Introduction

In our February monthly outlook, we mentioned that liquidity (or more specifically, its contraction) would be one of the most pertinent issues for risk assets in general and digital assets in particular this year. But the analogue to that which we didn't discuss in that report was the issue of (over)leverage in the crypto ecosystem. More specifically, evidence of improper risk management has surfaced in recent weeks, compounding the effect of market volatility in this space.

Solvency concerns have forced an accumulation of realized losses, exposing vulnerabilities in other parts of the crypto ecosystem. For example, bitcoin miners in recent history have focused on leveraging their balance sheet to obtain more hashrate, but their lowered earnings expectations due to market stress has added to pressures on crypto lenders. While debt financing has seen significant growth recently, we think the speculative risks here are somewhat overblown.

Stablecoins have also been affected due to concerns surrounding some reserve holdings. For example, Tether provided a US$1.1B secured loan to centralized (CeFi) lender Celsius in October 2021, though this may no longer be on its balance sheet. We have seen the market cap of stablecoins decline by $12.6B over the last two months.

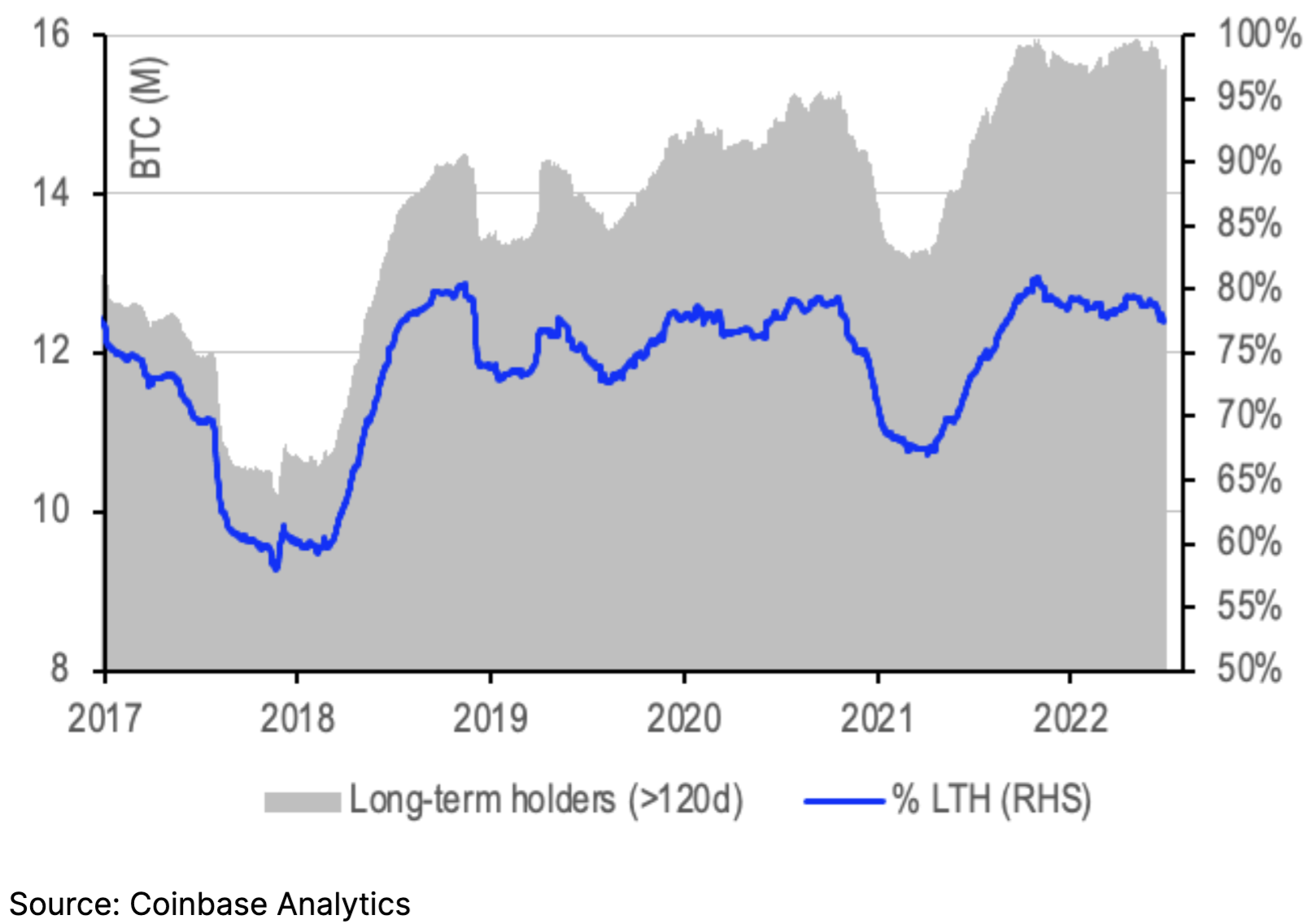

On the upside, onchain data suggests longer term bitcoin holders (those holding BTC for more than six months) are not selling into the market volatility, as they own a highly concentrated ~77% of total supply – down slightly from 80% to start the year but still quite high historically. We see this is a positive sentiment indicator as we believe these holders are less likely to sell BTC in turbulent periods.

Credit vs crypto risks

While many have traced the latest round of market volatility to the unraveling of CeFi crypto lender Celsius and hedge fund Three Arrows Capital (3AC), the vulnerabilities to the crypto ecosystem that led to these forced liquidations were apparent long before the events in June. Notably, the risks observed here are not crypto specific in nature, but rather credit specific.

That is, billions of dollars of risky credit backing DeFi protocols were financed by short-term funding. If you remove the DeFi component, the duration and liquidity mismatches involved here are actually reminiscent of previous crises experienced in the traditional finance world. In the case of Celsius, some of its money was locked up in Lido’s liquid staked derivative stETH (~445k) which can be traded on exchanges but can’t be redeemed for its underlying until some time after Ethereum’s Beacon Chain merges with the mainnet. That could be up to a year from now.

