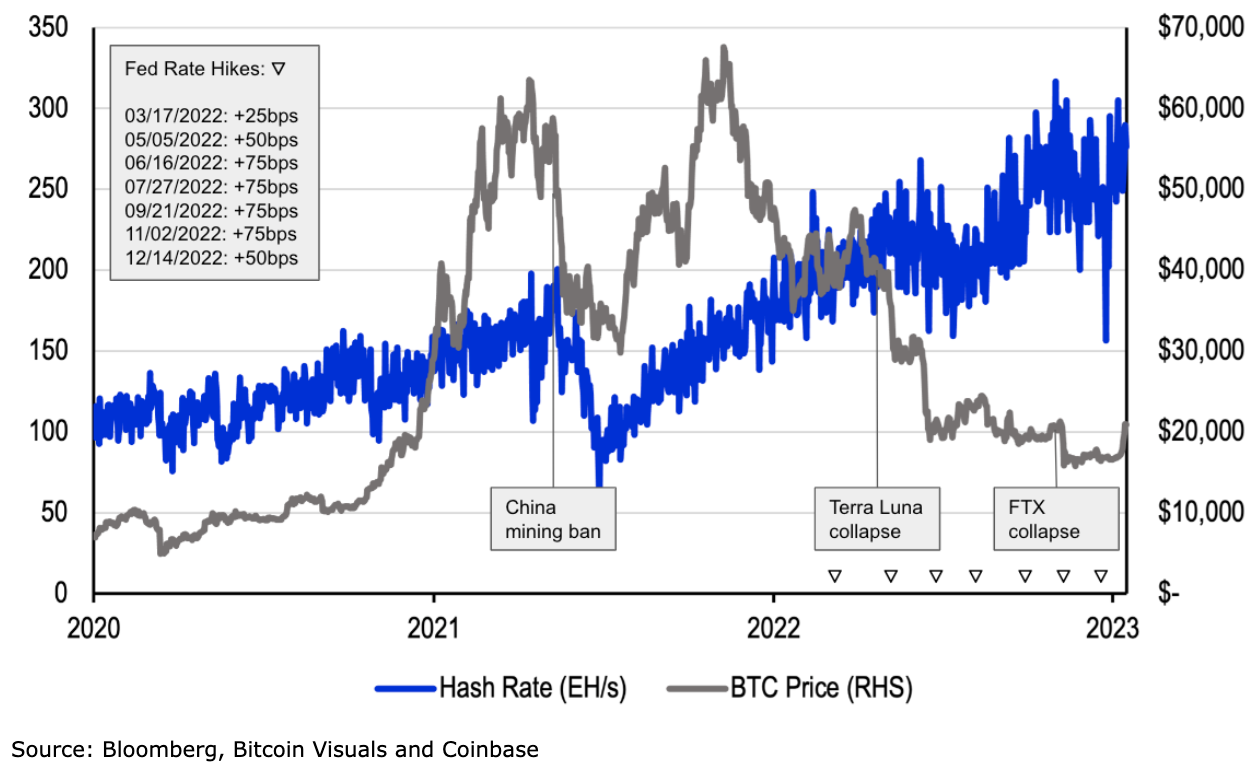

Following 2021 — a period of rapid capacity expansion and profitability growth for bitcoin miners — 2022 quickly became a comparatively tumultuous year for many operators, particularly those located in North America. A confluence of headwinds, both macroeconomic and crypto-specific, severely impacted the profitability of certain mining operators over the past twelve months, forcing many to restructure their balance sheets or even enter bankruptcy. Notably, however, the hashrate of the bitcoin network — a measure of the aggregate computing power competing to successfully mine the next block of bitcoin transactions — has maintained its upward trajectory amidst these headwinds and is currently near all-time-highs.

In this report, we explore the cyclical nature of bitcoin mining and the competitive forces driving aggregate network hashrate ever-higher, despite challenging economics for miners and meaningful distress observed in the public markets. While the divergence between bitcoin price and network hashrate observed since late 2021 has caused some pain for certain mining operators, the persistence of network hashrate growth can be an indicator of the heightening security of the bitcoin network and a reflection of the increasing demand for bitcoin mining.

