Summary

Despite a largely successful Ethereum Merge, we have seen ETH weaken ~20% (vs USD) in the two weeks after the event. In our view, that performance isn’t necessarily an indictment of the technology itself but rather a reflection of poor macro environment dynamics. That includes a more hawkish Fed stance and a challenging fiscal situation in the UK, for example. Regardless, many questions remain in a post-Merge world pertaining to ETH’s updated tokenomics, the schedule for further upgrades and the competitive landscape surrounding alternative layer 1 networks.

With the Merge complete, we believe the community will eventually turn its attention towards building more complex financial products on the network based on the staking rewards earned by validators. We estimate that the average staking yield has increased from 4.5% APR before the Merge to 5.8% now for users running their own nodes (calculated using backward looking activity trends), as earnings from transaction fees now accrue to block proposers. MEV should add an additional 0.9pp to that figure based on recent trends.

But the overall ETH supply is still growing, contrary to the narrative about becoming a deflationary asset. That’s primarily a factor of depressed on-chain activity, as base fees have averaged just over 12.5 gwei over the last two months compared to the 15.8 gwei base fee threshold needed for ETH supply growth to be negative. That may be affecting ETH performance alongside concerns over potential delays in the remaining upgrade roadmap. Staked ETH withdrawals still need to be permissioned, and there is no commitment as of yet as to which Ethereum Improvement Proposals (EIPs) have been accepted or rejected for the Shanghai Fork.

Staking rewards

Staking rewards have increased from 4.5% APR to 5.8% after the Merge based on our calculations for validators running their own nodes. (See footnote 1 below.) This reflects the combination of ETH issued to participants for fulfilling validation duties as well as earnings from transaction fees (excluding the burned base fee.) Note that our estimate does not include maximal extractable value (MEV) – referring to the profit that validators can earn via their ability to order transactions in a block – which we will discuss in the next section.

