Ethereum’s proof-of-stake (PoS) consensus mechanism is the largest economic security fund in crypto, totaling almost US$112B. But validators securing the network aren’t relegated to only earning the base rewards on locked up ETH. Liquid staked tokens (LSTs) have long been a way for participants to bring their ETH and consensus layer earnings into the realm of DeFi – to be either traded or rehypothecated as collateral in other transactions. Now, the advent of restaking has introduced another layer to this in the form of liquid restaking tokens (LRTs).

Ethereum’s relatively mature staking infrastructure and excess security budget has enabled EigenLayer to grow into the ecosystem’s second largest DeFi protocol by total value locked (TVL) at $12.4B. EigenLayer enables validators to earn additional rewards by securing actively validated services (AVS) via restaking their staked ETH. Intermediaries in the form of liquid restaking protocols are consequently becoming more ubiquitous as well, driving the proliferation of LRTs.

That said, we think that restaking and LRTs may pose additional risks compared to existing staking products, both from a security and financial perspective. These risks could become increasingly opaque as the number of AVSs grow and LRTs differentiate their operator strategies. Still, restaking (and staking) rewards are setting the foundation for a new class of DeFi protocols. Separate discussions around reducing staking issuance to a minimal viable issuance (MVI) could also further increase the relative importance of restaking yields in the long term if such proposals are implemented. Thus, the outsized attention on restaking opportunities is becoming one of the biggest crypto themes this year.

Ethereum’s restaking foundation

EigenLayer’s restaking protocol went live on Ethereum mainnet in June 2023 with AVSs to be launched in the next stage of its multi-phase rollout (in 2Q24). Effectively, the concept of “restaking” by EigenLayer establishes a way for validators to secure new features in Ethereum – like data availability layers, rollups, bridges, oracles, cross chain messages, etc. – possibly earning additional rewards in the process. This represents a new income stream for validators in the form of “security-as-a-service”. Why has this become such a hot topic?

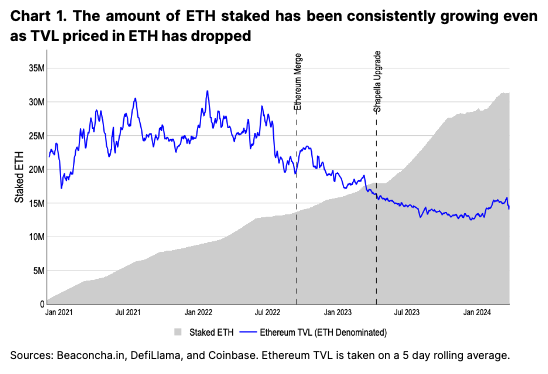

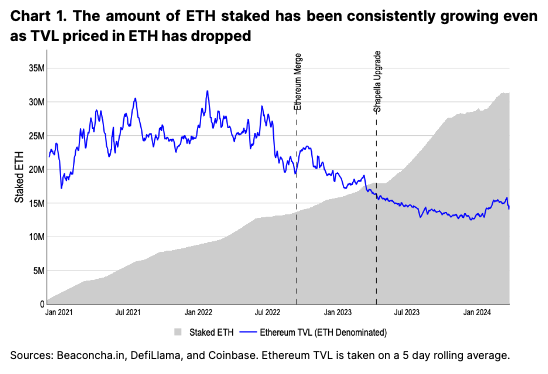

As the largest PoS cryptocurrency, ETH currently holds a tremendous economic foundation for securing its network from a hostile majority attack. At the same time, however, the relentless growth of validators and staked ETH has arguably gone beyond what is necessary to secure the network. At the Merge (15 September 2022), 13.7M ETH was staked, presumably sufficient to secure the network TVL of 22.1M ETH at the time. As we go to publish, approximately 31.3M ETH is now staked, a three fold increase in ETH denominated terms, but Ethereum’s TVL denominated in ETH is actually lower today (than in late 2022) at 14.9M ETH (see Chart 1).

That excess of staked ETH as well as the security, liquidity and reliability of the underlying asset make it uniquely positioned to help facilitate the security of other decentralized services. In other words, we think restaking as a concept was largely inevitable, as an extension of ETH’s inherent values. However, there is no free lunch. To ensure the correctness of these services, restaking is used for behavior validation and can be subject to seizure or slashing penalties, similar to traditional staking. (That said, slashing won’t be enabled when the first set of AVSs launch in 2Q24.) Also like staking, restaking operators are awarded additional ETH (or AVS tokens) for their services.

