There have been a lot of questions about what the crypto winter really means for institutional investors and how they are managing through the prolonged bear market.

We explored this and other topics in the 2022 Digital Assets Outlook Survey, conducted in partnership with Institutional Investor. The survey interviewed 140 institutional investors to get a read on current sentiment and outlook toward digital assets since the start of the crypto winter.

The survey was conducted between September 21 and October 27. Findings provide valuable insights on the changing needs of investors and evolving views of the asset class.

Keeping a long-term perspective

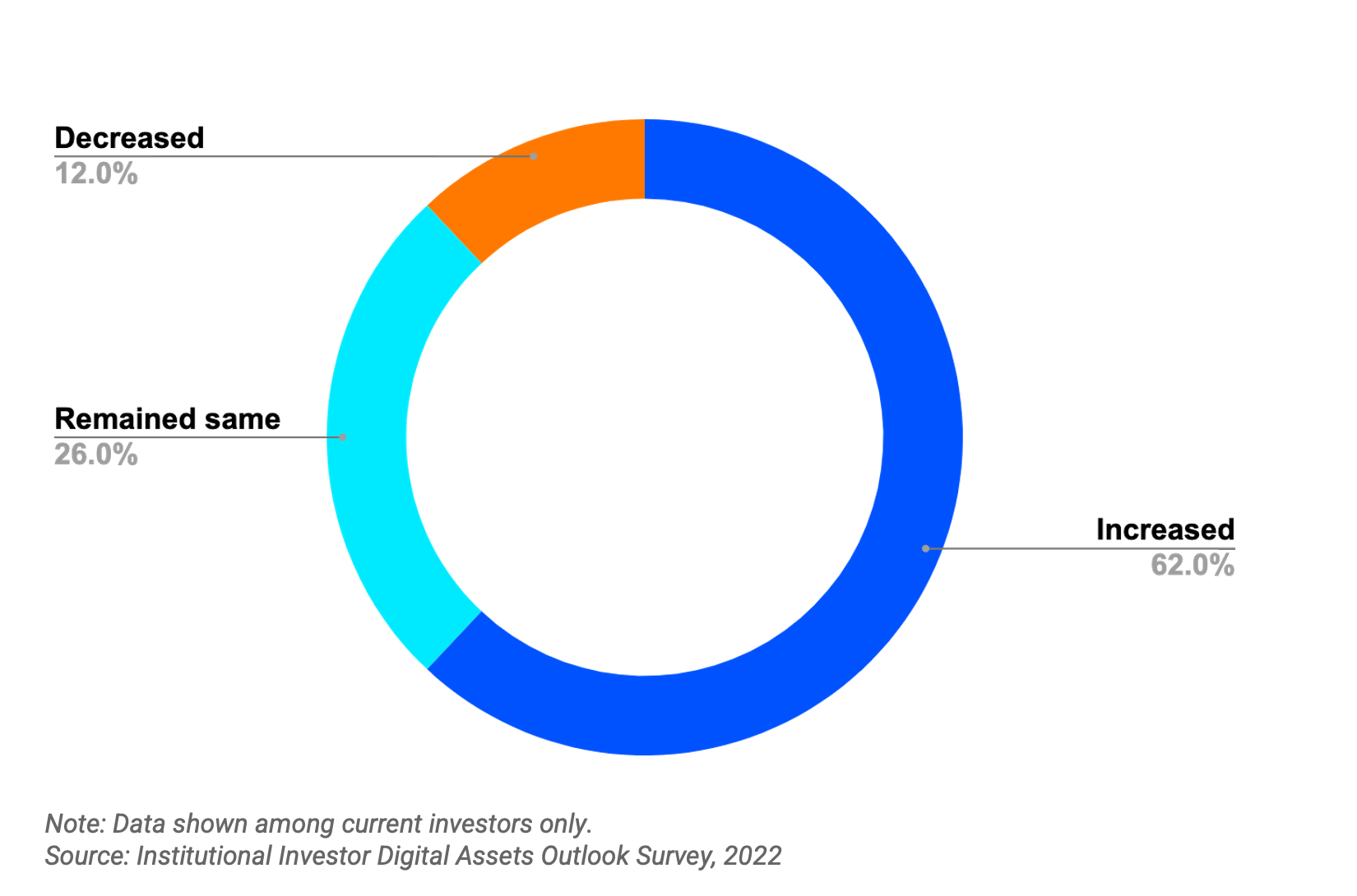

We examined changes in digital asset allocations in the survey and found that 62% of investors who are currently invested in crypto increased their allocations in the past 12 months (vs. 12% who decreased their allocations). This is evidence that institutional investors have continued to take a long-term view of the asset class even as prices have fallen.

