The exponential growth of Bitcoin’s hash rate to date underpins the strength and security of the underlying asset, making it relevant for bitcoin’s economic fundamentals. An increase in the hash rate is an increase in the cost to fork or otherwise reorganize the network. In our view, however, hash rate growth is not limitless and may increasingly slow – or even shrink – following subsequent halving cycles.

Mining machines have had smaller proportional efficiency gains relative to the growth of the network hash rate, and without significant bitcoin price appreciation, the revenue per unit of hash power could drop to all time lows following the halving in April 2024. Thinner margins could result in a larger proportion of forced selling by miners in order to meet fixed operational and financing costs, possibly making some miners unprofitable and increasing consolidation by well-capitalized entities who are able to acquire distressed assets at a discount.

Although this is not an imminent threat to Bitcoin’s sustainability, the drop in fixed block rewards does underscore the need for innovation that can drive miner revenue to support a strong network hash rate. In fact, recent surges in transaction fees have had an outsized impact on miner revenues compared to price movements. Absent any drastic price shocks, however, our overall view is that the network hash rate will likely continue to grow post-halving in the short-to-medium term, but may subsequently stall absent price appreciation or increased transaction fees. We think this could further push the Bitcoin community to explore solutions that sustainably drive miner revenue in the longer term due to renewed attention on Bitcoin’s hash rate security.