Liquid diet

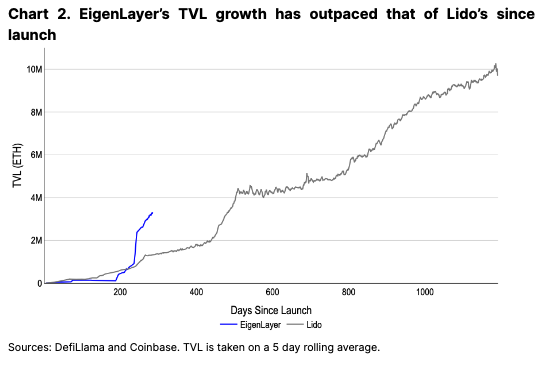

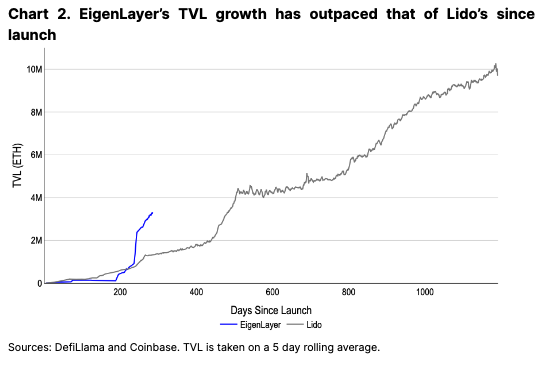

The growth of EigenLayer’s TVL to date has been astounding, putting it second only to Lido (Ethereum’s leading liquid staking protocol). EigenLayer accomplished this while retaining deposit caps for much of that process, and also before launching any live AVS. That said, it’s difficult to decouple persistent restaking demand from users’ interest in short-term point and airdrop farming. While the amount of restaked ETH could continue to grow in the long term as the protocol matures, we think that there could be a short term drop in TVL when point farming ends or if early AVS rewards are below expectations.

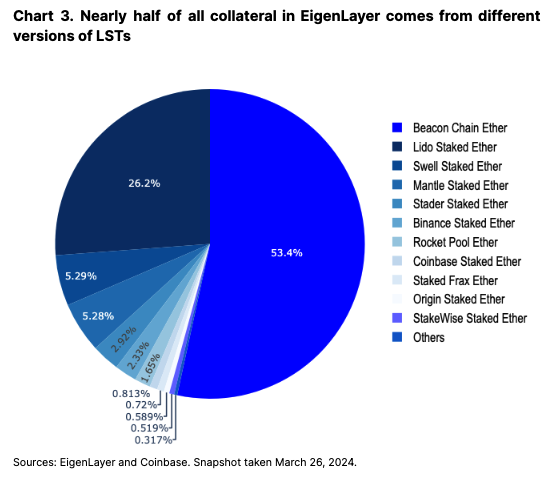

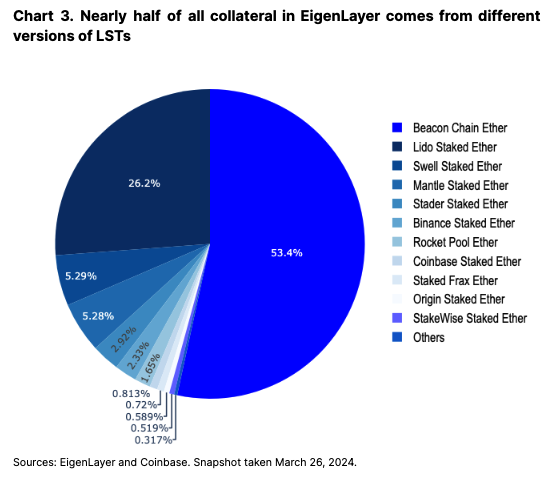

EigenLayer builds upon the foundation of the existing staking ecosystem by collateralizing a diverse pool of underlying LSTs or native staked ETH (via EigenPods). Procedurally, validators point their withdrawal addresses to EigenPods in order to earn Eigen points, which are to be exchanged for protocol rewards in the future. The LSTs locked in EigenLayer (1.5M ETH) constitute roughly 15% of all LSTs, while the overall ETH locked in EigenLayer accounts for nearly 10% of all ETH utilized in staking (3M of 31.3M ETH). (LSTs themselves represent 43% of all staked ETH in the ecosystem.) In fact, we think that restaking is responsible for the recent interest in new validator onboarding after staking demand had plateaued after October 2023. In February 2024, more than 2M additional ETH was staked, coinciding with the temporary suspension of EigenLayer deposit caps. Indeed, some LST providers are increasing their target APY as a way of leveraging interest in restaking to attract new users to their own platforms.

Learning from the popularity of LSTs, a rich ecosystem of LRTs has already developed, with more than a half dozen protocols offering versions of liquid restaking tokens with various points and airdrop schemes. Of the 3M ETH secured in EigenLayer, approximately 2.1M (62%) are wrapped in secondary protocols. We’ve previously seen similar patterns in the liquid staking market and believe that a diversification of alternatives will be important as this sector grows.

