Introduction

Spot bitcoin exchange-traded funds (ETFs) have the potential to widen crypto access to a new class of investors, including registered investment advisors (RIAs), retirement funds and other institutions that have historically been precluded from this asset class. However, we do not think ETFs alone will drive the narrative that defines bitcoin adoption in the long run. ETFs may be the vehicle, but the context matters. Compared to other safe haven assets like gold, for example, bitcoin’s network driven utility and inelastic supply distinguish the token from other assets. These attributes are why bitcoin can help diversify portfolios from a systematic risk perspective.

Still, the impact of one or more spot bitcoin ETF approvals are significant, as it will open up a massive opportunity for the wealth management community, which handles over a third of all wealth in the US. These are not market participants that would otherwise buy and custody bitcoin independently, but instead rely on ETFs to build their unique investment strategies. Moreover, we think ETFs can potentially lead to new financial products (like lending and derivatives) that could use regulation- and compliance-friendly ETFs as their underlying. This may redefine the market structure around how crypto assets are bought, sold and/or exchanged.

In the long run, this means spot bitcoin ETFs could add billions of dollars to the total crypto market cap as well as spark new potential investments for the asset class. While this will take time, we expect ETFs to lay the foundation for a more regulated environment, greater inclusion and a material growth in demand.

‘Wen’ ETF?

In our view, chances have sharply improved that one or more spot bitcoin ETFs may be approved by the US Securities and Exchange Commission (SEC) before the end of 4Q23. (See footnote 1.) Typically, the SEC extends its decision window to the furthest extent allowed by its regulatory framework, which in this case would be the final deadline of January 10, 2024 for the ARK-21Shares Bitcoin ETF application. However, the current timeline has been complicated by gridlock in the US House of Representatives. A potential government shutdown on November 17 would furlough over 90% of SEC staff. As a result, we think there is currently an open window for the SEC to be proactive in their decision making.

In recent weeks, we’ve seen a number of applicants amend their prospectuses with updated language, suggesting meaningful dialogue between these teams and the SEC. Although this is commonplace for such applications in other asset classes, this is a first for crypto, according to Bloomberg Intelligence. That seems to be driving up market expectations for one or more approvals, boosting investor appetite for bitcoin risk.

