Market View

Layer-2 scaling solutions (L2s) on Ethereum have seen considerable growth over the last three months. Monthly gas usage to settle L2 activity on the base layer more than doubled between February and March 2023 and has not retreated in either April or May. This may signal a sustainable new paradigm for L2 adoption, in our view. See chart 1.

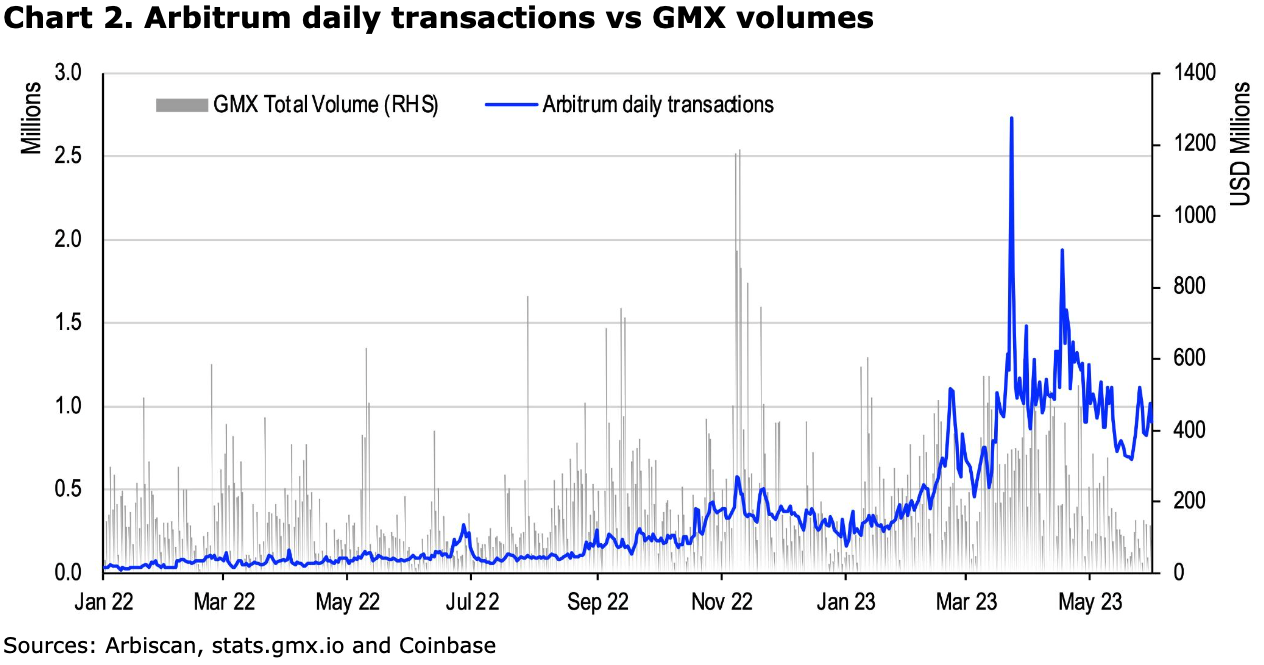

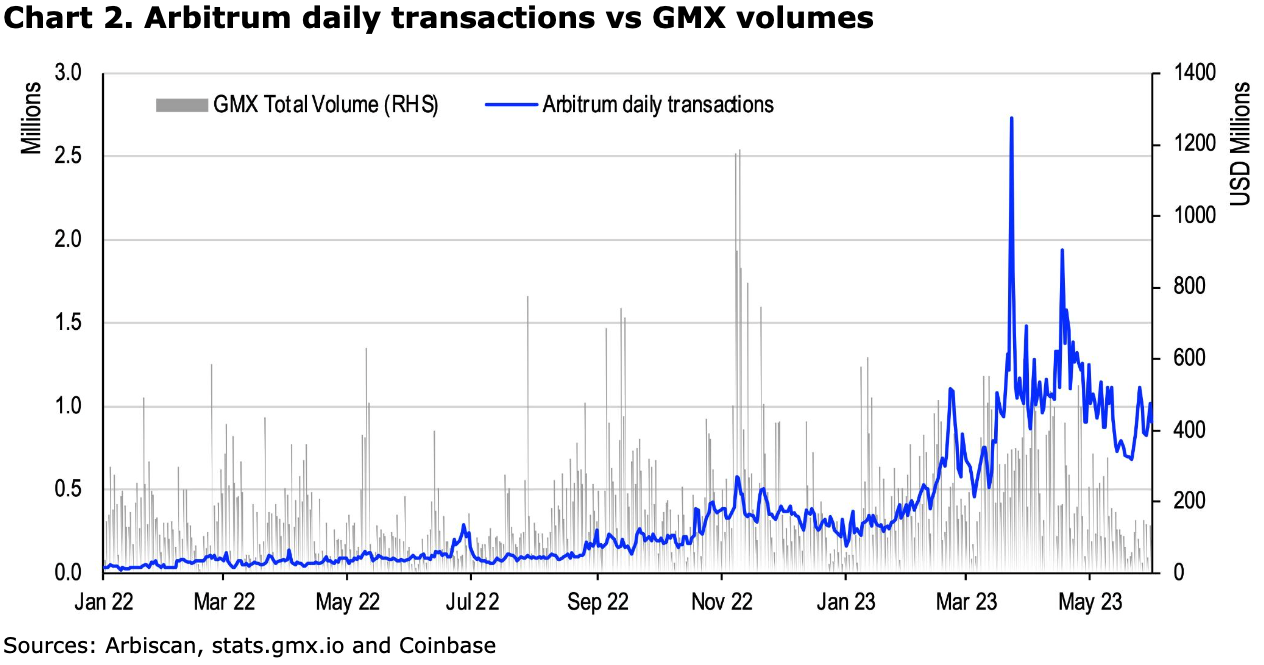

The initial spike in March L2 activity appeared to be associated with the anticipated airdrop of Arbitrum’s ARB token, which eventually materialized on March 23. Following that event, activity on Arbitrum did moderate in the absence of airdrop-farming incentives, but it has still been far above the historical average up to that point while total value locked (TVL) on the rollup increased by 21.9% during the last three months. That suggests that the DeFi activity on Arbitrum associated with protocols like GMX and Uniswap V3 has remained resilient. See chart 2.

