tokenomic info from online resources such as Coinbase, CoinMarketCap, CoinGecko, and Messari. Here’s how to interpret some of the information you can find via Coinbase:

Coinbase

Coinbase provides basic tokenomic information for the majority of popular cryptocurrencies. Here’s how you can access it:

Navigate to Coinbase Prices: Visit https://www.coinbase.com/price and select or search for a cryptocurrency.

View Tokenomic Data: Once you have selected a cryptocurrency, market capitalization and token supply information will appear below the price graph.

Tokenomic understanding

Tokenomic understanding is a fantastic starting point for an investor to compare and contrast the qualities of cryptocurrencies to other investment vehicles.

For example, the same factors that cause 1 SHIB token to be worth significantly less than 1 YFI token, despite SHIB having a much larger market capitalization, applies to the price discrepancy between 1 share of AAPL and 1 share of AMZN. AAPL has a lower share price because it simply has more outstanding shares than AMZN, despite the total market capitalization of AAPL being greater than AMZN.

On the other hand, common stocks may experience a stock split, where the total number of outstanding shares either increases or decreases, but each stock owner sees the same proportionate change in their share ownership. Cryptocurrency owners do not experience an increase in the supply they own when the total supply increases, aside from a few exceptions, including cryptocurrencies that accrue staking rewards. However, the cryptocurrency’s overall supply inflation rate may exceed the staking APY, as other factors such as ecosystem reserves increase the annual, overall supply inflation rate. This means although an owner receives more tokens through staking rewards, their position is still relatively diluted in context of the entire token supply when overall inflation is considered.

Tokenomic understanding allows an investor to see the bigger picture of the conditions that their investment will face in the future. An investor must be aware of future supply inflation trends and its relationship to current market capitalization if they want to understand market capitalization growth needed to achieve a specific return on investment.