The Decreasing Price Sensitivity of Miners

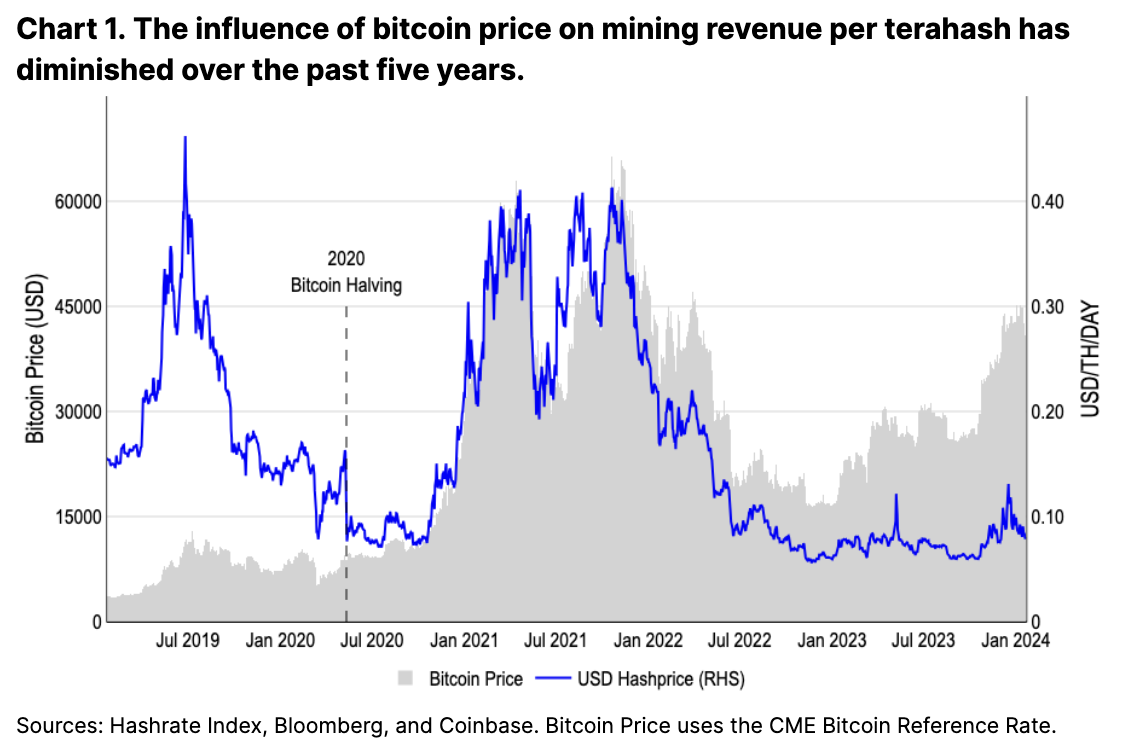

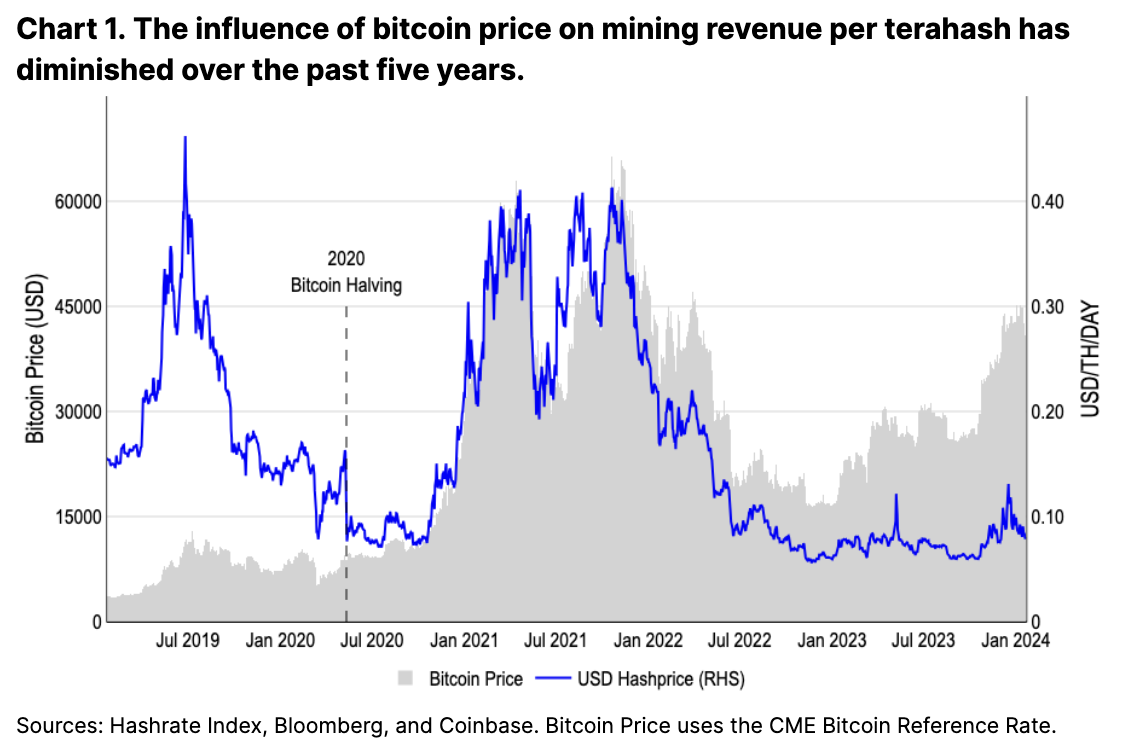

The overall bitcoin mining market can be viewed as a globally distributed commodity manufacturing operation with costs consisting primarily of (1) upfront physical mining rig and infrastructure overhead and (2) ongoing costs centered on energy expenditure and operations. Normalizing miner revenues to daily USD earned per terahash per second (TH/s) of compute power reveals that miner unit revenues have not risen in line with bitcoin price appreciation in 2023 (see Chart 1). (Note: for succinctness, all subsequent measures of compute power are done on a per second basis.) In layman’s terms, that means the increasing hash rate has likely absorbed most of the upside from higher bitcoin prices. Furthermore, it suggests that most increases in individual miner revenues have been driven primarily via the acquisition of more mining rigs.