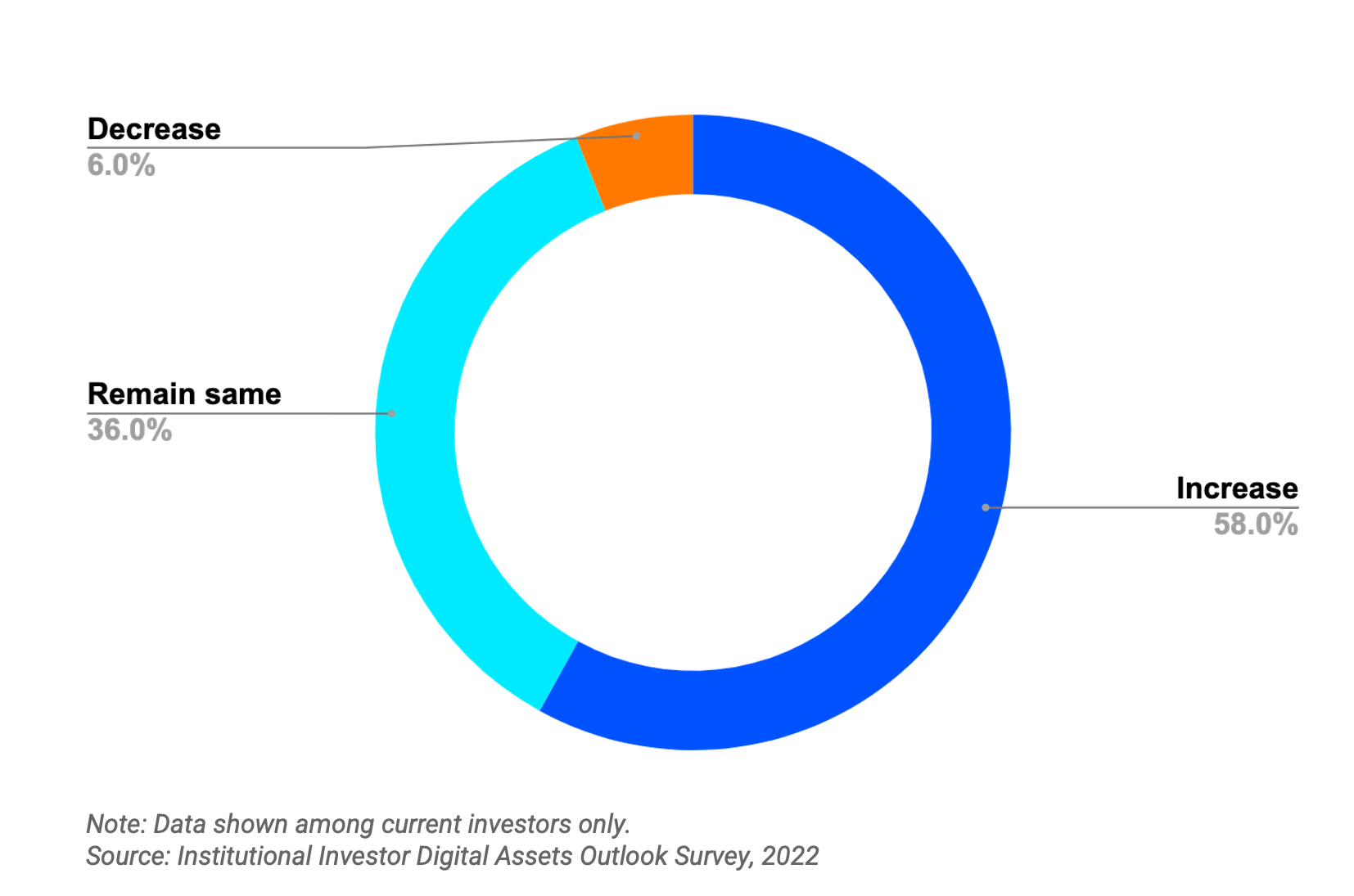

Looking ahead, 58% of investors expect to increase their allocations over the next three years. A majority of investors (59%) are currently using or planning to use a buy-and-hold approach.