The increasing demand for bitcoin mining globally, combined with its industrialization through the growth of public market miners in North America, has the potential to continue to support the upward trajectory of network hashrate in the year ahead. While higher aggregate hashrate may dampen the profitability of smaller scale or less well-capitalized operators (as larger, more well-capitalized players consolidate market share), the current trajectory is objectively a positive outcome for the broader security of the bitcoin network.

Chart 1. Bitcoin price and hashrate with key events

Inherent cyclicality

Given the historical volatility and cyclical nature of bitcoin’s price — in part driven by the supply side impact of new issuance halving every four years — it is reasonable to suggest that the business of bitcoin mining would be subject to some amount of cyclicality. Indeed, the market dynamics which characterize the bitcoin mining industry are directionally similar to the production cycles for traditional commodities, such as gold. As demand for the underlying commodity increases, the competition among market participants to establish or expand their operational footprint intensifies and the various inputs associated with building incremental capacity become more expensive. Ultimately, this operational response to an increase in demand of the underlying asset naturally materializes on a lagged basis, expanding up until the point where the demand growth for the underlying asset slows and the cycle begins to turn.

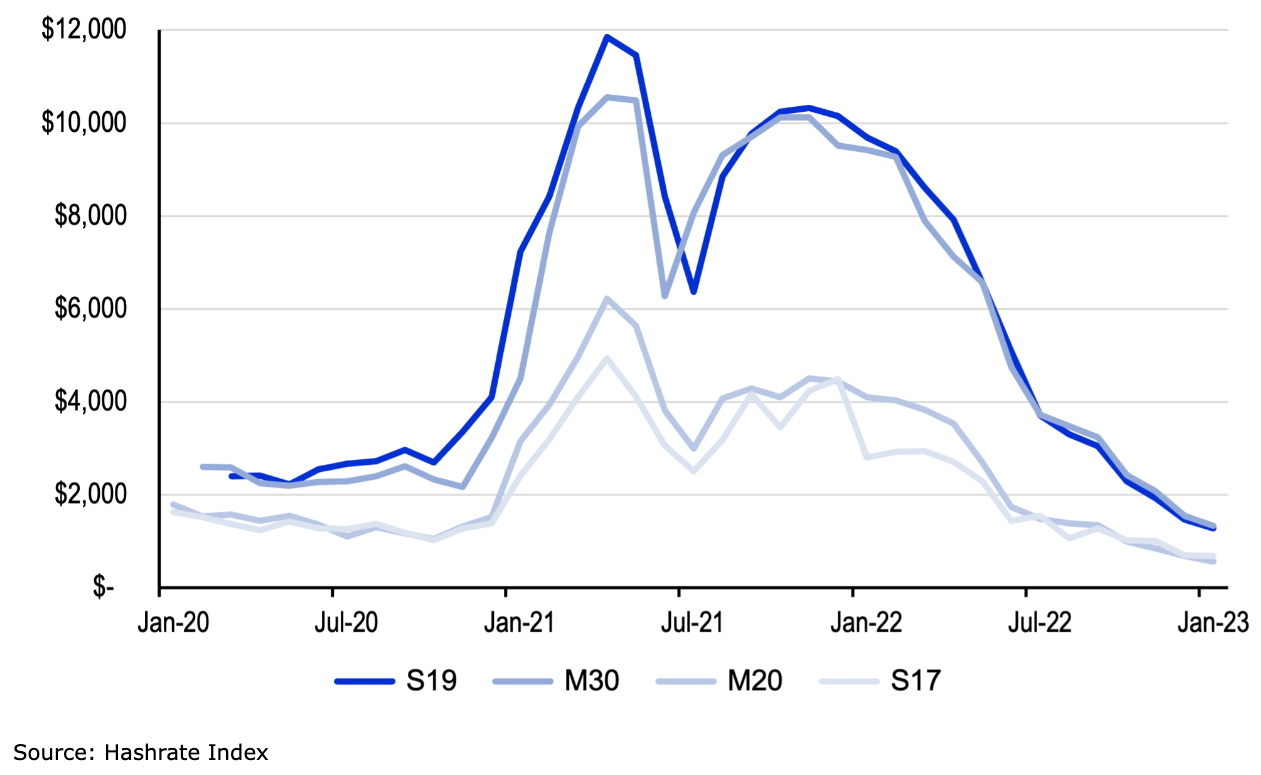

Chart 2. ASIC hardware prices per model

With respect to bitcoin mining, Application-Specific Integrated Circuit, or ASIC, machines can be viewed as the primary “picks and shovels” of the industry. We can establish the timeline of this most recent mining cycle by looking at the trajectory of price fluctuations for ASICs over the past few years. Beginning in late 2020, ASIC prices began a rapid ascent in response to the acceleration in the price of bitcoin. While ASIC prices are a decent real-time indicator of increased demand for bitcoin mining, the deployment of ASICs can take anywhere from 3 to 12 months (or even longer given pandemic-induced supply chain issues), meaning that the eventual impact on network hashrate and difficulty occurs on a lagged basis.

From late 2020 to early 2022, many mining operators in North America sought to expand their operations to take advantage of the increased profitability of mining, given the rising bitcoin price. This intent to deploy hashrate in the region was accelerated by the Chinese hashrate migration stemming from China’s mining ban in mid 2021, which added to the backlog of hardware awaiting deployment in North America. As operators rushed to acquire ASICs, build infrastructure and deploy hashrate, many took on excessive debt, often collateralized by their bitcoin holdings or ASIC hardware.

In hindsight, it is clear that many of these loans did not appropriately account for the possibility of a meaningful decline in the price of bitcoin. Further, once the price of bitcoin began to decline in earnest in March/April 2022, the mounting pressure on miner economics was compounded by factors exogenous to crypto such as rising energy costs and tighter credit conditions. The situation became particularly worrisome for operators who had entered variable rate agreements on either their power contracts or loans, or had failed to appropriately hedge their power costs. This amalgamation of headwinds forced many operators into distress, while those that had more conservatively managed their balance sheets were positioned to capture incremental market share.