In the longer term, restaking could be an increasingly important avenue for ETH yields if native staking issuance drops as a result of increased staking participation (which reduces yield as more validators join). Separate discussions to reduce native staked ETH emissions could further increase the pertinence of restaking yields (though this is still very early in the discussion phase).

That said, AVS yields are expected to be relatively low post launch, which could create challenges for LRTs in the near term. For example, Ether.fi, the largest LRT, charges an annualized 2% platform fee on its TVL for “vault management.” Not all LRTs have the same fee structure, however, and there is room for competition in this regard. But if we use this 2% fee as a rubric for calculating breakeven costs, AVSs would need to pay approximately $200M annualized (on the $12.4B restaked value) for EigenLayer’s security services to break even – more than Aave or Maker have charged in fees in the past year. That raises the question of how much business AVSs will need to generate in order to increase the overall yield to ETH stakers.

Advent of actively validated services

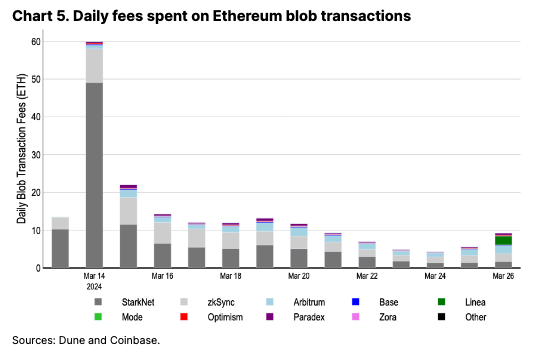

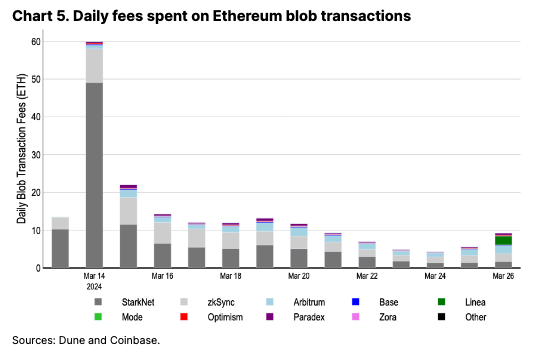

As of today, no AVS has yet launched on mainnet. The first AVS to release (in early 2Q24) will be EigenDA, a data availability layer that could fulfill a similar role to Celestia or Ethereum’s blob storage. Following the success of the Dencun upgrade in reducing layer-2 (L2) fees by upwards of 90%, we think that EigenDA will be another tool in the modular arsenal for cheaper L2 transactions. However, building or migrating L2s to leverage EigenDA is a slow process, and it could take several months before meaningful revenue accrues to the protocol.

To estimate initial yields from EigenDA, we can draw a comparison to Ethereum blob storage costs. Approximately 10 ETH per day is currently spent on blob transactions from many of the major L2s including Arbitrum, Optimism, Base, zkSync, and StarkNet (see Chart 5). Should EigenDA see a similar level of usage, the annualized rate of ~3.5k ETH in restaking rewards per year translates to approximately 0.1% of additional rewards, based on our conservative estimates. In our view, fees in the first few months are likely to be even less than that estimate, though the addition of multiple AVSs could quickly stack up yields.

Other AVSs being built in the EigenLayer ecosystem includes interoperability networks, fast finality layers, proof of location mechanisms, a bootstrapper for Cosmos chain security and more. The opportunity space for AVSs is extremely wide ranging and constantly growing. Restakers can selectively choose which AVSs they would like to secure with their ETH collateral, though this process becomes increasingly complex with each new AVS.

Dark corners

This raises the question of how different LRTs will handle (1) AVS selection, (2) potential slashing and (3) ultimately token financialization. In traditional staking, the one-to-one mapping between validator responsibilities and earnings is clear, making LSTs a relatively simple affair, all things considered. But with restaking, the many-to-one structure adds some nontrivial complexity (and diversity on the part of the LRT issuers) on how to accrue and distribute gains (and losses). Not only do LRTs pay the base ETH staking reward but also the rewards from securing a suite of AVSs. That also means that the potential rewards paid by different LRT issuers will vary.

At this point, a lot of LRT models have not yet been fully clarified. However, for there to be a single LRT per project, all token holders within a given protocol would presumably be subject to uniform AVS incentives and slashing conditions. The design of these mechanisms are likely to vary across LRT providers.

