Introduction

The US Securities and Exchange Commission (SEC) officially approved 11 spot bitcoin ETFs in the US on January 10. Despite this being a watershed moment for the cryptoeconomy, we think institutional investors have over-indexed on the short-term impacts that these products may have. Consequently, market players may be missing out on other opportunities and themes that could be relevant in the post spot bitcoin ETF environment.

First, we believe a search for yield will rejuvenate interest in decentralized finance (DeFi) in 2024. Not only has (1) the “cash and carry” trade between bitcoin CME futures vs spot become less lucrative given the access to ETFs but (2) central banks in many G10 economies will soon begin cutting interest rates in earnest. We think this may unlock capital that will need a new home.

Second, we believe there’s room for ETH to play catch up to its peers in 1H24. Although there was some rotation into ETH after the launch of spot bitcoin ETFs, the momentum was arrested by liquidations from a large defunct crypto lender alongside pressure from the sale of ETH options. We’re optimistic that the potential approval of spot ETH ETFs may be a catalyst for new flows (which doesn’t seem to be priced in) but there’s no consensus on this.

Finally, bitcoin miners have represented an important source of BTC selling since early November 2023. We think the Bitcoin halving in April may negatively affect the economics around mining, potentially increasing the sell pressure on miners as margins narrow and less excess profit can be retained in bitcoin. The impact of miner selling on markets, however, may not be immediate.

Short-term overestimation

Following the approval of spot bitcoin ETFs in the US, attempts to capture the performance impact of the $1.46B net inflow (between January 11 and 31 according to Bloomberg) into these products has been enormously difficult for several reasons.

First, it’s important to recognize that while the launch of these products are a watershed moment for the cryptoeconomy, US-based ETFs currently represent only 10-15% of the total BTC spot trading volume across global centralized exchanges and only 3% of outstanding bitcoin supply (or around 650k BTC).

Second, the SEC’s mandate of cash (rather than in-kind) creations and redemptions of ETF shares has introduced settlement latency between when authorized participants receive buy or sell orders and when issuers can create or redeem the corresponding shares. That time lag can create misalignments between onscreen ETF share prices and the actual net asset value (NAV). This can exacerbate the third issue, which is that there has been a number of offsetting flows among not only US-based ETFs but also global exchange-traded products and bitcoin proxies:

- A rebalancing of allocations away from less efficient bitcoin holding vehicles to more efficient ones like ETFs

- A rotation away from higher fee products in some jurisdictions to the lower fee products in the US

- A liquidation of some positions in pre-existing vehicles, such as FTX sales of their 22.3M shares outstanding in Grayscale Bitcoin Trust (GBTC) with others potentially on the way

Apart from ETF-related drivers of bitcoin performance, bitcoin miners were also an important source of selling pressure in January as this cohort reduced their net reserves by around 6000 BTC, based on CryptoQuant data. Reserves have been falling since November but seem to have found an interim floor near 1.83M BTC. Also a number of basis trades (long bitcoin spot, short CME futures) were opened days ahead of the ETF launches (we think possibly even by some APs), and unwinding them may have disrupted market liquidity and algorithm signals (i.e. CTA trackers). But the open interest on CME bitcoin futures seems to be stabilizing near 20,500 contracts ($4.4B) – in line with the December average – suggesting these positions have now been closed.

Taken together, we think the overhang of asset liquidations and other sources of technical spot bitcoin selling pressure are starting to abate, so BTC may soon start to trade more on fundamentals in the weeks ahead. In the short term, given the fairly benign macro backdrop, we think the current setup is positive for the asset class. Looking farther afield, we also see three key themes that may be worth watching in a post spot bitcoin ETF environment: (1) rising DeFi activity, (2) ether strength and (3) selling pressure on bitcoin miners.

DeFi ascends, basis recedes

One of the unintended casualties of US spot bitcoin ETFs is the “cash and carry” trade, which has historically been an important way for institutions to get synthetic exposure to bitcoin (particularly as many are barred from accessing the real thing). Specifically, trading the basis aims to profit from the price difference between bitcoin spot and CME futures. It’s ostensibly employed by many market players as a market-neutral strategy, even though in practice it doesn’t entirely mitigate directional risk because of supply-demand dynamics, changes in market sentiment and other factors.

