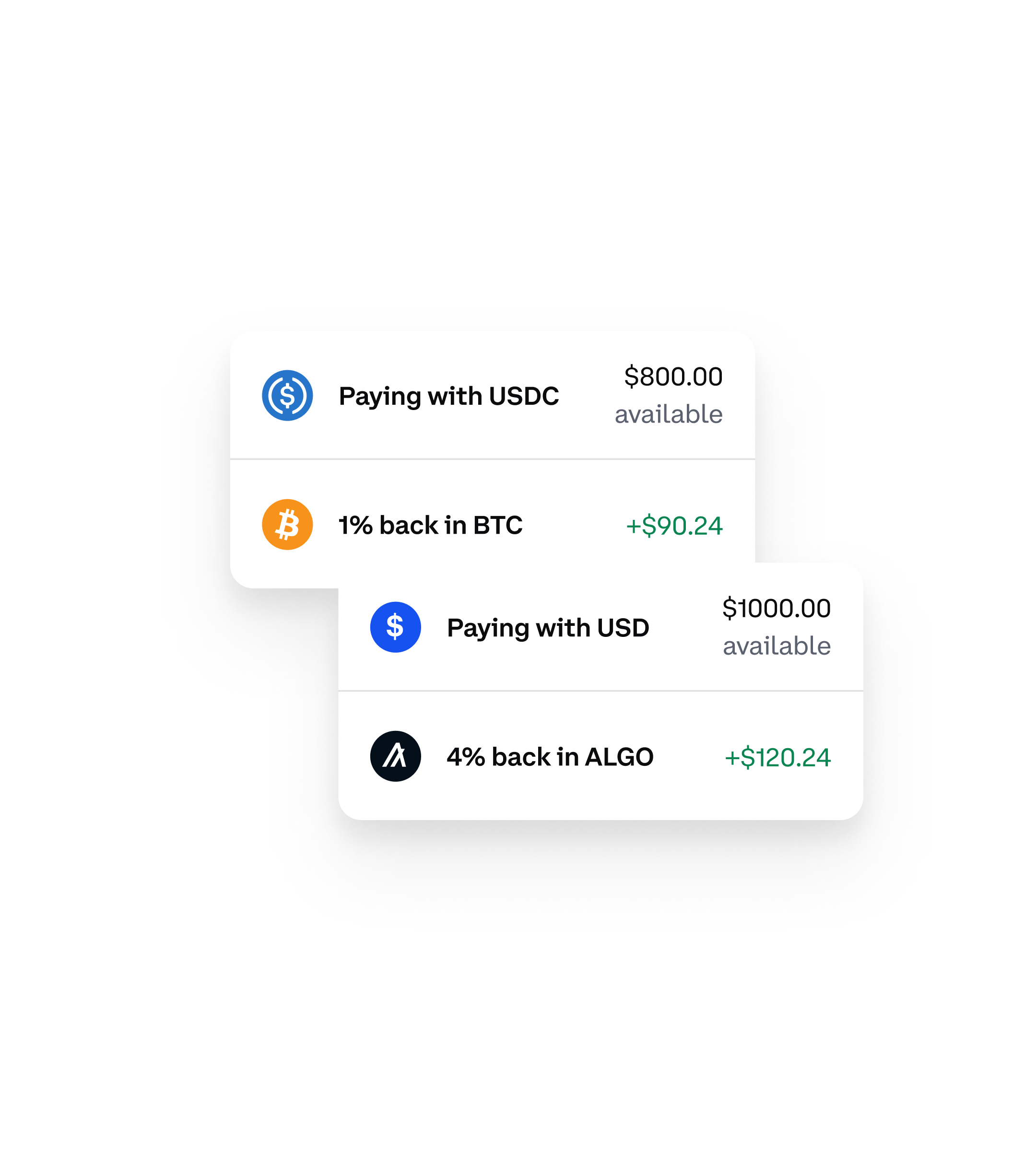

Earn crypto back on every purchase²

US users can stack crypto rewards fast from everyday spendingSpend cash or crypto³

Use your card anywhere Visa® debit cards are accepted, at 40M+ merchants worldwide.

No hidden fees

Enjoy zero spending⁴ fees and no annual fees⁵.

Earn crypto without buying crypto

Get unlimited⁶ crypto rewards on every purchase.

Pay with peace of mind

Industry-leading security features include: 2 factor authentication, card freezing, pin change, and more.

The choice is yours

Select from a list of rotating crypto rewardsMaximize your crypto portfolio

Get full control of what you earn, and switch rewards at any time.

Easy set up

Use your card instantly once approvedFund your card with ease

Link your bank account or get part of your paycheck deposited into Coinbase with zero fees.

Sign up with no requirements⁸

There is no credit check or requirement to stake your assets to become eligible.

Get 24/7 support

We’re available with dedicated phone and email support.

Frequently Asked Questions

Am I eligible for Coinbase Card?

Right now, Coinbase Card is available for all Coinbase customers who live in the US (excluding Hawaii). We hope to expand eligibility in the future.

Are there any fees?

There are no fees for spending US dollars (USD) or crypto, including USD Coin (USDC) with Coinbase Card. For more information on fees, please visit our Pricing and Fees disclosures.

Where is Coinbase Card accepted?

Coinbase Card is accepted anywhere Visa® debit cards are accepted, at over 40M+ merchants worldwide. If you choose to spend crypto, Coinbase will automatically convert all cryptocurrency to US Dollars for use in purchases and ATM withdrawals.

Are there tax implications?

There are generally no tax implications if you spend US dollars (USD) or USD Coin (USDC).

Spending any other kind of crypto involves selling your assets. Selling crypto using your card is a taxable transaction. Just like when you sell crypto on Coinbase, you'll be required to report gains and losses on your tax return. Please speak to a tax advisor to better understand how your card impacts your unique tax situation.