Introduction

Recent market volatility has led market players to test the liquidity and solvency of some consensus positions in the crypto ecosystem, namely algorithmic stablecoin TerraUSD (UST). This week, UST depegged from US$1 and led to the concurrent decline in the value of Terra’s native reserve asset, LUNA. In this week’s commentary, we discuss the mechanics of the protocol and the timeline of events that led to its destabilization. We have also seen fiat backed stablecoin Tether (USDT) affected despite important differences in the mechanics of how USDT is redeemed compared to UST.

Weekly Market Call

View replays of our weekly crypto market analyses from our Americas, APAC and EMEA Coinbase Institutional teams, available here.

Market View

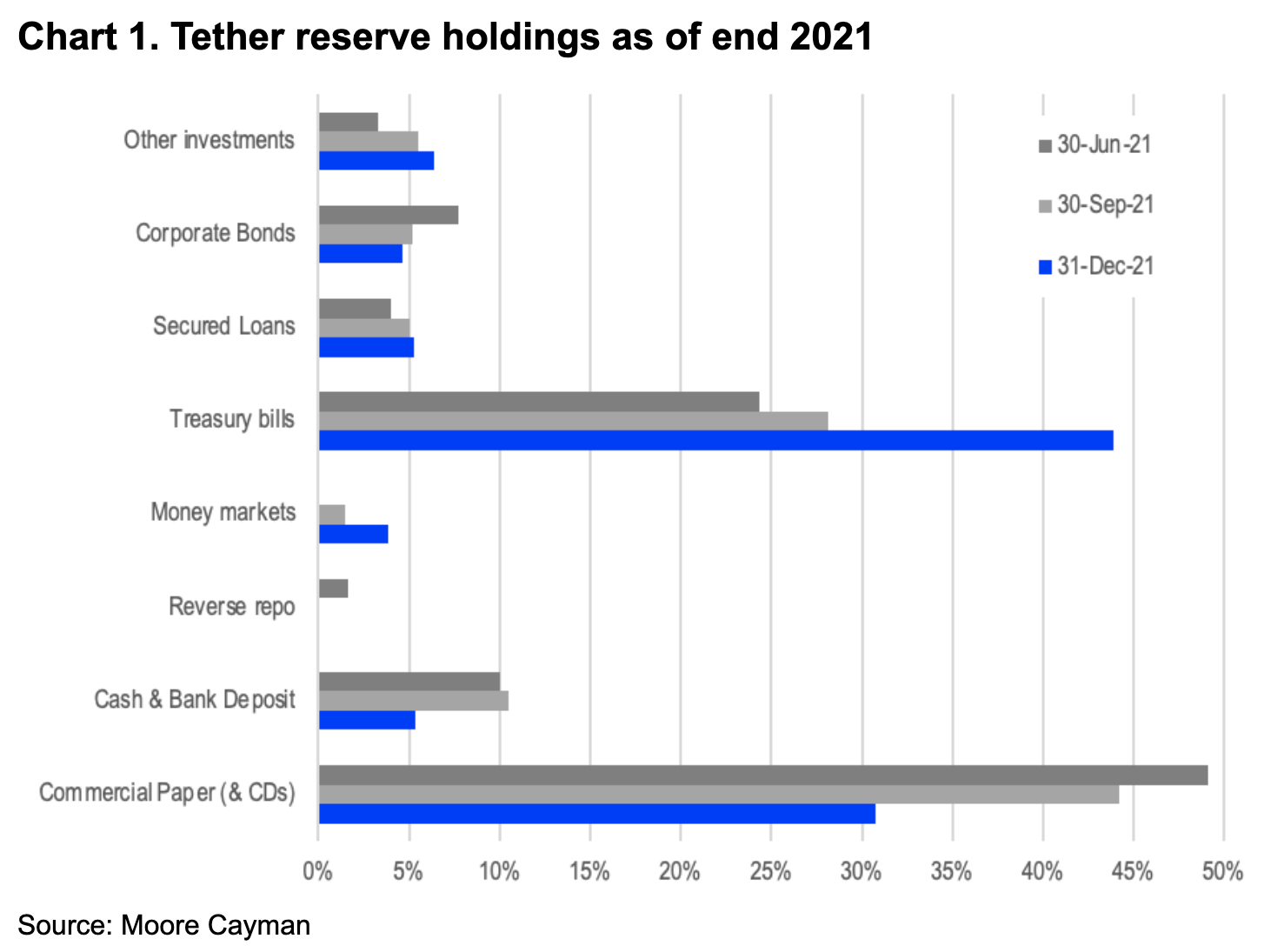

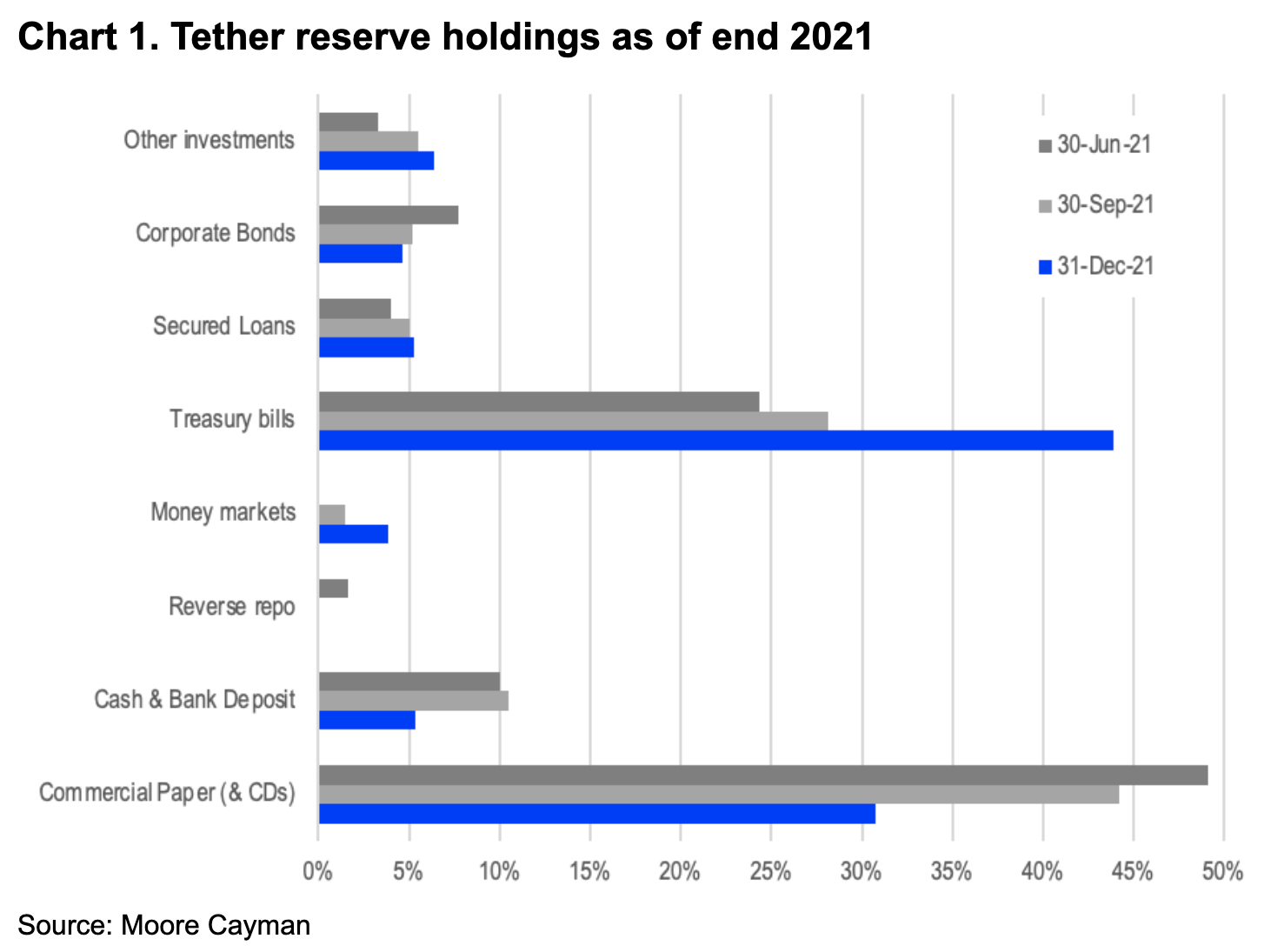

Multiple headwinds have given market players almost nowhere to hide in any asset class this week. In crypto, liquidity and solvency concerns have become most apparent in the stablecoins sector with TerraUSD (UST) bearing the brunt of the market scrutiny, which we discuss below. Tether (USDT) also saw an important depeg on Thursday which prompted Tether CTO Paolo Ardoino to comment that it has reduced its exposure to commercial paper in favor of treasuries in recent months (CP was 31% of reserves at the end of 2021). Importantly, the construction of USDT is also very different from UST in the way it attempts to keep its peg.

