Disclaimer: This blog references data from the Institutional Allocator survey conducted from Jan to April 2022.

As our dialogue with institutional allocators continues to grow we would like to share insights as to why they are considering investing in the digital asset class.

Asset allocators broadly represent the world's pensions, sovereign wealth funds, foundations, endowments, and family offices. They play a vital role in maintaining healthy and well-functioning markets. Their assets make up a significant portion of the $150 trillion in investable assets globally, and they are focused on investing for long-term outcomes making them a fundamental bedrock of the global financial system. Asset allocators invest across all asset classes, facilitating efficient and liquid capital markets and improving price discovery. To keep their assets safe, they demand accountability and push the investment management industry towards a stricter fiduciary mindset. In fact, the fundamental purpose of their asset pools is to grow into perpetuity to provide better outcomes for hundreds of millions of beneficiaries. So what role do digital assets play?

At Coinbase, we take pride in our mission, which is to increase economic freedom around the world through open systems. The investable technology underpinning the cryptoeconomy is catalyzing innovation and creating entirely new investable markets. We hear often that this technology is speeding up disintermediation of rent-seeking intermediaries but don’t spend enough time on why. The cryptoeconomy inherits the technical, operational and organizational properties of its blockchain and smart contract infrastructure (i.e., programmable, cryptographically secured, decentralized governance) which allow these networks to be secure, global, peer-to-peer, permissionless, open sourced and borderless. Building an economy on top of this infrastructure allows for near instant and global scalability which leads to improved access for billions of people around the world and the creation of an entirely new asset class for institutions. This is important to allocators today, who have put sustainability and stakeholder capitalism at the top of their list in evaluating investment opportunities and their impact on social change. We believe the cryptoeconomy has opened a completely new design space for investment, transparency and importantly governance, and will ultimately contribute to more healthy and inclusive economic growth. So for us, understanding the needs of allocators and ensuring they are able to participate in this new economy in a safe and trusted way is paramount. For Coinbase, allocators are essential partners in achieving our mission.

Digital assets are firmly in the alternative investment category for allocators, which is generally a catch-all for assets that are very different and less liquid than public equities and fixed income exposure. Of the approximately $150 trillion in investable assets, roughly $18 trillion of this represents alternative investments, made up of predominantly private equity, venture capital, infrastructure, real estate and hedge funds. Investment returns matter and allocators continue to depend more on alternative assets to grow faster than their liabilities and inflation. In the CAIA Association portfolio of the future it is suggested that the traditional 60/40 model of investing is firmly an idea of the past as we enter a completely new era. The response to 2020 resulted in a massive shift in global central planning policy following a 40-year cycle of consistently declining interest rates and falling inflation. Over the last decade, the allocator’s portfolio suffered from ever decreasing bond yields and anemic equity volatility, suppressing returns while their beneficiaries lived longer lives. This deepens the gap between assets and liabilities and forces portfolios to look for higher sources of uncorrelated alpha within the alternatives asset class. Allocators today hold anywhere from 10% to 50% of their assets in alternatives, with the higher percentages being championed as “the Yale model.” According to the Thinking Ahead Institute report of the top 300 global pension funds, the weighted average US defined benefit pension now holds as much as a 37% allocation to alternatives today. This did not happen overnight.

For institutional allocators, investing in emerging categories is not a new concept. Just as one does not turn battleships on a dime, neither do trillions of dollars flow into new assets until they are ready.Over the long term, the capital markets continue to push capital towards new and innovative areas where it can achieve a commensurate return. In the very recent history, high yield bonds, emerging markets, private equity and venture capital were once frontier asset classes. Each of these categories now hold a comfortable perch in most asset allocator's investment policy guidelines. Notably, alternative investments, namely private equity and venture capital, hold the crown for consistently generating the highest annual risk-adjusted returns over the last two decades. Private credit emerged from the ashes of the 2008 global financial crisis and has now crossed $1 trillion in market cap, establishing it as a darling investment during the last decade. Each of these categories took time to develop, mature, and proliferate as they made their way into the allocators’ portfolio. History rhymes and we see digital assets have already begun a similar journey. As we write this, the liquid crypto market has been growing for a decade and is valued at more than $1 trillion, largely dominated by bitcoin and ether (the tokens representing the Bitcoin and Ethereum networks).