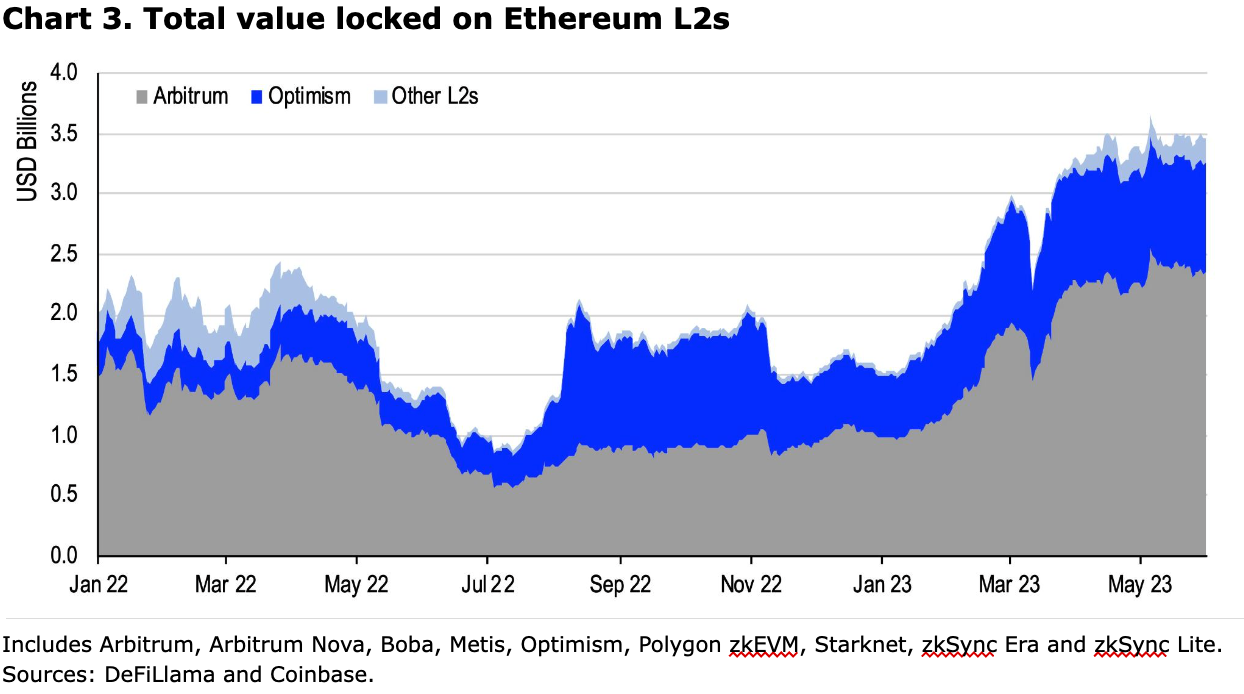

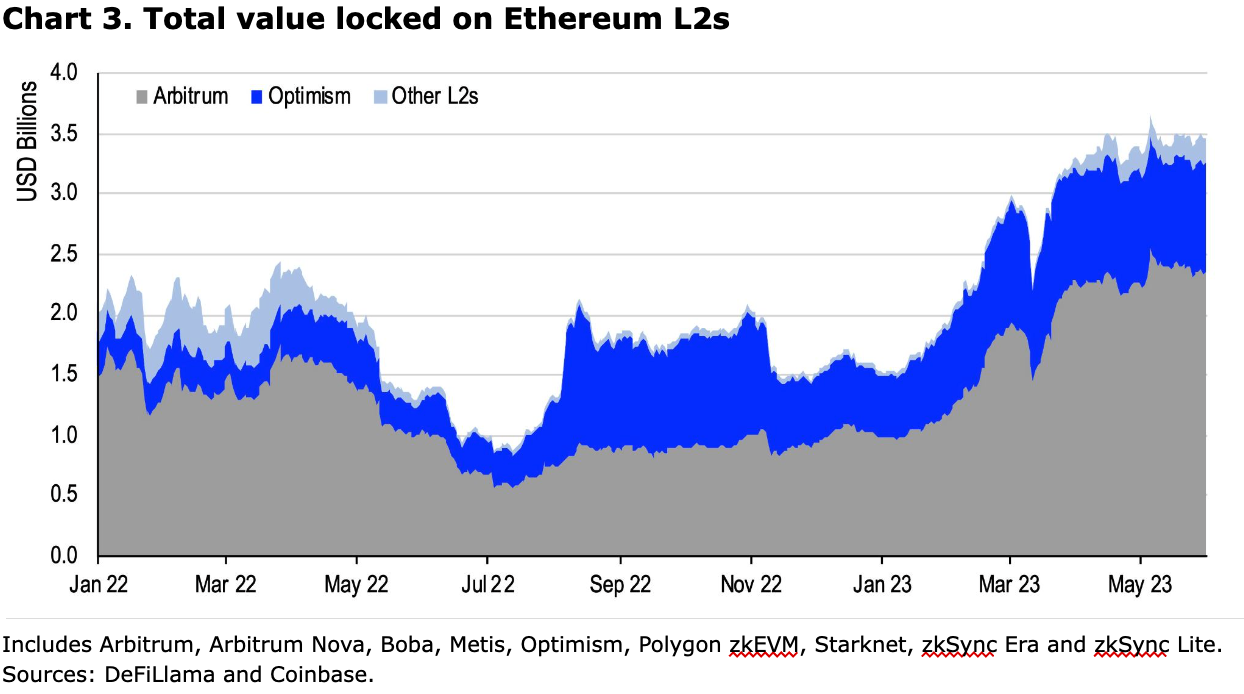

Overall gas data for this sector seems to suggest that user activity on L2s is not only rising, but is fairly sticky, despite the subdued price action in markets as of late. These L2 gas expenditures only represent around 8% of the gas used on Ethereum at the moment, but this is up sharply from the 2% average last year. That traction is evident in the large 124% increase in TVL on these scaling solutions year-to-date as well, with around US$3.4B locked in the L2 ecosystem, according to DeFiLlama. See chart 3.

That said, the recent price action in rollup-centric tokens like ARB and OP haven’t necessarily tracked these supportive fundamentals. This is in part because of the challenging macro environment as well as dilutive technical factors in the case of the latter. Earlier this week, Optimism unlocked 386M OP tokens for early investors and core contributors, more than doubling the circulating supply of OP (previously 335M). While this was a well-telegraphed move, the supply dynamics have still weighed on the OP token price for the last few weeks amid concerns about the selling pressure from early-stage investors. In May, OP traded down 33.6% against USD compared to only a 12.5% pullback in ARB, with the majority of the former’s depreciation occurring near the end of the month.

Coinbase Exchange & CES Insights

With BTC and ETH still well within their recent ranges, traders focused their attention elsewhere this week. The Optimism token (OP) unlock on May 31 was one focal point, as mentioned in the Market View above. This was a well telegraphed event that had weighed on Optimism’s token price in recent weeks, although the majority of that divergence happened in the week preceding the event.

The unlocked tokens were split between core contributors and early investors. While it was unclear what token holders may elect to do with their new freely tradable tokens, favorable valuation metrics helped to support the OP price. In the hours after the unlock, perp funding rates flipped positive suggesting the token had found a level where some were comfortable going long.

