A note from the author

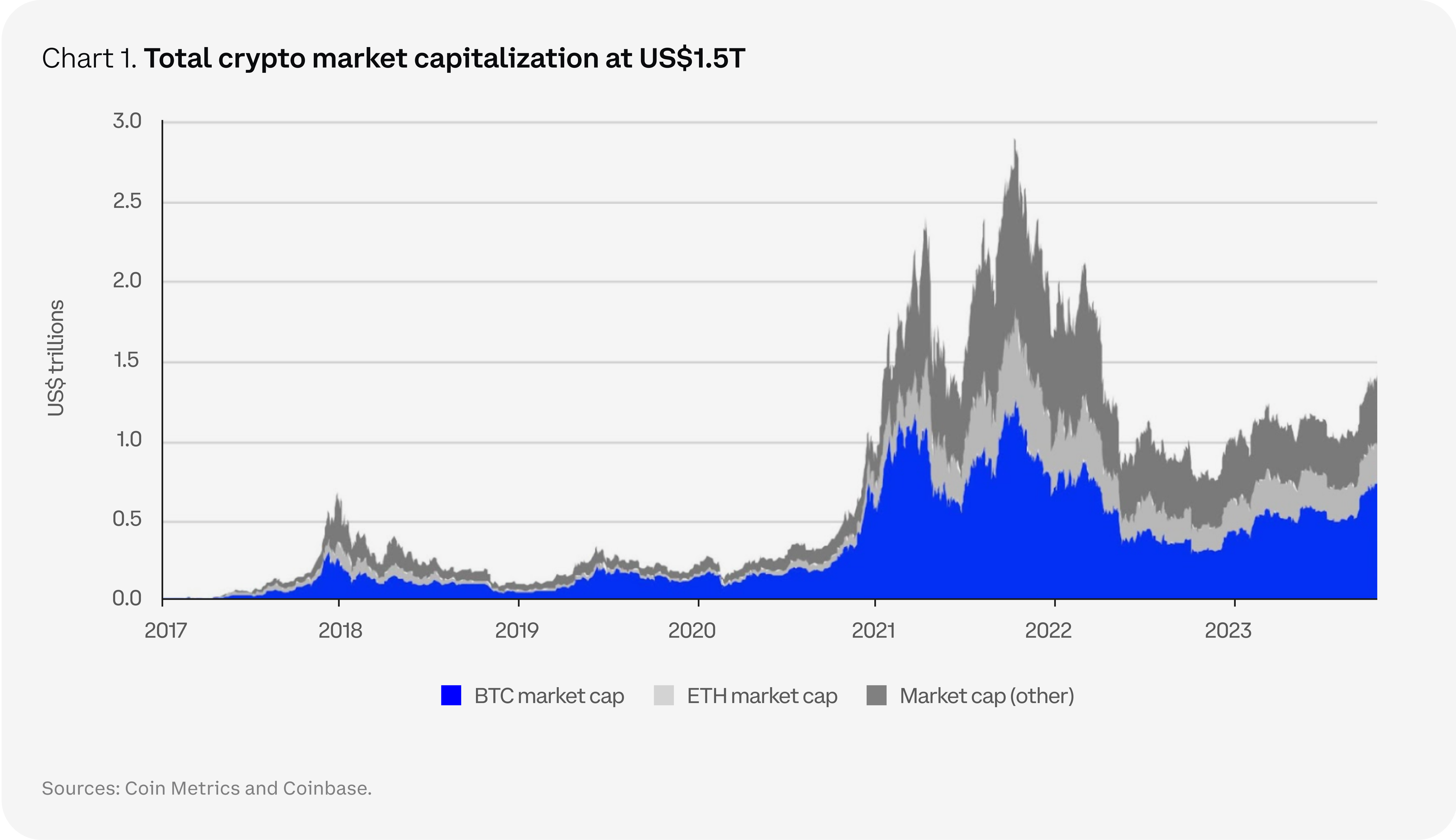

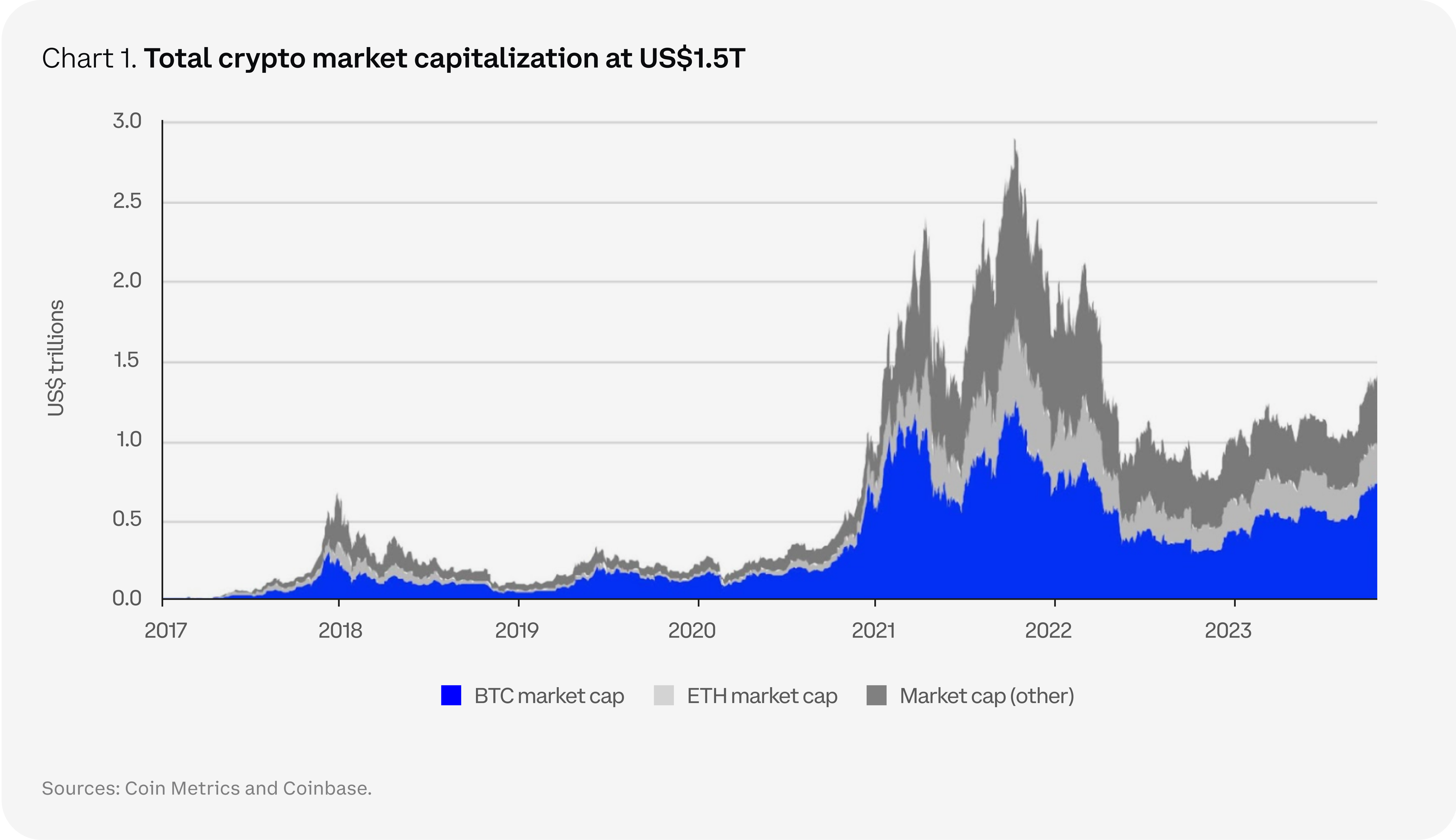

The total crypto market cap doubled in 2023, which suggests that the asset class has already exited its “winter” and is now in the midst of a transition. Still, we think it'd be premature to put labels on this or see the positive performance as vindication against the cynics who reveled in crypto’s greatly exaggerated demise. What’s clear, however, is that in spite of the hurdles directed towards the asset class, the developments we witnessed over the past year have defied expectations. They are evidence that crypto is here to stay. The challenge now is to seize the moment and build something better.