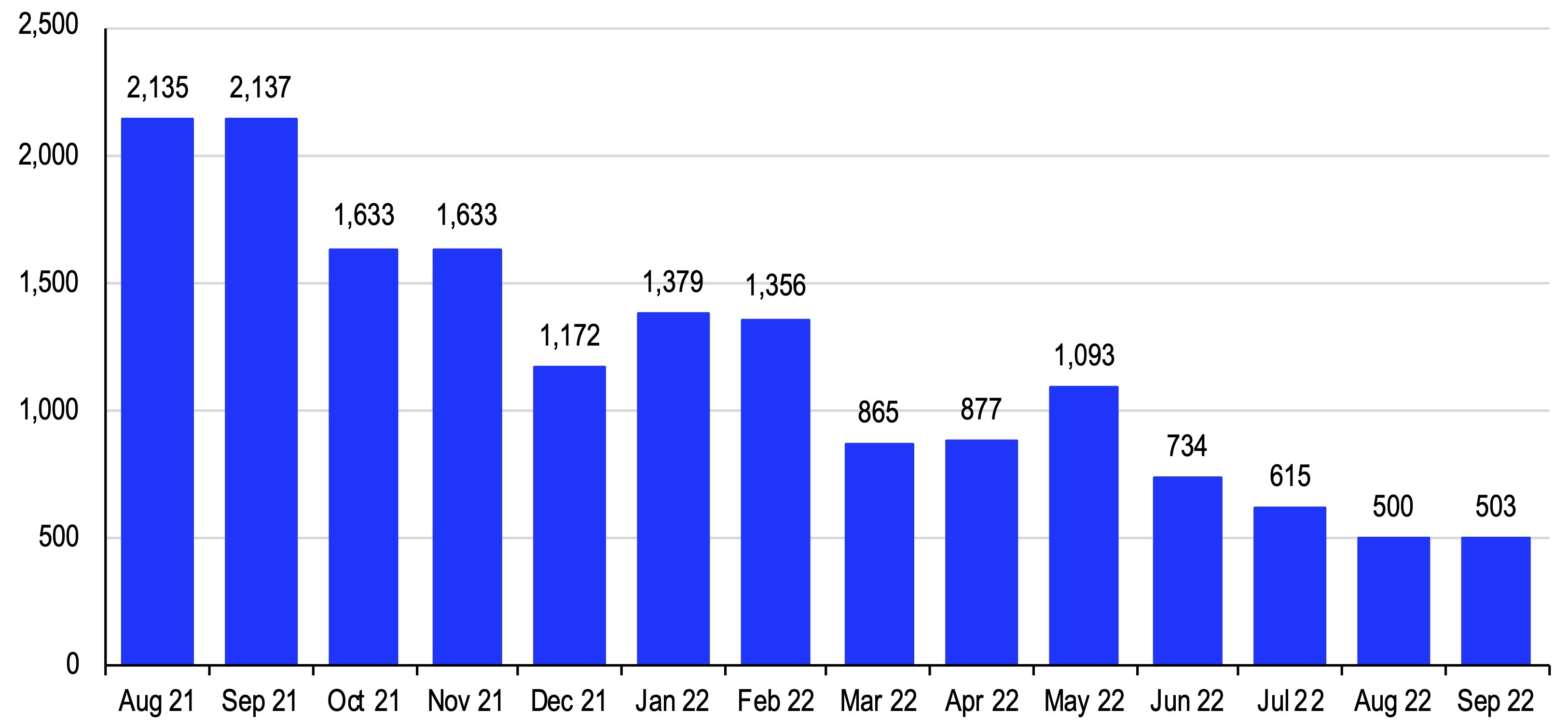

The figure above is lower than the reward estimates we had projected in late July, as our forecasts then were based on higher expectations of on-chain activity – netting closer to 1000 ETH per day in fees. In fact, daily net transaction fees have averaged ~500 ETH in both August and September (again, excluding burned ETH.) As a result, the contribution of transaction fees to overall staking yields is currently only 1.3pp rather than the 2.9pp as we had initially expected.

1. Average daily ETH transaction fees (by month) minus base fee

Looking ahead, the base reward earned from staking should mathematically decrease if we assume a greater proportion of ETH is staked in the future, given that it is inversely proportional to the square root of the total balance of all validators. However, we would expect a lower staking ratio than the 50-75% (of token supply) observed in other alternative layer 1 networks given the relative amount of Ethereum usage. Currently, around 12% of all ETH is being staked. We think the fact that stakers cannot withdraw their ETH until after the Shanghai Fork may keep this ratio contained for at least several more months.