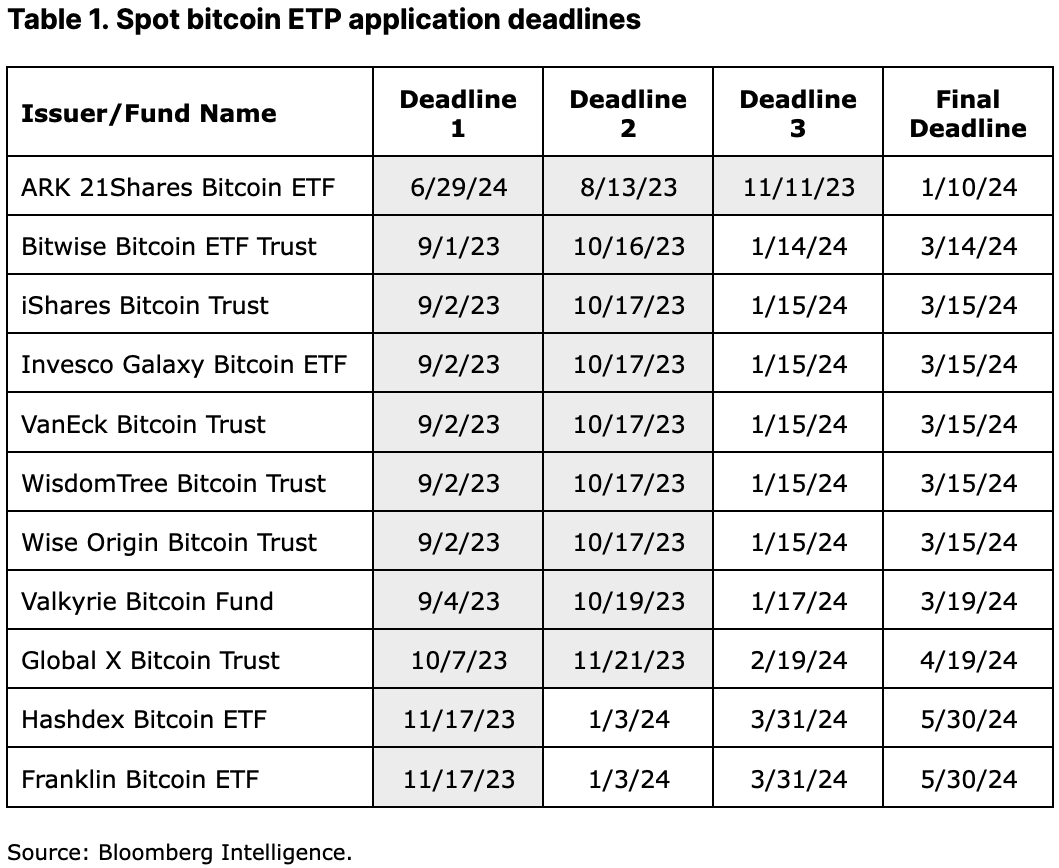

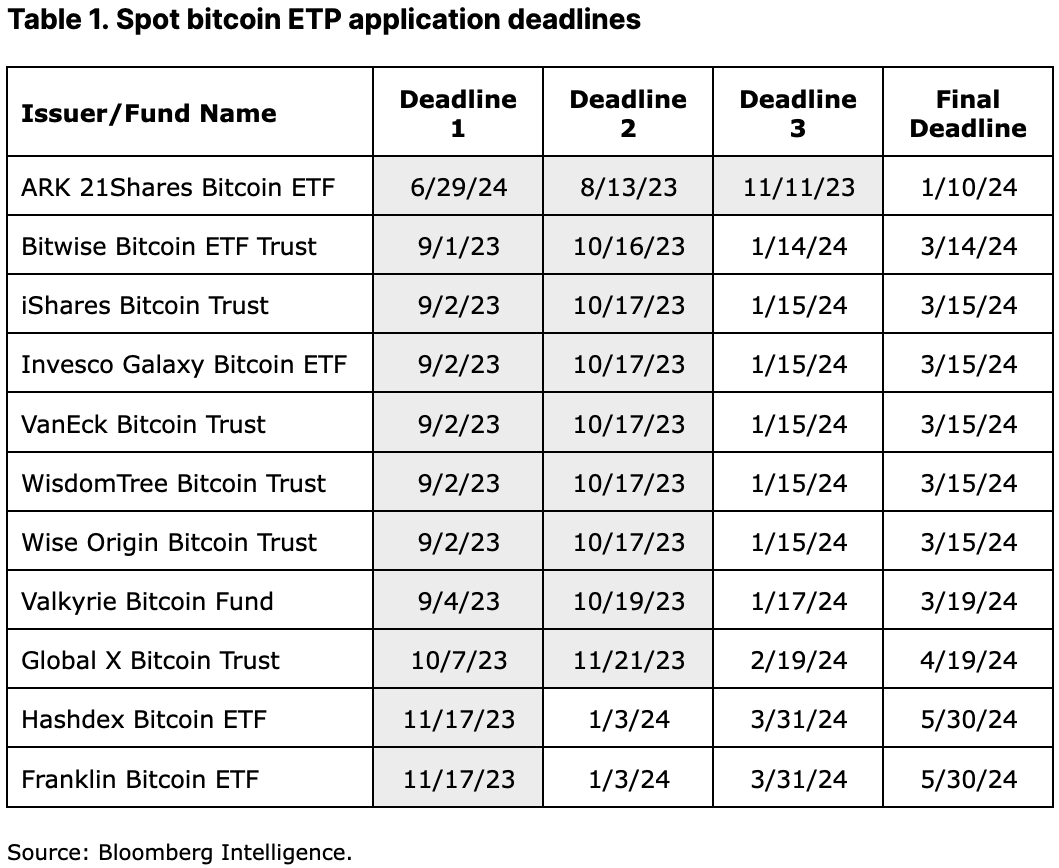

The conversation around spot bitcoin ETFs in the US has been around since at least 2013, but for years, the SEC has not approved any proposals citing concerns surrounding market manipulation, surveillance-sharing arrangements and liquidity. Two things have changed this year. First, a number of high-profile financial institutions including BlackRock, Invesco and Franklin Templeton launched spot bitcoin ETF applications (see table 1). Second, a federal court sided with investment firm Grayscale after it sued the SEC for rejecting an application to convert its Grayscale Bitcoin Trust (GBTC) to an ETF.