1. Current and expected allocation to digital assets

Question: In the past 12 months, have your allocations to cryptocurrencies… ?

Question: Thinking about the next three years, do you anticipate the percentage of your assets invested in cryptocurrency to increase, decrease, or stay the same?

Adjusting future expectations

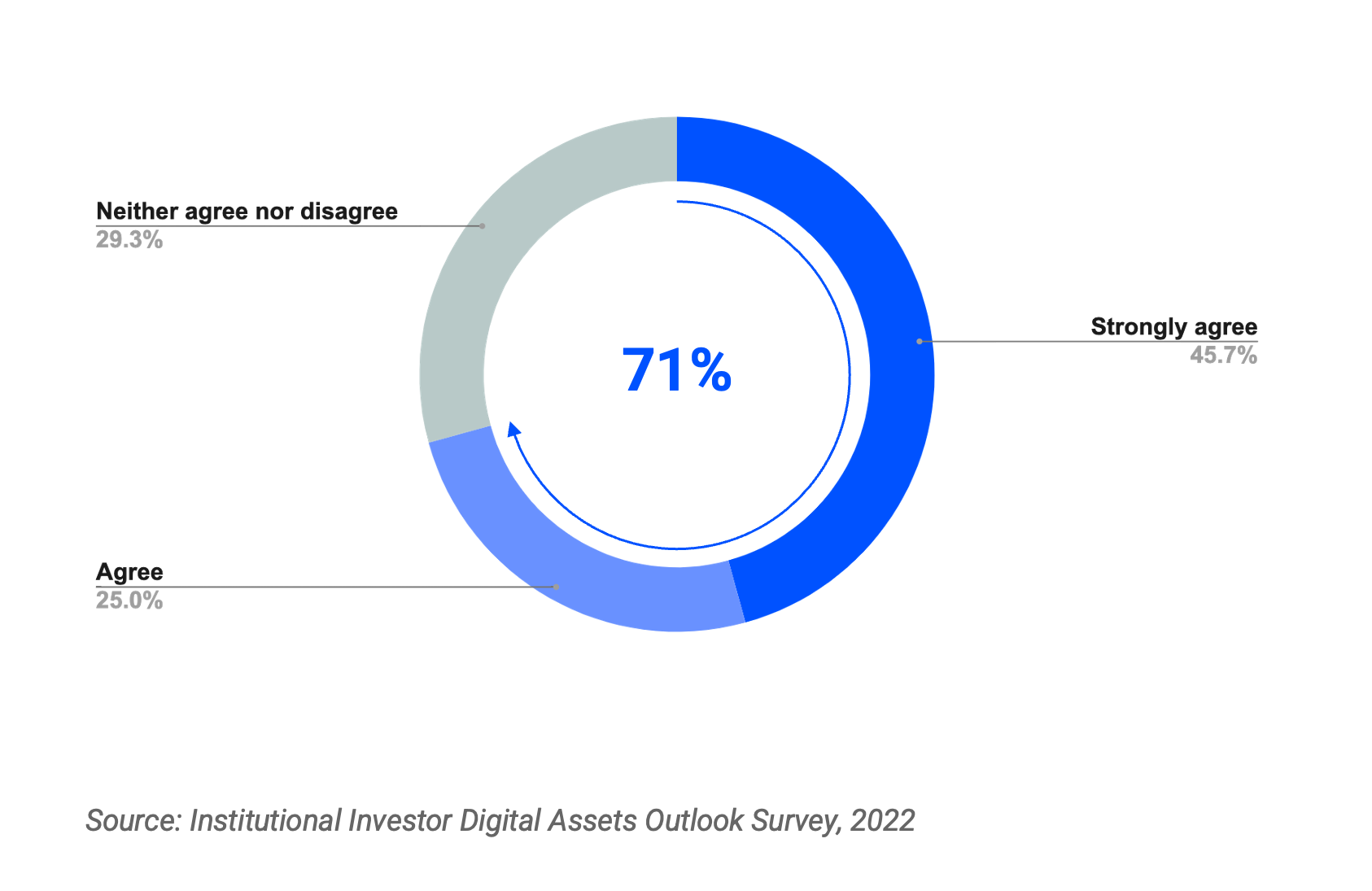

Overall sentiment towards digital assets has remained positive with 72% supporting the view that digital assets are here to stay (86% among those currently invested in crypto and 64% among those planning to invest). Given the current climate, this is a strong signal of the acceptance of crypto as an asset class.