Compounding the problem, Celsius used its stETH to recursively borrow from decentralized lending platform AAVE, further adding to the buildup of its short term debt. That is, they utilized a credit based yield enhancement strategy, and while the margin maintenance requirements are higher in DeFi, the strategy itself is not particular to crypto. The mechanics of the trade make it difficult to unwind when price discrepancies start to appear and customers start to demand their deposits back. That said, Celsius’ problems date back further to losses stemming from the BadgerDAO hack ($120M in December 2021), the Stakehound private key incident ($71M in February 2022), and the Terra ecosystem collapse (May 2022).

Meanwhile, 3AC also offloaded its stETH position amid broader liquidations amounting to ~$400M according to CoinDesk. Reports suggest that 3AC borrowed from many crypto lending entities, fueling contagion risks for its counterparties and adversely affecting the supply of credit.

Volatility accelerant

Consequently, the business models of the centralized lending institutions involved here also contributed to increased market volatility for the asset class in a structural way.

Broadly speaking, many CeFi lenders have historically relied heavily on short term retail deposits on which they paid high yields. They often invested the funds in loans struck with other counterparties that paid higher interest rates, pocketing the difference. But those counterparties themselves had duration mismatches and heavy rehypothecation of assets in their books, lending to crypto hedge funds and other entities. Liquidity squeezes then forced margin calls or outright recalls on some of these loans.

Notably, one of the segments that these counterparties lend to are OTC (over-the-counter) trading desks. Those OTC desks tend to expand their balance sheets and facilitate trades by borrowing uncollateralized to try and maximize their capital efficiency. Such uncollateralized loans would be made on the basis of these OTC desks’ on-chain and off-chain credit data. Nevertheless, when these loans are repriced or recalled, the desks are forced to show their clients wider bid-ask spreads or smaller trade sizes.

In traditional finance, these OTC desk loans would be secured and the traders would be given a settlement cycle to post collateral and deal with the funding. However, in the crypto space, the OTC desks were forced to widen spreads in a disorderly way punishing those investors looking to exit positions and driving the volatility for digital assets higher.

Bitcoin miners stress lenders further

That volatility then led to cyclical adjustments in other areas. Falling bitcoin prices, tightening credit conditions and rising energy costs have changed the economics for bitcoin miners. Many transitioned from raising capital via equity in 2020 and 2021 to increasing their debt towards the end of last year. In part, that was due to the greater availability of debt financing options as more competition among crypto lenders enabled more risk taking.