Since the launch of spot bitcoin ETFs, the CME futures basis has dropped sharply from levels of 25-45% (annualized) in late 2023 to an average of 10% in the weeks following the ETFs launch – not very lucrative, in our view, in light of the capital requirements for this trade. We see several reasons for this:

- Spot bitcoin ETFs are an elegant solution for Institutional players seeking direct bitcoin exposure, especially when compared to dealing with the separate transaction legs and financing costs of trading the basis.

- Futures-based bitcoin ETFs like the ProShares Bitcoin Strategy ETF (BITO) have roll costs that make them more expensive than spot bitcoin ETFs. The potential rotation we’re seeing into the latter may drive down liquidity in CME futures markets – eroding one of its relative benefits compared to spot markets.

That said, futures and futures ETFs still have a place in the ecosystem, as authorized participants like broker-dealers need to hedge their cash settlements intraday and can only use regulated instruments. Moreover, traditional market players will now be able to trade the basis more easily by, for example, buying the spot ETF and selling CME futures on leverage. That’s important to mention because typically, the first principal component of the basis in fixed income tends to be the cost of leverage, so if interest rate cuts and the Fed’s tapering of quantitative tightening makes leverage less of a binding constraint, the basis may still be attractive.

On the other hand, those conditions may also encourage many market participants to look for other ways to outperform the basis trade. That could represent upwards of $5B of capital that may be looking for a new home, based on our estimate of the total notional value of all existing CME bitcoin futures basis trades outstanding.

Note that it's difficult to know the precise total outstanding, as that data is not publicly available. But our figure assumes that leveraged funds’ net short position in CME bitcoin futures should be a good proxy for bitcoin basis trading activity, as it’s akin to what the Bank for International Settlements (BIS) cites as its proxy for basis trading activity in US Treasury futures. We estimate then that around 11,100 contracts (or $2.4B as each contract represents 5 BTC) could be employed in BTC basis trades, per the six-month average of CFTC data published up to January 30. Since open interest only captures one side of the trade, we also add back the equivalent spot position.

We believe a good portion of that $5B in capital could make its way into decentralized finance (DeFi) protocols like borrowing and lending or automated market makers, which are already offering more competitive yields versus US Treasuries. Indeed, onchain stablecoin lending rates have doubled throughout 2H23 to upwards of 7-10% depending on the network (see chart 3). Keep in mind too that the majority of DeFi activity still takes place on Ethereum, where 58% of the $60.4B in total value locked (TVL) resides.

What to do about ETH?

We think ether (ETH) has room to catch up after underperforming many peers (including BTC and SOL) over the last few months (since the start of 4Q23). In January, technical factors like the liquidation of a large ETH position by a defunct crypto entity as well as the sale of ETH call options by a major overwriter may have contributed to that gap. But now, volumes on both ETH spot and futures trading across global centralized exchanges appear to be light, based on CoinMetrics data.

We see room for ETH upside for several reasons. First, the approval of spot bitcoin ETFs formalizes crypto as an asset class among institutional investors, and both bitcoin and ether are the two most popular cryptocurrencies in that asset class with nearly 80% of the total US$1.7T crypto market cap. To put it another way, ETH is a crucial part of many market player benchmarks, so as more institutions enter this space, under-owning ETH potentially represents real career risk.