Public miner overview

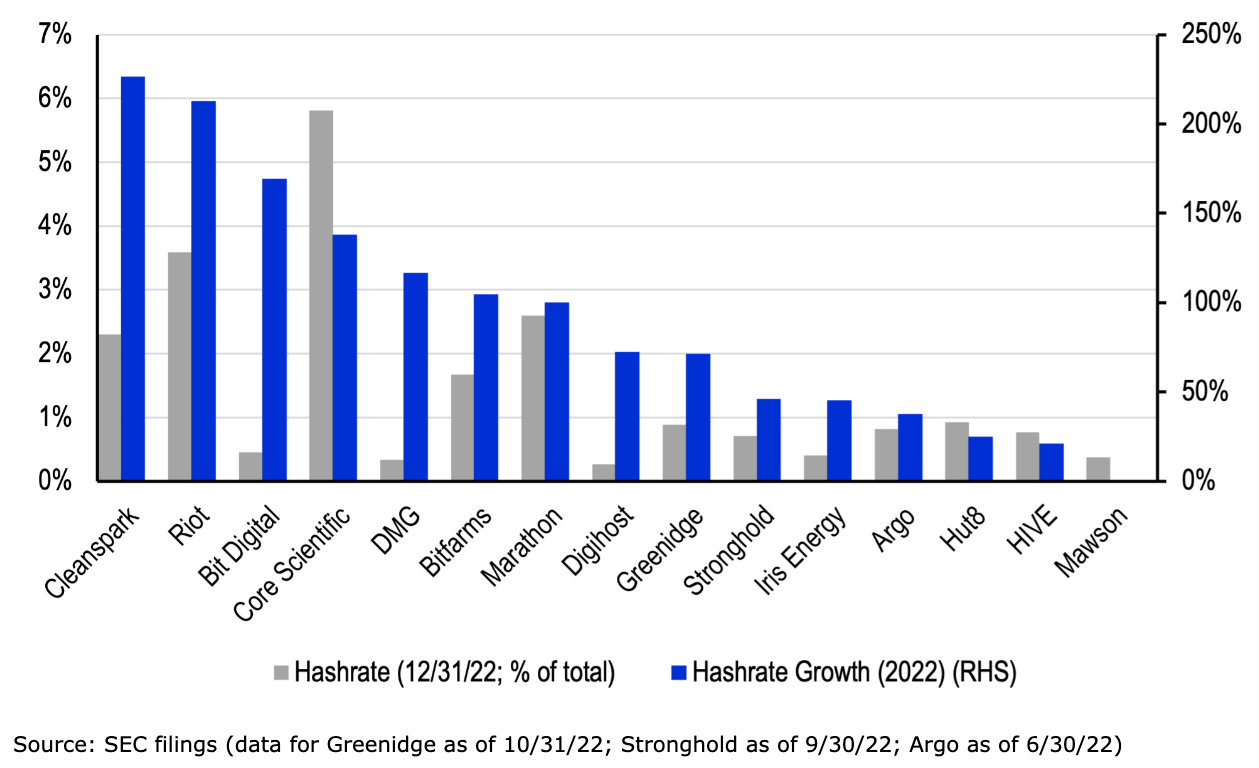

Despite the prevalence of privately held operators in the industry (~177 exahashes (EH)/s or ~75% of aggregate hashrate as of October 2022), publicly traded bitcoin miners represent a rapidly growing segment of the global market for hashrate. The business of bitcoin mining has become increasingly industrialized in recent years as more operators are looking to take advantage of greater access to equity and debt financing available in developed capital markets. Despite a difficult 2022, many of the mining operators in North America are forecasting extensive capacity expansion plans for 2023. Due to the enhanced transparency of these public entities that are required to issue audited financials to shareholders, they can serve as a useful barometer for the health of the mining industry. It should be noted, however, that miners in North America face relatively difficult conditions compared to the global market for hashrate. While they certainly benefit from relative regulatory clarity and developed capital markets, they’ve had to endure rising energy costs, as well as an increasing cost of capital stemming from interest rate hikes.