Convertible notes accounted for the majority of positions in 4Q21, followed by secured loans, senior unsecured notes, and finally loans secured by bitcoin holdings or ASICs (mining equipment). Equipment backed loans became one of the newer forms of financing to emerge in late 2021/early 2022 and alone makes up ~$4B in borrowing, according to Bloomberg (citing Luxor Technologies). The concern is that this collateral could be at a higher risk of depreciation, which means miners could be forced to liquidate their bitcoin reserves to post additional margin. However, in a recent report published June 28, we discussed why we think that risk is somewhat exaggerated.

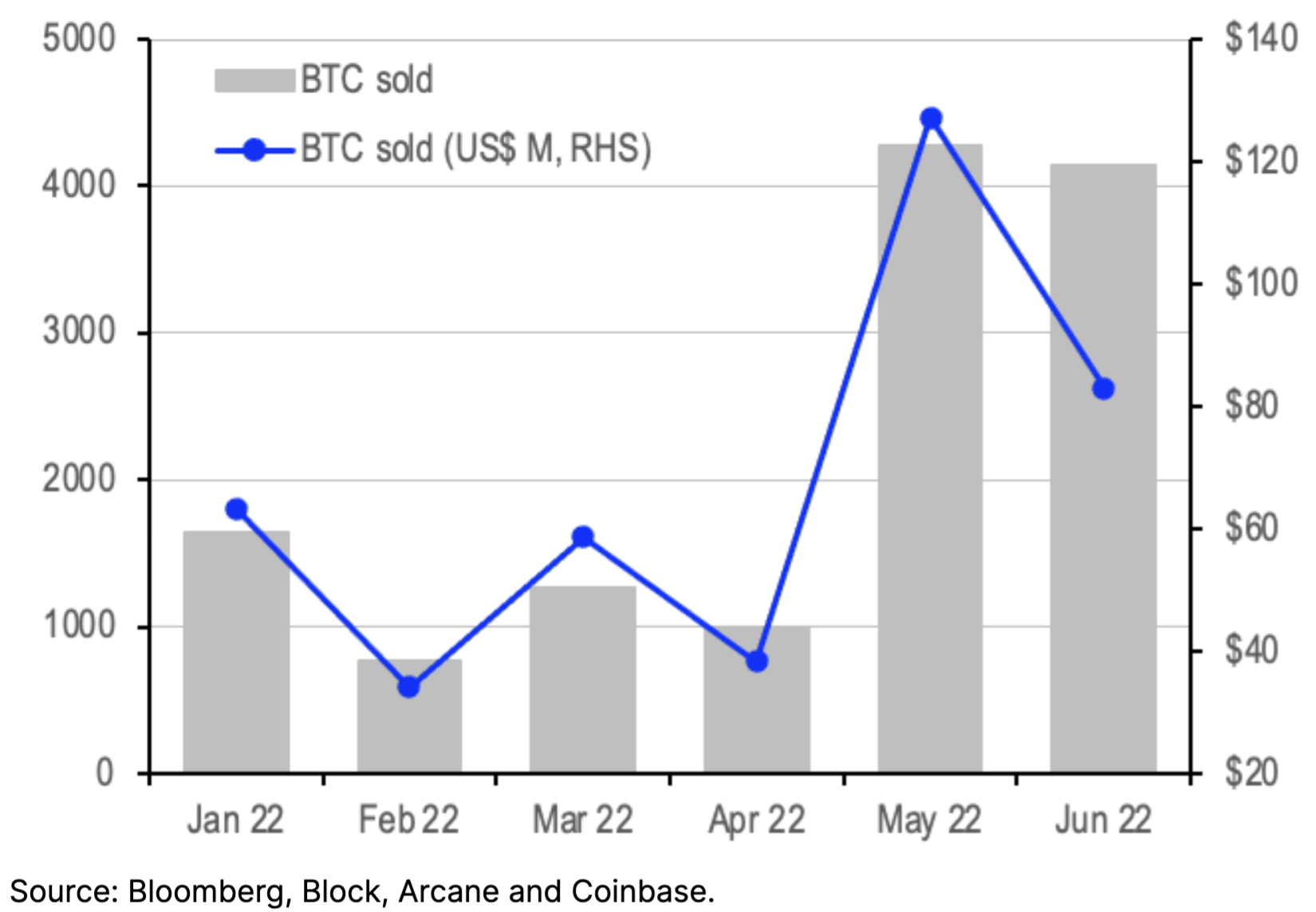

1. BTC selling by top 28 public miners

Among the top 28 public mining companies representing 20% of bitcoin’s hashrate (according to Arcane Research), we have seen ~13k bitcoin sold YTD from these miners, which represent 19% of their reserves. These public companies are still sitting on bitcoin holdings worth ~55k BTC (according to CoinMetrics) which can still be sold to meet loan obligations or previously planned investments. In total, all bitcoin miners hold around 800k BTC globally according to Bloomberg, so public mining companies’ reserves only represent 6.8% of that.