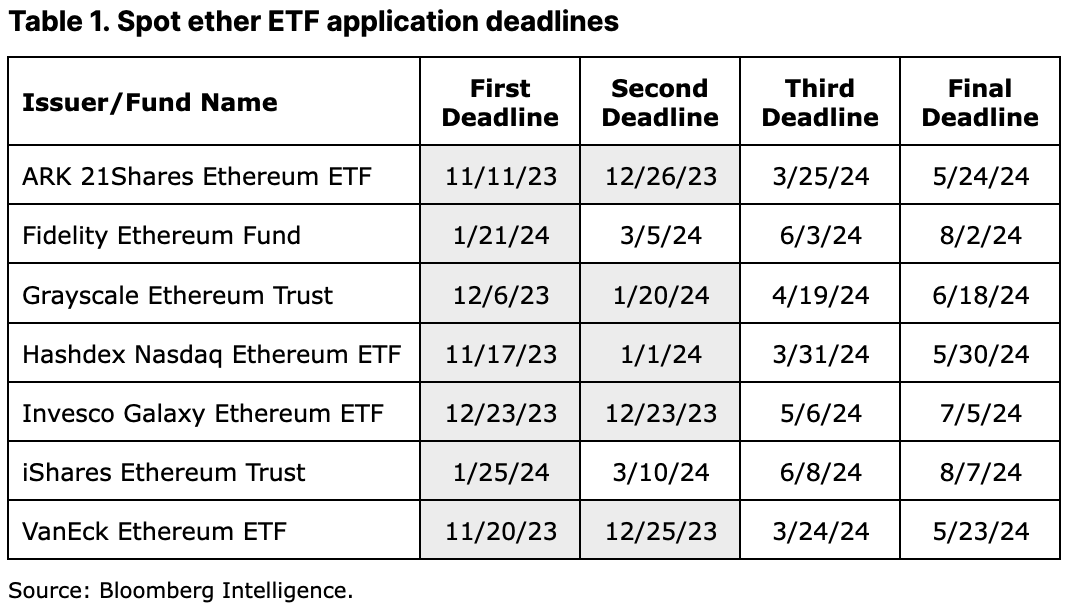

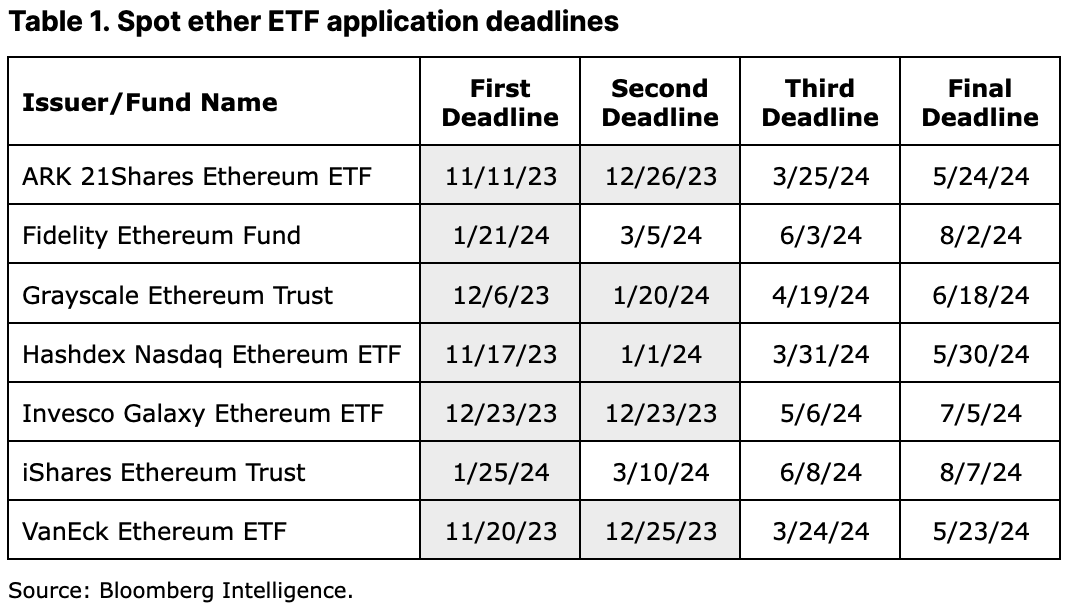

Second, having spot bitcoin ETFs in the US also improves the odds for a spot ether ETF. That is, we believe that ETH could receive the same treatment as BTC with respect to the possible collective approval of spot ether ETFs as early as May 23 – the soonest available final deadline for the current group of six applicants (ex-Grayscale conversion). However, what distinguishes spot ether ETFs from spot bitcoin ETFs, first and foremost, is the classification and still undefined regulatory status of ETH.

Recall that the central issue in the DC Circuit Court of Appeals’ ruling in the Grayscale Investments LLC case against the SEC was the relationship between CME bitcoin futures and bitcoin spot. This holds significant implications for ETH. The Commodity Futures Trading Commission (CFTC) initially allowed CME to list ETH futures (back in January 2021) as “standard” futures rather than “securities” futures – a decision that went unchallenged by the SEC. If the legal status of ETH were to become a problem for spot ETH ETF applications, that could reflect poorly on that 2021 decision and open up a potential conflict with the CFTC.