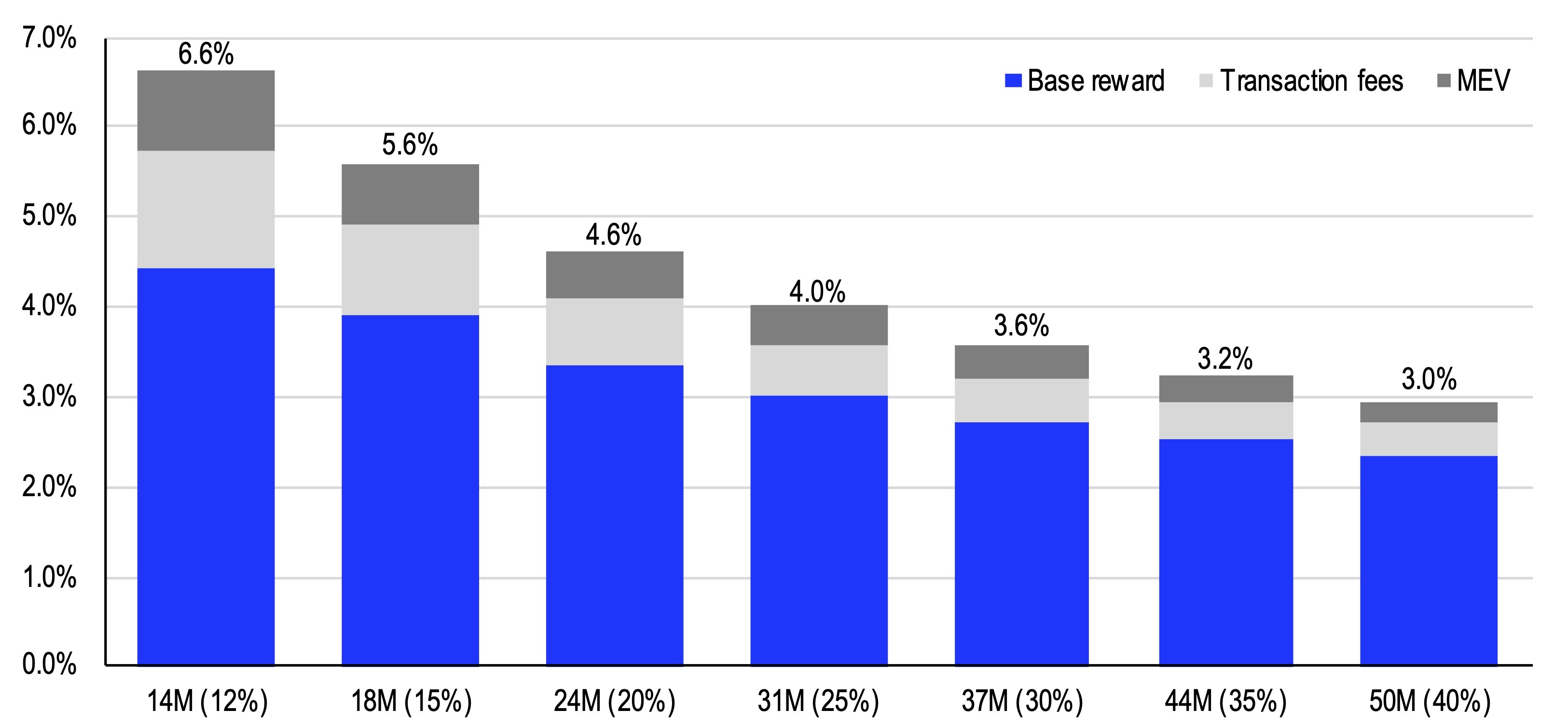

Below, we look at staking reward estimates based on incremental increases in the total ETH staked from 15% up to 40% of token supply (adding back the base rewards paid to validators.) We decompose these yields by base rewards, transaction fee earnings and MEV. This is for indicative purposes only, as it assumes an improbable scenario where on-chain activity will remain static indefinitely into the future with net daily transaction fees remaining at ~500 ETH and MEV validator earnings at ~350 ETH per day (based on the recent trends.) This is primarily to show the sensitivity of overall staking rewards to network activity. The biggest contributors to the decline in yields to 3.0% (at the low end of the spectrum) are transaction fees and MEV as they are increasingly distributed across a wider base of validators.

2. Staking reward estimates by ETH staked (% of total supply)

MEV earnings

Estimates of MEV (also referred to as realized extractable value or REV) earnings can be highly variable, as validators are selected at random intervals. Consequently, their MEV rewards depend on the level of activity and MEV extraction opportunities that exist at the time particular validators propose blocks, possibly leaving earnings unevenly distributed among validators. Note that that variability should decline as more users stake in the network. It could also be smoothed out further when proposer-builder separation eventually becomes enshrined in the protocol, providing validators with transparency over the highest paying block bundles and thus a more socialized MEV average.

Meanwhile, MEV earnings have been in decline in recent months. This may be due to several reasons. First, MEV is sensitive to the level of on-chain activity on a network. Arbitrage opportunities between exchanges, for example, require having trades to actually arbitrage. The amount of DeFi activity on Ethereum has declined from total value locked of $108B at its peak in November 2021 to $31B at the end of September 2022.

Second, MEV has helped minimize market inefficiencies and improved price discovery among decentralized exchanges (DEXs), which have perversely made it harder to find new arbitrage opportunities. Third, protocol changes on DEXs like Uniswap V3’s concentrated liquidity (inside of specific price ranges) make it harder to execute “sandwich attacks” (an aggressive form of front running that levers users’ market orders to artificially inflate prices for designated sellers or vice-versa) as solitary trades are less likely to push prices higher.

