The original hype around tokenization back in 2017 was around creating digital assets that represented ownership of illiquid, physical assets such as real estate, commodities, art or other collectibles on a blockchain. But the current high yield environment has given tokenization a somewhat different significance as an opportunity for digitizing financial assets such as sovereign bonds, money market funds and repurchase agreements.

We believe this could be a vital use case for traditional financial players and become a major part of the new crypto market cycle, though full implementation may take another 1-2 years. Compared to 2017, when the opportunity cost was closer to 1.0-1.5%, we think today’s nominal interest rates above 5.0% makes the capital efficiency of instantaneous (versus T+2) settlement much clearer to financial institutions. Moreover, the ability to run operations 24/7, automate intermediary functions and maintain transparent audit records can make simple onchain payments and settlements very powerful, in our view.

However, infrastructure and jurisdictional (legal) concerns remain core challenges. Most institutions rely on private blockchains, for example, due to their concerns around smart contract exploits, oracle manipulation and network outages – i.e. risks they associate with public networks. But we think that private networks can potentially make interoperability more difficult in the future. One possible result is fragmented liquidity, which would make it harder to realize the full benefits of tokenization, such as having a functional secondary market.

Tokenization and its discontents

In the crypto winter of 2017, tokenization seemingly failed to live up to its initial promise of putting trillions of USD in real world assets (RWA) onchain. The prevailing idea back then was that token issuers would convert the ownership rights to illiquid, physical assets such as real estate, commodities, art and other collectibles into digital tokens that would sit on distributed ledgers. The benefits would include fractional ownership of such goods, thereby democratizing access to assets that might otherwise be out of reach for many.

Even today, real estate seems to be a particularly ripe opportunity for tokenization amid persistent headlines about how home ownership has become increasingly unaffordable, especially for younger generations. Yet, despite having a well-formed use case, tokenization failed to gain meaningful traction in 2017. Instead, the next crypto market cycle was driven by experimentation with decentralized finance (DeFi), while the disruptive promise of tokenization was ostensibly deferred.

We think the recent resurgence of the tokenization theme has been due in part to the crypto market sell off in 2022, as many proponents emphasized the fundamental value of blockchain technology over token speculation. This harkens back to the now familiar mantra of “blockchain, not bitcoin,” which crypto-native skeptics of tokenization use as a derogatory refrain to argue that the current enthusiasm for these projects may only last until the crypto price action starts to recover.

What’s changed?

While we think this criticism has some merit, the current crypto cycle differs from the previous bear market in many important respects. Chief among these is the global rate environment. Between early 2017 and end 2018, the Federal Reserve gradually hiked interest rates by 175bps from 0.50-0.75% to 2.25-2.50% and kept its balance sheet relatively stable. Comparatively, the Fed has hiked rates by a whopping 525bps to 5.25-5.50% in the current tightening cycle (which started in March 2022) and reduced its balance sheet by over $1T over the last 18 months.

From the consumer perspective, higher front-end bond yields have contributed to a surge in yield-seeking behavior from retail investors. That demand has been funneled into more protocols seeking to tap into the market for tokenized US Treasuries in a way that wasn’t present in 2017. (Neither of the top two stablecoins by market capitalization – USDT and USDC – are natively interest bearing.) The regional banking crisis in March 2023 also made low yields on existing customer deposits all the more apparent. As such, tokenized products have the potential to boost onchain activity, in our view, but regulatory issues may be a barrier to widespread development and adoption – potentially leaving US consumers stranded.