While there is still tremendous ground to cover with understanding the role of digital assets in the portfolio, multiple studies are evaluating the potential for improved returns per unit of risk over longer periods from adding a small allocation of BTC or ETH. Additionally, in the May 2022 Global Investment Strategy outlook released by J.P. Morgan, digital assets were elevated as the preferred alternative asset class alongside hedge funds for the year, displacing other alternatives strategies. Recent data from a survey among hedge fund managers confirm the same findings: compared to other asset classes, digital assets are expected to offer the greatest potential for generating alpha. The nature of how an allocator invests in the cryptoeconomy is changing rapidly as the platform layer (blockchains) and protocol layer (applications) are investable through closed and open end fund structures across early stage venture, liquid venture, liquid hedge fund strategies, hybrid funds, and even directly holding liquid tokens via an index strategy. Increasingly, allocators are seeing many of largest and most sophisticated hedge funds add crypto to their existing strategies as yet another alpha source, with one survey showing hedge funds expect as much as 10% of their strategy to include crypto. Further development around derivatives such as futures and options are beginning to emerge as well, which will give access to this asset class through familiar product types and channels. The world’s largest asset managers see the opportunity, and we are at the beginning of a renaissance in new fund launches and strategic partnerships. As the ecosystem evolves, allocators should not be surprised to see the emergence of crypto-native asset management services and products driven solely through smart contracts on-chain. There’s a long road ahead for this asset class to grow and mature, but one thing is clear, allocators are paying attention.

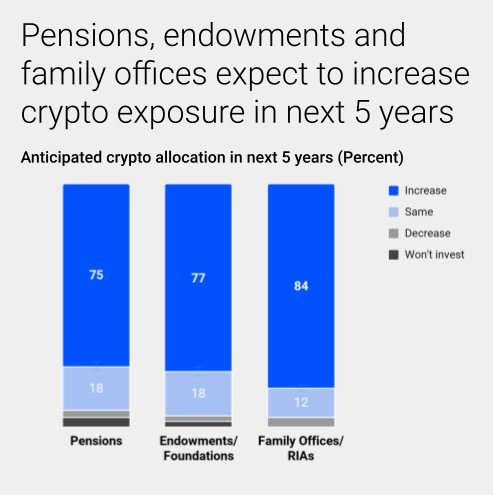

To get a clearer look into the future, we conducted a survey among 300 institutional allocators spanning across pensions, foundations & endowments, and family offices who are invested in crypto already, are conducting due diligence and are planning to invest in the next 12 months. While the survey was completed in April 2022, the results provide a good perspective on the allocator mindset through the recent bouts of volatility.

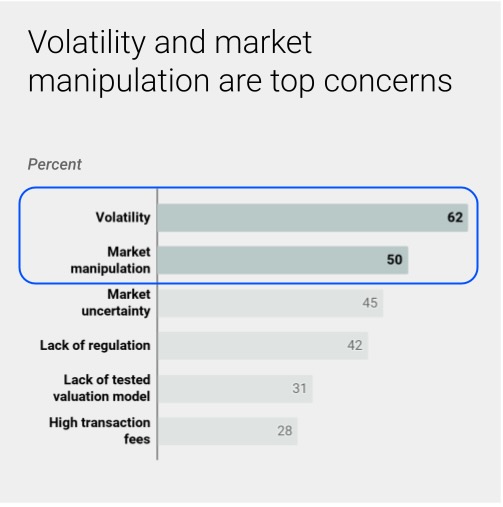

1. Over the long term, institutional allocators expect to add exposure. Our survey results showed that more than 70% of respondents expect crypto to become mainstream and account for a larger share of portfolio allocation within the next five years. Additionally, 68% of respondents agree that crypto will play a role in diversifying portfolio risk, while at the same time 62% view the top concerns are around asset volatility and other externalities.