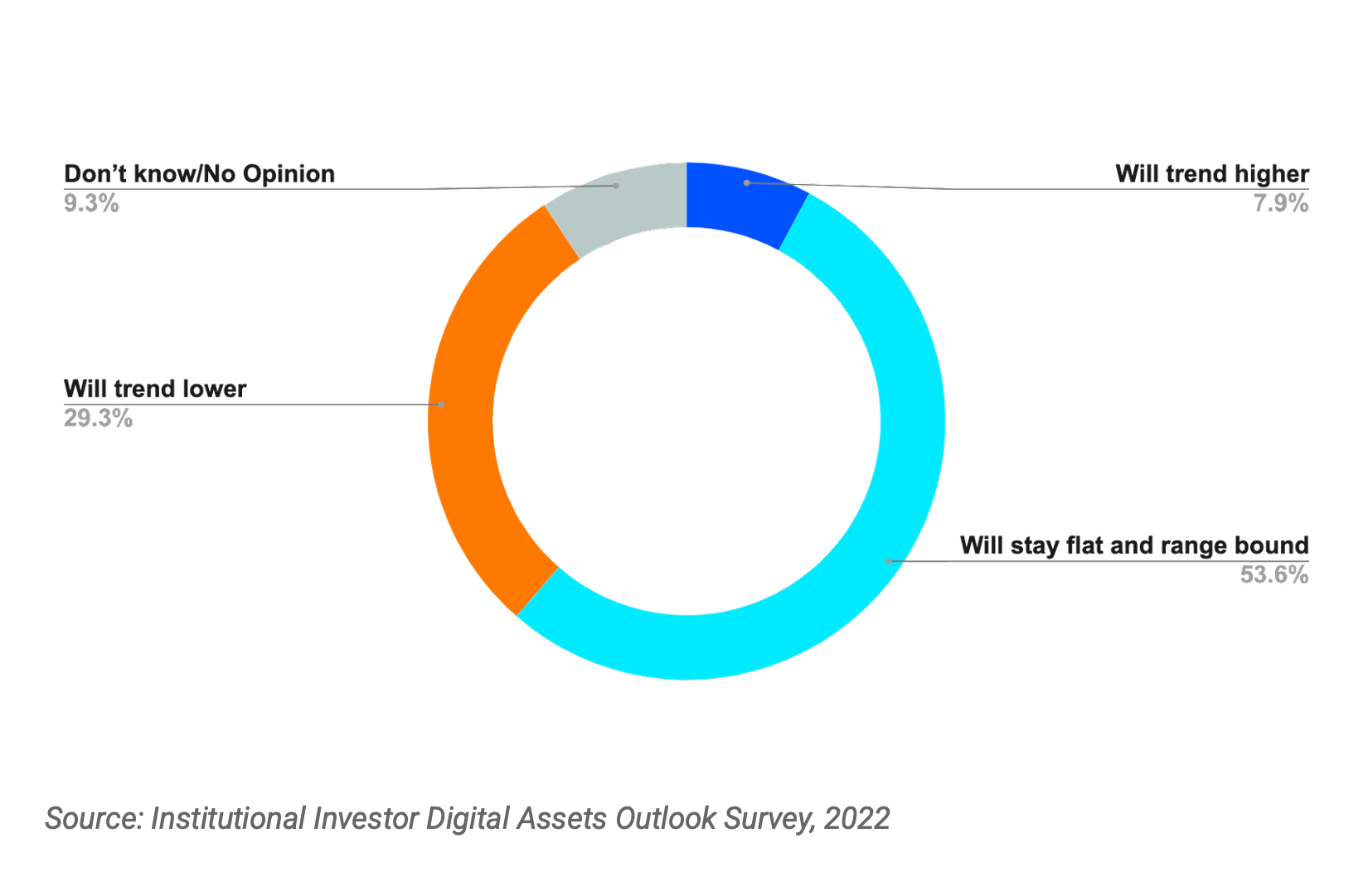

While sentiment remains positive, the crypto winter has dampened short-term expectations for price appreciation. When asked about their outlook on prices, 54% of investors stated that they expect crypto prices to be range bound, while 29% expect it to trend lower in the next 12 months.

Still, the price outlook over the long term remains positive with 71% of investors saying that they expect digital asset valuations to increase over the long term.