The catalysts for crypto’s recovery in 2023 have at times been extrinsic to the innovations that typically characterize its value. Both the US regional banking crisis and the proliferation of geopolitical conflict, among other things, reinforced bitcoin’s status as a safe haven alternative. Moreover, spot bitcoin ETF applications from some of the top US financial institutions have been an implicit acknowledgement of crypto’s potential to disrupt. This may be the precursor to greater regulatory clarity, removing the frictions that would otherwise prevent capital from flowing into this asset class.

But progress rarely moves in a straight line. To create a more resilient market, developers will need to continue building towards real world use cases that help us cross the chasm from early adopters to mainstream users.

The foundations of what this might entail are already evident – from web2 analogues like payments, gaming, and social media to crypto-specific advancements like decentralized identity and decentralized physical infrastructure networks. The former are easier to understand for investors, but these projects face an uphill battle against well-established web2 giants. The latter could transform the technological landscape, but the development timelines are longer while meaningful user adoption is further out on the horizon. However, blockchain infrastructure has come a long way in the last two years, enabling the necessary conditions for these applications to experiment and innovate – and putting us far closer to an inflection point.

Tokenization is another vital use case, which is currently attracting traditional financial players into this space. Full implementation may take another 1-2 years, but the resurgence of the tokenization theme reflects the economic reality that opportunity costs are higher today than they were immediately after the pandemic. That makes the capital efficiency of having instantaneous settlement on repos, bonds, and other capital market instruments much more relevant.

Against this backdrop, we think the secular trend for institutional crypto adoption will accelerate. In fact, anecdotally, the later stages of the 2023 rally have started to attract a broader set of institutional clients into the crypto space, from traditional macro funds to ultra high net worth individuals. We expect the availability of spot bitcoin ETFs in the US to advance this trend, potentially leading to the creation of more complex derivative products that rely on compliance-friendly spot ETFs as the underlying. Ultimately, this should improve liquidity and price discovery for all market participants.

In our view, all of these represent some fundamental themes for cryptocurrency markets in 2024, which we discuss in this report. If you have questions about our work or want to understand how Coinbase’s institutional practice can help your firm engage with the crypto markets, please contact us at institutional.coinbase.com.

Key theme 1: The next cycle

Bitcoin hegemony

Flows in 2023 played out largely as we expected in our Crypto Market Outlook 2023. Digital asset selection transitioned towards higher quality names, leading bitcoin dominance to steadily increase above 50% for the first time since April 2021. This was driven in large part by multiple well-known and established financial stalwarts applying for spot bitcoin ETFs in the US, as their participation in the space has helped to validate and enhance crypto’s prospects as an emerging asset class. Although there may be some capital rotation into riskier parts of the asset class next year, we believe institutional flows will remain firmly anchored on bitcoin at least through the first half of 2024. Moreover, pent-up demand from traditional investors seeking to enter this market will make it harder to supplant bitcoin hegemony anytime soon.

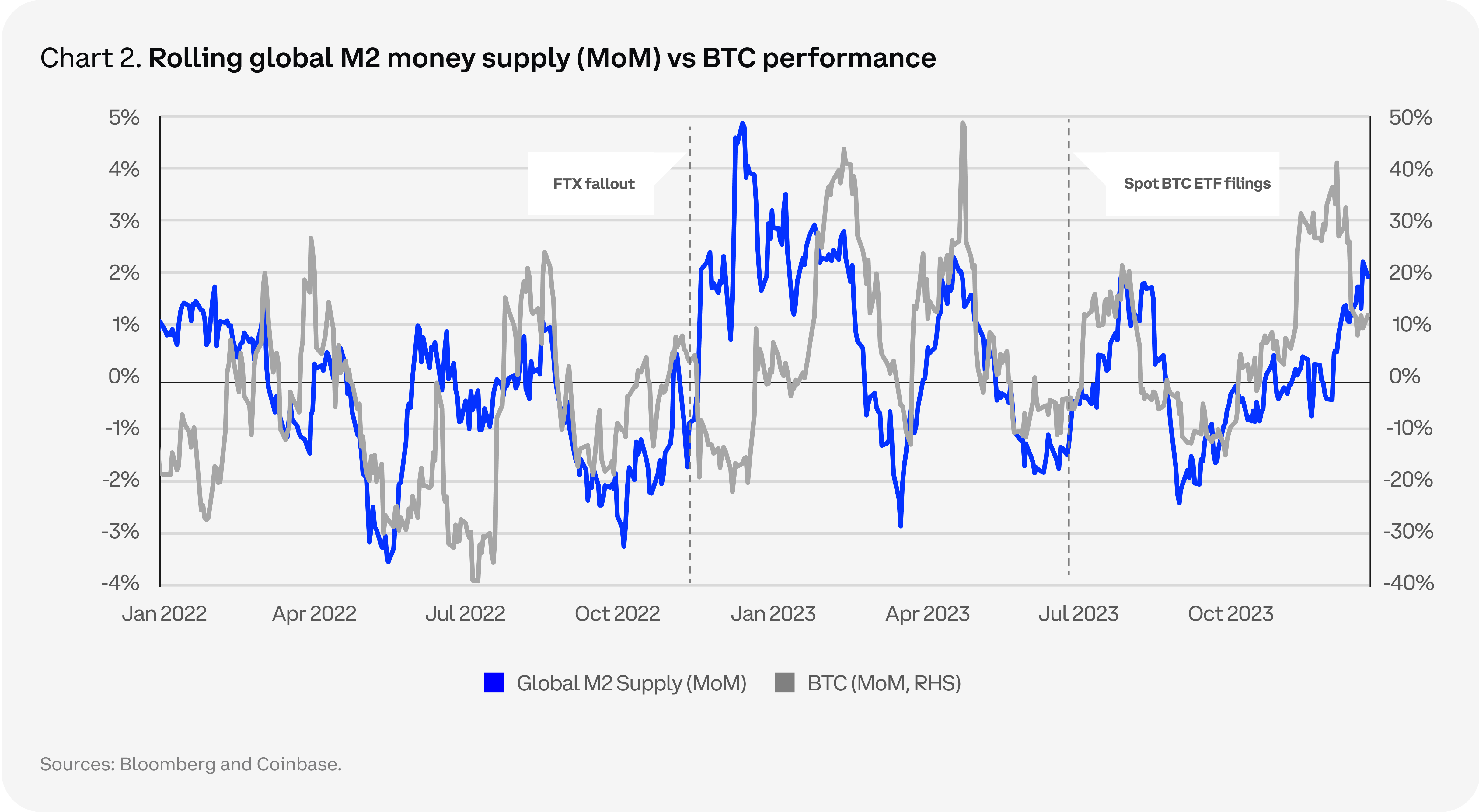

Bitcoin’s idiosyncratic narrative has helped it outperform traditional assets through 2H23, and we expect that to continue next year. Barring a widespread risk-off environment that begets a clamor for liquidity, we think bitcoin may perform well even against a more challenging macroeconomic backdrop. Fiscal dominance in the US and other countries may curtail the restrictive monetary policies keeping capital sidelined, for instance. The commercial real estate sector in the US looks vulnerable and may contribute to renewed pressure on US regional banks. Both developments should extend the secular trend towards bitcoin adoption as an alternative to the traditional financial system. All of this could strengthen the narrative around the disinflationary supply schedule associated with the Bitcoin halving in April 2024.

