Introduction

In basic terms, short selling refers to the practice of generating alpha from falling prices. When you short a digital asset, you borrow the tokens from a third party and promptly sell those tokens into the open market. If the price of those tokens fall, you take that opportunity to buy those tokens back at the new lower price and return the digital assets to your lender, netting some profit in the process.

Although the premise is simple, different economic actors have different motives for shorting that may not strictly involve price speculation. For example, bitcoin miners may use short sales to strategically hedge their exposure or receive upfront liquidity to cover operational expenses. This allows them to participate in the market’s potential upside while simultaneously reinvesting in their mining infrastructure to secure the network. The practice can also be used in derivatives transactions where one or both sides need to delta hedge. Basis traders support market efficiency by taking short positions in the spot market and going long futures (or vice versa).

While short selling may solicit criticism from its detractors, it serves some invaluable market functions that aren’t necessarily predicated on driving prices down. The activity often acts as a crucial check on market excesses, enabling (1) lower volatility, (2) higher liquidity and (3) better price discovery for digital assets. That said, the active spot market for shorting digital assets is still fairly small at the moment. We believe that developing this may be important for facilitating earnest two-way trading that improves the health and efficiency of these markets over the long run.

Opportunity or exploitation?

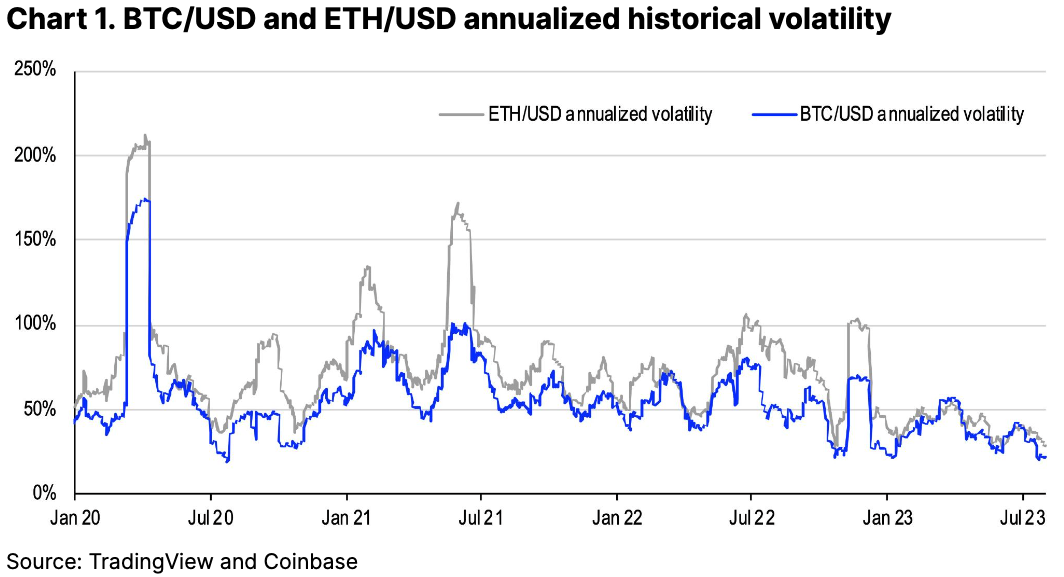

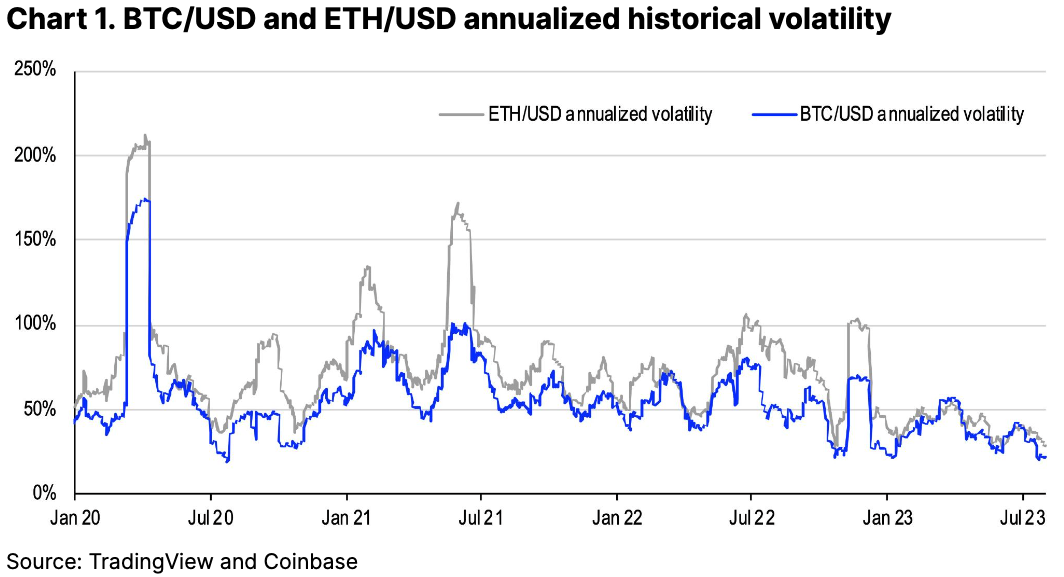

Short selling often seeks to turn the market convention of “buy low, sell high” on its head by allowing market participants to identify overvalued assets and express a view. Without short selling, the alternative leaves market players with access to long only positions that reflect one-directional (i.e. positive) sentiments, which can artificially drive prices above their idiosyncratic fundamentals. The risk is that if such projects do not then meet expectations, that can lead to sharp corrections in the future. In fact, the lack of developed short sale markets for the digital asset class may be one reason for its historically high volatility, which makes it harder for institutional investors to justify including such holdings in their portfolios.

Having two way markets supports more efficient price discovery, which may reduce volatility not just for single-name assets but for the crypto asset class as a whole. Reducing that volatility can help increase the level of active investor participation in this space by removing a key pain point for portfolio managers. The additional liquidity reinforces greater stability and efficiency for the market by having more buyers and sellers, allowing a greater pool of market participants to absorb trading volumes which limits price fluctuations and fosters a smoother trading environment.

