Market View

Stronger Macro Backdrop

Many technical factors pressuring bitcoin specifically (and crypto more broadly) are starting to be exhausted, in our view. This is evidenced by the liquidations at FTX (disposing of their Grayscale Bitcoin Trust or GBTC shares, for example) as well as the emergence of some large defunct entities from bankruptcy. Indeed, net inflows into US spot bitcoin ETFs have averaged more than US$200M daily over the last week (taking the total net inflows to $1.46B since January 11) with a healthy daily volume of ~$1.35B. Consequently, we expect macro factors to become more relevant for the digital asset class in the weeks ahead, which could be supportive for performance.

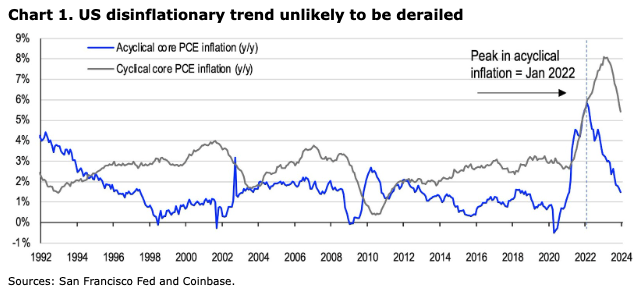

In the US, the likelihood of a soft landing seems higher than it was a few months ago with the economy ostensibly making only minimal tradeoffs between activity and inflation. Core PCE inflation (the Federal Reserve’s preferred measure of prices) at 2.7% YoY is trending in line with their 2% long-run target, and the assortment of recent economic indicators has been fairly resilient. We’ve previously explained that part of the reason for this combination has had to do with procyclical government spending and still buoyant levels of personal consumption, although we believe these drivers will not be sustainable in the months ahead.

Not only is the US budget deficit widening, but the labor market is cooling. Many American households are winding down their savings as suggested by the US personal savings rate falling to 17.6% (in December 2023) of the previous year. That’s despite the upside surprises to retail sales in the last six months relative to median survey expectations. Ultimately then, we would expect the economy to slow down, possibly in 1H24, although the chances of avoiding an outright recession seem very high– albeit the situation at New York Community Bancorp (NYCB) and the implications for regional banks is concerning.

This week, we had some indications of how the Fed is interpreting this scenario. The statement from the FOMC meeting said that “the risks to achieving [the board’s] employment and inflation goals are moving into better balance,” but the board argued that they won’t have the level of confidence they need on the inflation trend before the March meeting. The conversation on tapering its quantitative tightening (QT) program was postponed to the next meeting on March 19-20.

Overall, that suggests the easing cycle will most likely start on May 1, while an end to the Fed’s balance sheet reduction plans could start in June (though there’s a chance it could begin around the same time as rate cuts). We do not believe the disinflationary trend will be derailed and expect the Fed to cut rates by 100bps this year, compared to the 75bps implied in the dot plot or the almost 150bps priced into Fed funds futures. That would also be consistent with the typically anodyne stances pursued by policy makers during election years.

Ultimately, this would coincide with idiosyncratic drivers like the bitcoin halving in late April and could potentially prop up both bitcoin and other tokens in 2Q24. Moreover, we expect the effects of more advertising from ETF issuers and the inclusion of spot bitcoin ETFs in asset managers’ model portfolios to unlock increased liquidity in this space.

Onchain: Solana Airdrop Season

The airdrop for Jupiter, Solana’s leading decentralized exchange aggregator occurred on January 31, in one of the largest airdrops ever. This represents a continuation of major longstanding Solana ecosystem protocols launching tokens (e.g. Pyth in November 2023 and Jito in December) following renewed attention on the ecosystem throughout 2H23.

This trend is set to continue for at least several more months as a number of other high profile Solana projects still remain tokenless, and three more Jupiter airdrop rounds of equal size have yet to be released. We believe these token launches are poised to form the foundation of a renewed Solana ecosystem, and combined with the increasing pace of stablecoin inflows to Solana (up 13.7% in the past week to $2.19B), may make the ecosystem increasingly attractive to developers who may have previously been worried about onchain liquidity.

In our view, an underappreciated, yet important, result of this airdrop was the “real-world” stress testing that the airdrop represented for the Solana blockchain. Although some individual nodes were overloaded, which led to several cases of poor user experiences and transaction timeouts, there was no widespread blockchain halt.

Solana is fast approaching its first full year mark without any downtime (the last outage was on February 25, 2023), showcasing its significant ecosystem progress – especially when compared to an early history of crashes that halted the chain for days at a time. Solana’s recent 1.17 mainnet release for validators on January 15 was also timely in improving overall node performance and stability. There was also the recent announcement of a Solana Labs spinoff to a new legal entity, Anza Technologies, that may further increase diversification and strengthen the network’s resilience.

That said, the elevated airdrop activity did reveal some limitations in Solana’s performance. Gaining clear metrics on transaction failures caused by overloaded nodes is a known reporting gap because such transactions are neither recorded onchain nor do they reside long-term in a mempool like Ethereum. Ultimately, it makes little difference to the end user, particularly non-technical ones, whether their transaction failed due to a reversion in onchain execution or due to a leakage or delay in the node broadcasting stage. The lack of data collection and tooling around such infrastructure issues makes it harder to replicate, test, and resolve, which could lead to divergences between realized user experiences compared to purely onchain transaction statistics in the long-term.

In addition, the average priority fee surged more than 100x at times during the initial airdrop launch, up from $0.001 to more than $0.1. Although this is significantly less than a congested Ethereum counterpart, it highlights the incompleteness of Solana’s pseudo-localized fee markets and its priority fee mechanism where high fee transactions only have a probabilistic guarantee for block inclusion. The fee mechanism is currently undergoing some rework by the Solana labs team, and we may see preliminary fixes for this in the 1.18 release (as early as April), though the final resolution mechanism has not yet been decided. Still, the surge in fees in addition to a temporarily degraded user experience on the chain highlights the continued focus and importance of various approaches to scalability in the space.