Customers like Gaby are sending funds back home in a faster, easier, and more cost-effective way

Senders

Get the most of the crypto you sendZero fees to send

Sending crypto from one Coinbase account to another is always fee-free

More options

Send 100+ cryptocurrencies supported by Coinbase

Receivers

Get reliable, speedy transfersZero fees to receive

Receiving crypto from another Coinbase account is always fee-free, and now you can cash out for free too.²

Instantly available

Crypto will arrive in your Coinbase account almost as soon as your sender taps “Send”

More options

You can cash out in your local currency or hold the crypto in your Coinbase account as any of the 100+ cryptocurrencies that Coinbase supports

Currently available in Mexico, with more countries coming soon

How to send

Send in seconds from the Coinbase app or websiteSelect a crypto and an amount

Tap Send from the “Pay” tab of your app or browser, then select any amount from your existing crypto balances

Choose a recipient

Enter your recipient’s email or phone number. They’ll need to have a Coinbase account, or we’ll help them sign up when they receive their crypto.

Send your crypto with zero fees

Sending crypto around the world is fee-free.

How to receive

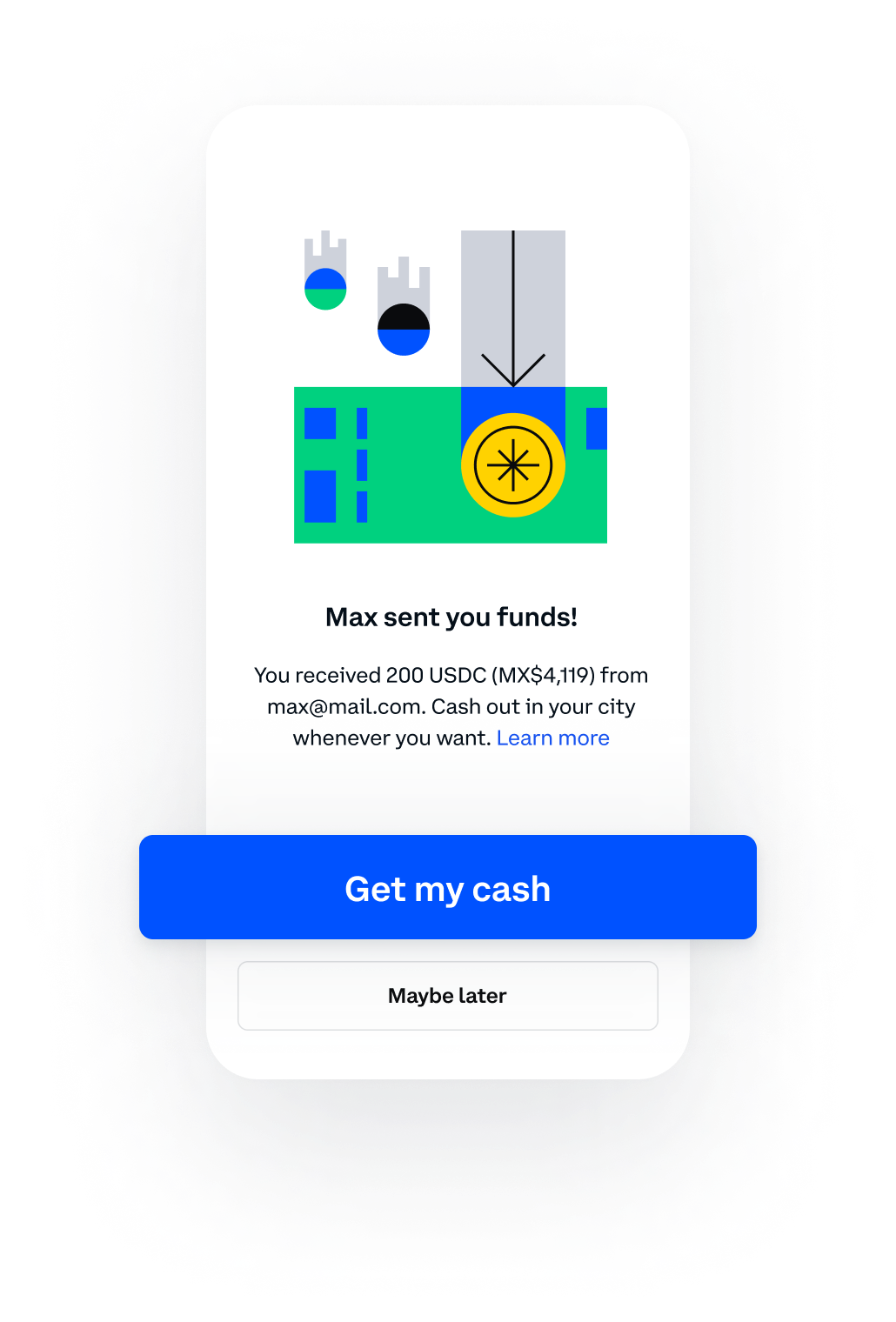

Access your funds instantlyGet an instant alert

You’ll get a notification when your crypto reaches your Coinbase account. Your funds are yours to hold, trade, or cash out.

Choose to cash out in your local currency

Tap Get my cash and select from over 30K+ locations to pick up your cash. Once you select a location, you’ll receive a tracker number that can be presented in person to cash out. You can cash out some or all of your money.

Or, choose to save or invest

You can also securely store your crypto in your Coinbase account, where you can protect or grow its value. You can choose to hold stablecoins pegged to the US dollar — like DAI or USDC — to protect against devaluation of local currency.