Market View

Bitcoin outperforms. Bitcoin has been outperforming its digital asset peers since mid February, but the move accelerated in early March, coinciding with the onset of the US banking system turmoil. In fact, its dominance as a percent of the total crypto market cap has surged from 43.9% at the end of February to 47.7% at the end of March. Part of the reason is that the stress in the banking system reinforced bitcoin’s “store-of-value” properties. That is, because bitcoin largely exists outside of the traditional financial system, it offers a hedge against current conditions. In fact, bitcoin’s correlation to US stock returns (proxied by the S&P 500) has fallen from a peak of 70% in May 2022 to 25% as of March 30 (i.e. relatively uncorrelated). However, we also believe bitcoin’s relative outperformance among peers reflects investor concerns regarding the regulatory status of non-bitcoin cryptocurrencies as well as thinner liquidity specific to some BTC vs stablecoin pairs. The latter has most recently been precipitated by Binance’s termination of its bitcoin zero-fee trading program on March 22.

Chart 1. Correlation between bitcoin and S&P 500 returns has fallen sharply

Macro. There’s no shortage of economic data coming up despite a shortened week (NYSE holiday on April 7). Most market participants will likely evaluate business conditions via the US ISM manufacturing data, before scrutinizing the US unemployment report for March at the end of the week. Economists surveyed by Bloomberg anticipate a median rise of 240k in US nonfarm payrolls following the end of the teachers’ union strike in Los Angeles in late March. Meanwhile, financial conditions in the US have tightened considerably as flows into money market funds accelerated after the onset of the US banking turmoil, bringing total net assets above US$5.1T.

Markets. April tends to be associated with positive seasonality for risk assets, partly bolstered by more cash being deployed from tax refunds in the US and Canada, among other places. The US dollar also tends to weaken during this month, which can benefit crypto assets. But seasonal trends are not always reliable. Last year, the S&P 500 weakened 8.8% in April as global growth concerns mounted, the Federal Reserve approached a critical policy decision on May 4, 2022, and quantitative tightening appeared imminent. Those same factors led to multilateral USD appreciation over the same period. However, we’re more sanguine about the current environment. The Fed is getting closer to the end of its hiking cycle, which should help long duration assets (even if cuts aren’t imminent). Meanwhile, on the crypto side, we believe Ethereum’s upcoming Shanghai (Shapella) Fork on April 12 will be an important event that could unlock longer-term value for users.

Web3

As discussed in our weekly commentary from early February, the Ordinals protocol allows individual satoshis to be inscribed with data, effectively repurposing them as NFTs (or “digital artifacts”) that can be transferred and stored on the Bitcoin blockchain. At that time, we noted that in order for the Ordinals protocol to gain meaningful traction, the infrastructure to support the trading/display of inscriptions would need to improve. Fast forward less than two months to today (March 31) and the trading environment for inscriptions has quickly matured from a predominantly over-the-counter (OTC) market facilitated through Discord channels to a multi-venue market leveraging Bitcoin-native functionality to facilitate the trustless trading of inscriptions.

Several of these marketplaces (including ordinals.market, Ordswap, Ordinals Wallet, OpenOrdex, and Gamma) have adopted a specific standard of the Bitcoin protocol called a Partially Signed Bitcoin Transaction (PSBT) to provide a trustless method for trading inscriptions. PSBTs are typically used to facilitate complex types of Bitcoin transactions (such as multisignature and CoinJoin transactions) as they can include metadata that allows multiple signers to more easily coordinate and determine specific conditions for a given transaction to be fully signed. In the realm of Ordinals and inscriptions, this functionality allows sellers in a marketplace to create listings via PSBTs that can be trustlessly purchased (fully signed) by a previously unknown buyer.

Notably, the popularity of Ordinals continues to attract mindshare from the broader NFT community. On March 21, the multi-chain NFT marketplace Magic Eden announced support for Bitcoin inscriptions on the platform via PSBTs. Importantly, the team at Magic Eden have also open-sourced their library of APIs designed specifically for enabling marketplace functionality via PSBTs. Since the launch on March 21, the aggregate trading volume for inscriptions on Magic Eden has totaled ~US$1.8M (through March 30), representing market share of ~42% over the period (per Dune Analytics). In light of this ongoing maturation of the infrastructure supporting Bitcoin inscriptions, we continue to believe that incremental sources of demand for blockspace – such as arbitrary inscription data – represent positive competitive forces that ultimately increase fees paid to miners, further incentivizing them to secure the network.

