Market outlook

Over the past 12 months, a third of institutional investors surveyed report increasing allocations to crypto.

A third of institutions took the price dislocations as an opportunity.

In the past 12 months, have your allocations to cryptocurrencies…?

Over the past year, a number of institutions allocated for the first time, while others who were already invested increased allocations even further.

Asset managers surveyed reported that their firms increased allocations at a larger rate (41%) than asset owners (27%).

Allocations to crypto are set to rise over the next cycle

Thinking about the next three years, do you anticipate the percentage of your assets invested in cryptocurrency to increase, decrease, or stay the same?

Institutional adoption and sentiment remain strong.

Nearly 60% of all respondents indicate they will increase crypto allocations over the next three years, with no current investors expecting to decrease allocations.

Nearly half of those not currently invested expect to come off the sidelines over the next three years and allocate to crypto.

Investors are more optimistic about prices heading into 2024

What do you think will be the likely path that cryptocurrency prices will take in the next 12 months?

In 2022, just 8% of respondents said that they expected crypto prices to trend higher in 2023; 54% said in 2022 that they expected crypto prices to be flat or range bound (see 2022 Institutional Investor Digital Assets Outlook Survey).

Over the past year, bitcoin prices are up 110% and ether prices are up 58%.

Crypto is seen as a good opportunity for risk-adjusted returns

Thinking about the next three years, in which asset classes do you see the biggest opportunities to generate attractive risk-adjusted returns? (Select all)

Private equity, U.S. equities top rankings of best opportunities.

Crypto ranks third after private equity and U.S. equities as the best sources of risk-adjusted returns heading into 2024.

In the 2022 survey, U.S. investment grade corporate bonds was first, followed by real estate. Private equity ranked 5th, U.S. equities ranked 4th, and crypto ranked 3rd.

Crypto as an investment

Broad institutional adoption is on the horizon according to 65% of respondents.

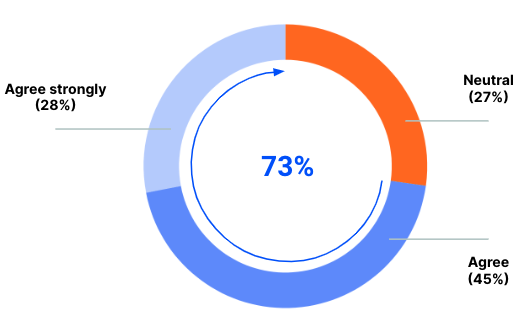

Cryptocurrencies are likely to become an investment vehicle used widely by institutional investors within 3-5 years.

What percentage of your total assets under management (AUM) are currently invested in cryptocurrencies or crypto-related companies? (*Note: Data shown among current investors only.)

If institutions invest widely in crypto, allocations could average 5% of AUM, bringing substantial inflows in the next 3-5 years.

Institutional investors gain exposure to crypto through a variety of products

Which of the following mechanisms does your institution use to invest in or gain exposure to cryptocurrencies? (Select all)

Many methods of exposure.

Although there is no clear preferred method to gain crypto exposure, spot crypto and crypto lending were the most frequently selected methods among respondents who are currently exposed to crypto.

Motivations to invest are: asset appreciation, outperformance, and the lack of other portfolio opportunities

Which of the following do you consider to be the main reasons to invest in digital assets? (Select all)

Momentum feeds on itself.

Asset performance takes care of everything. Higher trending prices are likely to spur momentum that increases investor interest. Investors ranked performance-based metrics as the top three reasons to invest - citing asset appreciation, outperformance, and the lack of other portfolio opportunities.

Barriers to investing are: volatility, ESG considerations, and security.

Which of the following do you consider to be the main concerns in investing in cryptocurrency? (Select all)

Shock waves from 2022 carrying through in minds of institutional investors.

63% of investors surveyed cited volatility as their top concern for investing in cryptocurrency. The largest drop from 2022 is the view that an uncertain regulatory environment is a main concern.

52% of institutional investors surveyed in 2022 cited an uncertain regulatory environment as a main concern.

Crypto utility

66% of institutional investors agree: more tangible economic value and real-world applications will be the next catalyst for growth

What do you think will be the next catalyst for growth in the industry?

Blockchain seen as better tech for payments and trade settlement among institutional investors surveyed

Blockchain technology can offer a quicker and more secure form of payment than the conventional banking system.

Blockchain technology will eventually replace legacy systems for trade settlement.

Appendix: Study background and methodology

In October, Coinbase commissioned Institutional Investor to conduct a survey of 250 decision makers across hedge funds, venture capital firms, pensions, foundations and endowments, family offices, sovereign wealth funds, and asset management firms in the US to understand their views on crypto investing. This survey included institutions that currently invest in crypto, those that have previously invested, and those that are evaluating whether to invest. The survey was fielded by Institutional Investor’s Custom Research Lab from October 19 to November 6, 2023.