In fact, prior to 2022, short term price increases to bitcoin greatly outpaced the supply flexibility of the network hash rate, resulting in the revenue per TH closely tracking movements in price. Since early 2023, however, daily revenues per TH have remained comparatively range bound between $0.05 and $0.15. While revenues are still correlated with bitcoin price, the elasticity of miner revenue with respect to bitcoin price has dropped sharply (i.e. the magnitude of correlated movements has decreased).

It is worth noting that the May and December 2023 miner revenue spikes above $0.10/TH/day were driven largely by a rise in transaction fees led by Ordinals usage, which saw transaction fees constitute more than 30% of total miner revenue at times (see Chart 2). In our view, the outsized impact of transaction fees on miner unit revenue is a result of the sporadic nature of this revenue stream, rendering established hedging strategies against the price volatility less applicable. This makes it difficult for miners to scale computing power based on predictable future transaction fees. For this reason, we think that the variability in transaction fees will continue to play an outsized role in miner revenue fluctuations, especially after the drop in fixed block rewards post-halving.

Miner Positioning and Post-Halving Economics

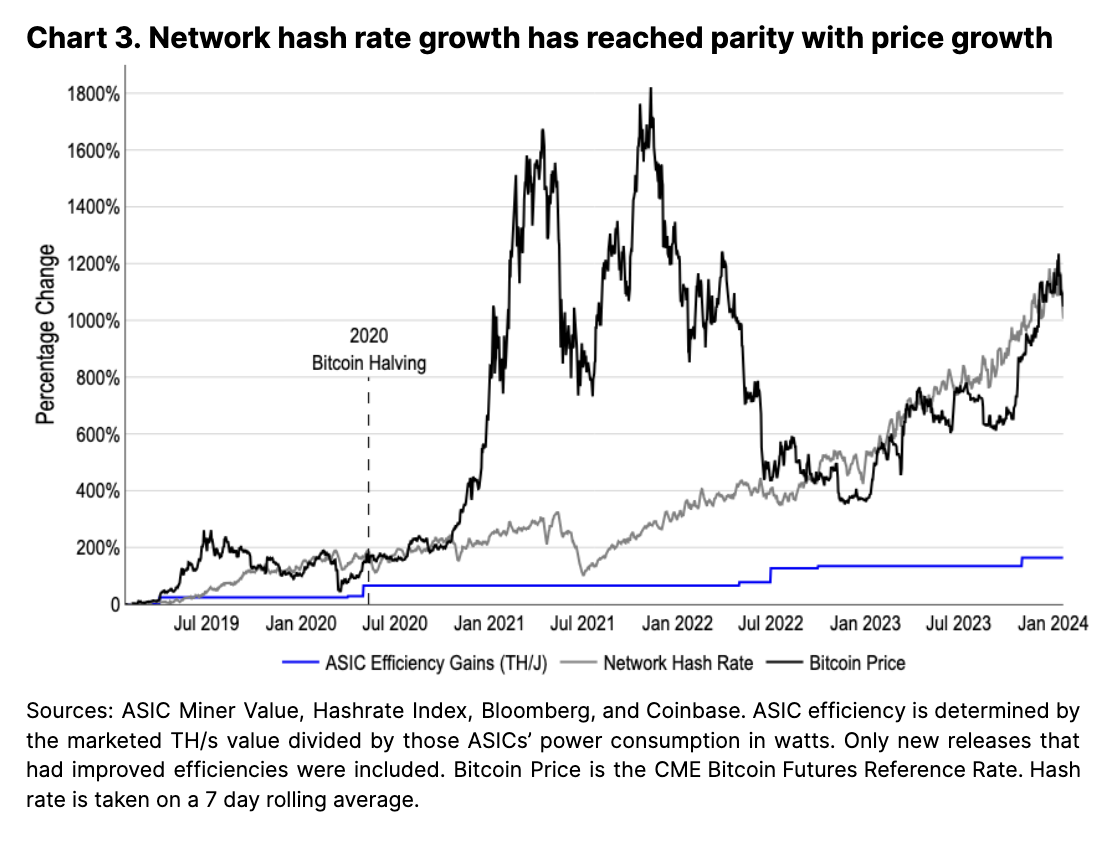

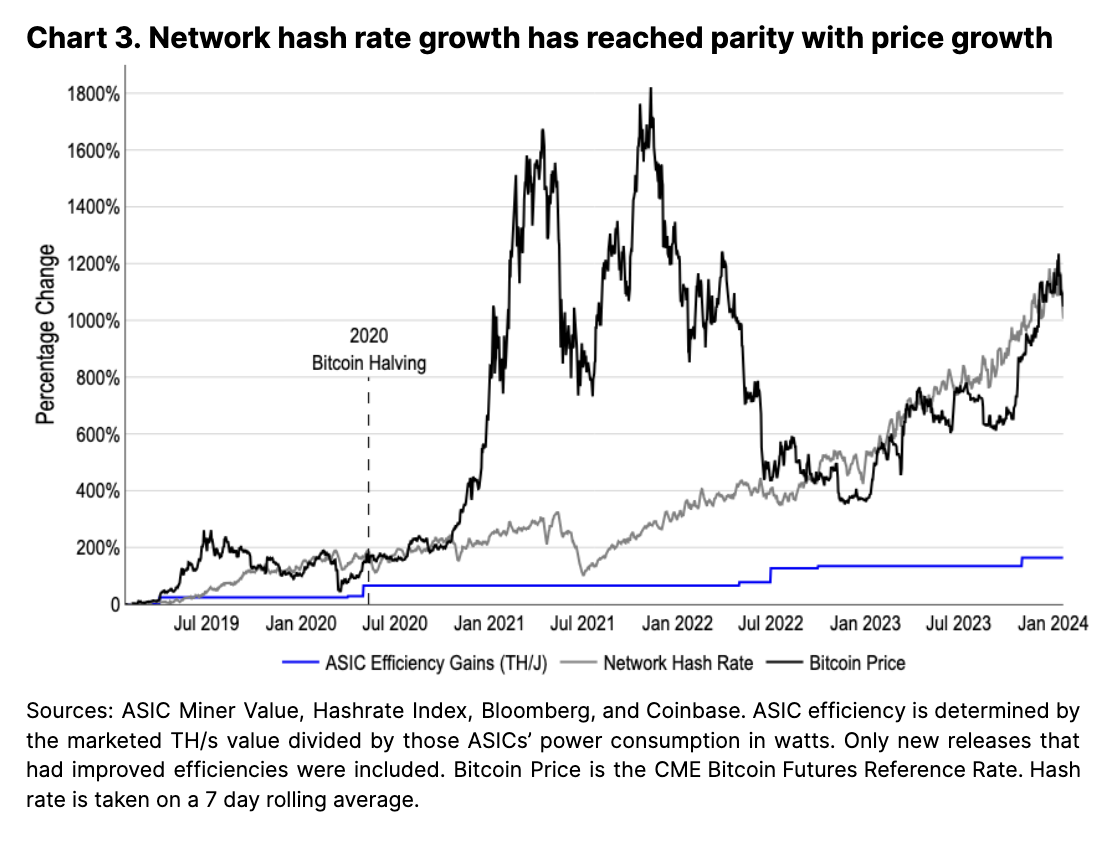

From a multi-year perspective, it is clear that the increasing saturation of the Bitcoin network hash rate is the primary driver of the decrease in revenue per TH (see Chart 3). Although the price of bitcoin far outpaced the more constrained growth of network hash rate throughout 2021 and 2022, the long term trend of hash rate has grown to meet bitcoin’s USD price. It is also evident that improvements to custom bitcoin mining machines (application-specific integrated circuits or ASICs) has been a marginal contributor to increased hash rate – the 1200% growth in network hash rate and price over the last five years far outpaced the 170% improvement in ASIC efficiency gains during that time by seven-fold. Hash rate growth has been driven primarily by an increase in the total number of operating ASICs rather than optimizations in energy efficiency.

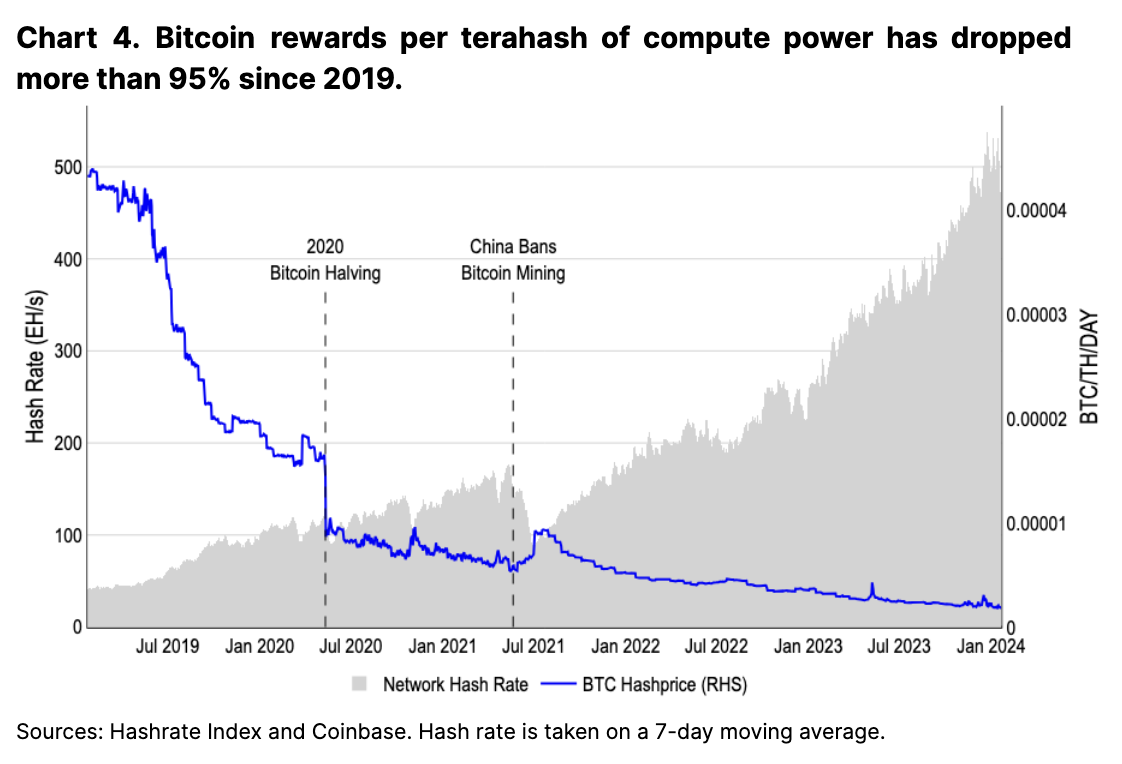

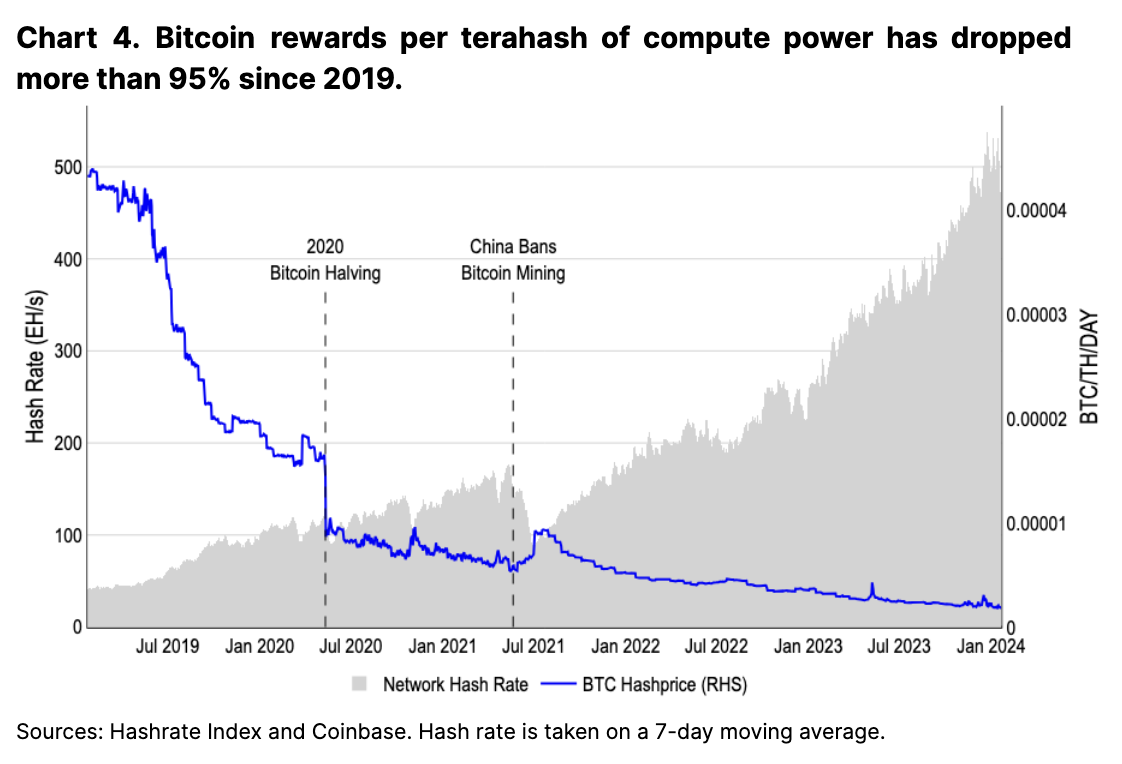

The network hash rate currently has a growth rate of approximately 100% annually, roughly keeping pace with price appreciation since 2H22. Following the halving, however, we are on course to set a historical low of bitcoin-denominated revenue per TH (see Chart 4). In addition to fixed block rewards halving from 6.25 to 3.125 BTC per block, recent filings from public bitcoin mining companies such as Marathon Digital Holdings and Riot Platforms reveal plans to significantly increase their mining capacity in the short-to medium term by more than 30%. It is reasonable to think that other mining groups plan on doing the same (public miners constitute ~25% of global hash rate), which could further compound the downward pressure on revenues per TH.

That said, we believe the hash rate still has some economically sustainable room to grow in the next few months prior to the halving as a result of increased transaction fees. Per our calculations, the realized network hash rate peaked at around 25% of the theoretical maximum sustainable hash rate through the 2020 halving, which we think still applies today (see Chart 5). Following the increase in transaction fees beginning in December 2023 the network is only operating at approximately 15% of the theoretical max. Echoing our earlier statement on the outsized impact of variable fee revenue, we have found that the maximum theoretical hash rate peaked on December 30 at the same time transaction fee revenue peaked, despite the price of bitcoin reaching a local top later on January 11, 2024.

(Note: The theoretical maximum hash rate is computed by finding the maximum total hash rate that can be generated by 75% of state-of-the-art efficiency machines to have exact breakeven costs on energy at $0.02/kWh, all with zero profitability to cover any other operational costs or the initial financing of ASICs.)

Assuming network metrics (bitcoin price, transaction fees, and hash rate) remain constant, the realized hash rate percentage would reach approximately 24% post-halving, in line with its historical “soft-ceiling”. However, miners would need to operate at a higher percentage of the maximum theoretical hash rate (approximately 32%) if transaction fees revert to pre-Ordinals levels – which may be unsustainable over the long-term for a subset of miners. Again, this discounts any variations to hash rate, which would likely skew these percentages higher as hash rate grows.