At a high level, UST is a decentralized algorithmic stablecoin which attempts to maintain dollar-peg stability through a mint/burn mechanism wherein minting US$1 of UST requires burning US$1 worth of LUNA, and vice versa. In theory, this mechanism allows for arbitrage opportunities to incentivize market participants to maintain the dollar-peg. Tether, on the other hand, holds reserves (including about half in cash and U.S. Treasury bills according to its auditor) such that 1 USDT can be redeemed for 1 U.S. dollar at any given time, with a market cap of ~$82B.

Importantly, the equilibrium of the Terra system is largely dependent on the utility of UST and resultant demand for UST, which to date has primarily stemmed from the ~20% yield offered by the Anchor protocol (at its highs accounting for ~70% of all staked UST). When demand for UST increases, more LUNA is burned and the LUNA price rises, but the reflexivity of the system means that when demand for UST falls, and is then redeemed to mint new LUNA, sell pressure on LUNA increases, potentially resulting in a downward flywheel dynamic (i.e inflating LUNA supply).

While this is not the first time UST has deviated from its peg (once in May 2021 and again in January 2022), this time is different for a few reasons. The most recent incident in late January 2022 occurred as Terra was integrating with a cross-chain leverage tool called Degenbox, which ultimately imploded, creating instability for UST’s dollar-peg. While the peg was ultimately restored, this caused Terra to rethink its collateralization model and buy ~US$3.5B of BTC over the past few months in order to supplement its LUNA-based reserve system (to be 20% BTC / 80% LUNA), allowing UST to be redeemed for BTC (as opposed to newly minted LUNA) in times of market stress, in theory preventing future downward flywheel scenarios. This time was also different in that the recent run up in demand for UST had increased its market cap from ~US$11B in late January to over ~US$18B just prior to this week’s events.

Further, on April 1, Terra announced they would be migrating UST liquidity from the existing UST-3pool on Curve (balanced by UST on one side and USDC/USDT/DAI on the other) to a newly created 4pool (equal parts UST/USDC/USDT/FRAX) in an effort to increase overall liquidity for UST. In anticipation of this migration, Terra pulled US$150M of liquidity from the UST-3pool on May 8. Soon after, one or more large market participants used US$350M of UST to further drain liquidity from the pool and began offloading UST on Binance for other stablecoins en masse, resulting in an initial depegging of UST down to ~US$0.97. As Terra had previously indicated they would begin defending the peg below ~US$0.98, this prompted them to begin liquidating their reserves to defend the peg, causing downward price pressure on BTC (as a result and in anticipation of Terra liquidating its BTC reserves). This sent shockwaves through the rest of the market resulting in further market panic and a run on the Anchor protocol as UST stakers sought to unstake and redeem their holdings, reducing Anchor’s TVL from ~US$17B down to ~US$8B as of May 10, and down to ~US$1.6B as of May 12.

Over the last few days, the price of UST oscillated between US$0.60 and US$0.90 as Terra continued its defense of the peg through the rapid expansion of LUNA’s supply and attempting to organize funding from market makers and VCs to replenish their reserves. On May 10, a rumor began circulating on Twitter that Terra was seeking US$1-1.5B of funding, wherein they would grant potential investors LUNA at a 50% discount to its spot price (~US$30 at the time of the leaked rumor) with a one year lockup and monthly linear vesting schedule. As of May 10, Terra had supposedly secured US$700M of commitments, but as of the following morning, no deal had publicly materialized. Instead, the price of LUNA continued its decline and UST fell even further off its peg, to US$0.29 at its lows. On May 11, with no backstop deal yet in place, Terra’s founder Do Kwon detailed their current plan via Twitter which essentially states the only path forward is to absorb the oversupply of UST by adjusting the mint/burn mechanism to allow for an over 400% increase in minting capacity (i.e. more rapid inflation of LUNA) in hopes of restoring the peg. Kwon noted that they will continue to explore various options for external capital to help absorb the UST supply overhang and suggested further protocol changes to more concretely collateralize UST.

All of the above has resulted in the circulating supply of LUNA increasing by roughly 6,700% between Tuesday and Thursday, up from ~345M to ~23.4B tokens, contributing to the cascading price of LUNA, which has fallen from over US$60 prior to these events to under US$0.01 at its lows on May 12. Further, the Anchor protocol has been drained from over US$17B to under US$2B. As of this writing, the market cap of LUNA is around US$200M (down from over US$30B as recently as May 4), while the market cap of UST is around US$5B (down from over US$18B weeks ago), reflecting the disequilibrium of the system which can only be ameliorated by reducing the supply of UST and further inflating LUNA (as of May 12, the outstanding supply of UST has been reduced by ~36% between Tuesday and Thursday).