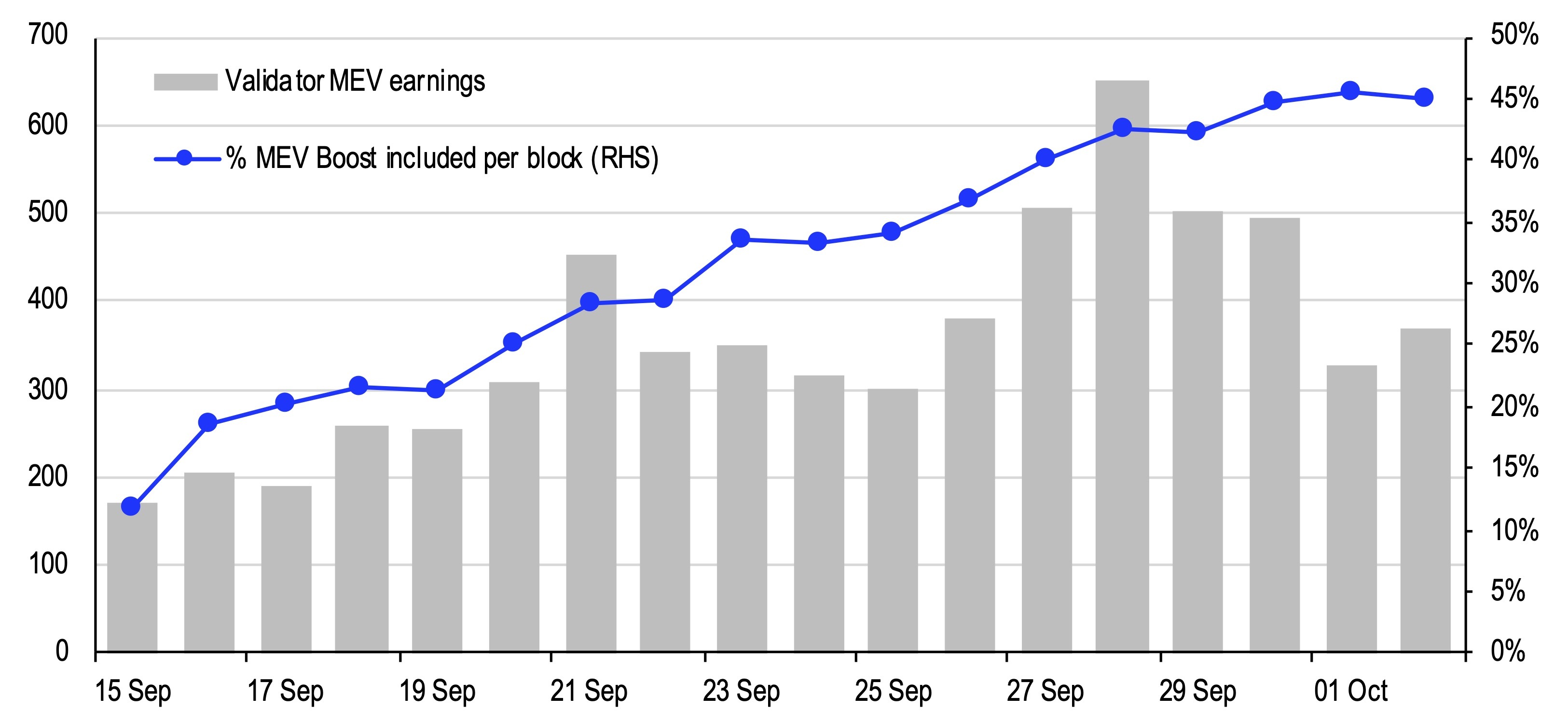

Consequently, average gross MEV earnings have declined from ~510 ETH per day in 2021 to ~350 ETH in 2022 YTD. Prior to the Merge, miners who wanted to capture MEV primarily used modified client software known as MEV-geth, which was introduced by the MEV research organization Flashbots. The percentage of pre-Merge blocks that included Flashbots bundles varied but mostly oscillated around 50-60%. Post merge, validators can run software like Flashbots’ MEV-Boost which is now available for multiple clients and is currently included in 47% of blocks. MEV-Boost contains a number of relays that validators can listen to including Blocknative, BloXroute, Eden, Flashbots and Manifold (currently 7 are active.) There are also competing solutions to MEV-Boost like Vouch (developed by Attestant) which allow validators to receive blocks from these same relays.