If the $4B in ASIC backed loans is accurate and it’s spread out over these 28 miners (and it’s not entirely clear that it’s not more miners), then each miner would be carrying a debt of ~$143M. Conservatively assuming:

- Each contract has an interest rate of 11% over a two-year term

- Miners are using Bitmain S19J Pro mining rigs (one of the most efficient machines) with 20,000 operating at each firm

- The average energy cost is $0.05/kwh

- The total hash rate is 1.8 EH/s (the average in 1H22)

Then with a BTC price of ~$20,000, each miner would only need to liquidate three bitcoin to pay the gap (principal and interest) every day. Even if the bitcoin price were to go to $10,000, they would need to liquidate 16 bitcoin from their reserves to pay the gap every day, which means they can still last ~120 days. From a market perspective, assuming this represented ~$1.7M in daily BTC sales, we think that would be unlikely to have a material impact on the price given that there is ~$6B in average daily BTC volumes on exchanges. That said, we would also need to consider the other loans sitting on public miners’ books for a more accurate accounting.

Stablecoin concerns

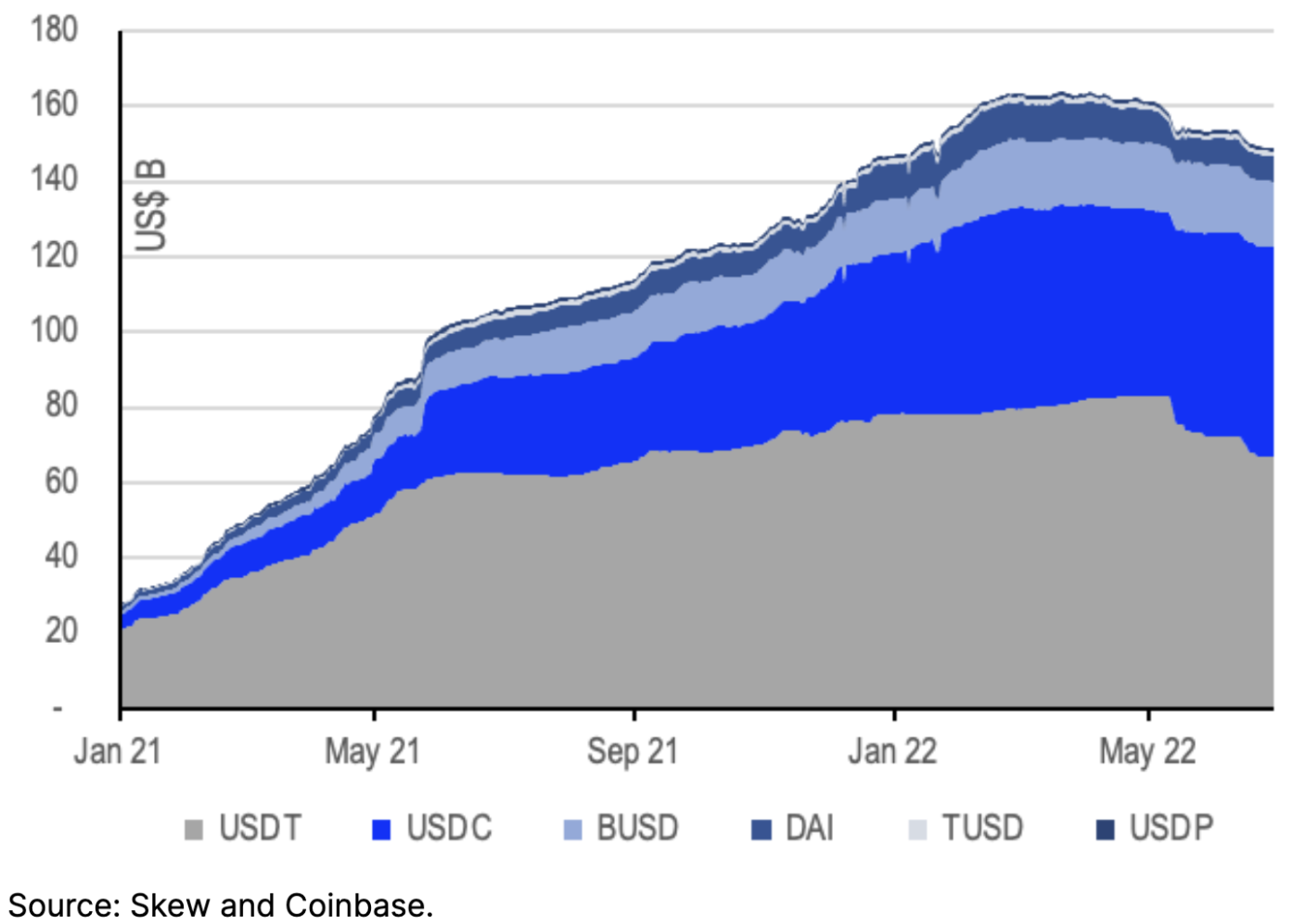

Elsewhere, the liquidations in June also contributed to a decline in the market capitalization of stablecoins. If we look at the top six fiat-backed and crypto-collateralized stablecoins, the total market cap has declined from $162B in early May to $149B at end-June, suggesting around $12.6B of capital may have left the crypto ecosystem. Some of those withdrawals could reflect the higher yields being offered in traditional finance relative to the 0.50-1.95% being offered on DeFi lending platforms. Indeed, if the US Federal Reserve follows through with another 75bps hike on July 27, we think that could put more liquidity pressure on stablecoins.