A new trading regime

The previous crypto winter (2018-19) ended with the advent of decentralized finance (DeFi) and the rise of multiple alternative layer-1 networks (L1s), ostensibly built to satisfy the anticipated demand for onchain blockspace. Experimentation with the protocols on these platforms brought crypto further into the mainstream before overall activity stagnated in late 2021. Consequently, it turned out that there wasn’t necessarily a need for more blockspace. Out of the depressed expectations that ensued, developers decided to use the crypto winter to build. They dedicated their time to confronting the technological hurdles that hinder new blockchain use cases from developing.

The first stage of that progress has been to build the infrastructure necessary to enable a web3 future, such as scaling solutions (layer-2s), security services (restaking), and hardware (accelerators for zero-knowledge proofs) to name a few. These remain important investment opportunities for the crypto space, but arguably, a lot of infrastructure has now been built over the last two years. As this enables more decentralized applications (dapps) to emerge, we think the trading regime for crypto will transition alongside these endeavors. That is, we expect more market players to focus on finding the potential web3 apps that can help crypto bridge the gap between early adoption and mainstream use.

Many market players rely on web2 analogues for their investment ideas in this space, like payments, gaming, and social media. Other use cases have emerged that have a more distinct crypto native flavor, including decentralized identity, decentralized physical infrastructure networks, and decentralized compute. We think the challenge isn’t just identifying the sectors but picking the winners. Achieving dominance in any given sector isn’t just about having the first-mover advantage (although it helps); it’s also about achieving and monetizing the right network effects. Before early 2004, there were at least six other social media platforms, including Friendster and MySpace, that had made their mark but which didn’t achieve the same network size or prominence as Facebook, for example. Given the nascency of the digital asset class, we expect many market participants to rely more on proxies and platform plays to capture the opportunities we’ll see in the next cycle.

The layer-1 equilibrium

In our view, the moderation in onchain activity over the last two years has reduced demand for “general purpose” alternative layer-1s. Ethereum’s dominance among smart contract platforms has remained steadfast, leaving only narrow room for direct competition. Around 57% of the total value locked in the crypto ecosystem sits on Ethereum, while ETH dominance of 18% of the total crypto market cap remains larger than any other token except BTC.[1] As market players increasingly focus on applications, we expect more alt L1s to repurpose their networks in a way that better aligns with the shifting narrative. More sector-specific platforms, for example, are already being propagated in the ecosystem. Some are focused on gaming or NFTs (Beam, Blast, Immutable X, e.g.) while others are focused on DeFi (dYdX, Osmosis) and/or institutional participants (Avalanche’s Evergreen subnet, Kinto).

At the same time, the concept of modular blockchains is gaining more traction within the crypto community, with many L1s stepping in to fulfill one or more core blockchain components including data availability, consensus, settlement, and execution. In particular, the launch of Celestia on mainnet in late-2023 reanimated the conversation around modular blockchain design by providing a readily-accessible, plug-in data availability layer.[2] That is, other networks and rollups can use Celestia to post transaction data and guarantee that that data is available onchain for anyone to check. Other Ethereum Virtual Machine (EVM) compatible L1s are opting to focus on smart contract execution by transitioning to Ethereum L2s, like Celo.[3]

That said, integrated (or monolithic) chains like Solana continue to have an important place in the crypto ecosystem, meaning the debate between the modular vs integrated theses may not be resolved anytime soon. Nevertheless, we think the trend towards increasingly differentiated chains – whether by sector or function – will continue through 2024. However, the value of these blockchains ultimately still comes down to which projects are building on top of them and how much usage they attract.

The evolution of layer-2s

The rapid growth of layer-2 scaling solutions has been accelerated by the emergence of new rollup stacks like OP Stack, Polygon CDK, and Arbitrum Orbit as well as the abstraction of functionality into specialized layers. As a result, developers are able to build and customize their own rollups more easily. Yet, despite the proliferation of L2s, they’ve diverted very little activity away from Ethereum mainnet and have instead been cannibalizing the activity of alt L1s.

For example, if we compare the canonical bridges linking Ethereum with L2s versus alt L1s, the share of ETH locked on rollup-linked bridges has grown from 25% of all bridged ETH at the start of 2022 to 85% by end-November 2023. Meanwhile, despite the growth in rollup usage, transaction counts on Ethereum have remained relatively stable averaging around 1M per day. Comparatively, the aggregate activity across Arbitrum, Base, Optimism, and zkSync currently average more than 2M transactions per day.

Moreover, the modularity thesis is manifesting in the L2 sector in altogether unique ways. Eclipse captured significant attention in 2023 for challenging existing conventions by being a “universal” scaling solution that relies on a modular architecture. Notably, Eclipse relies on (1) the Solana Virtual Machine (SVM) for transaction execution, (2) Celestia for data availability, (3) Ethereum for settlement (security), and (4) RISC Zero for zero-knowledge fraud proofs. This is just one example of how we are starting to see some experimentation with different (non-EVM) virtual machines on the execution layer, although it remains to be seen what the influence of this will be on the ecosystem. With the Cancun (Dencun) Fork also on the horizon in 1Q24, we may also see transaction fees coming down for L2s settling to Ethereum.

Key theme 2: Resetting the macro framework

The long road to de-dollarization

De-dollarization may continue to be a perennial topic of conversation in 2024, particularly as it’s an election year. However, the reality is that the USD isn’t under any threat of losing its global supremacy (or “privilège exorbitant" per former French President Valery Giscard d’Estaing) anytime soon. What is clear is that the USD is at an inflection point. Although de-dollarization may take many, many generations to unfold, the global monetary regime has already started to shift away from USD dominance – and for good reason. Macroeconomic imbalances in the US are growing as the cost of servicing America’s debt burden is projected by the Congressional Budget Office (CBO) to rise to $1T or 3.1% of GDP by 2028. The CBO expects the federal deficit to expand from an average 3.5% of GDP to 6.1% in the next decade.

