We think layer 2 scaling solutions (L2s) could be a major theme in 3Q22, especially after the host of recent announcements about zkEVM. If it becomes the base case that more economic activity occurs on L2s in the future, then it will be increasingly important to have dapp functionality on these layers, which could be further enabled by zkEVMs.

Originally, this technology wasn’t expected to be ready for at least another year if not more. In theory, it allows developers to port smart contracts directly onto L2s and give users an experience akin to what they have on Ethereum’s mainnet. For that to happen though, these protocols would need to combine zero-knowledge proofs with true EVM equivalence (as opposed to just EVM compatibility) – and even then, there are different levels of equivalence.

But as more dapps migrate to L2s, it’s feasible that these L2 application layers could eventually divert revenue away from Ethereum, which may exist mainly to store the transaction data. That in turn could reduce staking yields to validators and hurt the ETH price by limiting the amount staked on the network thus increasing the liquid circulating supply. It could also potentially impact the overall security of the network.

Of course, without L2s, Ethereum might not be able to compete with alternative L1s. Plus, over the long run, the revenue impact depends on whether the overall size of the pie (i.e. total activity of the ecosystem) continues to increase.

Scaling roadmap

The value proposition of layer 2 scaling solutions is simple. High gas fees and slower settlement times on the Ethereum network make it unsuitable for lower value transactions, so those transactions will most likely move to lower cost L2s. But gas fees are static whether you’re sending $200 or $2,000,000 so higher value transactions could remain on the mainnet because of Ethereum’s superior security.

L2s are independent ecosystems that sit on top of Ethereum in such a way that they rely on Ethereum for security. While L2s do not technically need to have their own native tokens, creating transactional tokens has been the direction of travel more recently. Many still use ETH to pay for transactions, but we think the trend could be that L2 ecosystems could become competitive rather than complementary to Ethereum’s. For example, Optimism still uses ETH as the default gas token, but its new OP token is also permitted now. When StarkNet launches its token in September, that token will be required to pay transactions fees on the L2.

Table 1. List of General Use L2s vs Ethereum

L2 name | TVL (US$ M) | Fees (US$) | Max TPS (est)* | Type |

|---|

Ethereum | 68,850 | 1.30 | 15 | Mainnet |

Polygon PoS | 2,290 | 0.25 | 65,000 | Commit chain |

Arbitrum | 1,756 | 0.25 | 4,500 | Optimistic |

Optimism | 743 | 0.21 | | Optimistic |

Metis | 134 | 0.02 | 2000 | Optimistic |

zkSync | 67 | 0.05 | 2000 | zkRollup** |

Boba Network | 50 | 0.10 | | Optimistic |

Aztec | 4.9 | 0.39 | 300 | zkRollup |

StarkNet | 1.1 | | 700 | zkRollup |

Polygon Hermez | 0.33 | 0.25 | | zkRollup** |

Scroll | N/A | | N/A | zkEVM |

The majority of L2s today encompass “rollups” that bundle transactions together and execute them in a new environment, before sending the updated transaction data back to Ethereum. In other words, it’s cheaper to submit one bundled result to Ethereum than have the network process thousands of transactions separately.

There are differences between optimistic and zero-knowledge (zk) rollups, which we have previously discussed in depth here. For the purposes of this report, it’s important to simply know that zkRollups utilize “validity proofs” to verify that the transactions being submitted to the network are valid whereas optimistic rollups assume their results are valid.

1. Daily transactions on select L2s

Next generation

So far, L2s have really only served to facilitate token transfers and swaps, mainly supporting wallets (for payments) and decentralized exchanges (though some of those exchanges, like dYdX, transact in fairly sophisticated instruments including perpetual swaps.) That could change once Ethereum Virtual Machine zero-knowledge (zkEVM) rollups are put into production, a prospect that once appeared to be 1-2 years away but now seems possible as early as 2H22. The goal would be to make the user experience on these L2s look and feel almost identical to the one on the Ethereum mainnet.