In the weeks since the Merge, validators seem to be receiving daily MEV rewards from MEV-Boost in line with the YTD average, which on an annual basis would push total rewards (including staking and transaction fees) to 6.6% APR, with MEV accounting for around 0.9pp in additional validator earnings. That said, this figure is based on recent observable MEV earnings and not on projections of higher or lower on-chain activity nor greater adoption of MEV software. Notably, a previous study conducted by Flashbots in early June 2021 made estimates based on a fixed amount of MEV per block.

3. MEV earnings post-Merge vs MEV-Boost inclusion in blocks

On-chain activity

On-chain activity remains the key to staking rewards, MEV earnings and ETH supply growth dynamics. According to Token Terminal, revenues on Ethereum are down 78.7% over the last six months totaling US$1.26B over that period compared to $6.03B in the preceding six months. This is in part why we believe the industry is focused on developing new use cases for crypto like gaming dapps and music NFTs. Ethereum is in the business of filling block space with transactions, and without new use cases, lackluster demand for block space may weigh on ETH performance, in our view. On the upside, we are seeing more stablecoin payments being sent globally using the network, and testing is currently underway to use blockchain technology to settle financial instruments.

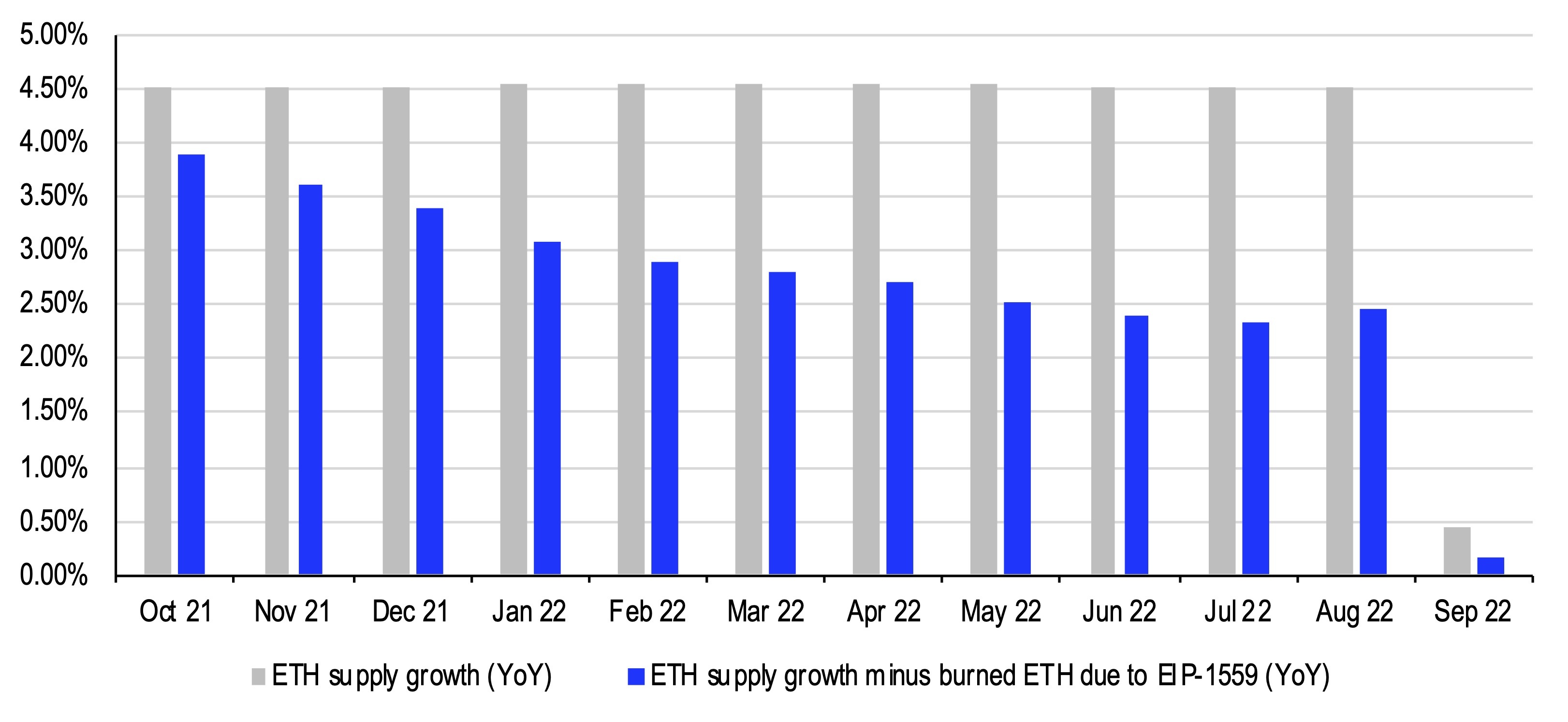

But for now, weak activity is one of the main reasons why ETH supply growth remains positive. As we anticipated, the rate of ETH issuance decreased after the Merge from 4.5% YoY to 0.45% YoY reflecting a greater than 90% decrease in new ETH supply after miners ceased being paid. If we factor in burned ETH, the adjusted annualized inflation rate actually fell to around 0.17% YoY (down from 2.45% YoY previously.)