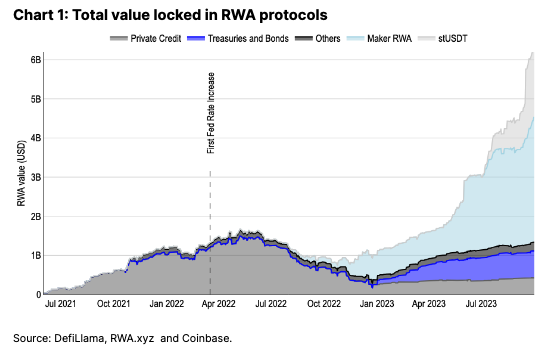

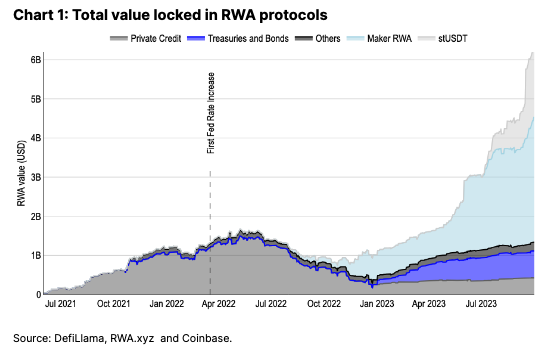

Over the past year, the rise in rates has been reflected in the shift in RWA protocol allocations from private credit protocols to US Treasuries (see chart 1). In particular, there has been remarkable growth in RWAs deposited as collateral in Maker vaults, which has minted more than $3B of DAI. As higher long and short term yields drive up borrowing rates in traditional finance, the comparatively lower borrow rate of DAI at approximately 5.5% looks increasingly competitive.

Meanwhile, for institutional investors, tying up capital in higher interest rate environments is much costlier than doing so in lower rate environments. The majority of traditional securities transactions currently settle in two business days (T+2) during which time funds from buyers to sellers are locked up and underutilized. (See footnote 1.) In 2017 when nominal yields were closer to 1.0-1.5%, market players were effectively paying negative real rates on these funds. Today, nominal yields above 5% translate to ex-ante real yields of 3% annualized. Thus, for markets that can transact anywhere from hundreds of billions to over a trillion US dollars per day, capital efficiency is more crucial now. We think that makes the value of instant vs T+2 settlement much clearer for traditional financial institutions in a way that it may not have been previously.

Over the last six years, many misconceptions about tokenization have also been dispelled among the senior leadership of major institutions. They are now much more aware of tokenization’s benefits, including the ability to run operations 24/7, automate intermediary functions and maintain transparent audit and compliance records. Moreover, counterparty risk is minimized because transactions can be atomically settled in delivery-vs-payment and delivery-vs-delivery scenarios. Also consider that many of the traditional market players involved in tokenization today have teams dedicated to both (1) understanding existing regulations and (2) developing the technology to the point where it can meet those regulations.

Pressures to Adapt

Thus, we think the business use case for tokenization has pivoted away from putting illiquid, tangible RWA onchain and towards capital market instruments like US Treasuries, bank deposits, money market funds and repurchase agreements (repos). Indeed, in a 5% interest rate environment, we think JP Morgan’s tokenized intraday repo (for example) is a much more compelling product than it might otherwise have been when interest rates were near zero just two years ago. To be clear however, many of the benefits (like improved unit economics, lower costs, faster settlement) of tokenization are not new, and distribution at scale is still required to make it work.

Projections on the size of the tokenization opportunity vary but estimates range from Citigroup’s $5T to Boston Consulting Group’s $16T by 2030. Such figures may not be as outsized as they may seem at first. For one thing, they include forecasts on the growth of central bank digital currencies (CBDCs) and stablecoins. In fact, the key variable that accounts for the variance in these estimates is the potential percentage of global money supply that tokenized assets may encompass.

Indeed, stablecoins present one of the clearest prospective templates for tokenization today with the potential for their reserves to include customer cash deposits and liquid cash alternatives in the future. We think stablecoin liquidity could be one of the clearest ways that tokenization intersects with the broader crypto economy as part of the next market cycle.

Legal Limbo

That said, stablecoins have yet to receive legal clarity in the US with regards to their status as bearer assets. But even outside the US, most tokenization efforts face large legal and regulatory hurdles during primary issuance as many laws governing this space are still new, and a number of key jurisdictions still lack clear legal frameworks for tokenization. Due to the nascency of the market, well-known legal precedents and templates do not yet exist and therefore require significant investments of both time and money to establish.