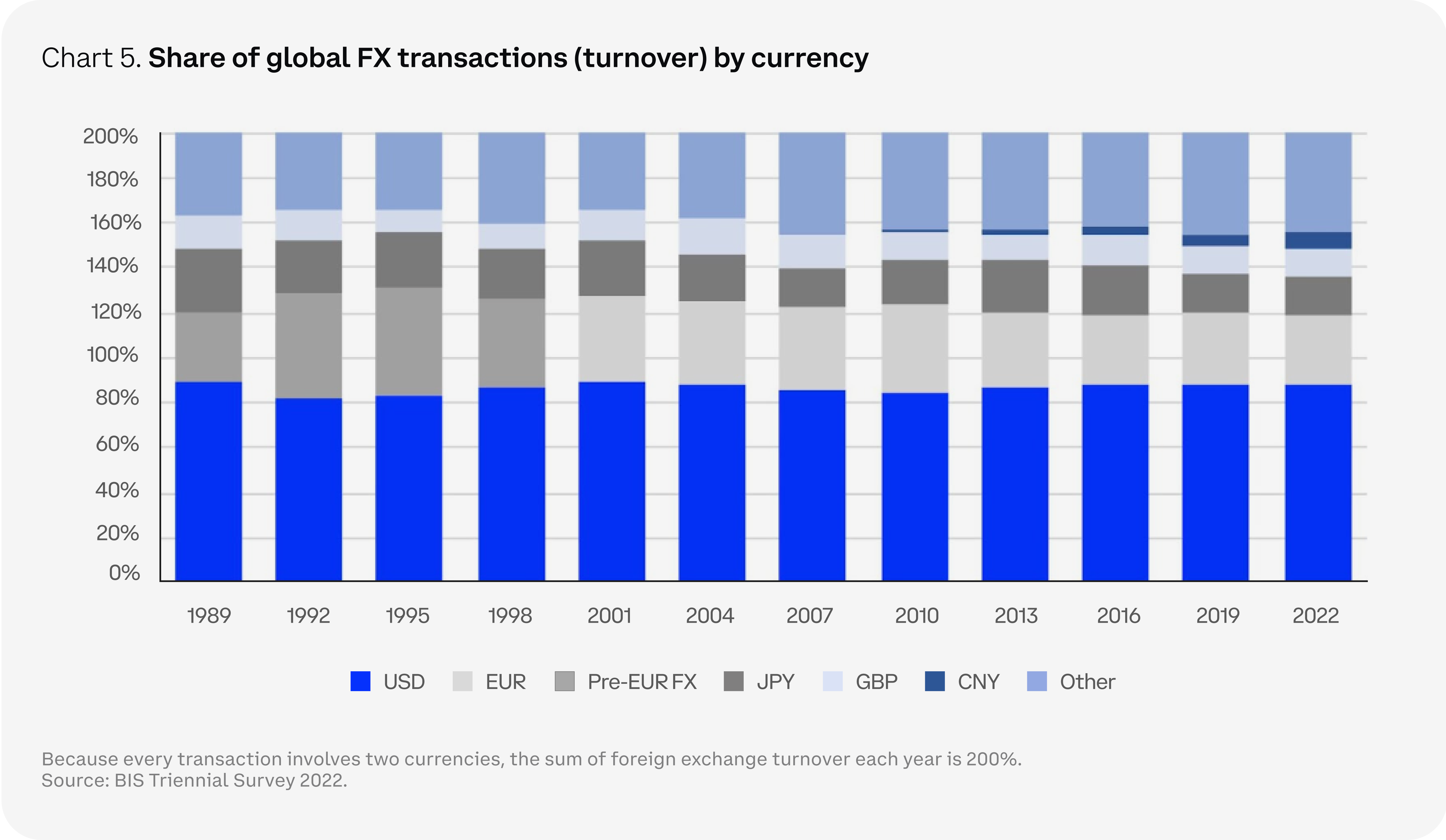

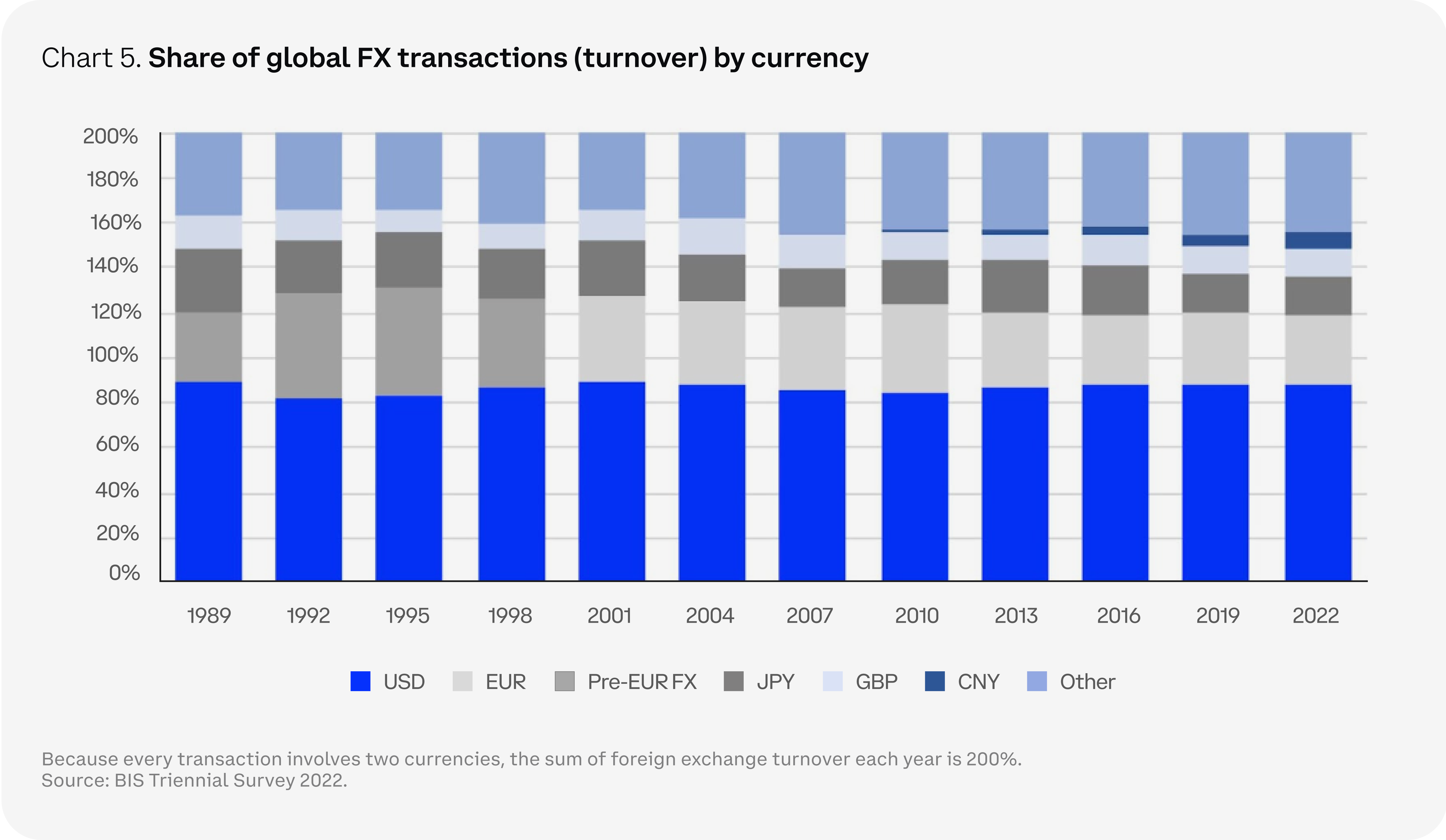

On the other hand, the de-dollarization theme has been a topic of discussion since at least the early 1980s, and despite that, the USD still remains the world’s reserve currency. Indeed, the USD’s outsized role in global finance and trade means the USD’s share of all international transactions has hovered around 85-90% for the last four decades. (See chart 5.) What has changed is the weaponization of global finance that began with increased US sanctions on Russia as a direct result of the war in Ukraine. This has accelerated interest in developing new cross border payment solutions as more countries are striking bilateral agreements to reduce their dependence on the USD. Both France and Brazil (among others) have started to settle commodity trades in Chinese renminbi, for example.[4] More trials are being conducted with central bank digital currencies to avoid today’s cumbersome system of correspondent banks.