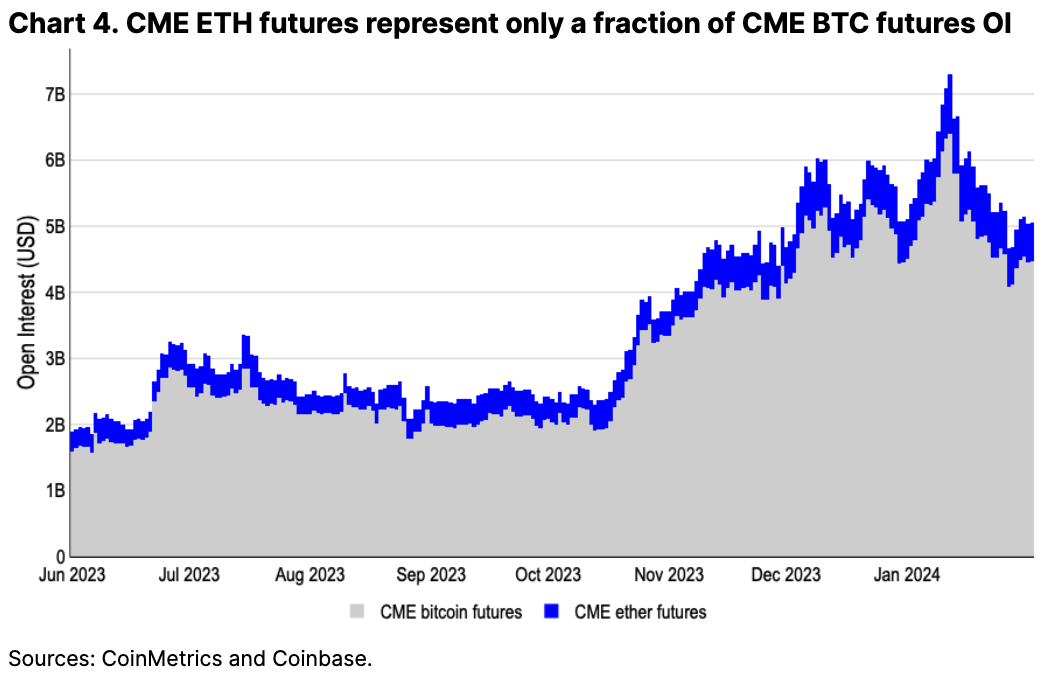

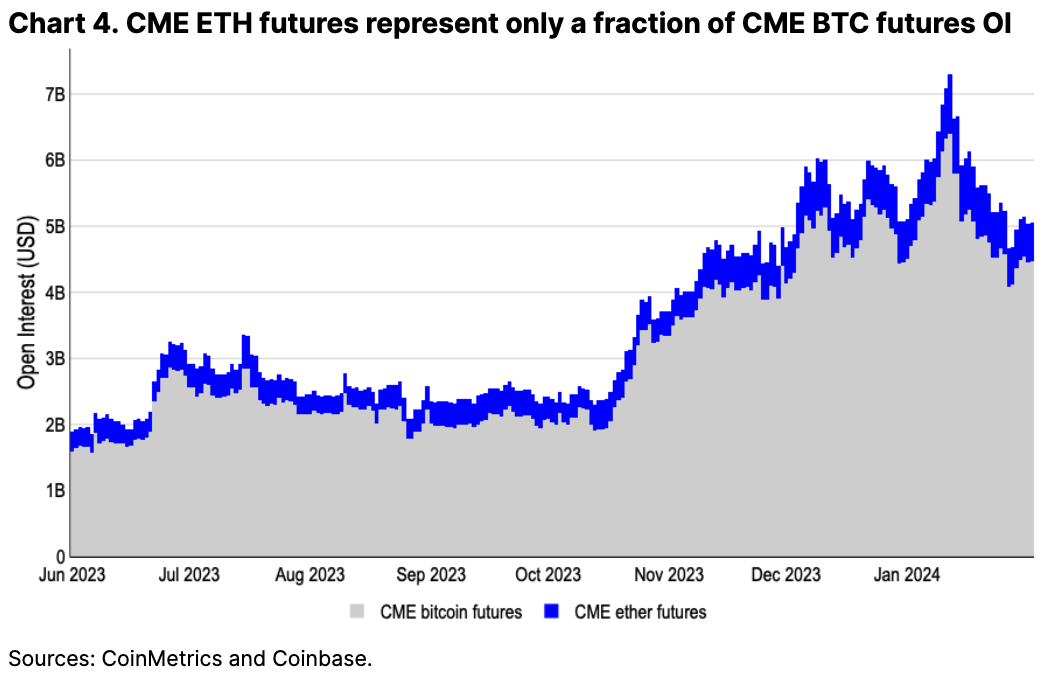

Nevertheless, there are key differences between the CME bitcoin futures market and the CME ether futures market, which may be important to consider here. For one thing, CME bitcoin futures have been around longer – December 2017 vs February 2021 for CME ether futures. That’s one reason why the CME bitcoin futures market is much deeper than ether futures. In fact, the notional value of open interest (OI) on CME ether futures of $601M is only 14% of CME bitcoin futures totaling $4.4B as of February 1.

It’s hard to say whether the gap in the market size between bitcoin and ether futures will affect how their respective correlations to spot returns are perceived. According to the SEC, the “significant size” test previously used as justification for their rejections of spot bitcoin ETFs in the past has been replaced by a correlation test, “assessing the sufficiency of a surveillance-sharing agreement with the CME … to establish whether, and to what extent, fraud or manipulation that impacts the spot bitcoin market also impacts the CME bitcoin futures market.”

As was made clear in SEC Commissioner Uyeda’s statement on the SEC approval, this test is a “novel, previously unarticulated standard to form the basis for approval”. Therefore, while we are optimistic on a spot ETF approval being passed, we also note that the SEC has left the door open to justify a ruling in either direction on spot ether ETFs.

That said, if we simply take the daily returns between CME ether futures vs spot prices, the resulting 94.6% correlation is not meaningfully different from the 95.3% correlation between CME bitcoin futures vs spot prices since February 2021. However, the SEC conducted their studies using 1 minute, 5 minute and hourly data, which was challenging for us to replicate due to certain limitations in our data collection methodologies. Moreover, the SEC’s approval of spot BTC ETFs did not lay out any quantitative guidelines on a threshold for “consistently highly correlated” returns. In fact, we think it’s important to note that the SEC’s “lengthy sample period” for correlation analysis began in March 2021, despite CME bitcoin futures launching in 2017. This enables the SEC to potentially apply a similar test for CME ether futures.