2. Short- and Medium-Term Price Expectations

Question: What do you think will be the likely path that cryptocurrency prices will take in the next 12 months?

Question: To what extent do you agree or disagree with the statement: Crypto valuations will increase over the long term?

Planting seeds for the future

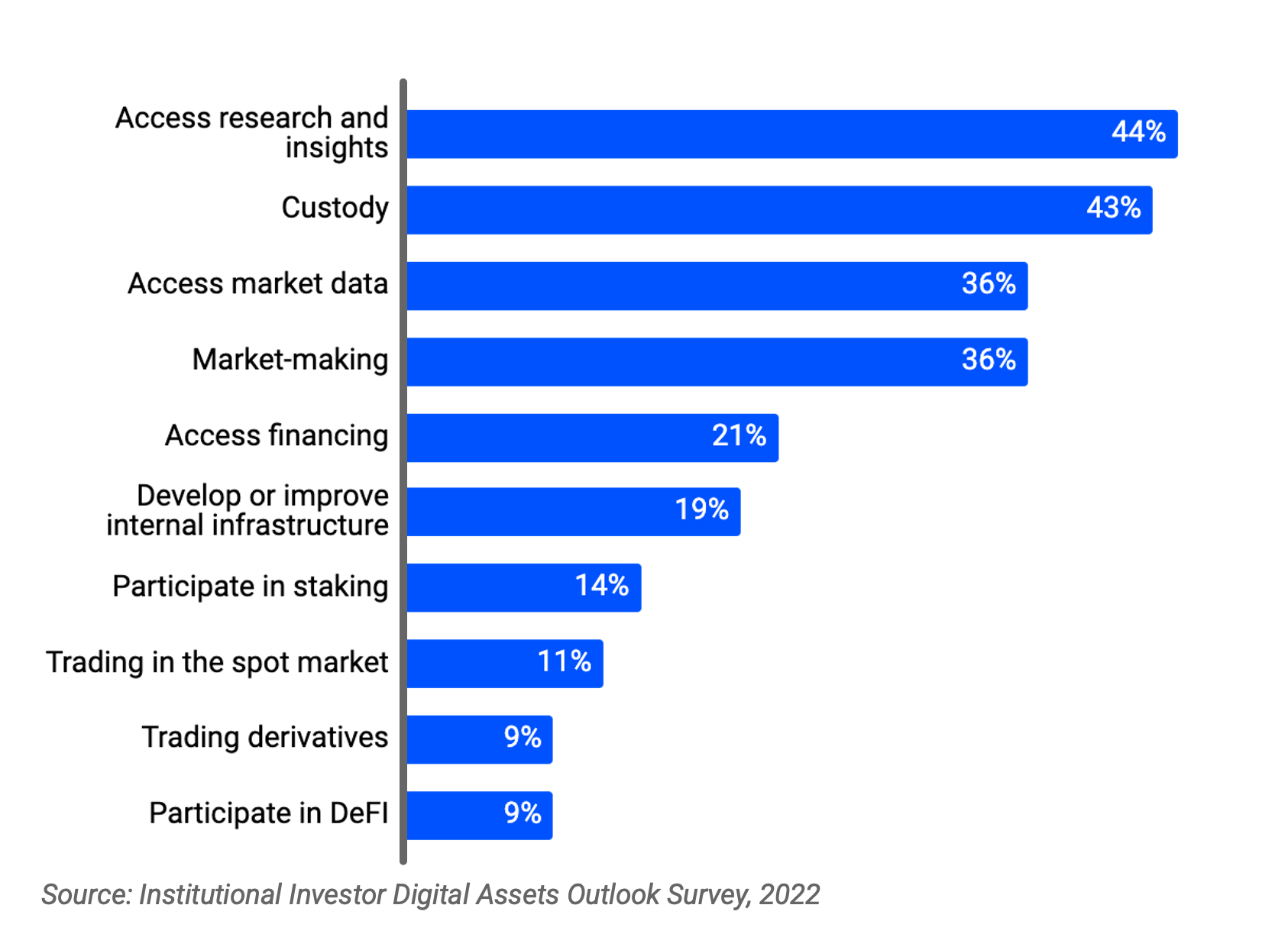

Results from the survey also reveal that investors are planting seeds for the future. We asked investors for specific activities that they are doing or plan to focus on as they invest in crypto. Among the top responses included access research and insights (44%) and to access market data (36%). Nearly a fifth of investors are deploying or planning to deploy crypto in their investment framework to develop or improve their internal infrastructure. Taken together, these data points highlight how there is a base of investors that are using the current environment to learn and build for the future.