Crypto advocates argue that bitcoin and other digital stores of value have an important role in this emerging shift from a unipolar to multipolar world, as the value of having a supranational asset that is not owned or controlled by any single country seems evident. Monetary transformations often take place in periods of socioeconomic upheaval that are only understood well after they happen, like paper money in 11th century China, promissory notes in 13th century Europe, or credit cards in mid-20th century America.

On the other hand, while digital cash and distributed ledgers will likely form a major part of the next transformation, displacing the USD in the global financial system is no small task. For one thing, the entire crypto market cap is only a fraction of the $13T in USD-denominated bonds available to non-banks outside the US.[5] The USD’s share of foreign exchange reserves has declined over the last 30 years, but it still comprises the overall majority at 58%.[6] But bitcoin doesn’t necessarily need to disintermediate the USD to play a valuable function as an attractive alternative in unstable conditions, which could potentially help it find a place as part of more countries’ reserve assets. Nor is the structural adoption of bitcoin and crypto contingent on the collapse of the USD, which explains why we saw bitcoin strengthening in tandem with the USD in early 2H23. Over the long haul, the monetary regime change that’s happening and crypto’s part in that will likely be momentous, even if we may not be around long enough to see the toppling of the old order.

The economic outlook for 2024

The chances that the US may avoid an economic recession in 2024 have increased sharply in recent months, although the probability of recession is not zero – as highlighted by a still deeply inverted US Treasury yield curve. The US’ particular brand of economic resiliency this year has been driven by high levels of government spending as well as near-shoring efforts to strengthen the domestic manufacturing sector, among other things. However, we expect these effects to wear off in 1Q24, leaving the economy much softer amid comparatively tighter financial conditions. But this doesn’t need to result in a recession, in our view. Rather, a recession will be contingent on endogenous factors like the potential for renewed weakness in the US banking system or the overall pace of disinflation.

On the latter, we’ve argued since March 2023 that inflation had already peaked and that moderating aggregate demand should cyclically support a stronger disinflationary trend going forward.[7] In large part, that has already materialized, while structural forces like artificial intelligence can lead to greater automation and lower input costs. That said, shifting demographics – such as the departure of baby-boomers from the workforce – may act as a counterbalance to that. Taken together, we think the combination of an economic slowdown and a moderation in price pressures should pave the way for the Federal Reserve to cut rates by mid-2024, if not sooner.

In our view, lower capital costs could support risk assets in 2Q24, but 1Q24 may present some challenges depending on how entrenched the Fed’s position is. Crypto may not be entirely immune in that scenario. But our economic outlook also translates to a weaker USD trend next year, which would be an opportunity for cryptocurrencies, as these assets tend to be priced in USD. Although the correlations between changes in many macro variables and bitcoin (and ether) returns have come down over the last year, an amenable macro backdrop still forms a core part of our overall constructive market thesis for 2024.

Reading the regulatory tea leaves

In a recent Institutional Investor survey, commissioned by Coinbase, around 59% of participants said they expect their firm’s allocations to the digital asset class to increase over the next three years, while a third said they’ve already boosted their allocations over the past 12 months. This affirms that crypto remains a globally important asset class with widespread commercial and investor appeal. However, while many jurisdictions around the world are taking decisive action on crypto regulations, uncertainty in the US is contributing to an environment of missed opportunities and enforcement-centric market constraints. Indeed, 76% of survey respondents agree that the lack of sensible and well-defined crypto regulations in the US has threatened the country’s position as a leader in financial services.

Moreover, irrespective of the specific language used in guidance and other public statements in 2023, the perception in the market is that US banking supervisors’ attitude toward the digital asset ecosystem is at minimum unfavorable, while some view it as being outright hostile. The result is that all but the largest and most reputable crypto companies may experience difficulty in establishing banking relationships. Whether intended or not, the regulatory gates being erected in the US through non-objection letters and other permission-seeking requirements has chilled the incentive for banks to invest in digital asset technology or take on clients that actively engage in these activities.

On the upside, we think more legislators in the US recognize the rising risk of global regulatory arbitrage with several US House Committees advancing the Clarity for Payment Stablecoins Act and the Financial Innovation and Technology for the 21st Century Act (FIT 21 Act) in 2023.

Separately, the potential approval of spot bitcoin ETFs in the US could widen crypto access to new classes of investors and reshape the market in unprecedented ways. Compliance-friendly ETFs could become the underlying for a new set of financial instruments (lending and derivatives, for example) that could be traded among institutional counterparties. We believe the foundations for crypto regulation will continue to be built in 2024, leading to more incremental regulatory clarity and greater institutional participation in this space in the future.