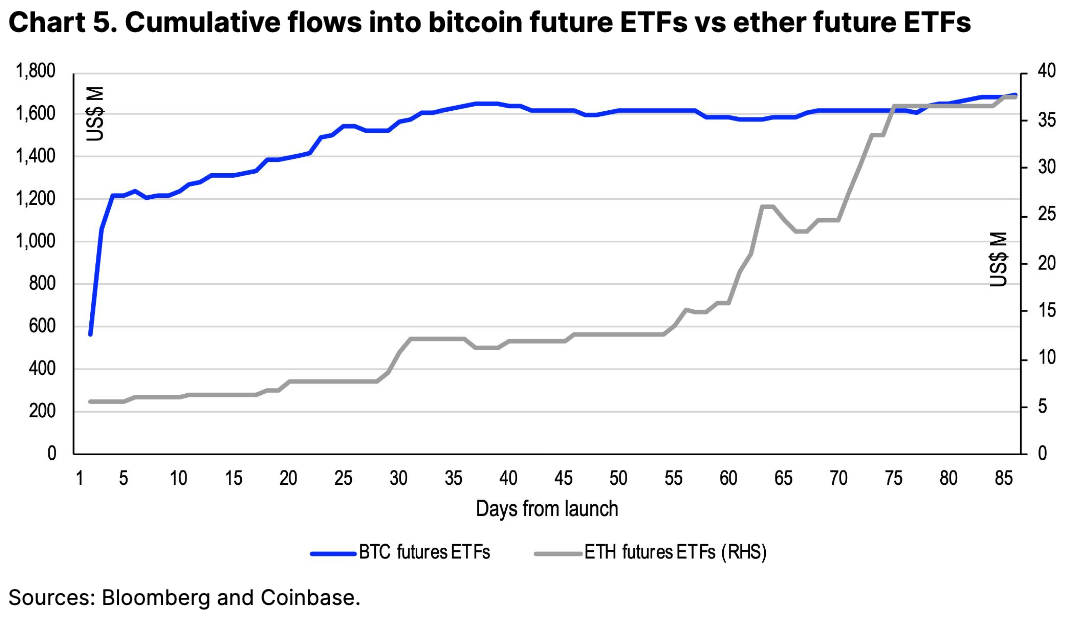

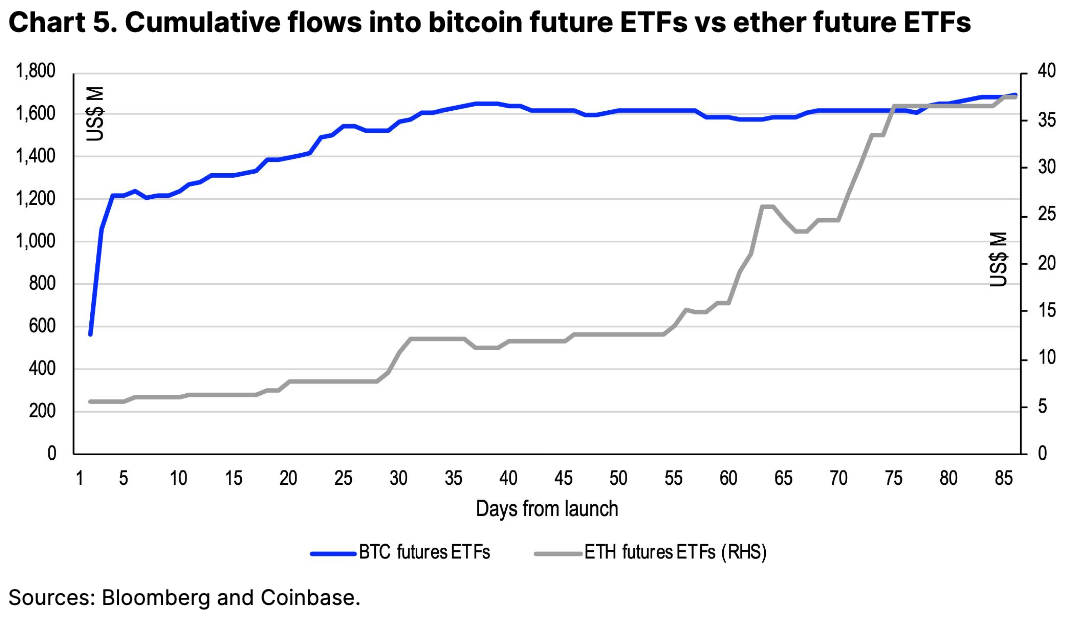

But there’s a separate concern that the difference in CME bitcoin vs ether futures open interest is indicative of a wider gap in the institutional demand for the underlying assets. That’s also reflected in the flows attracted by US bitcoin futures ETFs versus US ether futures ETFs. Within the first four months of launch, net inflows into BITO totaled $1.7B compared to around $38M of net inflows accumulated by the collection of ether futures based ETFs (note: we exclude dual BTC and ETH futures strategy ETFs).

That gap speaks to the difference in the investment propositions behind buying bitcoin as a store of value (which fits well within a traditional portfolio as a macro asset) compared to buying ether as a prospect on the future of web3 technology. Indeed, we think ETH’s ultrasound money value proposition is less well understood by the broader market. Moreover, the Ethereum network has many alternative layer-1 competitors and is still many years away from ossification with multiple future upgrades still planned.

On other hand, there are some important developments in the Ethereum ecosystem happening in the months ahead that could boost the attention on ETH. These include the Cancun (Dencun) Fork in late February/early March and the mainnet launch of EigenLayer for operators. We covered both of these topics in our 2024 Crypto Market Outlook.

