What is a DeFi aggregator?

DeFi aggregators bring together trades across various decentralized finance platforms into one place.

They aim to optimize trades by pulling competitive prices from across the DeFi landscape.

DeFi aggregators permit users to analyze and combine other users' trading strategies, which could potentially make the process more efficient and user-friendly.

Understanding DeFi Aggregators

Decentralized finance, or DeFi, is a rapidly evolving sector within the blockchain technology space. It strives to provide open-access, non-custodial financial products that promote transparency. However, the DeFi landscape is spread across various blockchains, each hosting an ecosystem of isolated financial protocols. This fragmentation can make it challenging for users to optimize their trades and get favorable returns on their crypto assets. This is where DeFi aggregators come into play.

DeFi aggregators bring together trades across various decentralized exchanges (DEXs) into one place, saving users time and increasing efficiency for potentially better trades. They aim to pull competitive prices from across the DeFi landscape, including DEXs, lending services, and liquidity pools, allowing users to optimize their trades.

Benefits of a DeFi Aggregator

Without using an aggregator, users would have to individually visit various exchanges, compare trading prices on each exchange to get a potentially good deal, and then manually execute each transaction using smart contracts. This process can be time-consuming and does not allow for complex trading routes or mechanisms.

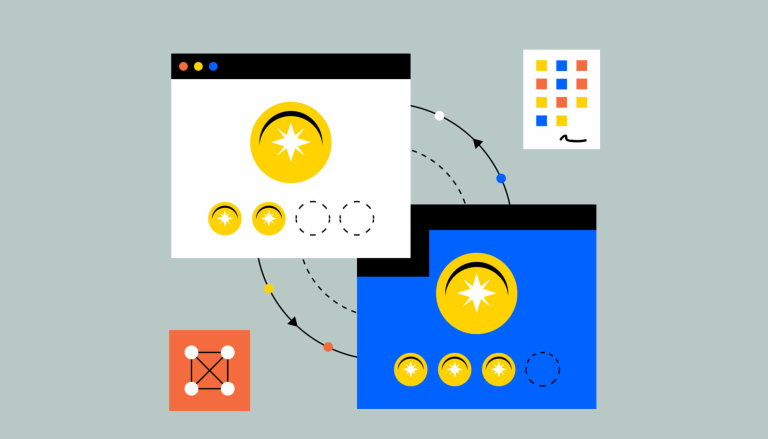

While DeFi aggregators aim to pull competitive prices, not all of them allow users to compare and combine strategies by dragging and dropping blocks to create a potentially effective strategy. This feature, specific to certain platforms, makes DeFi aggregators particularly useful for users looking to implement advanced trading strategies.

Using Successful Strategies and Combos With an Aggregator

While some DeFi aggregators may offer features that allow users to follow the strategies of more experienced traders, this is not a universal feature of all DeFi aggregators. These strategies are user-generated and available for all to view and mimic. Instead of having to execute the strategy on multiple different DEXs, users can execute the strategy on an aggregator using no-code combos to build the trade. This approach aims to save time, enhance efficiency, and potentially yield more favorable outcomes.

How Can a DeFi Aggregator Make My DeFi Strategy Simpler and More Efficient?

DeFi aggregators aim to simplify and potentially improve the efficiency of your DeFi strategy. They identify and share successful trading strategies with their users, who can then apply these strategies to their own trades. This feature is particularly beneficial for new or inexperienced users, as it allows them to copy complex trades without having to code it themselves.

Gas Fees and DeFi Aggregators

One potential downside of using a DeFi aggregator is the gas fees. As Ethereum continues to reach new all-time highs and volume increases across the network, gas fees tend to follow this upward trend. Usually, gas fees are higher on aggregators compared to using the individual protocol. However, while some DeFi platforms may offer solutions to mitigate high gas fees, the use of "gas tokens" or "gas cubes" is not a universally adopted solution across all DeFi aggregators. It’s also important to note that while gas fees may be higher on an aggregator, they act as a sort of “convenience fee” since the potential optimization and efficiency that comes with an aggregator may balance out the gas fee.