Key theme 3: Connecting to the real world

Tokenization, redux

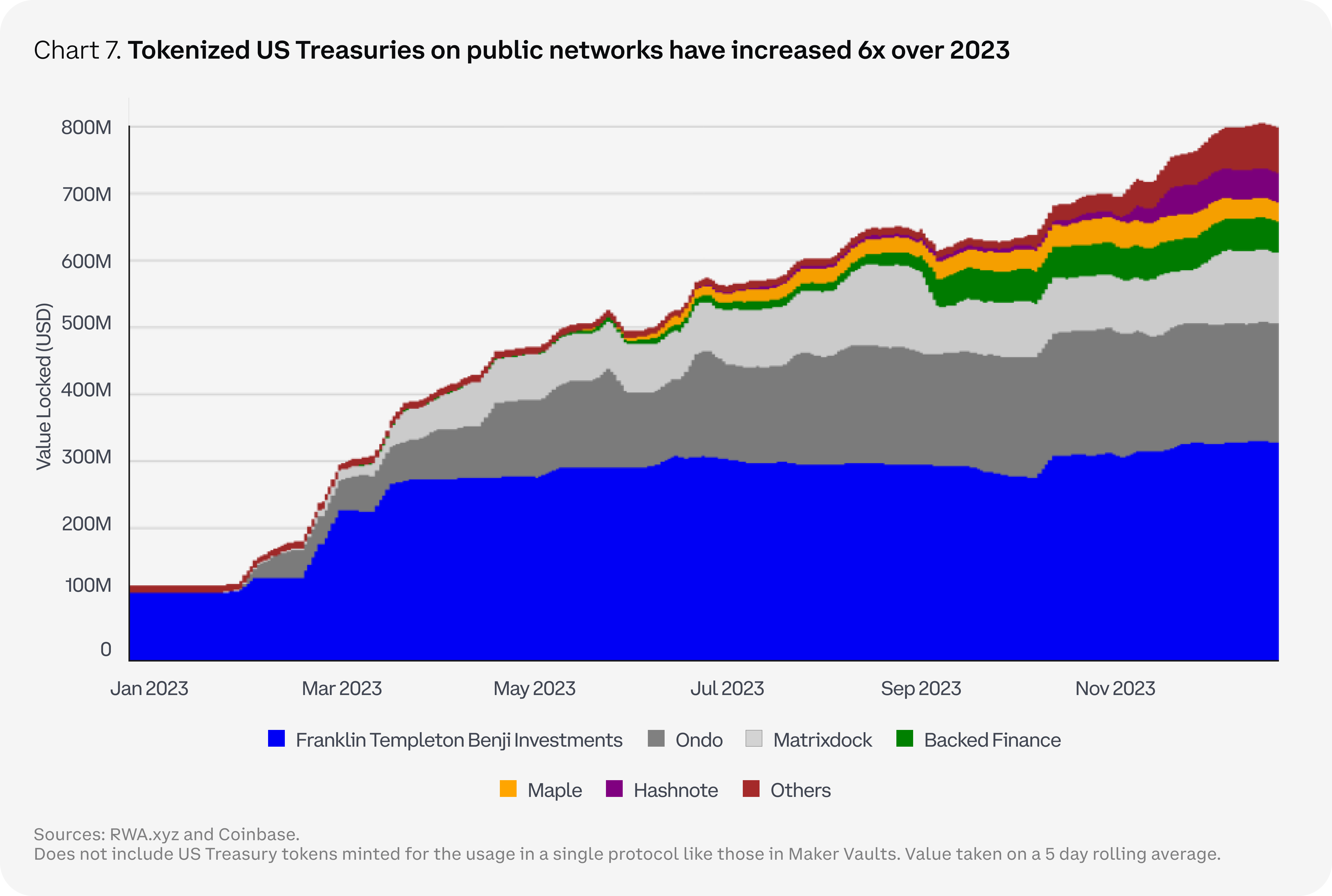

Tokenization is a vital use case for traditional financial institutions and we expect it to be a major part of the new crypto market cycle, as it is a critical part of “updating the financial system.” This primarily involves automating workflows and eliminating certain intermediaries that are no longer needed in the asset issuance, trading, and record keeping process. Not only does tokenization have strong product-market fit for distributed ledger technology (DLT), but the current high yield environment makes the capital efficiency offered by tokenization much more relevant than it was even two years ago. That is, for institutions, tying up capital for even a few days in higher interest rate environments is much costlier than doing so in lower rate environments.[8]

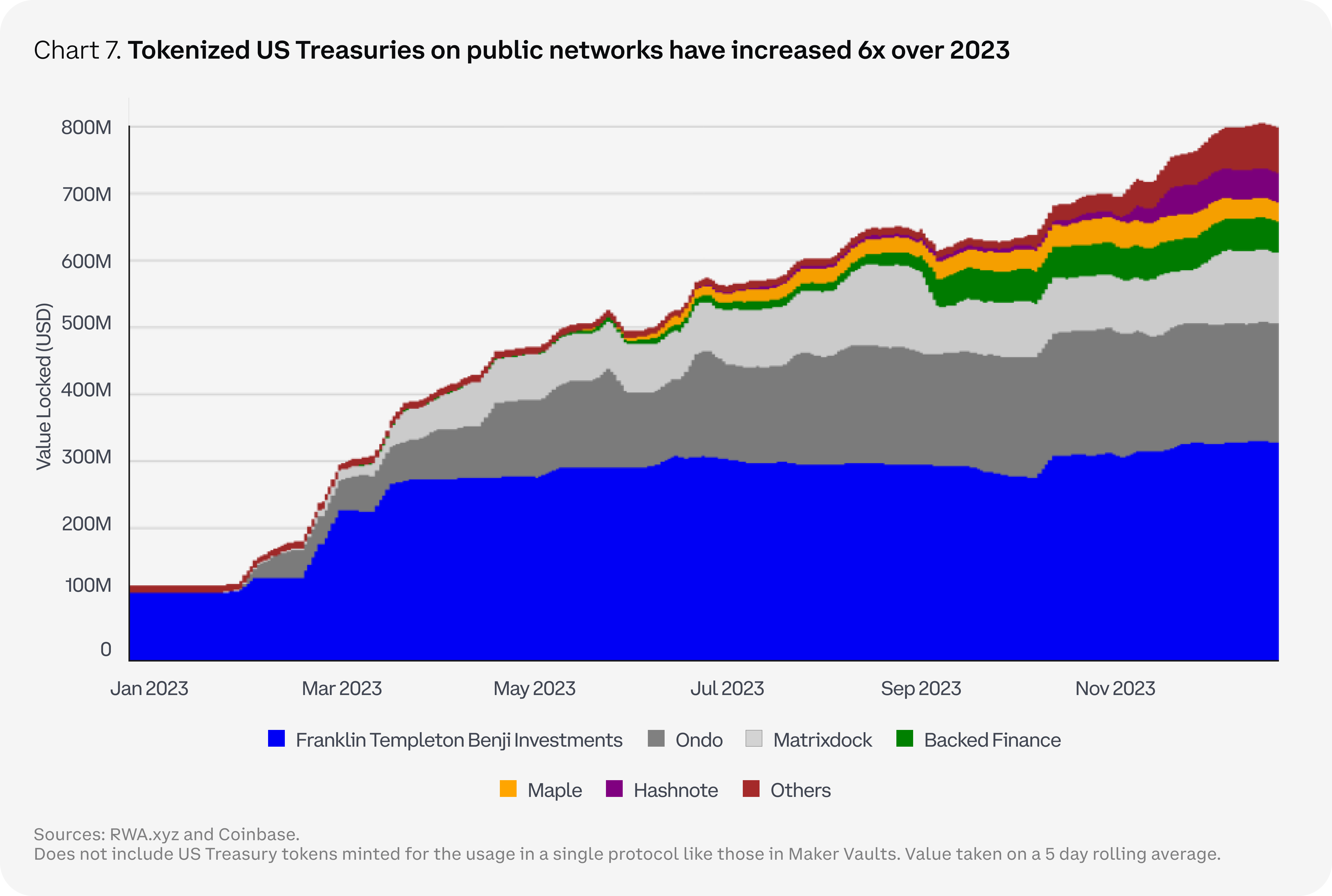

Over the course of 2023, we witnessed dozens of new entrants on public permissionless networks begin to offer access to tokenized US Treasury exposure directly onchain. Total assets held in US Treasury-like exposure onchain has increased 6x to over US$786M as digitally native users have sought to gain exposure to yields that have no connection to traditional crypto yield sources. In 2024, we may see tokenization expand to other market instruments including equities, private market funds, insurance, and carbon credits, given the client demand for higher yielding products and the need for diversified sources of return.

Over time, we believe that even more business and financial sectors will incorporate aspects of tokenization, though regulatory ambiguity and the complexities of managing different jurisdictions continue to pose significant challenges for market participants – alongside the integration of new technologies into legacy processes. This has driven most institutions thus far to rely on private blockchains, due to the risks associated with public networks such as smart contract exploits, oracle manipulation, and network outages. While private blockchains may continue to grow alongside public permissionless chains, this can potentially fragment liquidity due to interoperability hurdles, which would make it harder to realize the full benefits of tokenization.

An important theme to watch around tokenization is the regulatory progress being made in jurisdictions like Singapore, the EU, and the UK. The Monetary Authority of Singapore has sponsored “Project Guardian” which has produced dozens of proof-of-concept tokenized projects on public and private blockchains from tier 1 global financial institutions. The EU DLT Pilot regime has developed a framework for enabling multilateral trading facilities to utilize a blockchain for both trade execution and settlement, rather than through a Central Securities Depository. The UK has also launched a pilot regime seeking an even more advanced framework for issuing tokenized assets on public networks.

While many are now looking past “proof-of-concepts” towards possible commercialization, we still expect full implementation will continue to take place over multiple years given this theme requires regulatory alignment, progress with onchain identity solutions, and critical infrastructure within major institutions to operate at scale.

Can we play a game?

