What is the crypto fear and greed index?

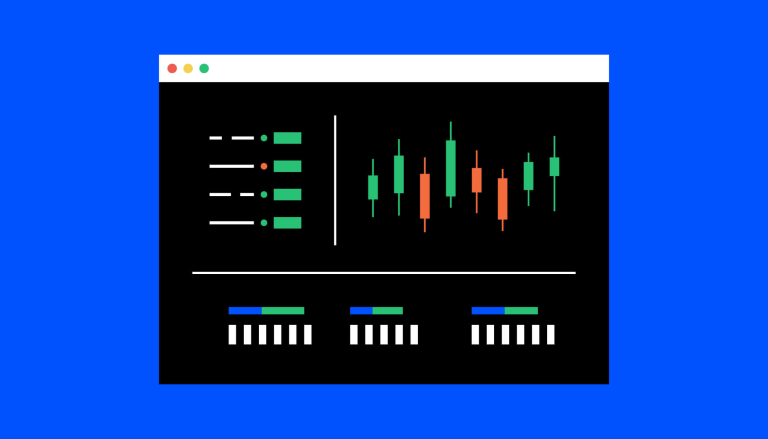

The Crypto Fear and Greed Index is a tool that gauges the market sentiment of cryptocurrencies, providing a score from 0 to 100.

The index utilizes various data sources such as volatility, market momentum, public sentiment data, and dominance to calculate the sentiment.

Traders often use this index to make decisions based on additional data about when to engage or disengage from the market.

Understanding the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a tool that strives to measure the overall sentiment of the cryptocurrency market. It uses a variety of data sources and combines them into a single figure, providing a score from 0 to 100. This score categorizes the market sentiment from extreme fear (0-24) to extreme greed (75-100). The index is primarily based on Bitcoin market data.

How is the Crypto Fear and Greed Index Calculated?

The index is calculated using a range of sources: volatility, market momentum/volume, public sentiment data, dominance, and trends. Each of these signals plays a crucial role in determining the market sentiment. For instance, a rise in volatility is used as a sign of a fearful market, while an unusually high interaction rate in public sentiment data is used to identify greedy market behavior. The index also uses data from Google Trends to see how many people are searching for information about Bitcoin.

How to Use the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index can be a tool for traders to make decisions based on additional data about when to engage or disengage from the market. For instance, a state of extreme fear could be a potential time for market engagement because investors are too worried, while extreme greed could suggest a potential change in market conditions. However, it's important to note that the index should be used as a guide and not as a definitive predictor of market movements.

Insights from the Crypto Fear and Greed Index

The Crypto Fear and Greed Index can provide insights into the long-term sentiment of the Bitcoin market. For example, a historical chart of the index can show how Bitcoin sentiment has changed over time. This can help traders gain a deeper understanding of the market's emotional dynamics.

Trading with Fear and Greed

The Crypto Fear and Greed Index is often used as a daily indicator rather than a tool for long-term trading. When the index value is low, it may imply that the cryptocurrency price will rise, and traders can decide their engagement strategy. Conversely, when the index value is high, it may suggest a potential change in market conditions. Understanding these dynamics can help traders make decisions based on additional data and potentially enhance their understanding of market dynamics.