One proposal is to take a tiered approach where LRT issuers could adopt a range of “high” and “low” risk AVSs, although that would require establishing as-of-yet undefined risk standards. Moreover, based on the architecture design, token holders’ final rewards would likely still be paid on the aggregate across all AVSs, which in our view defeats the purpose of a risk stratification framework. Alternatively, decentralized autonomous organizations (DAOs) can determine which AVSs to choose, but that raises questions about who the key decision makers are in those DAOs. Otherwise, LRT providers can act as an interface for EigenLayer and allow users to retain the decision making authority over which AVSs to adopt.

Emerging risks

At launch however, the restaking process should be relatively straightforward for operators as EigenDA will be the only AVS to secure. However, a feature of EigenLayer is that ETH committed to one AVS can then be further restaked towards other AVSs. While this can increase earnings, it can also compound risks. Committing the same restaked ETH to multiple AVSs presents challenges when it comes to disentangling the hierarchy of slashing and claims conditions among services. Each service creates their own custom slashing conditions, so there could be a scenario where one AVS slashes the restaked ETH for misbehavior, while another wants to reclaim the same restaked ETH as compensation for harmed participants. This could lead to eventual slashing conflicts, though as previously mentioned, EigenDA will not have slashing conditions on initial launch.

Complicating this setup further is that EigenLayer’s “pooled security” model – wherein AVSs leverage a common pool of staked ETH to secure their services – can be further customized via “attributable security.” That is, it’s possible for individual AVSs to acquire (additional) restaked ETH that’s used solely to secure their specific services – a form of insurance or safety net for the AVSs that pay a premium for it. Consequently, as more AVSs launch, the role of the operator becomes more technically complex, and slashing rules become far more difficult to follow. The extension of LRTs on top of this restaking complexity abstracts away much of these underlying strategies and risks from the token holders.

That’s a problem because ultimately, we think that people will go where the rewards offered by these LRT providers are highest. As such, LRTs may be incentivized to maximize their yields in order to gain market share, but these could come at the cost of a higher (albeit hidden) risk profile. In other words, we believe what matters will be the risk-adjusted rewards and not absolute rewards, but it may be difficult to have transparency on that. This could lead to additional risks as LRT DAOs are incentivized to maximally restake multiple times to remain competitive.

Moreover, LRTs could also put downward sell pressure on non-ETH AVS rewards if the LRT payouts are done entirely in ETH. That is, the value accrual for restaking could be limited by recurring sell pressure if the LRTs need to convert native AVS tokens into ETH (or ETH equivalent) in order to redistribute rewards to LRT token holders.

Separately, LRTs also carry non-negligible valuation risks. For example, in the event of an extended staking withdrawal queue (validator churn limits have decreased from 14 to 8 following Ethereum’s Dencun Fork), a temporary dislocation of LRTs from their underlying value is possible. If LRTs become a widely accepted form of collateral within DeFi (e.g. like LSTs in borrowing and lending protocols), this could unintentionally exacerbate liquidations, especially in low liquidity markets.

That’s assuming that these DeFi protocols are able to properly assess LRTs’ collateral value in the first place. Effectively, LRTs represent a diverse set of portfolio holdings, and the risk profile of those holdings can shift over time. New constituents can be added or removed, or the AVSs themselves can be subject to changes to their earnings or solvency risk. Hypothetically, we could see a scenario where a market downturn potentially impacts several AVSs at once, thus destabilizing the LRTs and amplifying the risk of forced liquidations and market volatility. Recursive borrowing would only magnify those losses. On the other hand, protocols that are able to decompose LRTs into their principle and yield components could help mitigate this risk somewhat, as tokenized principal could be used as pristine collateral while the tokenized yield could be utilized in interest rate swaps.

Finally, under certain scenarios a large fault in the restaking mechanism could threaten the underlying consensus protocol of Ethereum, as highlighted by Ethereum co-founder Vitalik Buterin. If the amount of restaked ETH is sufficiently large relative to all staked ETH, there could be economic incentives to enforce an incorrect decision that could lead to network destabilization.

Conclusion

EigenLayer’s restaking protocol is poised to become the bedrock for a wide range of new services and middleware on Ethereum, which, in turn, could generate a meaningful source of ETH rewards for validators in the future. AVSs ranging from EigenDA to Lagrange could also substantially enrich the Ethereum ecosystem itself.

That said, the adoption of LRT wrappers around the underlying protocol could lead to hidden risks from nontransparent restaking strategies or temporary dislocations from their underlying. How different issuers select which AVSs to secure alongside the distribution of risks and rewards to LRT holders remains an open question. Furthermore, the initial yield from AVSs may not live up to the extremely high expectations set by the market, though we expect that to change over time as AVS adoption grows. Still, we think that restaking champions the open innovation of Ethereum and will become a core part of the ecosystem’s infrastructure.