This week in Bitcoin price: Dec 7-14

After hitting its all-time high last week, Bitcoin has struggled to crack $20,000 — even as banks and insurance giants around the world race to invest, provide storage solutions, and build trading infrastructure. What can we expect in the weeks to come? Get the intel you need in our weekly dispatch from Coinbase researchers.

Published on December 14th, 2020

The big picture

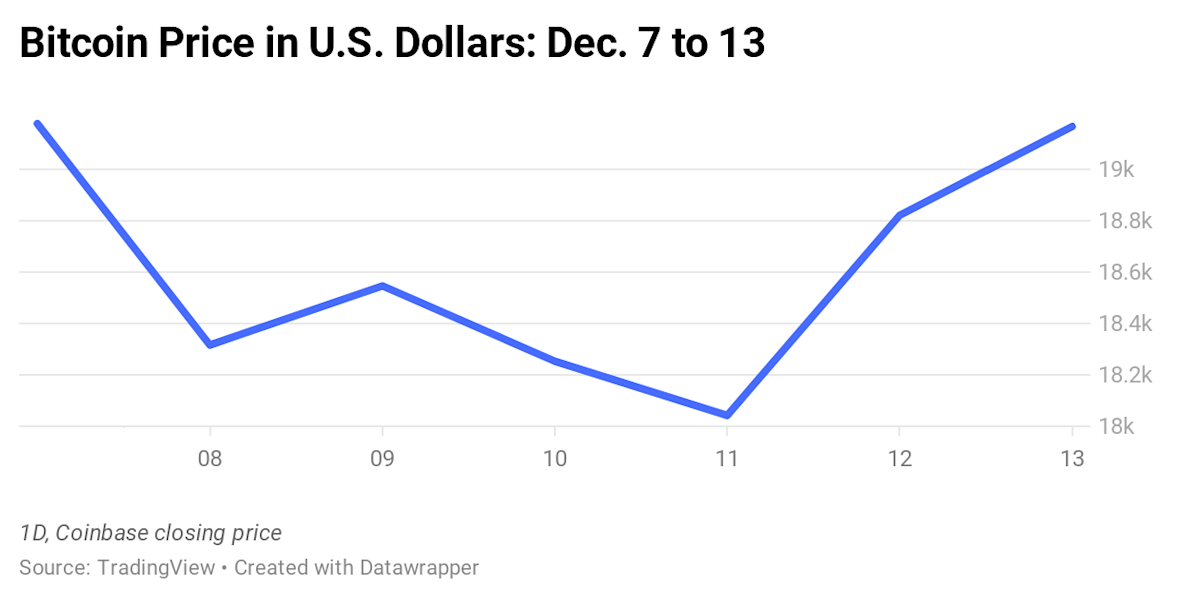

After reaching all-time highs last week (peaking at $19,300 on December 7th) and despite continued upbeat headlines, Bitcoin’s price has struggled to break $20,000. There are many theories for why prices have remained shy of that mark for the last few weeks, but our institutional desk reports clients expressing concern about incoming government regulations and suggests that could be a factor. But even though prices have slowed, regulatory uncertainty doesn't seem to be hindering the great race toward crypto banking — as major financial institutions around the world move to provide storage solutions, trading support, or add Bitcoin to their portfolio. So is this a temporary trend or are traditional financial giants genuinely committed to crypto’s future?

Key points

Finance-industry giants from Chicago and London to Singapore and beyond, are leaning further into Bitcoin. These moves are keeping with the year’s major trend of institutional investors making ever bigger moves into cryptocurrency. This week, for instance, Mass Mutual, one of the oldest insurance companies in the world, announced a $100 million Bitcoin purchase. (Worth noting that while $100 million is significant, especially for the typically cautious insurance industry, it represents just .04% of Mass Mutual’s general investment account.)

Bitcoin banking infrastructure is now being built in financial capitals around the world. London-based investment bank Standard Chartered (which has billions of dollars of assets under management) partnered with Chicago-based Northern Trust ($1 trillion under management) to launch an institutional-grade cryptocurrency-storage platform.

Singapore-based DBS, a private-banking giant with $184 billion in assets under management (as of the end of June), is gearing up to enable Bitcoin trading for institutional investors and wealthy individual clients as early as next week.