There are three main competing projects that have grabbed the market’s attention at the moment. Polygon estimates a testnet launch this summer and a mainnet launch in 2023. Matter Labs plans to launch zkSync 2.0 on the mainnet sometime in late October. Relative newcomer Scroll (which works with the Ethereum Foundation) announced a pre-alpha version of its testnet which is currently available for external testers.

Table 2. Comparing zkEVMs

| Polygon Hermez | zkSync | Scroll |

|---|

Testnet launch | 3Q22 (est) | Jul 2022 | Jul 2022 |

Mainnet launch (estimated) | 2023 | Oct 2022 | N/A |

EVM equivalency | bytecode | language | bytecode |

Open source | Yes | Yes | Yes |

If zkEVMs are implemented in earnest, general applications and the full suite of dapps could theoretically be made available on L2s without the withdrawal delays of their rollup predecessors. This can make them almost independent of the Ethereum network, which would relegate the L1 to simply being a repository of transaction data.

There can be only one?

That said, these protocols would need to combine zero-knowledge proofs with true EVM equivalence as opposed to just EVM compatibility. This is an important distinction. Typically, in order to develop dapps in a zkRollup, smart contracts would need to be written in a low level hexadecimal based assembly language (making it less independent of the processor instructions) rather than in Solidity, the high level programming language used to code Ethereum.

EVM equivalence means that applications could work natively on the L2 without having to worry about syntactical differences in the programming languages of the L2 vs Ethereum. Optimism 2.0 for example has EVM equivalence (also note their recent announcement on Bedrock.) Historically, optimistic rollups have been critiqued for their withdrawal delays when users try to bring assets back to Ethereum, as this has limited the user experience in the past.

EVM compatibility on the other hand may not support full composability among dapps and thus can also hinder the overall user experience compared to the mainnet. Unlike EVM equivalent rollups, EVM compatible rollups also may not be insulated from future code changes to Ethereum’s Virtual Machine like the inclusion of Verkle trees (at least not in the same way that some EVM equivalent rollups might be). Arbitrum for example is an EVM compatible optimistic rollup.

There are also different levels of EVM equivalence, but the primary ones for our purposes are (1) language-level equivalence and (2) bytecode-level equivalence. (A good breakdown of different zkEVMs can be found here.) What’s important to note is that each type has its tradeoffs in terms of speed or adaptability within the existing network infrastructure.

Language-level equivalence effectively means a smart contract can be translated from Solidity into a zk compatible language. But while equivalence at the language level can be fast, it does not facilitate direct portability of smart contracts to the L2. The zkEVM being implemented by Matter Labs (zkSync 2.0) practices language level equivalence. StarkNet too has a “transpiler” that translates Solidity into Cairo, its native programming language.

Polygon Hermez and Scroll on the other hand are trying to implement zkEVMs that are bytecode equivalent. That means the protocol would be able to auto-convert high level Solidity code directly into the low level programming language used by a zkRollup. This would allow for a more seamless transition of smart contracts directly to the L2 (though even at the bytecode level, there are important nuances regarding code interpretation that separates Polygon from Scroll).

Finally there are also fully Ethereum-equivalent zkEVMs that are under development. These would not compromise on changes, meaning L2s would no longer need to recompile (nor precompile) dapp code or recalculate transactions. In other words, their goal is to make the user experience an exact replica of the one on Ethereum, though in practice this could be slower than the other forms of EVM equivalence. At the moment, the Privacy and Scaling Explorations Team is being supported by the Ethereum Foundation to work on this technology.

The competition among these zkEVM projects (and rollups more broadly) could heat up because the prospect of moving between different L2s is still quite challenging (requiring multiple steps) as rollups tend to be independent platforms at the mercy of the bridging technologies available. Of course, it’s entirely possible that in the future, developers could create bridges to more seamlessly move tokens among the various L2s. But given the recent concerns surrounding cross-chain bridge exploits, it still seems like whichever zkEVM or rollup becomes the dominant application layer for Ethereum could very well house the bulk of the network’s economic activity in the future.

