Introducing Crypto Futures

Futures contracts built for the retail investor

Futures products and services on Coinbase Advanced are offered by Coinbase Financial Markets, a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets.

Accessible futures contracts

Access leverage, hedge your risk, and diversify your portfolio with regulated futures.

Enjoy access to crypto futures and spot trading through one integrated, secure and easy-to-use interface.

Take a short or long position, depending on which way you believe the market will go.

Open positions with less upfront capital using futures contracts built for your level of risk.

Take advantage of moving trends in real time with futures contracts that let you trade, speculate, and hedge the price of digital assets.

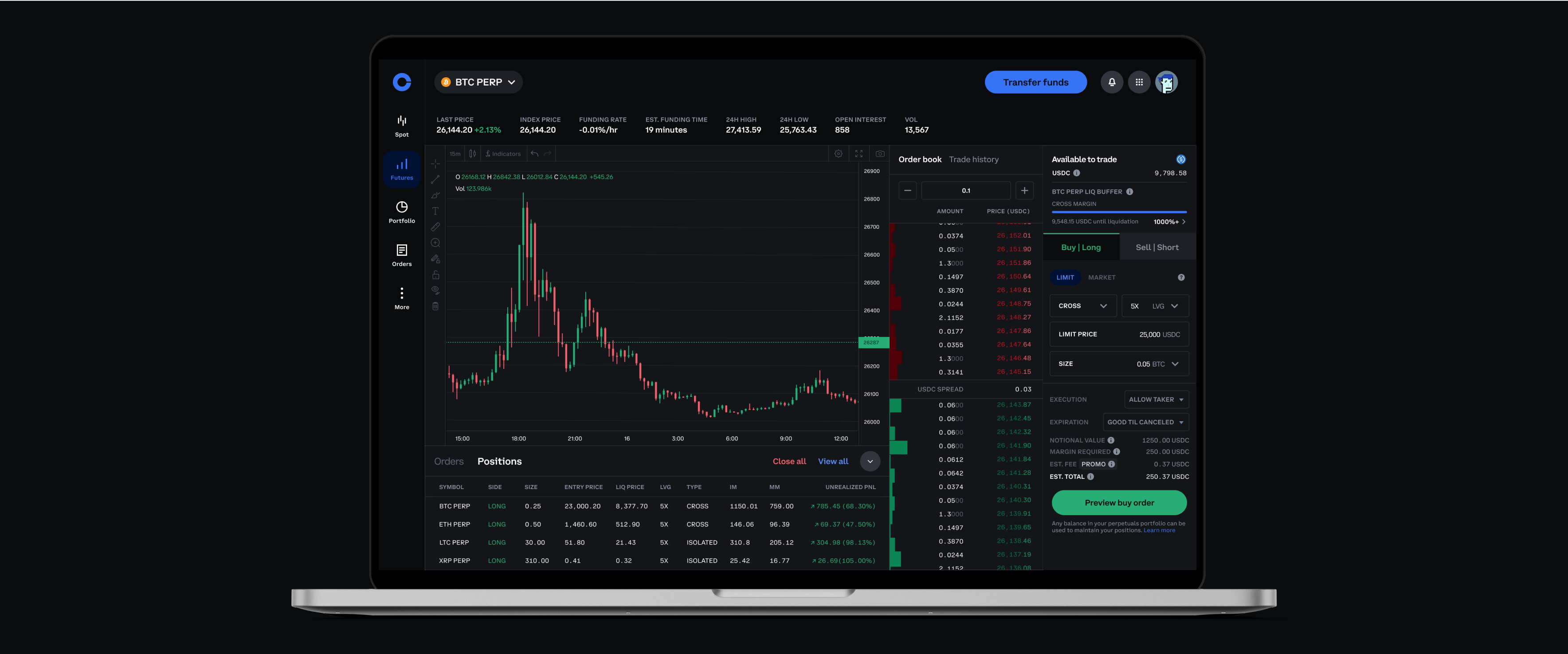

Ether

Bitcoin

Litecoin

Bitcoin Cash

Level up your trading

New to futures trading? Get up to speed on the basics.

Trading in futures involves substantial risks. You should only trade in financial products that you are familiar with and understand the associated risks, and after carefully considering whether such trading is suitable in light of your investment experience, financial position, and investment objectives.

Leverage in futures trading can work for you or against you. The risk of loss using leverage can exceed your initial investment amount.

Futures accounts are maintained by Coinbase Financial Markets, Spot accounts are maintained by Coinbase Inc., which is not CFTC registered and is not a member of the National Futures Association.

Coinbase Financial Markets is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians, or markets.