Moreover, the use cases for short selling are not necessarily limited to price speculation. Different economic actors may have different motives for using this practice. For example, hedging is an important facet of the shorting spectrum that involves safeguarding assets and/or accessing liquidity. The primary business of cryptocurrency miners is producing and holding tokens, but this exposes them to market fluctuations. Although they may want to participate in the market’s upside, miners could also have operational expenses that force them to source liquidity upfront. In this case, short selling serves as a valuable mechanism that allows such entities to reinvest in their infrastructure and maintain the network’s security.

What are the disadvantages of short selling?

Sounds pretty good, but what’s the downside? For practitioners, short selling can be risky as the upside on assets can potentially be unlimited, meaning the losses to short sellers have no ceiling but the gains are capped. In crypto markets, it’s not uncommon for the upside on some tokens to be multiples higher than the starting price, for example. We believe that this asymmetric risk-reward should act as a check on short sellers from pursuing this strategy without strong evidence of weak fundamentals.

But also in traditional finance, companies that become the target of short sellers argue that this cohort of investors can propagate misleading or false information that tarnishes such companies’ reputations.

Of course, in the US, any attempts to actively manipulate share prices - by either buyers, sellers or short-sellers - are considered illegal and subject to enforcement actions. This includes bear raids that involve coordinated efforts by traders to drive down stock prices via aggressive short selling tactics. More to the point, an August 2004 study by former Yale Finance Professor Owen A. Lamont found that in a sample of 327 disputes between target companies and short sellers, the majority of false claims were in fact made by the companies themselves and not the short sellers.

It’s important to note that under normal market conditions, short selling encourages market participants to scrutinize projects more closely, which can uncover potential risks and disincentivize mismanagement. In that sense, lending tokens to short sellers leads to greater information dissemination that aids the system more broadly. That includes the venture capital firms that often finance these projects, as quality assets can benefit from such appraisals.

Do extraordinary times really call for extraordinary measures?