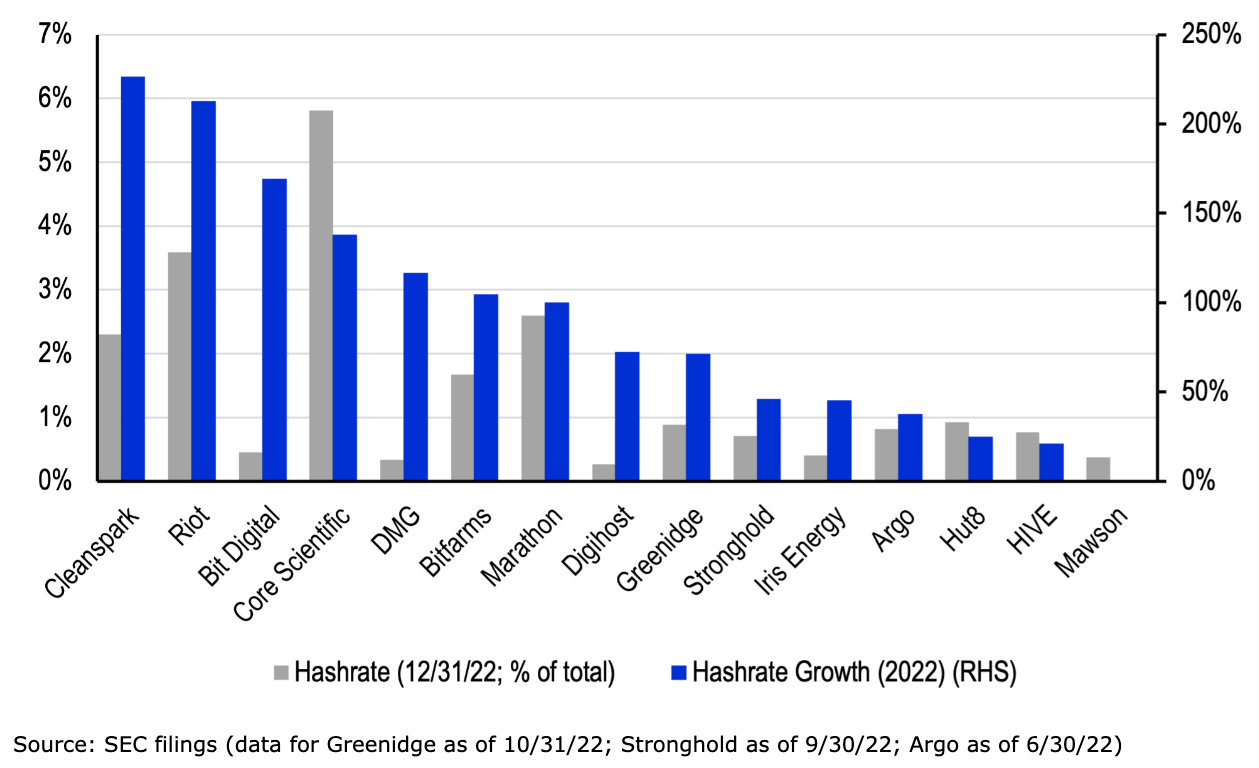

Further, given the influx of hashrate migrating to North America over the past few years, miners in the region may have felt compelled to aggressively expand their operations. Effectively, if a particular operator's share of network hashrate is not growing commensurate with the growth of the aggregate network, their market share is being diluted. A cohort of the top 15 public miners in North America that we will reference throughout this section had a combined hashrate of ~58 EH/s at the end of 2022, representing ~21.9% of aggregate network hashrate. Over the course of 2022, the bitcoin network’s hashrate increased by ~50% and the cohort of public miners detailed in Chart 3 grew their aggregate hashrate by ~109%, thus increasing their relative share of the network (from ~15.7% at the start of the year to ~21.9% by year-end). As shown below, certain miners were able to grow commensurate with (or even beyond) the aggregate growth of network hashrate (>50%), while others lost relative market share within the past year. Those operators that grew their hashrate by greater than ~109% took relative share within this cohort of public miners.