4. Annualized ETH supply growth (with and without burned ETH)

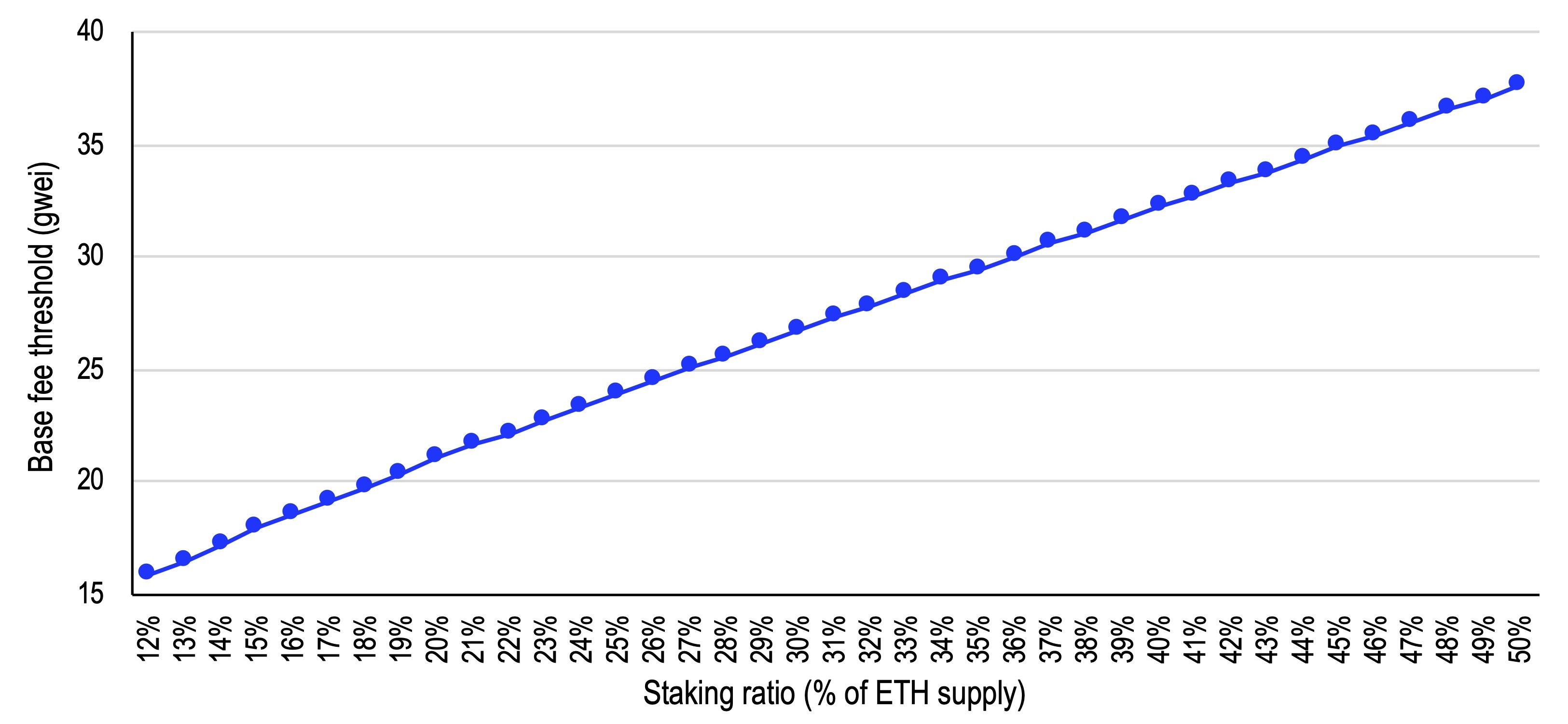

With the current amount of ETH staked, more on-chain activity is necessary to get above the 15.8 gwei base fee threshold needed for ETH supply growth to be negative. (See footnote 2.) But during August and September, base fees have averaged just over 12.5 gwei. Moreover, as additional validator nodes are spun up and more ETH rewards are issued, the base fee threshold for deflationary supply growth rises. At a 15% staking ratio (~18M ETH staked), that threshold goes up to ~18 gwei. Looking longer term, at a 40% staking ratio (~40M ETH staked), this increases to ~30 gwei. See chart 5.