However, in times of crisis or extraordinary market stress, detractors of short selling argue that the practice can exacerbate downward price movements by eroding investor confidence. That is, they believe that heavy short selling can accelerate losses when market participants pile into these trades. That creates a higher (negative) cumulative impact on the price than may otherwise be realized. (Of course, the opposite can be true as well – during periods of rising prices, short sellers may need to buy these assets to cover their positions, leading to short squeezes that drive prices higher.)

During the global financial crisis in 2008 and later during the COVID-19 pandemic, such concerns motivated many countries including the US to establish short selling bans on financial stocks to prevent or moderate potential market declines. In the US, the short selling ban (on downticks) started on September 19, 2008 and was lifted on October 17, 2008. A study performed by the Federal Reserve Bank of New York looked at whether such short sale restrictions have had an impact on stock performance.

They found that the historical relationship between short selling and price movements is actually weak. In fact, the authors noted that short sale bans can increase liquidity costs as well as volatility. This also affirms empirical evidence that suggests downward price moves are driven more by sellers of long positions, not short sellers. The report goes on to say that not only does short selling not cause market declines, but banning short selling does not avert falling prices when market fundamentals are weak.

An econometric analysis performed by the European Securities and Markets Authority (ESMA) on short selling bans enacted during the pandemic (between March to May 2020) similarly “did not identify any statistically significant correlation with abnormal returns, suggesting that the bans did neither harm nor sustain market prices.” Their work suggests such bans are actually associated with “significantly higher” bid-ask spreads indicative of liquidity deterioration compared to the control group. That said, they did notice a lower degree of volatility during the period in question, though this was coupled with lower predictive confidence. See the key metrics from this study in table 1.

Proving the counterfactual

While there is plentiful data for studying the impact of short selling on stock prices, short selling in crypto spot markets is still nascent, meaning we only have limited data to work with. For example, there is no centralized database for short sales of bitcoin spot (which represents 46% of the total crypto market cap), as these transactions are often conducted over-the-counter and not reported to third-party platforms. As a result, there is currently only scant information regarding utilization rates (i.e. the current borrowing demand for a specific token) and/or short interest (i.e. the total number of open short positions that have yet to be covered or closed).