The outstanding question at present is whether Terra will be able to secure additional funding to support the ecosystem. Even if they are successful in doing so, it’s unclear what level of funding would be sufficient to thwart off potential future crises. Regardless, we think Terra will likely need to amend the protocol to become more fully collateralized in order to regain credibility in the stablecoin market. Fortunately for the broader crypto market, it appears as though the potential insolvency of UST/LUNA does not pose meaningful contagion risk to other crypto assets, outside of the initial panic stemming from the liquidation (or anticipated liquidation) of Terra’s BTC reserves. During the most recent leg down for both UST and LUNA on May 11, other crypto assets have largely been isolated from price declines of the same magnitude, with BTC hovering near US$30K and ETH near US$2K as of this writing.

Coinbase Exchange and CES Insights

Exchange

Volumes on the exchange have spiked in the wake of the market turbulence reaching the highest levels since the sell-off during the end of January putting an end to the sideways trend that was in place over the last few weeks. Interestingly, despite larger volatility than during the sell-offs in January or December volumes are still somewhat lower in comparison, which suggests lighter positioning as well as potentially decreased interest from retail due to a difficult market environment.

The volume breakdown by asset traded also paints an interesting picture with bitcoin at above 36% while ETH is at a solid 22.24%. This is in line with what one would expect in a major sell-off with higher tail assets significantly underperforming and a rotation into BTC. BTC dominance has equally increased to 44.4% which is the highest it has been since last November.

The most traded altcoins were SOL, WLUNA and AVAX while UST was actually at only 0.95% of overall volume traded over the last week.

As the first stories started to emerge over the de-pegging of UST over the last weekend, the buy ratios for both WLUNA and primarily UST have collapsed recovering in the days after this. It’s especially noteworthy that WLUNA’s buy ratio was outpacing all buy ratios in this comparison on May 11 at 82% which suggests numerous traders trying to “catch the falling knife” while the price was down more than 90-95% on the day.

It’s also interesting to see that buy ratios for BTC, ETH and SOL were holding up for most part during the last days.

Coinbase Execution Services

It’s been one of the most busy weeks on the trading desk in recent memory which was primarily dominated by selling flow from a range of accounts both from the traditional finance side as well as from the crypto native realm. The selling was mostly focused on blue chip coins suggesting very light positioning in longer tail assets as well as significantly worse liquidity in higher beta altcoins as the market hasn’t seen this much distress in at least a year.

We have also started to see buyers starting to cautiously step in over the last few days and buy BTC and ETH. This started with crypto natives but reassuringly we have also seen traditional finance accounts starting to look at buying at significant discounts compared to only a few weeks ago.

Bitcoin Technicals

After breaking below the ascending trend-line on the daily chart BTC has seen its sell-off accelerate trading down to the $25,000 region on Thursday intraday breaking below the lower band of the Bollinger bands as well in the process. The price bounced back towards $29,500 in the second half of the day retesting this area with the risk being that $30,000 will become major resistance if we consolidate below over the next few days. In order to stabilize and start bottoming out BTC would need to start closing above this mark again.

However, the downside scenarios are certainly still in play as well with BTC essentially in “no-man’s land” and the next major technical support only at the 200WMA around the $22,000-23,000 area. If things were to deteriorate further the next line of support would come at around $20,000 which was the all-time high in the previous 2017/2018 cycle.

View From Around the World

Asia

Australia’s spot cryptocurrency ETFs - 21Shares Bitcoin ETF, 21Shares Ethereum ETF and Cosmos Purpose Bitcoin Access ETF - have finally debuted on CBOE Global Markets Inc.’s local exchange on Thursday after a previously delayed rollout. According to Bloomberg, the total trading volume surpassed A$1 million only two hours after the opening bell, marking a robust start for the country as its entire ETF market is only A$152B (~US$104B) versus the US$6.3T in the U.S. (Bloomberg)

Europe

Brexit hamstrung the UK’s efforts to create a thriving crypto industry. Now, it just might be the country’s ticket to regaining lost ground. That’s the view of more than half a dozen digital-asset executives, who expressed cautious optimism in interviews about the UK’s prospects, after a string of recent government initiatives intended to stem an exodus of crypto companies. (Bloomberg)