All that glitters is not gold

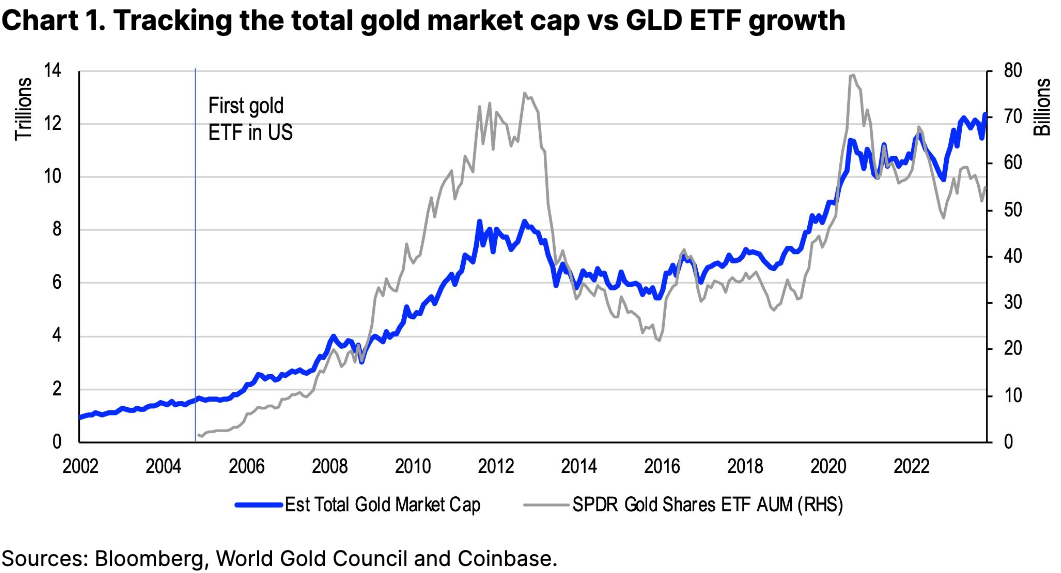

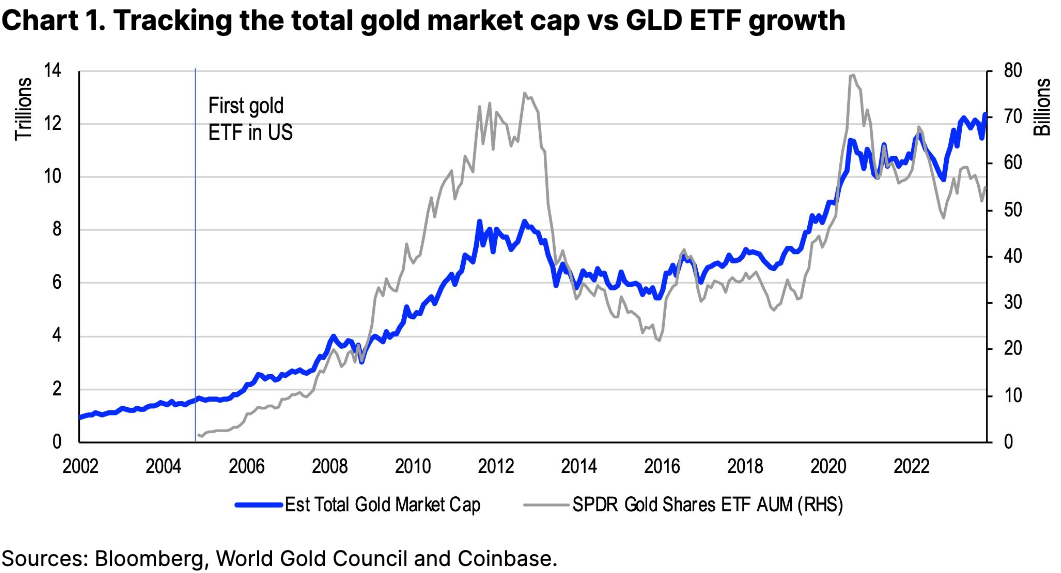

Spot bitcoin ETFs have the potential to grow the crypto market by reducing the frictions that would otherwise prevent capital from flowing into the asset class. Many users compare the current situation to the gold market and the ostensibly transformative launch of the first gold ETF in the US (see our previous monthly outlook). The SPDR Gold Shares ETF (GLD) was launched in October 2004 and expanded access to the gold market for many US clients who could not easily acquire or store physical gold. Crypto pundits see this as a sympathetic analogue for bitcoin.

However, the reality is that North American gold ETFs today represent less than 0.8% of the total gold supply, according to the World Gold Council. (See footnote 2.) We think their direct influence on the precious metals market may be somewhat overstated. For example, the GLD ETF attracted over $4.8B in net flows in its first year (inflation-adjusted to 2023 dollars), which is meaningful. But inflows didn’t really take off until during the global financial crisis in 2008 through 2012, during which time GLD’s AUM growth outpaced the rise in the broader gold market cap. We believe that more Americans sought umbrage in gold as a hedge against economic instability compared to residents in other regions, given that the US was the initial focal point for that crisis.

By contrast, GLD’s AUM has fallen from its 2020 peak during the post-pandemic era, despite the total gold market cap rising over the same period. We believe this is due to buying from global central banks (ex-US) amid concerns over rising geopolitical tensions and the weaponization of global finance.

While the launch of gold ETFs in the US was a significant event that allowed broader adoption of the precious metal, we do not believe that it alone was the defining catalyst that fundamentally changed the gold market. Context matters. Whether it’s gold or bitcoin, granting users access is undeniably important. However, what drives flows are the narratives that reinforce the unique characteristics of these assets in the context of changing market conditions.