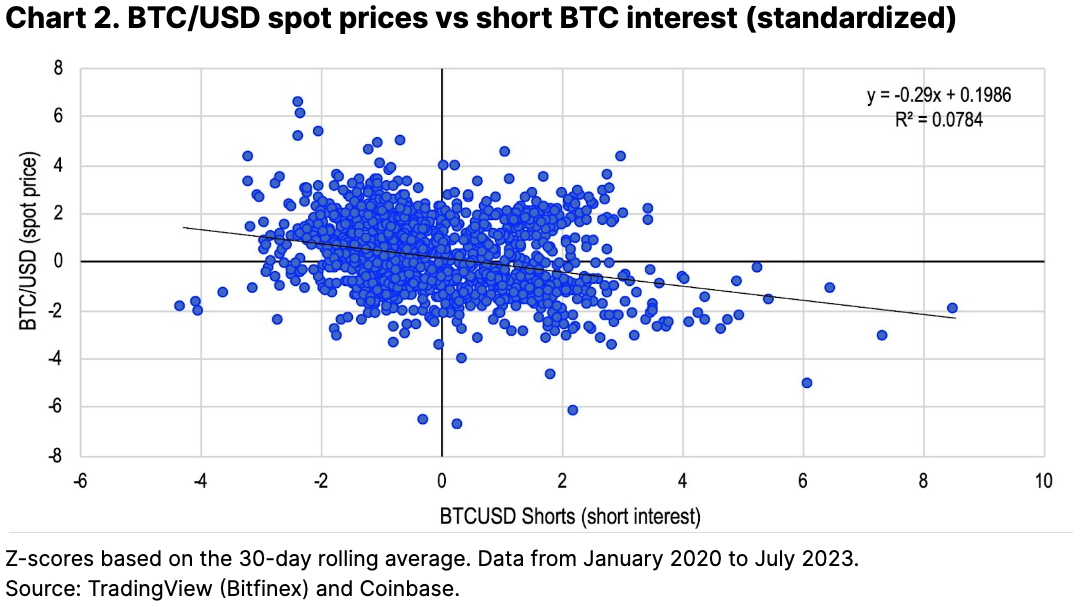

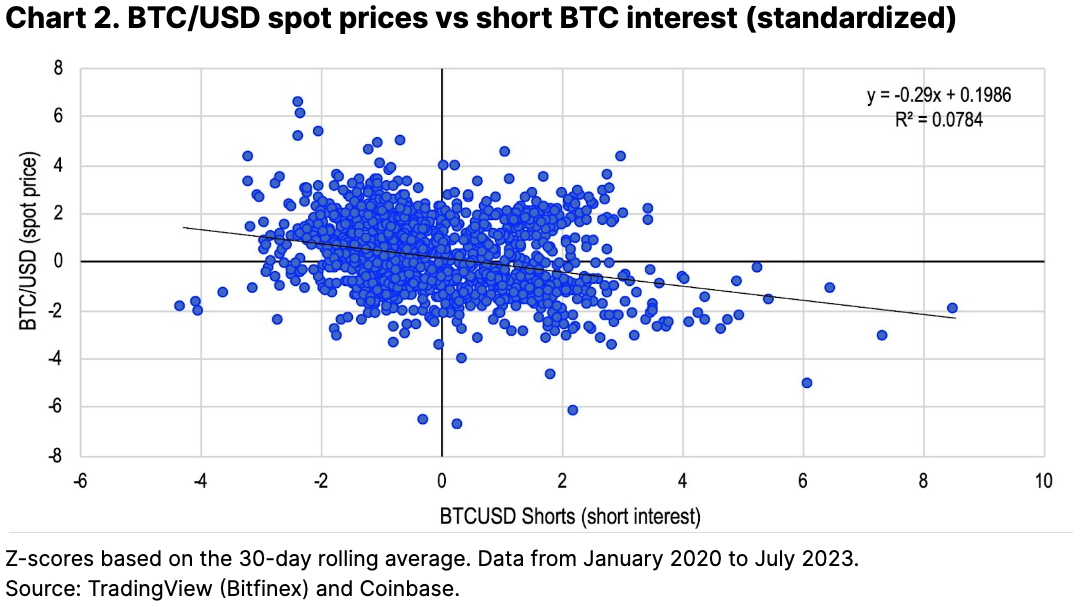

One available source for gauging short interest is the BTCUSD Shorts index, which tallies the total number of bitcoin that have been sold short on the Bitfinex exchange and have yet to be closed out or covered by short sellers. We use this to help analyze the longer-term impact of short sales on crypto prices.

For example, a linear regression of normalized bitcoin spot prices and short interest between January 2020 to July 2023 suggests that bitcoin prices have had little to no sensitivity to open short positions with a very small r-squared of 0.08. That said, even if there were a strong correlation between short interest and spot price movements, that wouldn’t necessarily indicate that there is a strong causal relationship between short interest moves and declines in the spot price (more likely, it would be the other way around). See chart 2 and footnote.

Alternatively, we can also look at the statistics for the period between November 6, 2022 to January 10, 2023. This period coincided with a large short interest in bitcoin due mainly to the collapse of crypto exchange FTX. For this exercise, we normalize the data in our regression via min-max scaling by taking the (1) difference between the daily short interest and the minimum short interest during this period, divided by the (2) difference between the maximum short interest and minimum short interest during this period.

Here, our results do suggest that there was a higher sensitivity of bitcoin prices to short interest at this time compared to our larger data set, but only marginally with an r-squared of 0.14. That is, short interest did in fact increase during this period at the same time that bitcoin prices also fell. But where BTC/USD spot prices depreciated early in the sell off between November 6 and November 12, 2022, we only saw short interest peak two weeks later on November 25. There is no indication that short selling had any major negative impact on bitcoin spot prices during this time.

Conclusions

While this is only a small data sample, we believe it provides some insight into the impacts of short selling on asset performance. Over time, it is possible that short selling can lower the liquidity premium by encouraging more active trading and increasing the depth of the market. As short sellers step in to offer shares for borrowing, there is enhanced liquidity, creating a more robust trading environment. This could help narrow the gap in the bid-ask spread, ultimately benefiting all market participants. Short selling can also serve as a counterweight to exuberant market sentiment by offering a dissenting voice against overinflated assets as well as a vehicle for hedging and risk management.