For example, Luxembourg, one of the earliest adopters of tokenization laws, enacted its first legislation to allow the use of blockchain for securities in March 2019, and has since passed several pieces of legislation as recently as March 2023 to allow the tokenization of collateral. The EU Distributed Ledger Technology (DLT) Pilot Regime also only came into effect in March 2023, opening the path for broader tokenization efforts.

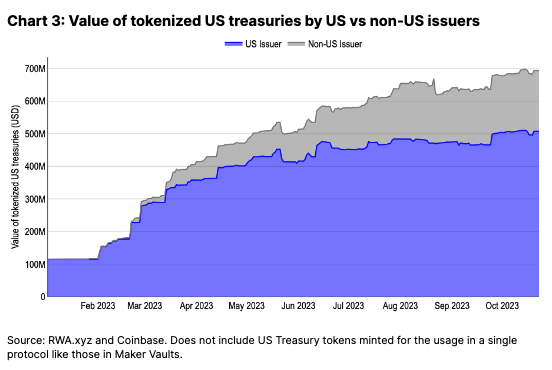

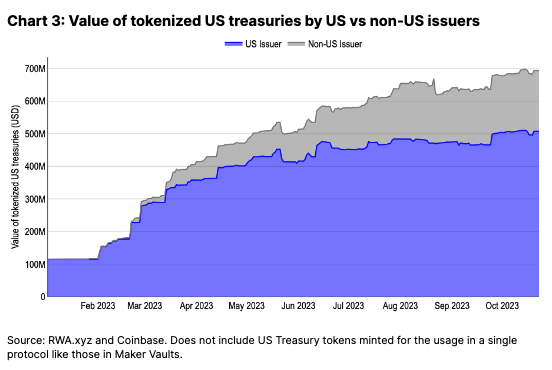

Because of this regulatory ambiguity, multiple platforms are often required to handle tokenized assets in different jurisdictions. Many onchain tokenized treasuries, including OpenEden, Backed, Matrixdock and Ondo, limit participants to accredited investors and often to non-US persons only. An increasing number of US Treasury token issuers are registered in non-US jurisdictions (see chart 3). The jurisdictions of issuing institutions are not always clear to the end user and range from highly-regulated jurisdictions like the US and Switzerland to places like the British Virgin Islands, adding an additional layer of counterparty risk on top of existing smart contract risk.

Legal structures and investor requirements for private blockchains are similarly complex and are only beginning to be tackled. The Euro-denominated EIB bond issued in November 2022 was the first digital bond issued under Luxembourg law, while the HKD-denominated HKMA bond in February 2023 was the first such product governed by Hong Kong law. The process of securities dematerialization to DLTs varies across jurisdictions, and the interplay of cryptographic ownership, physically decentralized networks and jurisdiction-specific securities is still undergoing early stages of exploration.

Financial Fissures

A direct consequence of the legal challenges above is that liquidity on the secondary market suffers because investors need to onboard to new trading channels for each disparate platform. That can be time consuming since know-your-customer (KYC) and anti-money laundering (AML) checks are generally not shared across protocols and institutions.