(See previous month outlook for more details on table 2 above.)

What makes bitcoin different

An important difference between bitcoin and gold is that bitcoin supply is much less elastic, with a fixed supply schedule. We think this point is underappreciated, as theoretically more gold can be mined to meet demand when prices rise, but the same can't necessarily be said of bitcoin. Moreover, bitcoin is a growth story. The utility of the bitcoin network expands in relation to the number of users using the network, which directly contributes to the value of the token. Comparatively, there are often no growth aspirations for buying gold.

Both those factors mean that bitcoin can occupy an altogether distinct role in portfolios from a systematic risk perspective. Consider too that monetary policy in many G10 countries is currently running a greater risk of being driven by fiscal dominance, which could further increase global M2 money supply and support bitcoin performance. Thus, we think relying too heavily on direct comparisons to gold may do digital assets a disservice.

Demand and supply

Gold may be incongruous to bitcoin for another reason. Mainstream access to crypto today is arguably more ubiquitous than gold was prior to 2004. In fact, it’s still easier to transact and hold bitcoin than physically buy and custody a commodity like gold, which is typically one of bitcoin’s strengths as a store of value. But if users can already buy bitcoin directly, that begs the question of what purpose a spot bitcoin ETF ultimately serves.

Although this critique is not without merit, we believe crypto accessibility is not well understood in the context of the wider investment community. As of 3Q23, US households hold over $154T of wealth (total assets minus total liabilities), of which more than a third is managed by institutional players like wealth advisors, banks and broker-dealers. Many large asset managers do not independently buy and custody bitcoin. Instead, they often rely on ETFs to build their unique investment strategies, which distinguishes spot bitcoin ETFs from alternative means of bitcoin accumulation.