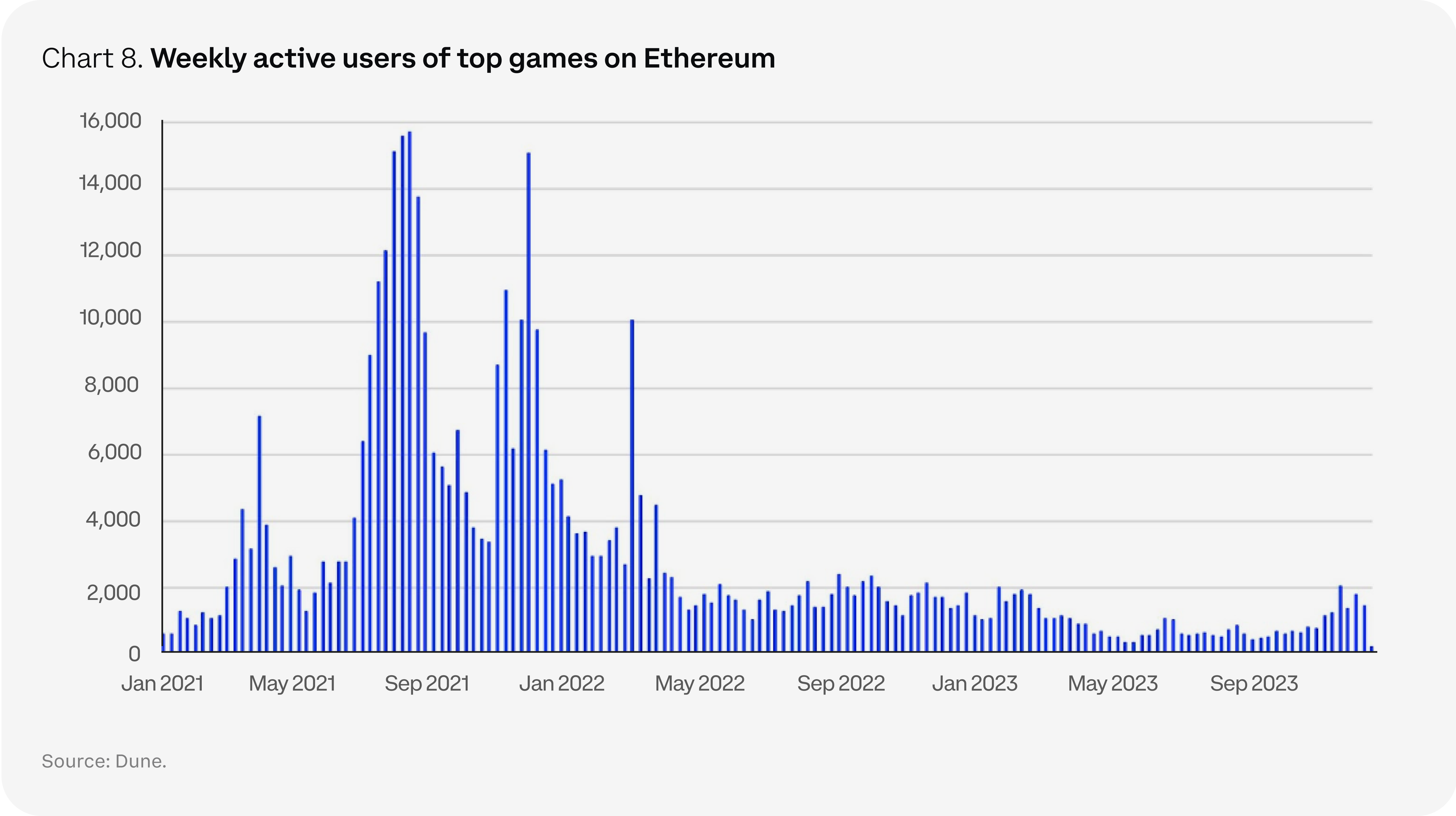

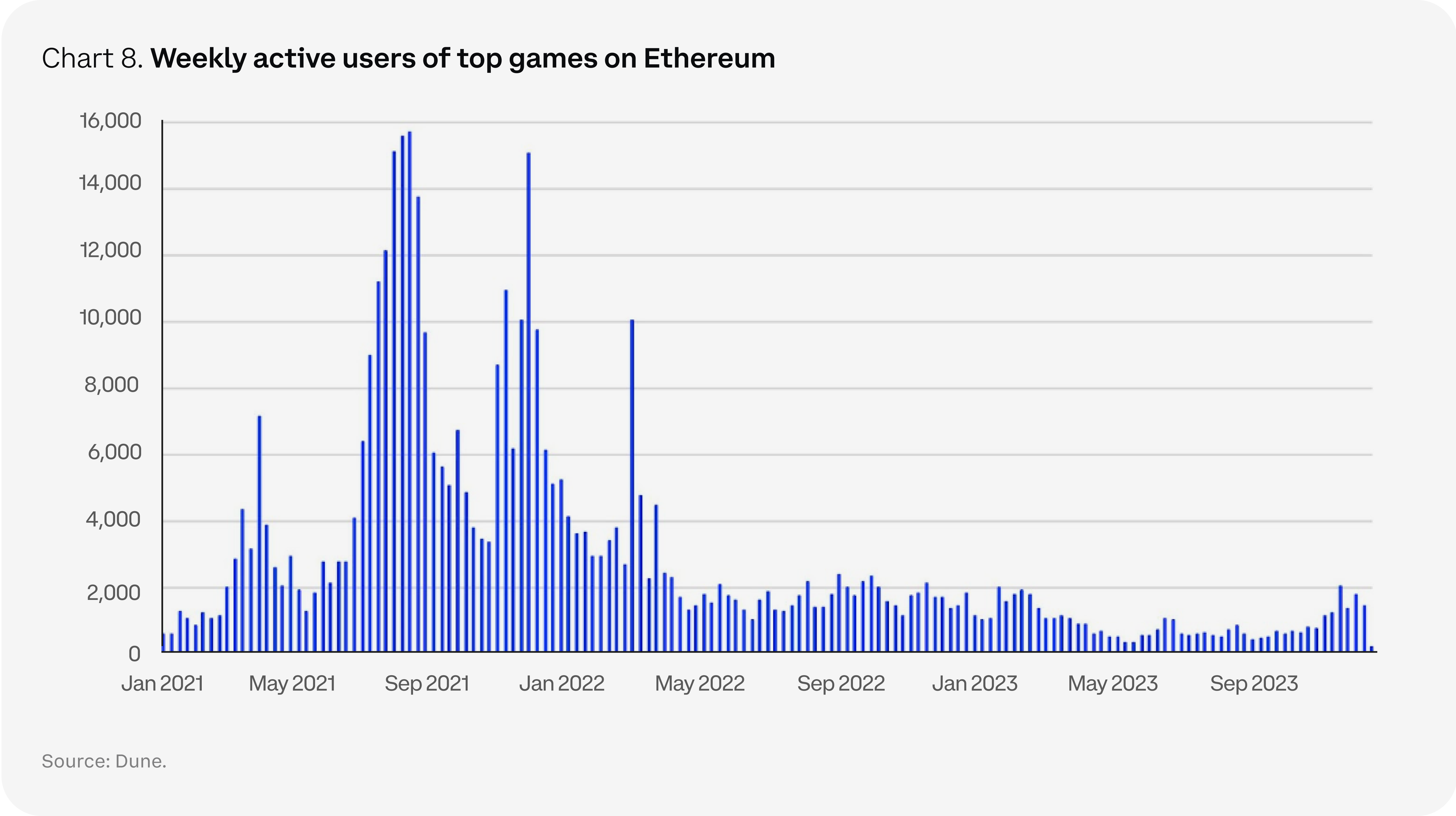

Web3 gaming has had a resurgence of interest in 2H23 after a steep drop in transaction activity in the early stages of the most recent crypto winter. At the moment, this sector is mainly concentrated on capturing the attention of mainstream gamers that sit outside of many “crypto first” communities. Altogether, the gaming industry represents a total addressable market of around US$250B at the moment, which is projected to grow to $390B over the next five years.[9] However, while the opportunities for investment may be massive, users have broadly spurned existing web3 “play-to-earn” models that were exemplified by early projects such as Axie Infinity. In fact, such models may have led to greater skepticism from many mainstream gamers regarding web3 integrations.