The aforementioned ongoing investments into scaling would likely sustain the hash rate growth for several months after the halving in order to cover financing costs of new equipment and other operational costs. Beyond that, the path to profitable hash rate growth after that is less certain. It would require one or more of (1) bitcoin price appreciation, (2) reliable increases in transaction fees, or (3) unprecedented breakthroughs in ASIC efficiency.

In our view, the post-halving miner economics could increase selling pressure on miners as margins narrow and less excess profit can be retained in bitcoin. This may not be immediately impactful to markets, however. As the rate of bitcoin issuance drops, the absolute number of bitcoin that miners can sell also drops – even if they are selling a proportionally higher amount of mining rewards. What may be more concerning is a scenario where miners need to sell portions of their unrestricted bitcoin holdings to finance future operations, though we don’t think that would be likely in the near term.

In the long run, however, decreased mining revenue margins is a potential threat to decentralization in bitcoin mining operations. We think the next halving will weaken the viability of independent, non-institutional miners from retaining profitability, which could further contribute to consolidation both at the miner and the mining pool levels. Institutional miners likely are better positioned to acquire distressed mining assets at a discount, have improved operational efficiency due to economies of scale, and have access to cheaper energy sources. Although concentration risks for private miners is unknown, the Bitcoin hash rate currently appears to be well distributed among miners, with the largest publicly traded bitcoin mining companies all below 5% of global hash rate. However, there is concern over the growing centralization of mining pools with two pools controlling more than half of the hash rate. If well-capitalized mining entities absorb smaller competitors, this centralization is likely to continue increasing.

Variable Sources of Miner Revenue

As fixed rewards drop post-halving, we think the future profitability of miners will increasingly rely on transaction fee driven revenue. That said, the path to achieving this is not straightforward. Fees also constituted a high proportion of block rewards through the 2017/18 and 2021/22 cycles where transaction fees similarly contributed 20%+ of transaction fees at various points. In our view, this is largely because periods of significant appreciation in bitcoin price draws increased network usage, which in turn drives up transaction fees. However, none of the increases to date have been sustainable (in contrast with Ethereum’s consistent daily gas used). Ordinals have been touted as one solution, though the volatility in Bitcoin Ordinals transactions suggests that such activity may be transient or cyclical in nature (similar to NFTs on Ethereum). Ongoing work in Bitcoin layer-2s (L2s) seem promising, though none have yet gained sufficient traction in constituting meaningful portions of transaction fees.

Separate from mining bitcoin, some institutional miners can additionally profit from energy agreements with local governments where they are able to turn off mining operations and curb energy expenditures in return for energy credits. This, however, does not contribute to Bitcoin’s economic security via active hash power, and also further advantages well-capitalized mining entities that can draw on reserves to weather variations in bitcoin price or periods of reduced mining activity. Thus, the creation of sustainable bitcoin network fees to miners beyond block rewards is imperative.

Conclusion

Whereas most halvings have been associated as catalysts for price appreciation, we think the causation factors are far less straightforward and appear to correlate strongly with the economic regime of the time in conjunction with the halving’s reaffirmation of bitcoin's fixed supply. (See our report covering the halving’s impact on bitcoin’s price.) As a result, the uncertainty around constant price increases emphasizes the increasing need for sustainable miner revenue via transaction fees, which has already begun materializing throughout 2023.

Though we think that the hash rate will continue to increase in the short to medium term, we also believe that we are rapidly reaching a point where growth will be unsustainable with a corresponding appreciation in price. We hope this enables the somewhat fragmented Bitcoin community to begin rallying around finding long term solutions for miner incentives without changing the emission schedule or relying solely on price appreciation. In addition to the halving highlighting Bitcoin’s finite emission schedule, we think that this halving will call further attention to the increasingly outsized role transaction fees have in miner economics.