Chart 3. Hashrate growth of top public miners in 2022

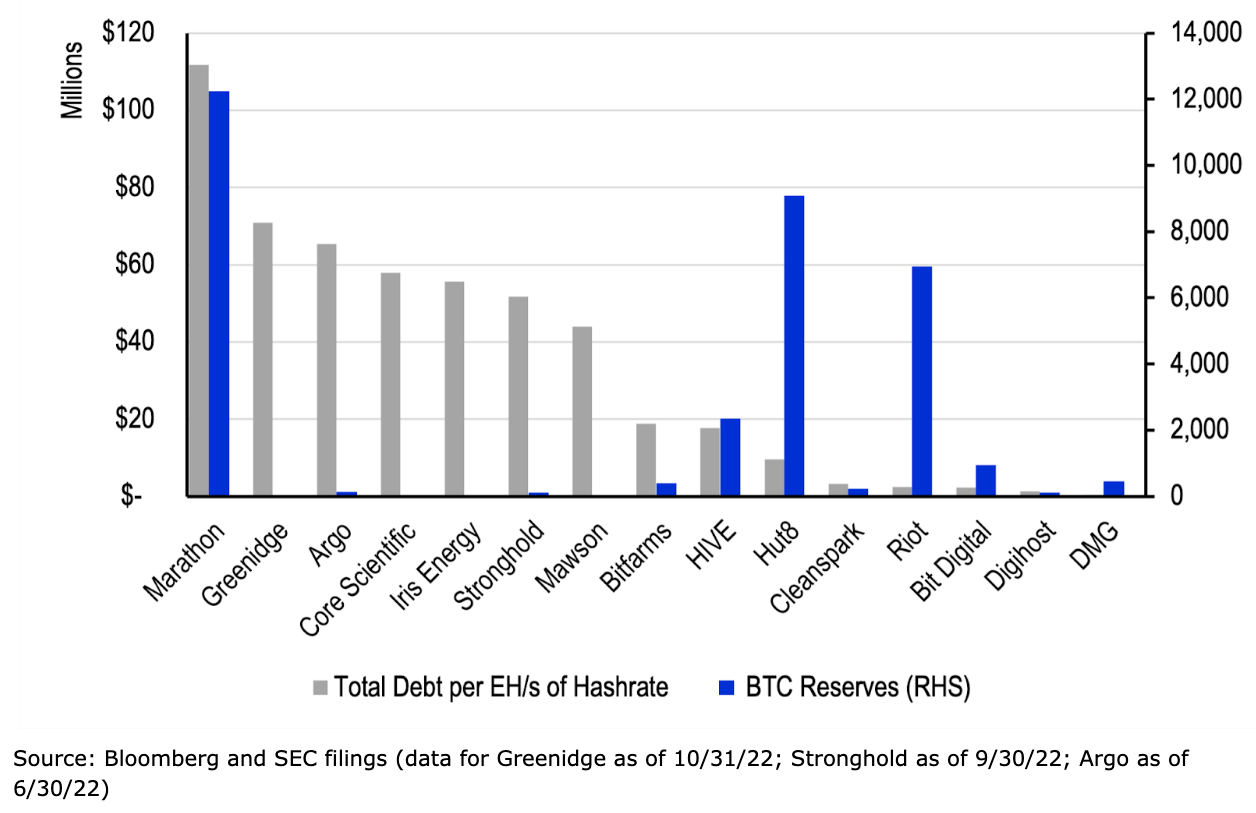

Hashrate growth, however, does not paint the full picture for this cohort of miners. Certain miners pushed aggressively to expand their hashrate at the expense of the health of their balance sheets. Leverage in the form of ASIC-backed loans became increasingly problematic in early 2022 as the price of ASICs began to plummet. Core Scientific, which filed for bankruptcy in December, raised a total of ~$366M over the past two years from six creditors, collateralized by their hardware (representing 8.9 EH/s of their 15.7 EH/s of total hashrate reported at year-end). Accordingly, the fair market value of the collateral backing these loans (which are now being restructured through bankruptcy) has fallen dramatically (in the range of ~50-70%). Interestingly, the creditors which supplied these ASIC-backed loans to miners are also in a precarious position, as their recourse options include becoming mining operators themselves (taking possession of the ASICs), liquidating the ASICs into a relatively illiquid and declining market, or working with borrowers to restructure the debt. For many creditors, the third option is actually the path of least resistance.

While some mining operators are better positioned than others (i.e. those that were more conservative with debt financing and appropriately hedged power costs), it should not be entirely surprising that the most distressed mining operators happen to be located in North America, given the circumstances. Rising input costs, excessive leverage and an environment of increased competition all contributed to the current positioning of this cohort of operators. Chart 4 depicts the total debt levels across this cohort of miners (per EH/s of