Additionally, the scarcity of available ether proxy vehicles compared to bitcoin also likely means fewer offsetting outflows, if spot ETH ETFs are approved. Ultimately then, we think the potential approval of spot ether ETFs in the US could still represent new capital into the ETH market, even if those flows may potentially be a magnitude lower than the capital flowing into spot bitcoin ETFs. Those ETH-related flows could be higher if spot ether ETFs end up distinguishing themselves from spot bitcoin ETFs by paying staking rewards, but we think that’s unlikely in the first launch phase.

Bitcoin miners in the post-halving period

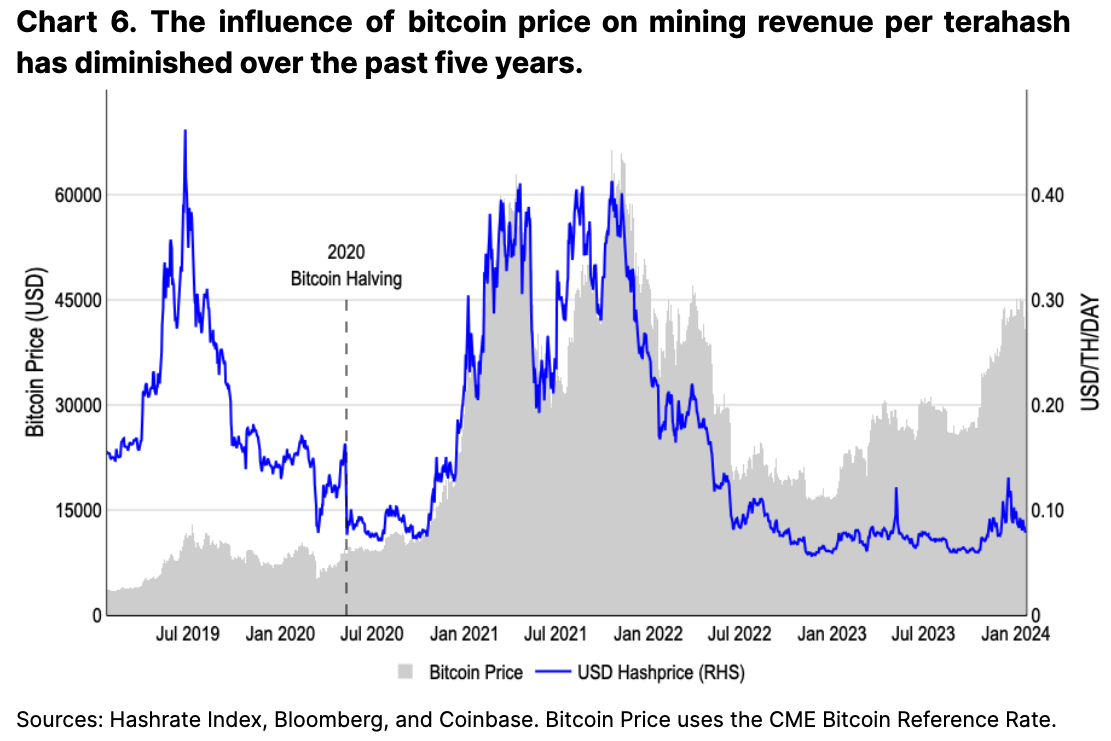

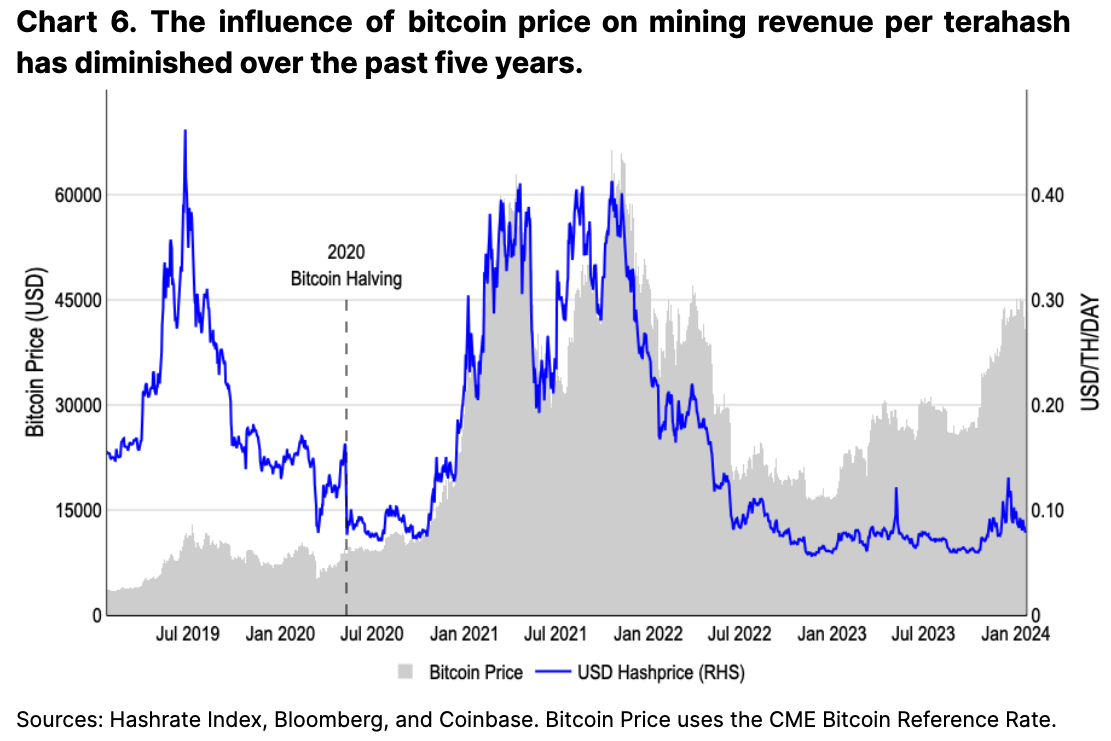

The Bitcoin network should experience its fourth halving in April, where the block reward will fall from 6.25 bitcoin per block to 3.125 bitcoin per block. That will reduce the total amount issued from ~900 bitcoins per day (representing an annual issuance rate of 1.7%) to ~450 bitcoins per day (or 0.8%). What this will mean for miners is that they’ll need to compete more for smaller block rewards, as their revenue from newly minted coins will be cut in half. That could increase the selling pressure on some miners, as their profit margins narrow and less excess profit can be retained in bitcoin – assuming static bitcoin prices and/or overhead costs.

This may not be immediately impactful to markets, however. As the rate of bitcoin issuance drops, the absolute number of bitcoin that miners can sell also drops – even if they are selling a proportionally higher amount of mining rewards. What may be more concerning is a scenario where miners need to sell portions of their unrestricted bitcoin holdings to finance future operations, although we don’t think that would be likely in the near term.