5. Base fee threshold needed for deflationary ETH supply growth

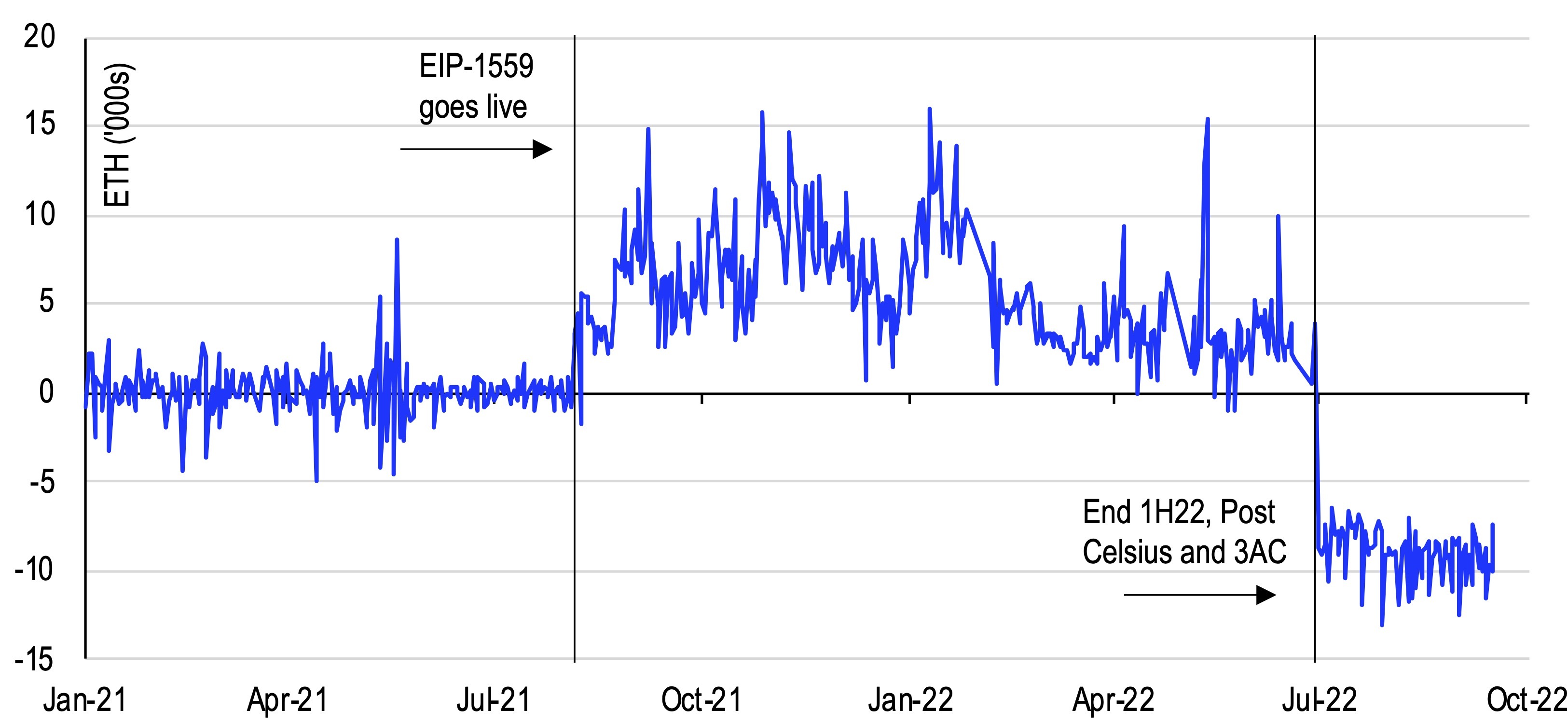

Finally, ETH miners represented one source of concentrated ETH selling pressure in 3Q22. On-chain data indicates they accounted for net outflows of 709k ETH (US$1.1B) total during these three months or almost 9k ETH per day. See chart 6. With the transition to a proof-of-stake consensus mechanism, that selling pressure should now be alleviated going forward, which should support the price action.

6. ETH miners had net outflows in 3Q22 up until the Merge

Roadmap for further upgrades

Following the Merge, Ethereum co-founder Vitalik Buterin considers the network about 55% completed, which could put scrutiny on the remaining upgrade roadmap. Many developer teams are on hiatus after the Merge and aren’t likely to start working towards anything new until November 2022. We think that could weigh on investor sentiment post-Merge, as staked ETH are currently not available for withdrawal until the next set of upgrades are implemented. Given how long it took for the Merge to take place, investors may be concerned about the potential for future delays in the roadmap, whether or not that’s warranted.

Presumably, withdrawals of staked ETH should come in the Shanghai Fork, which we’ve previously estimated could be 6-12 months after the Merge. But there is no commitment as of yet as to which Ethereum Improvement Proposals (EIPs) have been accepted or rejected nor the exact time frame for when those could be completed. We believe there has already been significant progress on EIP-4895 to enable staked ETH withdrawals as recently as