Guide to Polygon

September 13, 2022

Polygon has a portfolio of solutions ranging from commit-chains to zk-rollups. It aims to become a multi-approach, one-stop solution for all Ethereum scaling needs. This protocol guide only focuses on the Polygon PoS chain.

By Viktor Bunin, Protocol Specialist

Introduction to the Polygon PoS chain

Polygon Proof of Stake (PoS) chain is an EVM-compatible “commit-chain,” meaning Polygon “commits” the merkle root of all blocks produced onto Ethereum. Polygon PoS offers high throughput, determined by the gas limit (which is currently 30m per block or up to 700 tps). It also offers low transaction fees, providing users more affordable access to decentralized apps, while maintaining high standards of security. Being a commit-chain, Polygon PoS boasts a unique architecture that enables it to inherit some aspects of Ethereum’s security.

Polygon PoS is run by a decentralized network of proof of stake validators, and its EVM-compatibility allows developers to redeploy their Ethereum apps on Polygon with minimal code changes. Owing to its affordability, scalability, security guarantees, and alignment with Ethereum community’s values, Polygon PoS has gained exponential adoption in the past couple of years among millions of users and a number of non-crypto native companies.

How Polygon PoS chain works

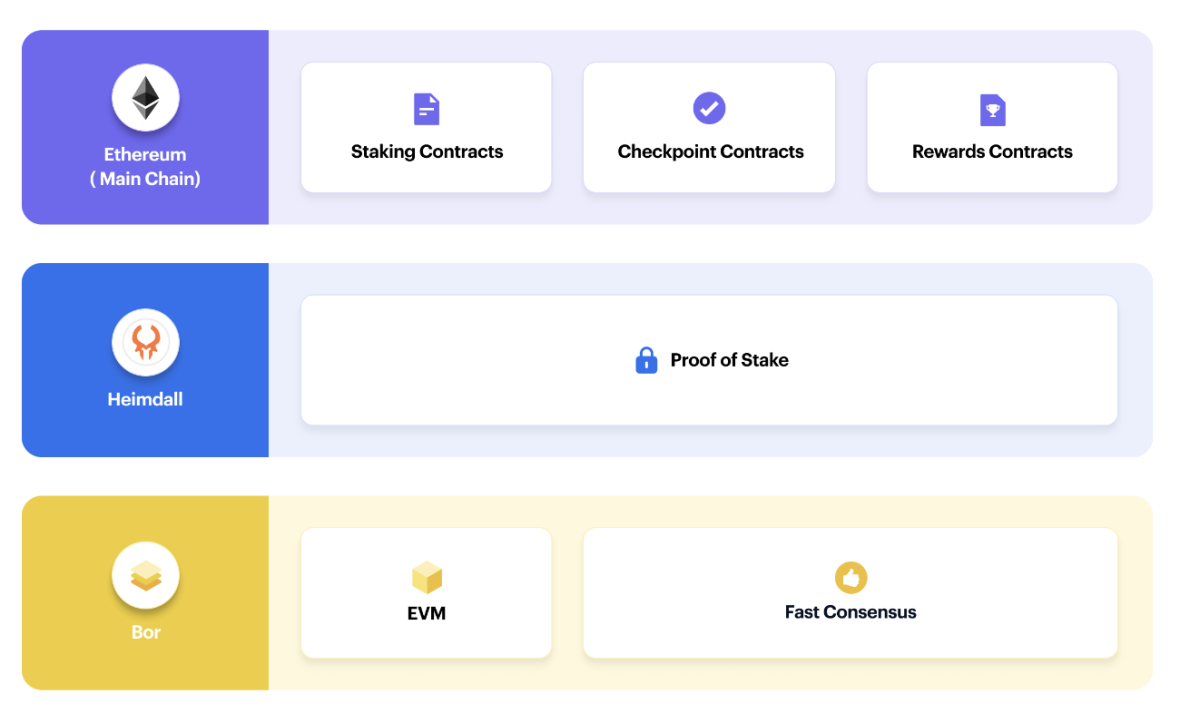

Polygon PoS utilizes an elaborate architecture that works in sync to achieve high throughput with minimal fees. Polygon staking contracts are deployed on the Ethereum blockchain, but the Polygon PoS chain’s architecture consists of two chains (Heimdall and BOR) that work in tandem to enable fast transactions and low fees:

Heimdall: the PoS chain that consists of the active set of validators. Heimdall selects the block producer committee (e.g. validators that are selected to produce blocks on BOR), and acts as the coordination layer between the staking contracts on Ethereum and the validators on Polygon. Heimdall relays inputs from Ethereum to facilitate the block producer selection process on BOR, and relays information about the set of active Polygon validators from the staking smart contracts on Ethereum to Polygon PoS. Heimdall also regularly uploads the checkpoints (the merkle root of all blocks produced on Polygon PoS) on Ethereum, enabling anyone on the Ethereum network to query and check for correctness.