3. Strategies used or planned for investing in crypto

Question: How are you currently deploying crypto or planning to deploy crypto within your investment framework?

Evolving attitudes towards digital assets

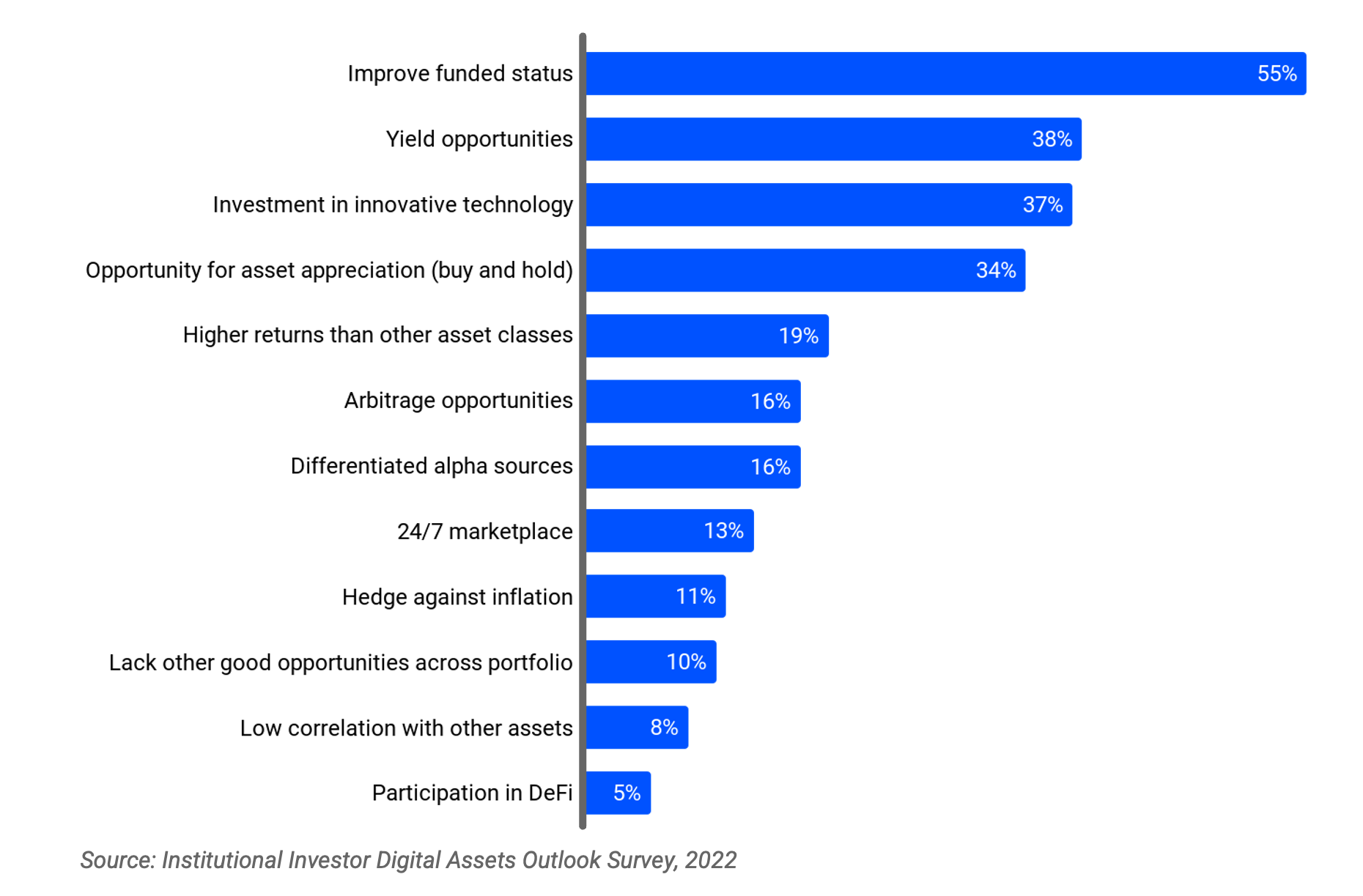

Survey findings also show that reasons for investing and attitudes towards the asset class are evolving. Investors pointed to the goal to improve funded status,access yield opportunities, invest in innovative technology, and potential for long-term appreciation as main reasons for investing in the asset class. This is a departure from past studies where having low correlation with other asset classes and being a hedge against inflation were more prominent factors (1).