September 20, which augurs well for near term implementation. But some of the other upgrades are less mature and may require more research such as EIP-4844 (proto danksharding) and EIP-4488 (transaction calldata gas cost reduction.) The question now is whether these upgrades will be excluded from the Shanghai Fork or if the fork will be delayed to accommodate these upgrades. We believe that uncertainty may impede investor confidence.

Conclusion

Putting all of this together, we think many of the questions surrounding a multichain future have been left unresolved after the Merge, particularly regarding the competitive landscape surrounding alternative layer 1 networks. Notably, the Merge was never meant to solve the problems of high gas fees and low throughput for example, with Ethereum relying on layer 2 scaling solutions to ultimately handle those issues. But until transaction costs definitively come down, these may remain impediments to Ethereum’s on-chain activity and strengthen the arguments in favor of alt L1s.

Some of these issues come down to perspective. Ethereum’s developers are focused on the longer term (3-5 year) game plan for the network, but markets may be looking for shorter term gains. On the upside, there are more projects being built on Ethereum today than in any other ecosystem with 7,300 active developers over the last 30 days representing ~13% of the top 850 protocols, according to The Tie. We’re also still in the early stages of the technology reaching mass adoption, so having a longer term perspective on the prospective distribution of blockchains from a user activity standpoint might be appropriate.