What happens to Ethereum?

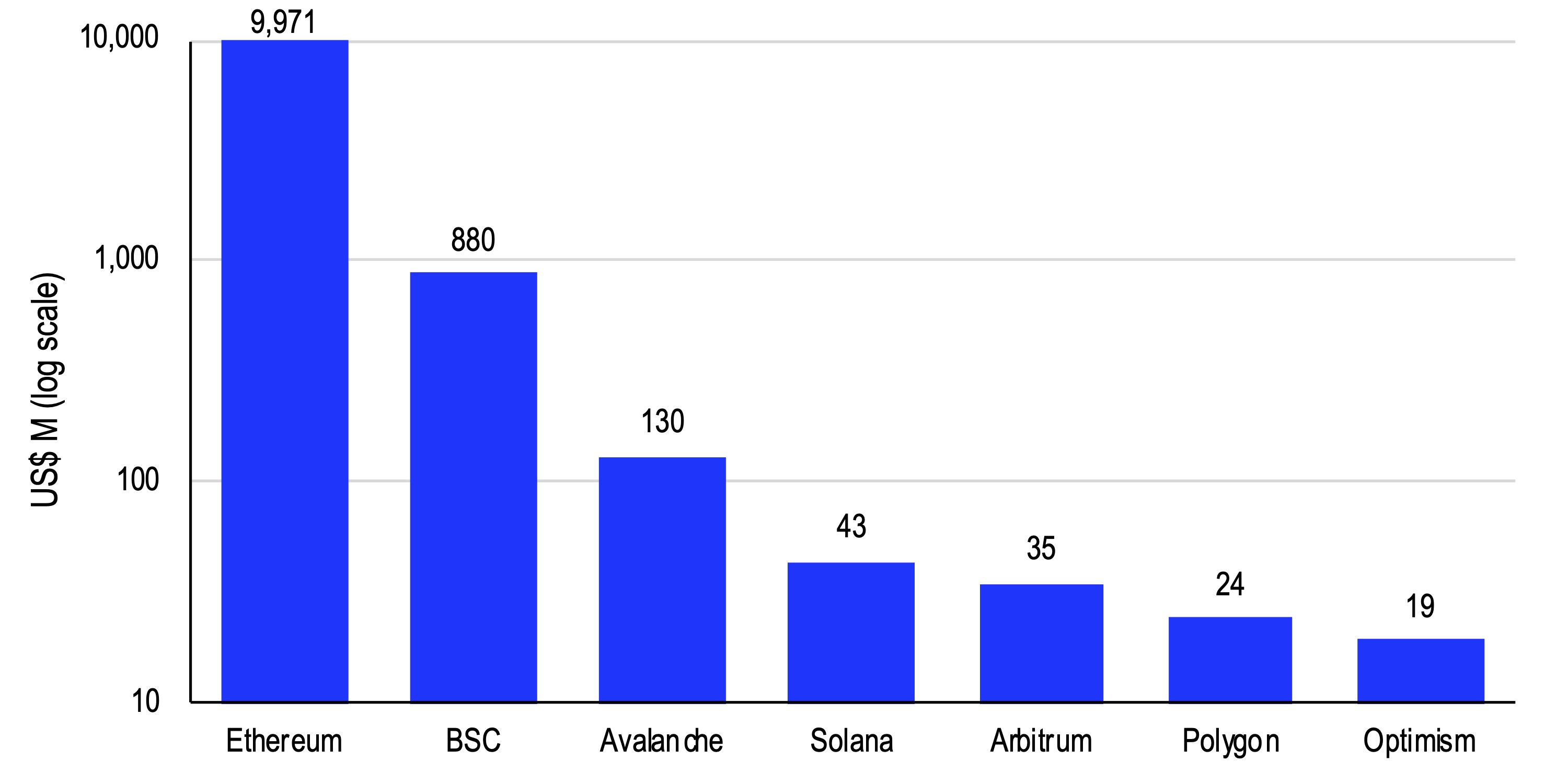

Thus, the future of L2s could very well be a zero-sum game, as whichever L2 houses the majority of dapps could one day power the entirety of the Ethereum ecosystem. That suggests that L2s could eventually divert revenue away from Ethereum itself. Over the last 12 months, Token Terminal has reported that Ethereum has earned US$9,971M in total revenue compared to an aggregate of only ~$78M on Arbitrum, Polygon and Optimism (see chart 2). There is around $68.9B in total value locked on the L1 compared to $5.2B across L2s (representing 7.6% of Ethereum’s TVL) listed in table 1.

2. Total revenue over the last 12m

We’ve discussed in a previous report that when Ethereum’s mainnet merges with the Beacon Chain (converting its consensus mechanism to proof-of-stake), validators staking ETH could see their yield increase from 4.2% to ~7% APY (not including MEV). The increase in future rewards is based on net transaction fees (i.e. excluding the base fee), whereas current rewards are based on the ETH issued to participants for fulfilling validation duties.

If more user activity migrates to L2s and those L2s require their own tokens to facilitate transactions, that could potentially reduce the staking yields to validators who will earn less on those net transaction fees. If that discourages staking on the platform, that could increase the size of the ETH liquid circulating supply, possibly hurting ETH prices. (Note however that if ETH staked on the network falls, the yields would correct higher as the base reward is inversely proportional to the square root of the total balance of all validators). In any case, a decline in the number of validators could also potentially impact the overall security of the network.

Of course, without L2s, Ethereum might not be able to stay competitive with alternative L1s in the short term (in terms of speed and cost), which is precisely why L2s are part of Ethereum’s scaling roadmap. Indeed, after the merge (which could take place in September 2022), there are two pending improvement proposals (EIP-4844 on proto-danksharding and EIP-4488 on transaction calldata) that would effectively reduce the cost of using L2s, ostensibly without sacrificing security.