Crypto & Traditional Overview

(as of 4pm EST, March 30)

Asset | Price | Mkt Cap | 24 hour change | 7 day change | BTC correlation |

|---|

BTC | $27,985 | $542B | -1.55% | -1.51% | 100% |

GBTC | $15.82 | $10.95B | -0.2% | -1.2% | 72% |

ETH | $1,781 | $215B | -1.6% | -2.2% | 89% |

Gold (Spot) | $1,982 | - | +0.9% | +2.2% | 27% |

S&P 500 | 4,048 | - | +0.51% | +1.2% | 15% |

USDT | $1 | $79.4B | - | - | - |

USDC | $1 | $33.2B | - | - | - |

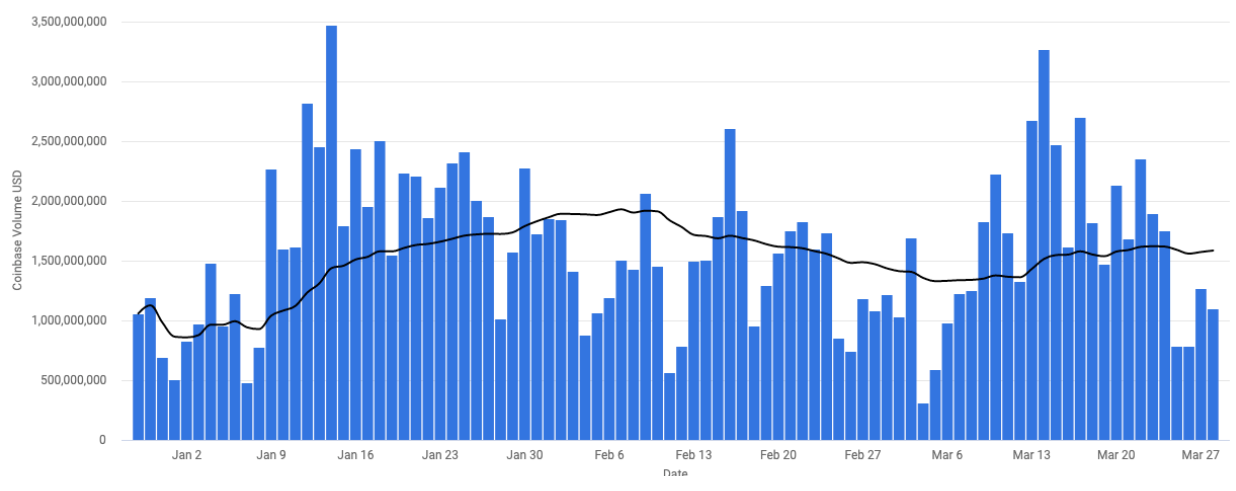

Coinbase Exchange & CES Insights

Volumes on Exchange have come back down compared to the week before though the trend in asset preference remains similar – with more focus on the large cap names and the stables. BTC dominance rose even further this week as the recent regulatory headlines with the SEC and CFTC highlighted the uncertainty that still surrounds ETH and other alts.

On the trading desk, traditional and crypto native hedge funds continue to be net buyers of BTC and ETH, while high net worth individuals (HNWIs) and family offices took profit in the large caps.

View From Around the World

Europe

According to Coindesk, “lawmakers on two key committees in the European Parliament have voted in favor of imposing limits on payments by unverified crypto users” of EUR 1,000. This is part of a set of measures to “forbid businesses from accepting large cash payments and create a new European Union Anti-Money Laundering Agency, AMLA.” The cap will not apply “if a regulated wallet provider is involved or the identity of the payer is known.” (Coindesk)

The EU’s Council has proposed a legislation requiring smart contracts to contain a “kill switch under a revision of the European Union’s Data Act,” according to Coindesk This will allow activity on smart contracts to be interrupted or terminated. A few lawmakers have objected to this legislation, citing difficulty in setting standards for smart contracts. (Coindesk)