hashrate), as well as their amount of bitcoin reserves held at year-end. The total debt of this cohort of miners as of their last public filings is approximately US$2.4B in aggregate and they held a combined ~33k BTC (~US$760M) in their reserves at year-end. These metrics provide some insight into the financial positioning of these firms in the context of their go-forward ability to generate and accumulate new bitcoin. Firms like Hut8 and Riot have been able to amass large BTC reserves with relatively little debt.

Chart 4. Total debt (per EH/s of hashrate) and bitcoin reserves of top public miners (as of Dec. 31, 2022)

One miner’s distress is another’s opportunity

While mining conditions remain stressed for many operators, the theoretical decline in network hashrate resulting from ASICs being unplugged in North America has largely been offset by incremental sources of hashrate coming online. While data on the scale of some of these new operations and their precise origins is relatively sparse, there are a handful of plausible sources of incremental hashrate being deployed over the past twelve months, namely:

- Well-capitalized operators in North America: Firms like Riot, Cleanspark and Bit Digital were more conservative with regard to leverage than their peers prior to credit conditions tightening and were able to grow their share of network hashrate over the course of 2022. Further, many of the mining operators in North America have provided forward guidance suggesting meaningful capacity expansion in 2023. It is also worth noting that Foundry, a privately held bitcoin mining pool operator domiciled in the US (a subsidiary of Digital Currency Group), nearly quadrupled its hashrate over the past year (~86 EH/s at current) and is now the largest bitcoin mining pool in the world.