In the simplest terms, EIP-4844 creates space on Ethereum’s blocks for “blobs” which would be a data type that only L2s could use, while EIP-4488 lowers gas fees on calldata. These could support zkEVMs which may be more expensive than their optimistic and zkRollup counterparts upon their initial release (as they are computationally more expensive).

In other words, there is still a symbiotic relationship between Ethereum and these L2s, which make their success (or failure) contingent on the success (or failure) of Ethereum. If for example we saw Ethereum making upgrades to its network to increase its native throughput, that might curtail the need for L2s altogether, although for now that seems unlikely.

Also the impact of L2s eating into Ethereum’s revenues could be a short term phenomenon. Over the long run, revenues depend on greater activity in the overall crypto ecosystem as well as whether Ethereum becomes the dominant universal (or general use) blockchain. If L2s facilitate more transactions by making them cheaper, faster and easier, the initial revenue impact could be mitigated by the increased activity that eventually takes place on the network.

Conclusions

To deal with its shortcomings on cost and throughput, we think Ethereum needs L2 scaling solutions to remain competitive with alternative L1s. But at the same time, L2s could very likely siphon revenue from the mainnet as they may become increasingly competitive rather than complementary to Ethereum. At the moment, the TVL in L2s is only a small fraction of the amount on Ethereum, but as zkEVM implementation looks increasingly achievable, we could see major traction in L2 growth.

For now, transacting on the Ethereum mainnet will likely still fulfill a need for users who require or value security over speed. That issue could be significant considering the recent losses on cross-chain bridge exploits has amounted to $2B YTD. Still, having more activity accrue to an application layer 2 would reduce congestion as well as fees on the L1 (limiting MEV as well), and that could potentially support better price discovery for ETH.