4. Top reasons to invest in digital assets

Question: Which of the following do you consider to be the main reasons to invest in digital assets?

While some investors categorize digital assets as either real assets/commodities or as alternative assets, more investors are creating their own category for crypto or classifying crypto as part of innovation or emerging technologies. This is also evidence of a long-term opportunity that may emerge in the future.

From the standpoint of expected returns, crypto continues to be regarded as a high return investment. Of the different asset classes covered in the survey, 56% of investors pointed to US investment grade corporates as offering the highest alpha opportunities in the next three years, followed by digital assets (35%) and real estate (35%). Within strategies to generate alpha, investors noted crypto hedge funds as offering better alpha opportunities over venture and long-only funds.

A call for policy makers to act

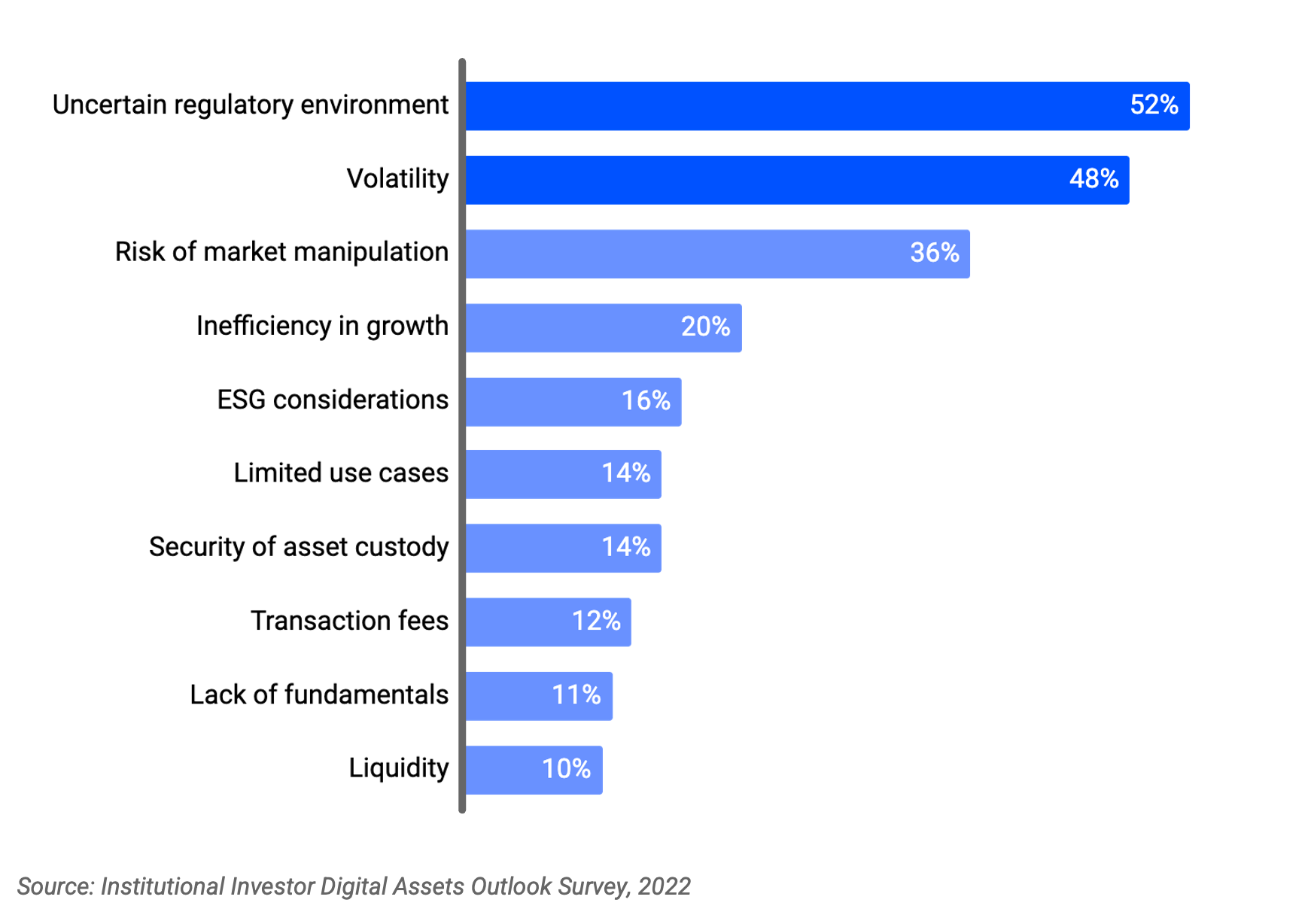

Investors are unequivocal in their desire for regulatory clarity. Of the multiple factors that impact their consideration to invest in digital assets, investors identified regulatory uncertainty as the top factor. This is particularly true among those that are planning to invest in the next 12 months – where 64% noted concerns.

5. Concerns about investing in digital assets

Question: Which of the following are you most concerned about when considering investing in cryptocurrencies?

Lessons from the market turmoil

Once again, when thinking about market turmoil in crypto, investors use it to reinforce their view that regulatory clarity is needed. Nearly half (47%) of investors consider events such as the Terra Luna crash and 3AC bankruptcy as a call to action for policy makers to create a level playing field and enact much-needed regulation. More than a third (36%) consider such events to be important reminders for firms to adopt better risk management strategies.

When asked for factors that they consider in selecting a crypto partner, investors highlighted security, regulatory compliance, and trust as the most important.

The recent high-profile bankruptcies have put a spotlight on how firms operate differently in meeting these needs and have further reinforced the need to take a prudent approach in selecting partners.

6. Top factors considered in selecting a crypto partner

Catalysts for growth

Looking to the future, more than 7 in 10 investors cited more real-world applications as the top catalyst for growth in the asset class. More investor knowledge and regulatory clarity were a distant second and third, cited by around 4 in 10. This highlights that while regulatory clarity can remove barriers to growth, better use cases and more education are also needed. This also indicates the expectation that there will be new applications introduced in the market and, at the same time, acknowledges the need for use cases that can attract more users and significantly enhance network effects.

Conclusion