2. Decline in stablecoin market capitalization

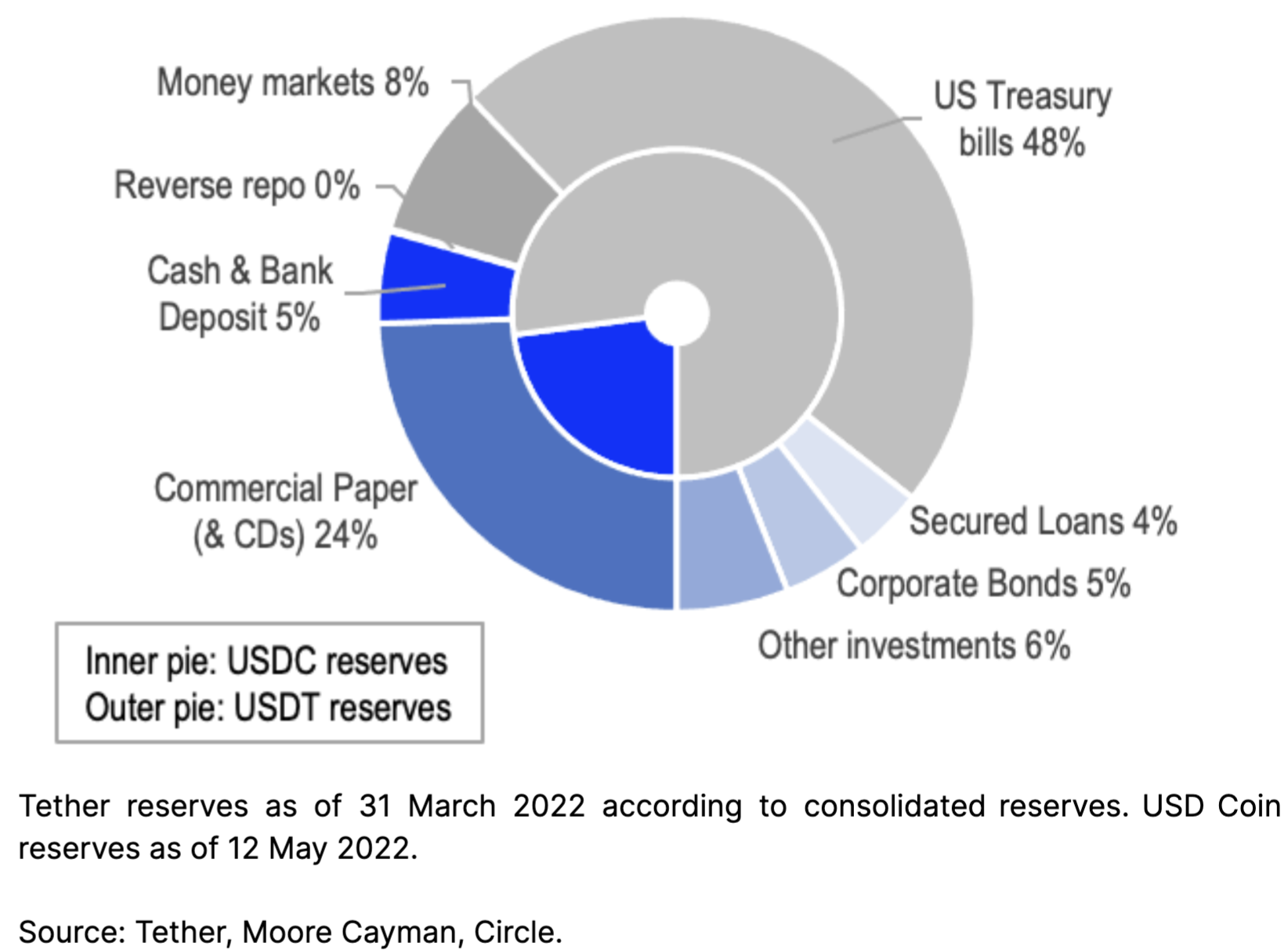

Tether (USDT) and USD Coin (USDC) continue to make up the majority (~82%) of the stablecoin market, but there has been a rebalancing of USDT to USDC over the last two months. About $16.4B has been withdrawn from USDT while USDC has had net inflows totaling $6.5B since early May. Part of that reflects concerns that Tether was the lead investor in Celsius’ early equity raises with a 7.8% stake as of early 2021, according to the Wall Street Journal. Tether also provided the CeFi lender with a $1.1B credit facility paying 5-6% interest in October 2021 backed by bitcoin collateral. This appears to be part of the $3.1B in secured loans included in Tether’s March 31 accountant’s report. However, Tether recently reported that this position has been liquidated and is no longer on their balance sheet.

Discomfort among market players with the opacity of USDT reserve holdings is not new. Tether does not have a formal audit of its reserves, which has led some to question whether its holdings are credit worthy. Some investors have even tried to borrow USDT to short it. But Tether does provide a consolidated reserves report from its accountant, which indicates it has a large cash buffer, while their chief technology officer Paolo Ardoino said the firm is currently conducting a full audit of its reserves, according to the Wall Street Journal.

We believe investors more likely see shorting USDT as an asymmetric risk-to-reward proposition and are not necessarily making a bet on the likelihood of a depegging incident. Moreover, if Tether is holding ~53% of its reserves in cash and short dated government bonds, then this buffer should be more than sufficient to withstand pressure from the short bets leveled against it, in our view.

3. Tether (vs USD Coin) reserves

Long term HODLing