BOR: The EVM-compatible chain that produces blocks on Polygon. BOR is a geth implementation with some customizations. Consensus on BOR is inspired by the clique PoA (Proof of Authority) consensus and enables BOR to achieve high block speed with fast consensus. Since BOR is EVM-compatible, developers can seamlessly re-deploy Ethereum based decentralized applications on Polygon PoS with minimal code changes.

Source: PolygonWiki

Polygon’s PoS chain is inherently tied to Ethereum in the following ways.

Polygon staking & rewards contracts are deployed on Ethereum: The staking smart-contracts of Polygon are deployed on Ethereum and are updated with information about the block producers on the network, allowing anyone on Ethereum to query them and check for the correctness of the block production process. Unlike a typical EVM-compatible sidechain, Polygon relies on inputs from Ethereum to operate.

Checkpointing: Polygon PoS periodically compiles the merkle root of all transactions on the chain and submits it on Ethereum. This process is called checkpointing, and the submitted merkle root is called a checkpoint. Transactions on Polygon are said to achieve finality once the checkpoint containing the transactions is submitted on Ethereum and added to an Ethereum block. Since Polygon “commits” the checkpoint to Ethereum, it is known as a commit-chain.

How delegation works on the Polygon PoS chain

The native token of Polygon is MATIC which is an ERC-20 token on Ethereum. MATIC is used to pay for the transaction fees on the Polygon network and to stake and secure the chain. Since the staking contracts of Polygon are deployed on Ethereum, users can use their MATIC directly on mainnet to delegate their stake. There is no minimum delegation and a user with just 1 MATIC can delegate their stake to help secure the network. However, since the staking contracts are on Ethereum, a user who wants to delegate must have some ETH balance to fund the gas on Ethereum to delegate their MATIC.

The active set on Polygon is made up of 100 validators with voting power determined by the amount of MATIC staked, either self-bonded or via delegation. Active validators are eligible to complete work on the chain and earn rewards. Since the active set on Polygon is limited to 100, delegation is important for democratizing participation in Polygon PoS. MATIC holders can support Polygon PoS validation by delegating their stake to existing validators for a validator commission fee.

Fees range from 0-100% of total rewards earned by the delegator, depending on the validator’s goals and capacity. Notably, token holders can delegate non-custodially and directly claim their rewards from the Polygon official dashboard. Once a user delegates their MATIC, withdrawal from delegation is subject to an unbonding period of 3-4 days during which the delegators won't earn rewards.

Here is our step-by-step guide to delegating MATIC tokens.

Rewards on the Polygon PoS chain

Polygon has allocated 12% of its total 10 billion token supply (~1.2 billion MATIC) to reward validators and delegators via inflation. Inflationary rewards will be distributed within the first five years of the network and post that, the network aims to be sustained through transaction fees alone.

Hence, there are two components to rewards on Polygon POS:

1. Inflationary rewards: Proportionally distributed to all the validators in the pool based on the amount of MATIC staked. Rewards are paid out after every checkpoint (roughly 34 minutes) as outlined in the table below.

*The timing of the payout and the economics of the protocol are set by the protocol, and subject to change.

A checkpoint proposer bonus is awarded to the validator that is selected to submit the checkpoint on Ethereum (~10% of the fixed inflationary rewards allocated for each checkpoint interval) and the remaining inflationary rewards (~90%) are distributed amongst all validators based on their stake weight after each checkpoint.

2. Transaction fees: Each block producer on Bor is given a certain percentage of the transaction fees collected in each block. Polygon’s transaction fees are structured similarly to Ethereum’s and recently Polygon implemented its own version of the EIP-1559. (Meaning only “priority” fees are a part of the rewards pool, and the base transaction fee is burnt/removed from the supply).

This rewards calculator is a useful tool for estimating annual rewards, and can be adjusted according to the total staking rate of the network.