The survey data covered pensions, foundations & endowments, and family offices and we see a consistent level of interest in adding crypto exposure across each category.

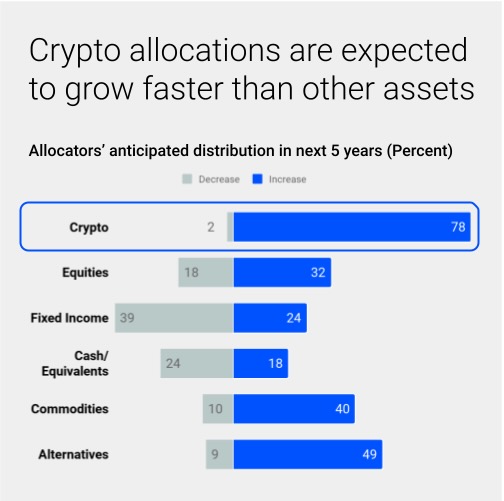

Breaking the data down by specific asset classes, we see that allocators expect to reduce fixed income and cash in favor of alternatives. Crypto (which as we stated earlier is considered an alternative investment) received the biggest nod in terms of increasing exposure over the long term. A handful of endowments and family offices that have been investing in crypto since the early days of 2018 and prior have now amassed a sizable crypto exposure in their venture and direct holdings. However, the vast majority of allocators expect crypto to be less than 1% of their overall plan assets in the long term, so the data here is not adjusted for the size of the allocation.

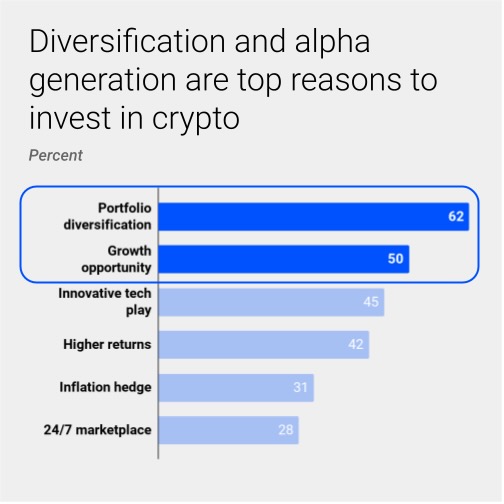

2. Institutional allocators understand the risk and opportunity that comes with investing in the cryptoeconomy.

When we asked for reasons for investing in the cryptoeconomy, portfolio diversification (67%) was the number one mention. This was closely followed by the opportunity for growth (64%) and innovative technology play (52%). However, allocators understand this new asset class is not without its fair share of risks. Our survey showed that 62% of allocators were concerned with the volatility of the assets, with fewer allocators citing potential market manipulation and lack of regulation as a concern.

3. Institutional allocators acknowledge that crypto is here to stay.

We also learned from the 2022 Institutional Allocator survey that:

- 75% of institutional allocators expect digital assets to be a mainstream investment in the next five years

- 80% expect digital assets to be less volatile in the next 3 years with more widespread adoption and greater investor knowledge

- 67% see more regulatory clarity in the next 5 years

- 77% believe that crypto promotes economic freedom

We do not expect a break in this trend. We continue to see strong interest among allocators. Lauren Abendshein, Head of US Institutional Sales at Coinbase echoes this observation: “The last few months have validated the status of cryptocurrencies as risk assets that can play a role in any investment portfolio. Most importantly they present a long-term investment opportunity.”

Allocators as vital partners in driving industry growth

For our part, we are also taking the long view and continue to focus on initiatives to help the industry grow. In the survey, a majority of allocators noted that education remains an opportunity and that it will be an important driver of growth. Volatility is the top barrier for investing in crypto and allocators point to the lack of investor knowledge as the main culprit. We continue to invest in education and thought leadership through our Coinbase Institutional Research and Insights Hub and will continue to develop thought leadership for the asset allocator community at large.

It’s a tremendous privilege and responsibility for Coinbase to be the gateway into the cryptoeconomy. We do not take this responsibility lightly and will put our clients’ interests first as we continue driving towards accomplishing our mission.