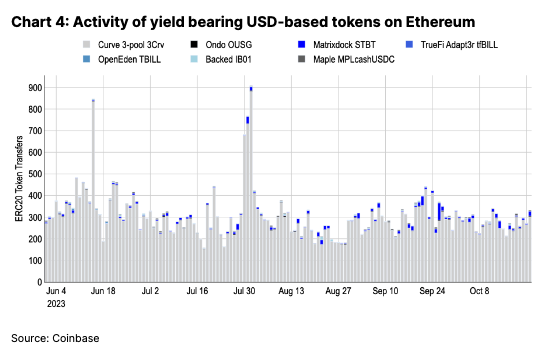

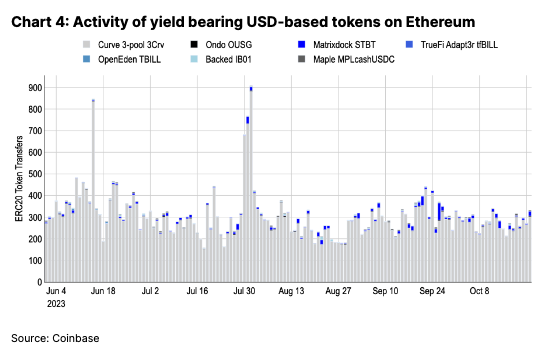

Many tokenized assets thus have a tough time finding transparent price discovery in DeFi via channels like automated market makers (AMMs). This is reflected in the muted activity of tokenized treasuries on Ethereum when compared to similar non-KYC assets. See chart 4. For example, Curve’s DeFi-native 3-pool (3Crv) token market cap is not significantly higher than that of Ondo Finance’s institutional grade OUSG tokenized treasuries ($199M vs $140M), even though the former has nearly 200 times the holders (9254 vs 56). (See footnote 2.)

3Crv also has an order of magnitude more daily transactions despite offering lower yields to holders (as of October 24) and reached more than 100 unique daily transactors within a month of its 2020 release according to Etherscan. Ethereum-based tokenized US Treasuries on the other hand have – in aggregate – less than a dozen average daily transfers nearly a year after launch. Thus, we believe investor barriers severely hamper liquidity and adoption, although Uniswap V4’s controversial KYC hook may alter the future path of adoption and liquidity for such assets.

Permissioned Chains and Private Tokens

Separately, many institutions have opted to build their own private blockchains for tokenization purposes due to concerns around smart contract exploits, oracle manipulation, network outages and compromised keys – i.e. risks that they associate with public networks. Add to that that permissioned chains offer the benefits of private, no-fee transactions and the KYC of all network participants.

Technology providers in the private blockchain space appear to be consolidating around four primary solutions: (1) Hyperledger’s platform suite, (2) Consensys’ Quorum, (3) Digital Asset’s Canton, and (4) R3’s Corda. Each platform has its own distinct ecosystems, but different projects built on the same technology stack are not automatically interoperable due to the physical separation of networks. This isolation negatively impacts the ability to atomically settle transactions – one of the primary benefits of tokenization.

Indeed, it’s worth noting that some of these platforms only settle the trade leg onchain but not the cash leg. That is, the cash moves through traditional bank rails (and thus still relies on separate cross-bank solutions), so the process of real-time settlement is incomplete. Furthermore, multiple platforms can fragment liquidity across chains akin to the problem created when different public blockchain networks are utilized.

A tremendous amount of work is being done for cross-chain interoperability technologies as discussed in our recent report on bridges, and many of these private blockchain providers are focusing on interoperability initiatives within their own ecosystems. However, enabling interoperability across chains, particularly permissioned chains, is not only a technological problem, but also a legal and business one. Thus, we view interoperability and liquidity as key challenges that will persist in the short to medium term as platforms consolidate and the space continues to gain legal clarity.

Conclusions: What Lies Ahead

We expect institutional interest in tokenization to persist into the next crypto market cycle as the benefits (capital efficiency, faster settlement, increased liquidity, reduced transaction costs, improved risk management) in a high interest rate environment are clear. That said, what’s changed is the focus on which underlying assets are being tokenized, as traditional financial players are focusing on US Treasuries, money market funds and repos.

How this will be implemented matters. Our view is that the next one to two years will be a period of platform consolidation around three axes: (1) financial verticals, (2) jurisdictional boundaries and (3) technology stacks. Consolidation and interoperability also remain top of mind as tokenizing a security on one chain and a payment currency on another greatly increases complexity and risk while exacerbating settlement times and reducing transparency. Without consolidation, the tokenization space will continue to face challenges in liquidity fragmentation and investor onboarding, particularly in the secondary markets.

However, traditional firms are typically slower to pivot and many have already committed to building out their own tokenization platforms. Thus, in our view it is far too early to select potential winners, although we believe that the adoption flywheel will be largely driven by an early network effect and the ability to deftly maneuver through a changing legal and technological landscape.

Ultimately, we view interest in tokenization as a reflection of an industry shift from focusing on pure decentralization to a practical combination of centralized entities and semi-decentralized networks that can onboard additional users. As more jurisdictions develop legal frameworks for tokenization, we anticipate a gradual shift towards unlocking tokenized liquidity in the longer term through consolidation and interoperability.