The implications of this may be massive for cryptocurrencies, as ETFs can potentially redefine the market structure around how these assets are bought, sold and/or exchanged. ETFs would take bitcoin further into the mainstream, putting it within reach of millions of investors in the broker dealer, registered investment advisor (RIA) and tax advantaged account structures, where such vehicles currently trade in the US. With ETFs, money managers will have a direct channel for including bitcoin in client portfolios based on formal benchmarks. That could potentially lead to new financial products (lending and derivatives, for example) using compliance-friendly ETFs as the underlying, which could then be traded among institutional counterparties.

Thus, what an ETF represents for bitcoin adoption extends beyond the immediate inflows into these products, potentially reshaping the market in entirely unprecedented ways. Nevertheless, we think this will take time to unfold. For example, employers may not allow 401k retirement contributions to bitcoin on day 1 of spot bitcoin ETFs launching.

In addition, we think banks and broker-dealers (who manage over 80% of the assets in the wealth management industry) represent a major opportunity for this space. This cohort of investors is less likely to own existing futures-linked bitcoin ETFs because these instruments tend to be less capital and tax efficient and potentially more expensive than what may be offered by spot bitcoin ETFs. However, strategic allocations from these sources may be restricted in the short term due to their firms’ unique requirements on AUM thresholds or historical track records. Such obstacles may only be alleviated over time.

Forecasting is hard

Trying to forecast the size of the potential net inflow into spot bitcoin ETFs can distract market players from the larger transformation taking place in the asset class. Moreover, there are a number of challenges that make this exercise difficult to do with reasonable accuracy.

First, this is a new asset class, which makes it hard to gauge potential flows, because it often takes time for demand to percolate, both within the broader population and inside the wealth management community.

Second, flows are contingent on the trading regime. Opportunity costs are higher and capital more scarce than they were two years ago, while the current investment environment is unlike any we've previously experienced. That gives us fewer comparables for analyzing flows with respect to previous periods.

Third, flows are often path dependent, and there are currently a lot of variables that may affect initial allocations to ETFs. For example, there is already over $22.1B in AUM locked up in Grayscale’s GBTC product, which cannot be redeemed for the underlying bitcoin until GBTC is converted into an ETF. When those conversations are enabled, this may affect flows in both directions depending on market positioning, competitors’ expense ratios and liquidity.

Thus, in our view, tracking the flows in the first week that these products launch may be far less useful than thinking about the long-term market impact. Currently, we are witnessing a massive generational transfer of wealth from baby boomers (those aged 57-75 years old) to millennials, who are much more amenable to having crypto exposure in their portfolios. By making bitcoin more easily accessible via traditional vehicles, ETFs have the opportunity to reach new segments of the population and allow adoption to grow at scale.

Conclusions

Ultimately, spot bitcoin ETFs will widen crypto access to new classes of investors. However, the impact of one or more spot bitcoin ETF approvals will be far-reaching and cannot be measured in flows alone. That is, the opportunity is potentially much greater than just enabling new capital to access the crypto market. ETFs will ease the restrictions for large money managers and institutions to buy and hold bitcoin, which will improve liquidity and price discovery for all market participants. Plus, having a vehicle that meets key regulatory and compliance requirements may also open the door to new products, such as lending, futures and options, which could utilize ETFs as their underlying. If that materializes, it can multiply the existing crypto offerings for accredited investors and widely expand adoption.

In the long run, this could add billions of dollars to the total crypto market cap, although we believe this will take time. Fortunately, we think the ETF narrative is bringing more attention to bitcoin at an opportune time, as the world has fewer safe haven alternatives amid a backdrop of rising geopolitical tensions and increasing economic dysfunction. The US Treasury bond market has been shaken up, dollars are expensive and the US banking sector remains highly vulnerable. We think this makes bitcoin all the more attractive going into 2024 as an alternative to the traditional financial system.