Market View

The steep pace of global central bank liquidity withdrawals over the last six months has proven to be a material constraint on trading activity across all asset classes, and crypto has been no exception. Since April, the total aggregate balance sheets of G6 central banks (including the Fed, ECB, Bank of Japan, Bank of Canada, Bank of England and the People’s Bank of China) has fallen by US$2.8T to $27.4T as of October 18. Comparatively, global policy makers’ balance sheets fell by $4.1T between February 2022 and October 2022 which led both US stocks and digital assets to move 2-3 standard deviations lower in the early stages of that sell off. That said, the effect of this liquidity withdrawal on crypto markets has been difficult to disentangle from other factors, as the acceleration this year occurred at around the same time that regulatory scrutiny began to gain momentum in 2Q23.

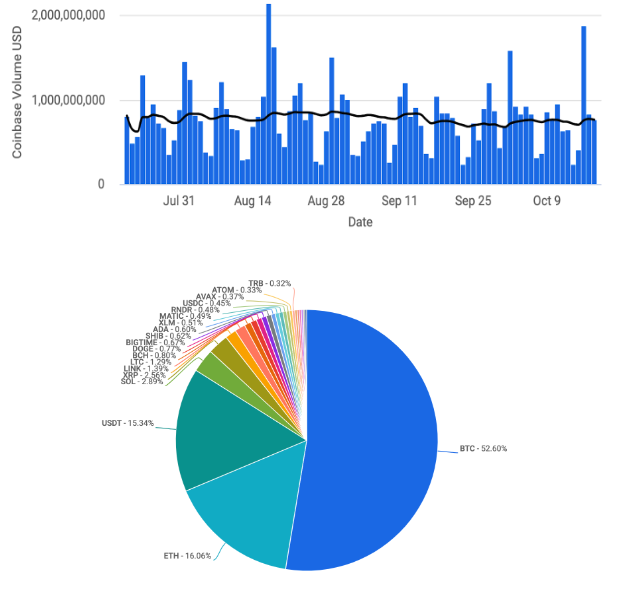

To separate these effects, we use factor analysis to identify the crypto volumes (for BTC and ETH only across multiple exchanges) associated with global central bank liquidity and distinguish them from the volumes driven by crypto-specific themes. Data alignment is a challenge here as global liquidity injections and withdrawals tend to have a lagged impact on trading activity. Nevertheless, we believe chart 1 shows that the recent sharp adjustments in trading volumes for BTC and ETH on a month-to-month basis has been driven primarily by the decline in global liquidity, whereas the pace of moderation for trading volumes linked to crypto-specific factors year-to-date has actually been smaller, more consistent and smoother.

Meanwhile, long end US Treasury bond yields have continued to climb higher, as Fed Chair Jerome Powell this week took a non-committal, data-dependent stance on monetary policy. Regarding our points on central bank balance sheets above, he also avoided discussing the role that quantitative tightening has had on the yield move, although he recognized that the current US fiscal path is “unsustainable.”

Procyclical fiscal spending has been doing its part to support a resilient US economy, as evidenced by stronger than anticipated retail sales, industrial production and home sales data reported this week. But it’s also contributed to higher borrowing and heightened bond market dysfunction. The bond market volatility index has risen by 35% since mid-September, and we believe this has been more important for risk performance than the nominal levels of yields themselves. Moreover, we think the recent data may drive expectations higher as we approach the holidays, which may be a potential setup for disappointment.

In derivatives, ETH (traditional) futures open interest on the CME has finally started to pick up over the past 10 days after the muted market response to the launch of several ETH futures-linked ETFs in the US earlier this month. That said, at $421M as of October 18, ETH open interest on the CME has only recovered to the levels last observed in mid-September. Open interest weighted basis has stabilized following the trend lower in recent weeks, currently near a 1-month yield of around 1.6% annualized. Separately in options, the 25-delta 1m skew for ETH has been retracing lower over the last 10 days suggesting market players may be unwinding their downside risk protection.