Key network stats

As of time of publication (September 2022), typical Polygon transactions cost less than 200 Gwei in gas fees – less than $0.01 according to PolygonScan. Currently, a typical transaction on the main Ethereum network costs around $2.00 per transaction (and was often much higher this past year), a challenge that has compelled the growth of alternative scaling solutions such as Polygon PoS.

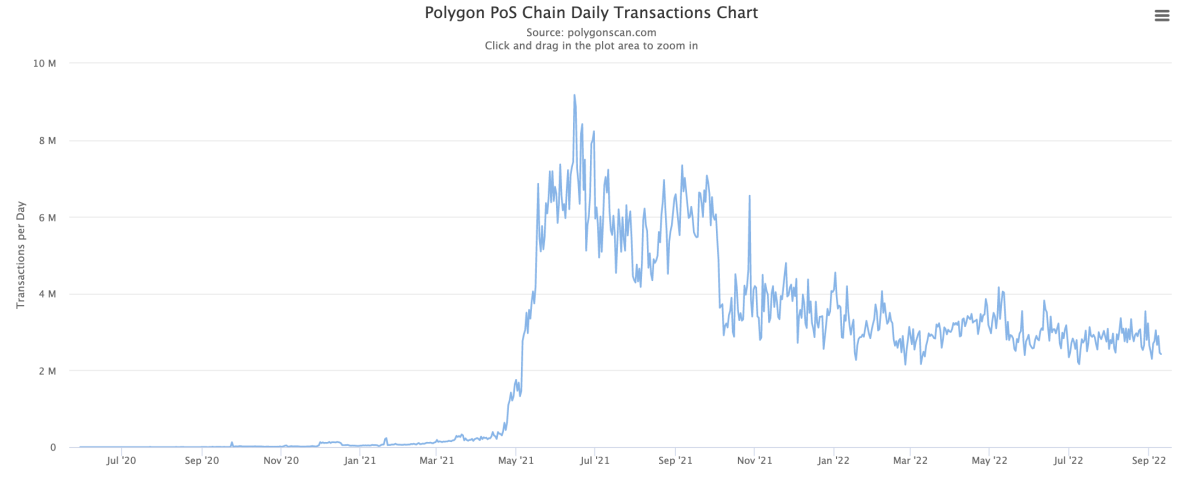

Today, Polygon typically processes around three million transactions per day – compared to Ethereum’s main network which typically processes around 1.1 million transactions per day.

Source: PolygonScan

Over the course of 2021, the number of unique addresses that have used Polygon surged above 120 million – surpassing 150 million today.

Source: PolygonScan

Slashing on Polygon

As of July 2022, there is no slashing on the Polygon network. However the network plans to impose slashing for double signing with the V3.0 upgrade.

Why stake with Coinbase Cloud

Coinbase Cloud is highly experienced with EVM, the Tendermint ecosystem, and high throughput chains, a perfect mix for supporting the Polygon PoS chain.

Delegating to our community validator is non-custodial and requires no engineering resources.

Coinbase Cloud is a subsidiary of Coinbase – a public company that upholds high standards for our products’ quality, reliability, and security.

Visit our step-by-step guide to delegate your MATIC to our non-custodial public validator

Contact us to learn more about staking MATIC with Coinbase Cloud

Special thanks to Amogh Gupta for writing the majority of this article while serving as a Protocol Specialist on our team.

This document and the information contained herein is not a recommendation or endorsement of any digital asset, protocol, network, or project. However, Coinbase may have, or may in the future have, a significant financial interest in, and may receive compensation for services related to one or more of the digital assets, protocols, networks, entities, projects, and/or ventures discussed herein. The risk of loss in cryptocurrency, including staking, can be substantial and nothing herein is intended to be a guarantee against the possibility of loss.This document and the content contained herein are based on information which is believed to be reliable and has been obtained from sources believed to be reliable, but Coinbase makes no representation or warranty, express, or implied, as to the fairness, accuracy, adequacy, reasonableness, or completeness of such information, and, without limiting the foregoing or anything else in this disclaimer, all information provided herein is subject to modification by the underlying protocol network. Any use of Coinbase’s services may be contingent on completion of Coinbase’s onboarding process and is Coinbase’s sole discretion, including entrance into applicable legal documentation and will be, at all times, subject to and governed by Coinbase’s policies, including without limitation, its terms of service and privacy policy, as may be amended from time to time.