This is prompting greater experimentation from developers, who are trying to merge the network effects of a high-quality AAA game with sustainable financialization mechanics. For example, gaming studios have considered minting web3 primitives like non-fungible tokens (NFTs) that can be used, transferred, or sold in-game or on designated market places. However, surveys indicate that a large majority of gamers dislike NFTs, which broadly reflects their rejection of the play-to-earn or pay-to-play ethos.[10] Meanwhile, for the gaming industry, the value-add of tapping into web3 architecture is that it promises to improve user acquisition and retention, but as of yet, this is still an unproven thesis. With many projects reaching the 2-3 year mark in their game development process (following an influx of fundraising in 2021-2022), we think the possible release of some web3 games in 2024 may soon give us the stats and data we need to better assess this sector.

How to hardwire a decentralized future

A big theme for 2024 (and most likely beyond, depending on development timeframes) is the decentralization of real world resources. We are specifically focused on decentralized physical infrastructure networks (DePIN) and the related concept of decentralized compute (DeComp). Both DePIN and DeComp utilize token incentives to drive resource creation and consumption for real world constructs. In the case of DePIN, these projects depend on creating economic models that help incentivize participants to build physical infrastructure (from energy and telecommunications networks to data storage and mobility sensors) that sit outside the control of large corporations or centralized entities. Specific examples include Akash, Helium, Hivemapper, and Render.

DeComp is a specific extension of DePIN that relies on a distributed network of computers to meet specific tasks. The concept has been reinvigorated by the mainstream adoption of generative artificial intelligence (AI). Training AI models can be computationally expensive, and the industry is exploring whether there’s an opportunity for decentralized solutions to alleviate the problem. It’s still unclear whether the ability to express the AI theme within blockchain will be viable, but the sector is growing. For example, a separate but related field of research called zero-knowledge machine learning (ZKML) focuses on privacy and promises to revolutionize how sensitive information is handled by AI systems.[11] ZKML could potentially enable large language models to learn from a set of private data without ever accessing that data directly.

DePIN represents a strong real-world use case for blockchain technology that can potentially disrupt the existing paradigm, but it is still relatively immature and faces a number of hurdles. These include high initial outlays, technical complexity, quality control, and economies of scale to name a few. Moreover, many DePIN projects have been focused on how to incentivize participants to supply the necessary hardware for these projects, but only a few have started to tackle the financialization models for driving demand. Although a demonstration of DePIN’s value may come early, realizing the benefits could nevertheless take years. Thus, we think market players will still need to take a long duration view in order to invest in the sector.

Decentralized identity

Privacy is a new frontier for blockchain developers, who are leveraging innovations like zero-knowledge (ZK) fraud proofs and fully homomorphic encryption (FHE) to enable computations on user data while still keeping that data encrypted. The applications for this are extensive, particularly as it pertains to decentralized identity – which describes an end-state where users have full control and ownership of their personal data. For example, this could enable a healthcare research organization to analyze patient data, helping them discover new trends or patterns for specific diseases but without revealing the sensitive health information of any patients. To achieve this, however, we think individuals would need to have control over their own identity data – a departure from the current status quo of having this information sit on the servers of many disparate centralized entities.

To be sure, we’re still in the very early stages of tackling this problem. But ZK systems and FHE were once considered purely theoretical concepts that have recently seen more experimental implementations within the crypto industry. In the next few years, we expect to see greater advancements in this field that may get us to the point of having end-to-end encryption in our web3 applications and networks. If so, then we believe decentralized identity could have a strong product-market fit in the future.

Key theme 4: Future of blockchain

A better user experience

One of the big themes to emerge from the recent bear market cycle is a focus on how to make crypto technology more user friendly and accessible. The added responsibility of managing crypto and all that entails (wallets, private keys, gas fees, etc.) is not for everyone, which makes it hard for the industry to mature unless it can overcome some key user experience-related challenges. Progress around account abstraction appears to be yielding meaningful results on this front. The concept of account abstraction dates back to at least 2016 and refers to the idea of treating both externally owned accounts (like wallets) and smart contract accounts similarly, thereby simplifying the user experience. Ethereum advanced account abstraction in March 2023 with the introduction of the ERC-4337 standard, opening up new opportunities for users.

For example, in the case of Ethereum, it could allow application owners to act as “paymasters” and pay for users’ gas fees or enable users to fund transactions with non-ETH tokens. This functionality can be of particular importance to institutional entities who do not want to hold gas tokens on their balance sheets due to price variability or other reasons. J.P. Morgan’s proof-of-concept report as part of Project Guardian highlights this, with all gas payments handled via Biconomy’s Paymaster service.[12]

With the Dencun upgrade set to potentially reduce rollup transaction fees by 2-10x, we think more decentralized applications (dapps) may pursue a “gasless transactions” path, effectively allowing users to focus only on high-level interactions.[13] This may also enable new non-financial use cases to develop. Account abstraction can also facilitate robust wallet recovery mechanisms to create failsafes against simple human error (like losing a private key, for example). The goal is for the crypto ecosystem to attract new users as well as encourage existing users to become more active participants.

Validator middleware and customizability

Developments like restaking and distributed validator technology (DVT) are giving validators the ability to customize key parameters in new ways – to better accommodate changing economic conditions, network demands, and other preferences over time. The growth of validator middleware solutions has already been a major theme in 2023 from an innovation perspective, but their full potential – for enhancing customizability and unlocking new business models – has yet to be fully realized, in our view.

In the case of restaking, currently being pioneered by EigenLayer, this could be a way for validators to secure data availability layers, oracles, sequencers, consensus networks, and other services on Ethereum. The potential rewards earned from this process will likely represent a new income stream for validators in the form of “security-as-a-service.” EigenLayer officially launched phase 1 on Ethereum mainnet in June 2023 and will begin registering operators to actively validated services (AVS) in 2024, after which restakers will be able to delegate their staked positions to those operators.[14] We think these developments will be worth watching to see what percentage of staked ETH will be allocated towards additional security provisions, when EigenLayer is fully open to the public.

Meanwhile, distributed validator technology (DVT) for proof-of-stake networks can offer stakers more design choices as far as setting up and managing their validator operations. DVT splits the responsibilities (and private key) of a single validator among multiple node operators, thereby limiting single points of failure.[15] This can reduce the risk of slashing penalties and enhance security because a single node operator being compromised does not leave an entire validator compromised. Moreover, for solo stakers, DVT gives participants the ability to run a validator and earn rewards without putting up as much collateral (assuming they partner with others via platforms like Obol, SSV Network, or Diva Protocol to meet staking thresholds), thus lowering barriers to entry and promoting greater decentralization.[16] Thus, we may see DVT enable validators to distribute themselves geographically to mitigate liveness and slashing risks.