Our analysis of bitcoin positioning based on onchain data suggests that recent BTC selling has been carried out almost exclusively by short term speculators. Longer term bitcoin holders on the other hand (which we define as those holding BTC for more than six months) have not been selling into the market weakness. These holders own a highly concentrated ~77% of total supply, which is down slightly from 80% to start the year but still quite high (see chart 4). In fact, it’s far above the 60% level we saw in December 2017, when bitcoin prices had peaked before the start of the first official crypto winter.

We see this is a positive sentiment indicator as we believe these holders are less likely to sell BTC during turbulent periods. Thus, even if retail demand has fallen sharply as is typical of bear markets, the supply vs demand situation remains in balance due to the bitcoin retention of these longer term holders providing a stable base of ownership.

4. Long term BTC holders stable at ~77%

Conclusions

Ultimately, we believe the issues at the heart of the recent crypto market selloff comes down to a mismatch in short dated borrowing versus long dated illiquid assets. While this has purged a lot of the excess in crypto risk, the bottom for digital assets may not be discovered until we see equity earnings forecasts in traditional markets finally revised lower, as the threat of a global economic recession looms. On the upside, if earnings forecasts highlight some form of price stabilization, then what we’re currently seeing could be a floor for crypto prices.

Positioning for crypto assets looks supportive, in our view, as onchain data suggests many speculative holders have now been removed. For example, the bulk of bitcoin supply is now being held by longer term holders, which was not the case during the previous 2018 crypto winter. We think these holders are more likely to have higher resolve about selling their holdings into weakness, which we see as a precondition for seeing an eventual recovery, perhaps in 4Q22.