Outside of specific events like unlocks, we are hearing that active market participants are running low net exposures while they wait for momentum to return to the market. Many cite diminishing global liquidity as a key risk heading into summer. With the debt ceiling nearly resolved, the US Treasury could soon issue bills to refill the General Account balance, potentially draining liquidity from markets.

View From Around the World

Europe

In a consultation paper published this week, the European Banking Authority is proposing to amend its money laundering and terrorist financing “risk factors guidelines to set common, regulatory expectations of the steps CASPs [crypto asset service providers] should take to identify and mitigate these risks” of money laundering through privacy coins or self-hosted wallets. The plan will be open for comment until August 31. (Coindesk)

Asia

The Hong Kong Monetary Authority is collaborating with the Central Bank of the United Arab Emirates on cryptocurrency regulations to “strengthen cooperation on virtual asset regulations and developments.” Topics like financial infrastructure and financial market connectivity were brought up as key topics. After the meeting, both central banks held a seminar for senior executives from banks in Hong Kong and the UAE. According to Coindesk, HKMA’s chief executive said that the “relationship will benefit both jurisdictions economically as they share ‘many complementary strengths and mutual interests.’” (CoinTelegraph)

The Reserve Bank of India is calling for G20 nations to pay more attention to the macro impact that cryptocurrencies represent to the broader global economy “rather than just nations and customers individually,” according to Coindesk. In particular, in India’s role as president of the G20, it intends to address the “macro-financial and cross-sectoral implications and risks of crypto-assets.” Indian Finance Minister Nirmala Sitharaman has said that regulating crypto assets should be “an international priority.” (Coindesk)