As fixed rewards drop post-halving, we think the future profitability of miners will increasingly rely on transaction-fee-driven revenue, which we previously discussed in our report “Bitcoin Halving and Miner Economics” (published January 30). But the path to achieving this is not straightforward. Fees also constituted a high proportion of block rewards through the 2017-18 and 2021-22 cycles where transaction fees similarly contributed 20%+ to miner earnings at various points. In our view, this is largely because periods of significant appreciation in bitcoin price draws increased network usage, which in turn drives up transaction fees.

However, none of the increases to date have been sustainable (in contrast with Ethereum’s consistent daily gas used). Ordinals have been touted as one solution, though the volatility in Bitcoin Ordinals transactions suggests that such activity may be transient or cyclical in nature (similar to NFTs on Ethereum). Ongoing work in Bitcoin layer-2s (L2s) seem promising, though for the time being, none have gained sufficient traction in constituting meaningful portions of transaction fees.

Conclusions

Much of the attention on US spot bitcoin ETFs are still fixated on flows, but unlocking new capital for the asset class depends heavily on the wealth managers currently carrying out their due diligence on these products. That depends on factors like liquidity and performance history, as registered investment advisors want to ensure that what they recommend to their clients can stand the test of time.

In our view, watching for the short-term flows may be something of a distraction from the more important crypto themes emerging in the post-ETF environment. For example, if we’re right and DeFi activity begins to pick up in 1H24, that could add meaningfully to the value proposition for ETH, as 58% of the total DeFI value remains locked on Ethereum. That’s significant as ETH has otherwise lacked a strong narrative in recent months. Meanwhile, the bitcoin halving is coming up in April 2024 and represents the next big catalyst for crypto markets, but its effects on bitcoin performance are not well understood, in our view.