Investors have continued to invest in digital assets despite the crypto winter. They are using the current environment to learn and build for the future. While acknowledging that recent market events have dampened the short-term outlook, investors are taking a long-term view. There is also strong evidence of broad institutional acceptance that crypto is here to stay.

Institutional investors resoundingly want regulatory clarity, cited as a key consideration factor, especially among those that are still mulling plans to invest. With the recent collapse of FTX, this finding takes on even more importance.

As institutional investors continue to invest in digital assets, and their calls for regulatory clarity grow, they can influence the direction of the industry, help raise standards, and push for better governance, making the asset class more accessible, safer, and easier for all to navigate.

Download a PDF of the research study data and charts.

Coinbase perspective

As we look back historically at the establishment of alternative asset classes, like emerging markets equities, it is not uncommon to see high volatility and market events such as government defaults. But these short-term setbacks have not dissuaded institutions from taking a long-term view and investing capital in the asset class in considerable size. For many institutional investors today, emerging asset classes represent over 5% of their total portfolio allocation. So. And similarly, we expect crypto to continue to be part of their overall strategy.

This study’s findings are consistent with our conversations: institutions continue to take a long-term view on the adoption of crypto as an asset class, with a belief in crypto's ability to disrupt financial services. A short-term bout of volatility is not going to dissuade them.

Our institutional business is built for leading institutional funds, corporates, asset managers, and hedge funds. We expect they will continue to express interest and allocate – even through the short-term cycles – as challenging as they are.

- Brett Tejpaul, Vice President of Institutional

Appendix: Study background and methodology

Coinbase partnered with Institutional Investor (www.institutionalinvestor.com) to obtain a clear picture of institutional investor sentiment and outlook towards digital assets since the start of the crypto winter.

The study was conducted by the Institutional Investor Custom Research Lab using an online survey. A total of 140 US institutional investors participated in the survey representing total assets under management of about $2.6 trillion. Data was collected between Sep 21 and Oct 27.

The study includes institutional investors who are currently invested in digital assets (36%) and those who plan to invest in the next 12 months (63%). Of those who are currently invested in digital assets, a majority (64%) invested in the last 3 years.

This covers feedback from investment decision-makers from hedge funds, asset managers, and allocators (e.g., defined benefit plans, non-profits, sovereign wealth funds, endowment, foundations, private banks, RIAs and family offices).