- Private or state-owned operators in regions with access to low-to-zero cost energy: Areas such as Russia, the Middle East, Africa and South America have seen increased demand for bitcoin mining leading to meaningful investments to build out mining capacity, typically taking advantage of cheap or otherwise stranded energy sources.

Further, this mining cycle may differ from past cycles in that there are more incentives to engage in bitcoin mining, outside of pure speculation on the price of bitcoin. Increasingly, market participants are leveraging the bitcoin network for more specialized use cases, including:

- The geography-agnostic monetization of stranded energy sources that would otherwise be wasted or are uneconomical to transport to a grid/population: Natural gas flare capture represents a form of bitcoin mining that is actually a net positive in terms of emissions, as it converts otherwise flared methane into carbon dioxide, a much less dense form of carbon emissions. Large energy companies including Shell and Exxon have begun to engage with bitcoin mining, as they can bolster the profitability of their existing operations by monetizing otherwise stranded energy, while also reducing their net emissions.

- Demand response programs aimed at stabilizing isolated energy grids: Bitcoin miners represent a very unique buyer of energy that has the ability to curtail their consumption at any time (known as an interruptible energy load), while most large industrial consumers of energy are unable to economically interrupt their operations. The two main forms of “demand response” being implemented by mining operators include: (1) negotiating with energy providers/utility companies to lock in a static low cost of electricity for a certain period of time (typically below market rates), under the condition that they will curtail (turn off) when demand from the grid spikes (periods of peak demand). Miners engaging in this form of demand response will ensure that the benefits of mining at a lower static cost will outweigh the potential downtime expected during periods of peak demand. Alternatively, (2) miners will sell power (i.e. turn off machines) back to the market at spot rates. In this arrangement, miners aren’t necessarily forced to curtail in response to peak demand, but instead are directly monetarily incentivized to do so. They will only engage in this form of demand response if the spot rates afforded to them by the market outweigh the profits they would have otherwise generated by mining bitcoin. This method is most prominently implemented by miners operating within the Texas/ERCOT grid.

- Bootstrapping renewable (and intermittent) energy sources: The largest impediment for wind and solar capacity to effectively support populations at scale is the near-term profitability of those operators. The intermittent nature of wind and solar, combined with the imbalance of excess capacity versus what can actually be transported to grids for use, means that early-stage wind and solar projects are often producing energy that goes unused. Bitcoin mining can complement the build-out of this capacity by offering a profitable means of energy usage during times of off-peak demand (i.e. smoothing out the intermittency). A joint venture between Tesla, Block, and Blockstream announced last year plans to employ this concept in West Texas, creating a financial incentive to construct solar capacity through mining bitcoin.

These incentive-based sources of incremental hashrate are not necessarily dependent on the operators’ desire to accumulate bitcoin, as is traditionally the case for mining operators. Instead, bitcoin mining is being used as a tool to directly monetize energy sources that would otherwise be stranded or uneconomical to transport to a grid or population.

Conclusions

Given the hashrate trends observed throughout 2022, the amount of incremental hashrate coming online could outpace the amount of hashrate being unplugged by distressed operators in the coming months. Several of the most stressed operators took steps to restructure/reduce their debt obligations in 2H22 and even those that have entered bankruptcy processes, like Core Scientific, have signaled their intent to continue operating their mining fleet. Further, recent price performance of bitcoin, albeit it short-term and potentially subject to reverse, has provided some temporary reprieve to miners operating at the edge of profitability.

As we’ve discussed, much of the recent growth in hashrate has been the result of capacity expansion in North America. This reflects both the lagged migration of hardware from China (post mining ban) as well as the effectiveness of regulatory clarity and access to developed capital markets in catalyzing the deployment of hashrate. In summary, a highly competitive operating environment in North America could continue to incentivize these miners’ rapid expansion of capacity. Additionally, incremental demand for bitcoin mining stemming from innovative forms of on-site energy monetization should further support the growth of network hashrate going forward. For these reasons, barring a severe decline in the price of bitcoin or other factors which could threaten the economics of future capacity expansion, one could expect that network hashrate will continue its upward trajectory in 2023.