In news out of mainland Europe, Julius Baer Group Ltd., a Zurich-based private bank, is partnering with startup SEBA Crypto AG to provide wealthy clients with digital asset solutions and plans to extend the bank’s service into “storage, transaction, and investments in such assets.” And BBVA, the second-largest bank in Spain, with about $840 billion in assets, is poised to enable trading and custody of bitcoin.

Despite this raft of positive global development, regulatory uncertainty in the U.S. is potentially dragging the trend toward record highs — and, some fear, will make it harder for stateside firms to compete globally. Following Treasury Secretary Steven Mnuchin’s recent comments suggesting new crypto regulations are on the way, several Congressional representatives sent a letter urging the U.S. Treasury to rethink “burdensome regulations on digital self-hosted [Bitcoin] wallets.”

Addressing rumors about what the new regulations might look like, Brian Brooks — former Coinbase CLO and current Acting Comptroller of the Currency for the U.S. — said to expect “clarity” in coming weeks. He added, “I think you’re going to see a lot of good news for crypto before the end of the term.”

Debate around regulations mostly follows two paths: Arguments for reduced regulation tend to focus on the potential for new rules to hamper U.S. traders’ and firms’ ability to compete as global innovation heats up in the digital currency space. Brooks, representing the other side of the debate, notes that well-crafted rules can create clarity — and that clarity will accelerate adoption by major financial players.

According to the research desk, one other factor that likely slowed the growth of prices this week was profit-taking by large holders of Bitcoin. This is something they had expected to see in previous weeks as prices heated up, but with the year’s end approaching and the market seeming to slow, they weren’t surprised to see clients locking in gains.

Blockchain trends and analysis

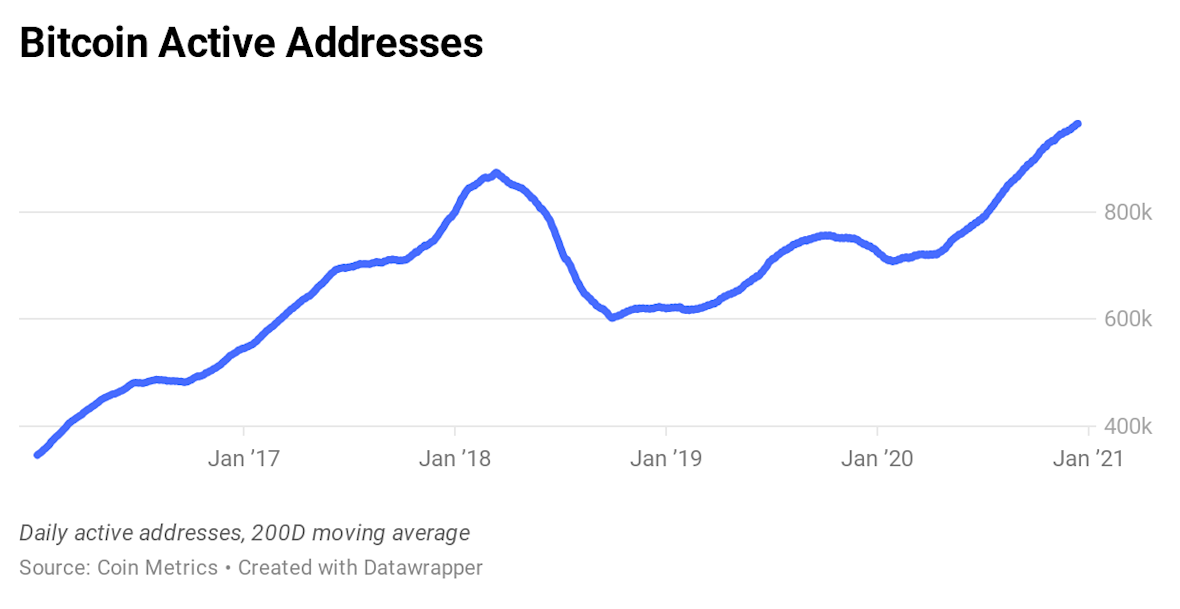

While Bitcoin prices might not have spiked again this week, activity on the Bitcoin network keeps growing. According to market data firm Coin Metrics (a Coinbase Ventures portfolio company), the moving average number of active addresses on the Bitcoin network is far surpassing all-time highs. Activity has been increasing at a steady pace, nearing an average of a million active addresses per day — a number that significantly exceeds the peak of the 2017 bull run.

Want to read more?

Here are a few of the week’s crypto headlines Coinbase analysts recommend: