Why should asset allocators consider digital asset hedge funds?

In the recent environment where high inflation, rapidly changing interest rates, and instability in the banking system are exacerbating volatility, certain hedge fund strategies can shine.

Over the last decade, many allocators shunned hedge fund allocations and are only just beginning to build (or rebuild) their hedge fund allocation. As markets adjust to new realities, many large asset owners are boosting risk-mitigation sleeves, attempting to hedge complex tail-risk scenarios, and looking to gain exposure to specific themes via rapidly evolving niche strategies.

In fact, according to Preqin data (Table 1), since 2017, niche strategies are one of only three categories of hedge funds that have seen an increase in AUM (CTA and macro are the other two).

Crypto hedge funds fit squarely in the niche category, sharing many similarities with the emergence of the broader hedge fund industry in the early 2000s.

Crypto hedge funds are a compelling strategy that we view as an important potential alpha diversifier.

The crypto economy is an emerging global economic marketplace, with highly fragmented infrastructure, new technology rails, heavy retail flows, growing institutional flows, complex global regulatory considerations, and tremendous information asymmetry. While these dynamics present a unique set of challenges, they also offer hedge funds a disruptive and exciting new set of opportunities to capture uncorrelated returns.

Recently, institutional investors have started waking up to the opportunities in crypto hedge funds. Institutional Investor’s Digital Assets Outlook Survey (October 2022) revealed that investors expect crypto to be one of the top three markets in which to generate alpha in 2023 (Chart 1). Of those that identified crypto, 41% of investors prefer crypto hedge fund strategies as the best vehicle to gain crypto exposure. Respondents’ optimism for crypto in 2023 looks prescient, as the price of bitcoin rose 69% in Q1 2023.

Yet, many allocators are still gaining crypto exposure via venture funds or spot holdings. If they only knew:

- Growing universe of funds. There is a growing list of crypto hedge funds with 3-year track records.

- Some returns have been stellar. Certain strategies have 5-year average returns over 30% and 3-year average annualized returns over 80%.

- Crypto can be a portfolio diversifier. Crypto hedge funds can offer low beta and low correlation to broad equity markets and/or BTC.

- You can control vol. Additionally, there are BTC long-only systematic strategies offering less than 30% annualized volatility.

Alas, stellar returns do come with a warning sign. Statistical diversification by itself is not as useful if the strategy introduces extreme counterparty uncertainty, fails to generate positive (or less negative) returns when markets fall, or does not provide liquidity when needed for portfolio rebalancing. Institutions must assess managers and strategies with a multi-dimensional lens that considers statistical (directional), structural (uncorrelated), and tactical (tail risk or path independent) returns, as well as operational and liquidity risks.

Allocators must gain an understanding of the investment, operational, and strategic merits in many of the top crypto hedge funds. The right combination of traditional hedge fund portfolio construction and a small allocation to crypto hedge funds may add both capital and risk efficiency to the portfolio-construction process. To realize these potential benefits, allocators need to understand the underlying assets and the landscape of crypto hedge fund strategies.

The budding of a new market

Crypto is an emergent technology, and allocators should view direct exposure similarly to how they view exposure to other megatrends, like biotechnology, the climate transition, and artificial intelligence/machine learning (AI/ML). Each of these trends is significantly disruptive and will likely displace legacy business models, but the companies building them are still early stage and very venture-like.

Tokenomics 101

Digital asset hedge funds primarily trade tokens, which are synonymous with crypto assets. Many funds also trade derivatives of tokens, such as futures, perpetual futures (which are explained below), and options. Tokens are issued by companies across many sectors, including file storage, wallet infrastructure, blockchain scaling, node hosting, app development, asset management, payments, and more.

Tokens are a digital representation of ownership held on a blockchain and can provide many benefits, such as the ability to vote, participate in governance, or simply access services.

The token's unique architecture is a necessary component for driving engagement on decentralized networks. Increasing engagement leads to network effects, which can generate cash flow for the protocol and the entire system.

Many crypto tokens offer benefits of decentralization, while providing unique utility use cases that strengthen and engage the network and create a virtuous cycle of growth. Because the costs and the time required to launch a token are extremely low, liquidity timelines for venture capital investors and founders have accelerated. Where traditional venture capital holding periods are typically around five years, with crypto companies they are often closer to two years. In a favorable market environment, this accelerated timeline can lead to a compounding effect, as crystallizing returns earlier enables a manager to reinvest those returns in search of new high-performing investments.

The token, and tokenization broadly, is a fundamentally disruptive force that will impact the entire public and private markets industry. Tokens got their start in the venture world, and they have provided general partners, their limited partner investors, and company founders with a way to reduce duration, lockups, and liquidity risk that has never really been possible at scale. Many VCs today view the most “antifragile” startups to be those with hybrid equity-and-token structures. As a company grows, having a token strategy allows it to flex different monetization muscles to grow the user base, drive network effects, and eventually become cash-flow positive.

What's happening with web3?

The world is transitioning from web2 to web3. Web3 is a trustless, permissionless, and decentralized internet that leverages blockchain technology.

Its defining feature is ownership. Web3 gives users full ownership of their content, data, and assets via blockchains. It empowers users to read-write-own.

a16z put out a thorough update on The State of Crypto in March 2023 that highlights the growth and scale of the asset class and the central role of web3 in the crypto economy. Chart 3 describes the difference between web1, web2, and web3. Notably, the web3 technology stack powers the way that both individuals and institutions interact with the blockchain, hold their assets, and move value.

This technology has massive implications for web2 companies, particularly those with business models that rely on high take rates (Chart 5). Web3 offers users and creators the promise of substantially lower fees and increased revenue sharing, and it is already upending the internet economy.

Thousands of new companies have emerged, building businesses that seek to disrupt legacy incumbents and create entirely new categories. Most of these companies are expected to have a token model that allows them to engage their network and to create monetization opportunities to drive cash flows. As tokenization grows and evolves, regulatory clarity is needed to ensure that all investors are safe, and that there is clear standardization with regard to what a token represents and what disclosures are required.

With regulatory clarity, we expect to see both the number of tokens and the use cases for them accelerate. We are already seeing early signs of disruption and innovation in traditional asset classes, including tokenized bonds, equities, and private market assets. Tokenization has the potential to revolutionize both public and private markets, much as it has the VC space, by bringing additional liquidity to investors.

A recent report by the Boston Consulting Group suggests that by 2030 the crypto economy will capture as much $16 trillion through the tokenization of private markets. In order for the crypto economy, which is today valued at $1 trillion in total, to support $16 trillion just in tokenized private-market assets, we expect to see exponential growth in network demand, new companies, and new tokens.

How deep and liquid are the crypto markets?

Total crypto market cap stands at around $1.16 trillion (May 2023). This represents more than 10,000 tokens across 100+ different categories (Source: CoinGecko).

The two most liquid crypto currencies, Bitcoin (BTC) and Ether (ETH), offer ample liquidity. Across all exchanges, BTC daily trading volumes range from $25 to $40 billion, and ETH daily trading volumes range from $7 to $20 billion.

BTC and ETH dominate the landscape, with 65% of the total crypto market cap, while a long list of altcoins hold around 25% and stablecoins hold around 10%. While much of the market’s focus is naturally on BTC and ETH, nearly $250 billion is held the universe of 10,000+ other tokens, many of which can be potential sources of alpha if one can account for their varying liquidity profiles and constraints.

The exchange landscape

Liquidity in crypto assets is split across centralized exchanges (CEX) and decentralized exchanges (DEX). CEXs are run by a single, regulated intermediary that matches buyers and sellers, facilitates orders, and transfers funds between parties. Coinbase is an example of a centralized exchange, and there are more than 200 CEXs across the globe.

Decentralized exchanges are just what they sound like; they are open-source, software-based exchanges that match buyers with sellers for peer-to-peer transactions. On a DEX, no single party controls the order book. It’s entirely run by open-source code and governed by a community of developers. The most popular DEX is Uniswap, which currently handles about 56% of total DEX volume across all major blockchains and enjoys a dominant position on the Ethereum chain with ~62% of market share. At peak activity, Uniswap volumes have been on par with the top centralized exchanges.

A new version of DEX dubbed “Permissioned DeFi” is currently emerging. Permissioned DeFi seeks to satisfy regulatory Know Your Customer and Anti-Money Laundering (KYC/AML) requirements. Volume in the permissioned space is very small today, but we expect it to grow, which could open up additional opportunities for US-regulated crypto hedge funds. BASE, a new open source, permissionless blockchain incubated by Coinbase, could enable developers to explore more solutions with permissioned DeFi.

On CEXs and DEXs, trading volumes are robust and growing. Aggregate monthly BTC trading volumes range from $600 billion to $1 trillion across CEXs and DEXs. Aggregate monthly ETH volumes are a close second at $200 to $600 billion (Chart 7).

In addition, there are thousands of smaller tokens that offer varying levels of liquidity.

Investors can utilize many common trading strategies on many CEXs and DEXs including long, short, limit, leveraged, VWAP, TWAP, and more.

Derivatives trading

The derivatives market is very large and growing, with more than 60 centralized and decentralized derivatives exchanges globally. Daily trading volume in 2022 averaged more than $100 billion. Offshore crypto derivatives include futures, options, and a new product termed perpetual futures or “perps.” Perps allow a user to express a levered long or short position on a single asset, typically a token. Importantly, unlike traditional futures, which have an expiration date and require delivery of the underlying asset, perps never expire. Instead, they are constantly rebased using a funding rate. The funding rate is based on the difference in spot and perp price. If funding rates are positive, the perp buyer will pay the seller; if they go negative, the perp seller will pay the buyer.

Here in the US, hedge funds without an offshore presence use CME Group and Coinbase regulated futures exchanges for crypto hedging and risk management. CME Group, whose crypto offering covers regulated futures and options on BTC and ETH, is one of the most liquid US venues for crypto derivatives (Chart 8).

Hedge funds with a legitimate offshore presence can, and do, benefit from trading on offshore exchanges. Derivatives markets spread across many different geographies are ripe for arbitrage opportunities, particularly when they have ample liquidity. Utilizing offshore exchanges can help funds hedge their crypto exposure, but it also necessitates managing counterparty risks in offshore transactions.

The digital asset hedge fund landscape

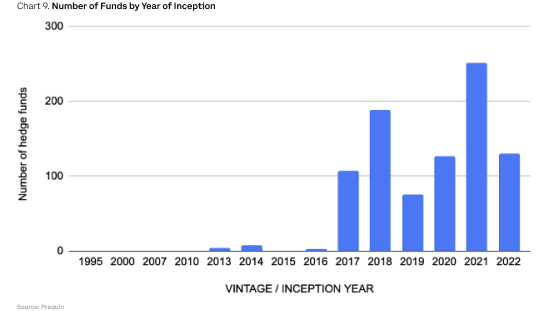

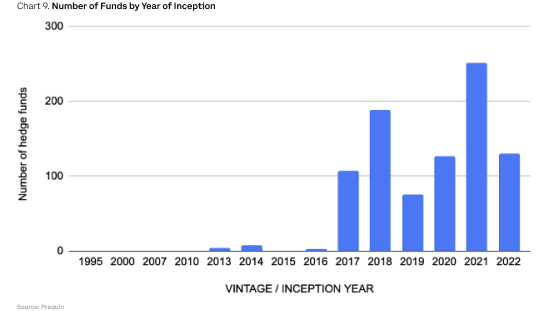

We have seen hundreds of new crypto hedge funds emerge over the past five years, and there are now around 1,000 funds being tracked across different data providers. However, many funds are still trading proprietary capital or have AUM below the required SEC reporting limit, so finding robust data can be challenging. In this section, we pull data from multiple sources including Preqin, HFRI, NilsonHedge, and Galaxy’s VisionTrack to paint a broad picture of how crypto hedge funds are constructed across the industry today.

While the space is still young, Preqin data shows us that nearly 300 crypto hedge funds launched prior to 2020, suggesting that there are a robust number of funds with at least a 3-year track record. This is a positive trend for the industry as the 1-year and 3-year track records are key milestones for institutional allocators.

Following the success of many early “crypto-native” funds launched in 2017-2018, many of the largest traditional hedge funds prepared to launch their own dedicated crypto strategies in 2021-2022.

In crypto, they recognized the emergence of an alternative market, new alpha sources, and new ways to grow their business. On top of that, funds see crypto strategies as a means to attract and retain employees, as many talented developers, engineers, and investors have been moving to the space. Coinbase’s Q3 shareholder letter (page 14) discussed this trend, noting that 25 of the world’s 100 largest hedge funds have onboarded to our Coinbase Prime product.

Many of the funds that launched in the bear market of 2018 were extremely well positioned coming into the 2020 bull market. Naturally, their businesses grew and evolved alongside the crypto industry, and they now offer multiple strategies. For example, one very well known fund established in 2018 is now a full platform with more than $800M under management and has an investment team of more than 30 professionals ranging from protocol smart-contract engineers to systematic trader/PMs and in-house counsel. This particular manager launched its first venture fund in 2018, followed by a liquid token fund launch in 2019-2020, and a market neutral strategy in 2020. It is now raising capital for a second venture fund. This manager has attracted institutional-quality limited partners from pensions, sovereigns, endowments, and major family offices. Over the full cycle, they developed robust risk-management processes, redundant counterparty operations, and strong compliance programs and fund administrators. Importantly, they returned ample capital to early LPs, allowing them to ride out the 2022 bear market with a clear understanding of the volatility of the asset class.

Galaxy’s VisionTrack public dataset shows us that as of December 2022, nearly $93 billion of funds are dedicated to crypto hedge and venture funds (Table 2). Venture funds dominate with 62% of that AUM, while hedge fund structures hold 13% of AUM, or roughly $12 billion.

Fundamental long-only hedge funds have garnered the lion’s share of hedge fund assets, with over $9 billion in AUM. This suggests that investors are comfortable with directional risk in crypto and prefer to have exposure to potential price appreciation.

Putting performance into perspective

Allocators must ask a few important questions when considering adding an actively managed strategy to their overall portfolio:

- Does the manager possess the requisite skills to generate alpha?

- Is that alpha worth the fees and risk?

- Is the strategy diversifying to the rest of the portfolio?

When it comes to crypto, bitcoin seems to be a natural benchmark to measure market beta. To explore the potential for alpha, Chart 11 compares the performance of multiple hedge fund strategies and bitcoin (orange line) over time.

Since 2017, multiple crypto hedge fund indices have shown outperformance vs. a passive bitcoin long-only strategy at different periods.

Since 2020, a long-only bitcoin strategy would have generated the highest peak returns, but also suffer the sharpest drawdown.

Over the longer term, strategies like systematic trend, multi-strategy, and market neutral offered better downside protection coming into 2022 and 2023, leading to outperformance vs. long-only over time.

The indices above are constructed by Prequin and represent the combined returns of more than 200 crypto hedge funds in aggregate. They are adjusted to control for survivorship bias, reflect audited returns, and are presented net of fees.

Looking at Galaxy Digital’s VisionHill custom benchmark data, which begins in January 2018, we see a different set of hedge fund strategies outperform passive long-only (Chart 12 and Table 3). Differentiating between long-only, long-bias, and market neutral strategy selection will further add to the ability to capture alpha.

How should we think about diversification?

A key question we want to answer is how crypto is increasingly becoming recognized as a potential source of alpha and as a diversifier. From a diversification perspective, it’s important to look at correlations of crypto (using BTC and ETH here) against a broad set of traditional asset classes, including bonds and commodities, and against common factors like inflation and volatility (ie: VIX). Taking a wider aperture allows investors to see true diversification across the portfolio, not just against equities, and is in line with how they consider traditional allocations. It also informs why macro and CTA strategies are increasingly adding bitcoin trading to their strategies.

Additionally, new concepts like “structural diversification” must be considered. Crypto trades 24 hours a day, 7 days a week, 365 days a year, and is inherently “detached” from the traditional economic system (ie: banking system). So naturally, one should expect there to be a unique set of factors driving volatility. Thus, crypto is an excellent tool for expressing risk or hedging large tail events when there are few other options available.

For an example, take the current banking crisis, which kicked off in earnest in March 2023. This crisis, as many do, intensified over a weekend. If you overlap the charts, bitcoin clearly responded as a preferred risk-off vehicle for investors who feared contagion in the US banking system.

The idea of crypto as a broad diversifier should allow us to think about how the asset class is an orthogonal risk to spread shocks, rate shocks, inflation surprises, and more.

Chart 13 shows that BTC and ETH have roughly 0.5 correlation to the S&P 500 equity market, but near 0.1 to zero correlation to commodities, CPI, and negative correlation against US bonds and the VIX.

To dig deeper into correlation metrics, we can utilize NilssonHedge’s rolling 21-day correlation and beta measures of different traditional hedge fund strategies vs bitcoin. Here we can see that equity market neutral (Chart 14) and CTA strategies (Chart 15) generally have negative correlation and near zero beta vs. bitcoin exposure. The interpretation here is that a crypto hedge fund strategies may offer diversification to a traditional hedge fund program with market neutral or CTA strategies.

However, a traditional hedge fund book with equity long-short (Chart 16) and event driven strategies (Chart 17) exhibit low beta but strong positive correlation to BTC. As of March 2023, we are seeing correlations turn over substantially, a trend that may not persist, but should pique the interest of hedge fund analysts researching this space.

Meanwhile, looking at traditional equity long-biased hedge fund strategies (Chart 18) and energy/commodities strategies (Chart 19) shows us that crypto hedge funds have a positive correlation combined with very high beta. This suggests that a crypto hedge fund may not be a good diversifier, but rather may be a potential alternative to equity long bias.

What conclusions can we draw from this? A crypto hedge fund looks to be potentially diversifying against the majority of traditional hedge fund strategies, including CTA, macro, relative value, but excluding equity long bias and commodities. This might suggest that reducing equity long bias in favor of a crypto strategy may be a good use of risk-capital allocation that would add to a hedge fund book’s overall volatility, without adding any of the same exposure.

Comparing risk-adjusted returns

Risk metrics such as Sharpe ratios, Sortino ratios, skew, kurtosis, and percentage of upside/downside capture help to round out performance data so it is comparable at the strategy or fund level. With a full peak-to-trough market cycle (2018-2022) behind us, and hundreds of hedge funds reporting performance, we can make fairly accurate comparisons.

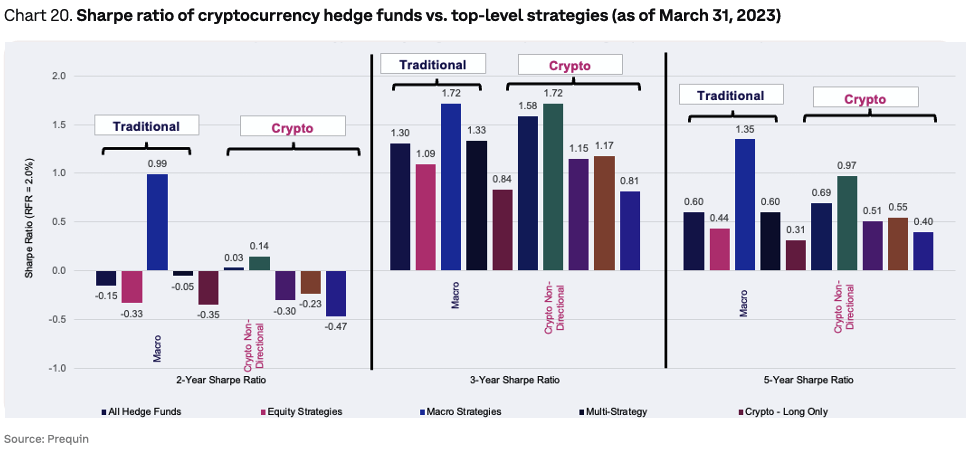

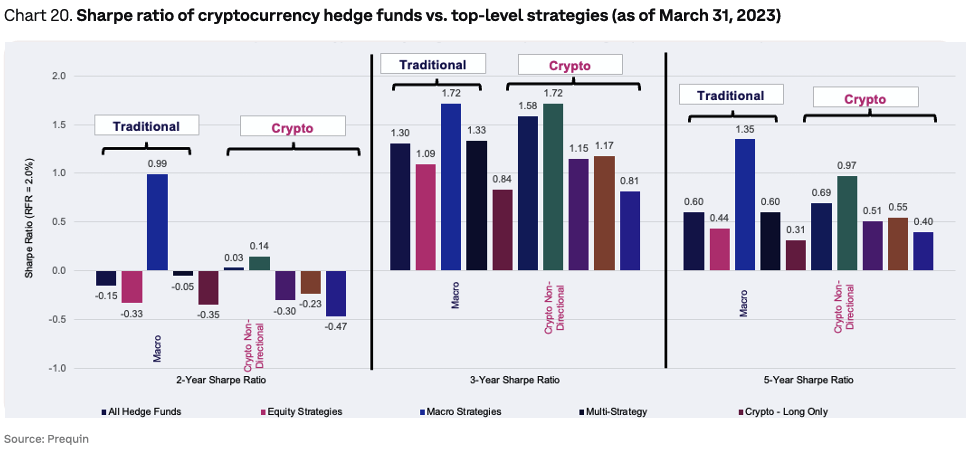

Preqin data comparing Sharpe ratios shows us that over 2-year, 3-year, and 5-year horizons, the aggregate crypto multi-strategy and hedged strategies had meaningfully better risk-adjusted performance than certain TradFi strategies, such as equity long-biased and traditional multi-strategy. Interestingly, even amidst the substantial up and down swings, none of the crypto strategies were large outliers, on risk-adjusted basis. Macro/CTA strategies are the only two strategies in this data set that materially outperformed crypto on a risk-adjusted basis across all these time periods.

Data in Chart 20 would suggest that crypto can be not only a diversifying and uncorrelated position in the portfolio, but it may even offer improved risk or capital allocation options compared to many traditional equity long-bias strategies. However, as the old saying goes, “you can’t eat Sharpe ratios,” and allocators need to actually pick a strategy and a manager if they want to invest in crypto. This is where things get tricky.

Decoding dispersion

Looking again at NilssonHedge, we see that dispersion at the manager level was truly in a league of its own in 2022, and it continues to be in 2023. Charts 21 and 22 show manager performance at the bottom quartile, top quartile, and median level in 2022 and in 2023, year-to-date.

This view clearly shows 2022 was an anomaly in terms of performance for all hedge fund strategies, and 2023 is starting to look much healthier and positively skewed.

Still, the difference in performance between top- and bottom-quartile crypto hedge funds is around 40% year-to-date, as of May 2023, compared to 1%-5% in traditional strategies. Manager selection really matters in crypto.

Generally when dispersion is high, manager selection must be one of the most important factors in generating above-average returns (and avoiding blow-ups). When manager dispersion is low, strategy selection typically matters more (e.g. choosing to go fundamental or quant directional vs. market neutral).

Chart 23, which measures month-over-month manager dispersion since 2018, shows that there is a wide dispersion between top (blue) and bottom (red) quartile managers that has persisted throughout both bull and bear markets for crypto.

High manager dispersion within strategies themselves may indicate idiosyncrasies within the strategy or the asset class that will impact an allocator’s decision to go with one manager over another.

Another interesting facet of crypto hedge fund strategies is the immense positive skew. Looking at the HFRI Cryptocurrency Index (Chart 24, red bars), we can see return distributions spread out across both tails, with very little concentration in the belly. This is a very different distribution of performance than traditional hedge funds, which cluster in the middle, and actually have a negative skew.

For crypto funds, there is a healthy skew towards the 20+ side, suggesting the positive tail of returns can be meaningfully better than the negative tail.

Crypto hedge funds are also largely able to capture positive market moves on a daily basis. Chart 25 shows the aggregate crypto strategy is on par with TradFi, capitalizing on 60% to 70% of the market’s up days.

Investment and operational due diligence

In February 2023, Coinbase and other key industry players partnered with the Alternative Investment Management Association (AIMA) to publish a new set of due diligence questionnaires (DDQs) for digital-asset investment managers and funds (available here).There are two modules that address digital-asset open end funds and closed end funds that may apply to hedge funds, venture funds, and hybrid vehicles.

The release is timely given the increased scrutiny of the risks involved when allocating to digital assets and investors’ heightened demand for transparency. These DDQs have been primarily designed for investors to evaluate the unique investment and operational risks that come with allocating to digital-asset investment funds. They can also help managers meet investor demands for transparency more efficiently by creating a standard, comprehensive template for information sharing.

Below is a brief overview of the areas where the DDQs can help allocators, as well as some suggested questions to ask during the due diligence process.

- Trading strategy - Does the fund invest in token warrants, side letters, use liquidity pools, or engage in staking? How does the fund allocate returns of the same investments across these different vehicles?

- Trading infrastructure - How many centralized and decentralized exchanges does the fund utilize for liquidity. What redundancies exist should the exchanges fail?

Trade execution - How does the fund measure price movement given crypto trades 24/7/365 and has no closing price?

- Counterparty risks - What is the process for evaluating counterparty risk across exchanges, liquidity pools, and lending agreements?

- Risk management - What is the process for managing risk over nights and weekends? How does the fund set targets that trigger risk-off moves or hedging?

Team, research process, deal evaluation - How do the fund and its members evaluate new opportunities?

- Performance measurement - Does the fund provide daily or monthly performance numbers? What benchmarks are used and why are they appropriate for the investment style?

- Use of leverage - Crypto is already highly volatile, if the fund uses leverage, how does it control for excess volatility?

- Fund service providers - Will the fund allow the LP to speak directly with all service providers during due diligence?

Comparison of key operational differences

There are three fundamental differences between digital asset hedge funds and traditional hedge funds:

- The underlying assets traded

- The infrastructure required to trade and manage risk, and

- Regulatory matters

Focus | Crypto hedge fund | TradFi hedge fund |

|---|

Strategies | Directional/fundamental long only, quant/systematic, market neutral, multi-strat, credit, medium/high latency HFT. Note: low latency HFT not prevalent yet in crypto due to infrastructure limitations. | Directional/fundamental long only, quant / systematic, market neutral, credit, multi-strat, CTA, event driven, macro, relative value, risk parity, low latency HFT |

Asset types traded | Tokens, stablecoins, perps, futures, options, NFTs, structured products. Note: every service provider supports a different suite of assets due to the listing process. | Equities, credit, derivatives, FX, futures, options, structured products |

Custody | Qualified custodians and prime offerings, self-hosted wallets, custody infrastructure solutions, multi-party computation, smart contract wallets, permissioned and permissionless access, anonymous users. | Regulated, qualified custodians, and prime offerings. All users KYC’d. |

Fund admin and audit | Crypto-dedicated fund administrators and auditors are somewhat new, and must build technology to handle new asset types. Depend heavily on managers to share on-chain data from self-hosted wallet access. Some brand names, such as KPMG, Deloitte, and others. | Robust fund administration and audits by brand names. |

Domicile and jurisdiction | Most funds list in Delaware and Cayman with a typical master feeder structure. Increasingly Singapore, UAE, Switzerland, Bahamas, UK, Luxembourg, Hong Kong, and other more crypto-friendly jurisdictions are being utilized. | Primarily Delaware and Cayman |

Regulation | Investment Advisers Act of 1940 applies. Many hedge funds are still under the exemption given small size. | Most funds are registered with the SEC. |

KYC and AML | Funds that use U.S.-regulated exchanges are fully compliant (e.g., Coinbase US). Funds that use decentralized exchanges (DEX) or non-U.S. exchanges are engaging with users outside the U.S. regulatory regime. | All funds, counterparties, and trading venues are covered under existing regulations and licenses. |

Fees and expenses | Most are between 1.5/15% and 2%/20% | Most are between 1.5/15% and 2%/20% |

Counterparty risk | Certain strategies have high counterparty risk, while others have low counterparty risk. Most hedge funds must use multiple infrastructure solutions and must keep collateral deposited at different exchanges in order to trade. | Counterparty risk is generally low for exchange-traded assets and OTC assets traded against major dealers. |

Nuances of crypto hedge fund strategies

Digital asset hedge funds generally fall within five categories:

- Discretionary long-only fundamental

- Long bias (fundamental or quantitative/systematic)

- Systematic trend or momentum (long bias/long-short)

- Market neutral or relative value

- Multistrategy

Directional strategies: Long only and long biased strategies

Long only and long-biased strategies are directional strategies that expose the investor to the crypto economy using a variety of products, including spot tokens, derivatives, options, and sometimes public equities or bonds of crypto proxies. Many crypto hedge funds also have an allocation to private deals (directly in the fund strategy or via side pocket) where a token warrant or option is included. This gives the fund the ability to acquire said token for a lower price at its launch on a future date.

Long only and long-biased strategies can be fundamental or systemic in nature.

In fundamental strategies, funds are typically active users of the protocols and combine deep fundamental research with active community engagement, participation in DeFi protocols, governance voting, gaming, staking, and more. As such, some of these fundamental strategies might start to look like venture capital investment styles that take a very active participatory role in early stage protocols. This strategy might be considered a “hybrid” style that blends a hedge fund structure with tools a venture capital firm uses. Fundamental strategies might be limited in their hedging capabilities and instead have to “go to cash” in order to manage risk during high volatility periods.

In systematic strategies, funds will blend a base layer of fundamental research with automation, applying structured data, machine learning algorithms, and scalable trading infrastructure to create a portfolio that might include a blend of 60% systematic, 30% fundamental long, and 10% derivatives. The opportunity with these strategies is that they offer more control over risk management and lower volatility than a purely fundamental strategy. It would not be uncommon to see a systematic strategy targeting 30% volatility when bitcoin has more than 70% realized annual volatility. Systematic strategies may also have the ability to more actively hedge short-term price movements using options, futures, or perps. Most frequently, this would be done using short to mid-horizon frequency models built on crypto pricing data.

Regardless of style, funds generally start with a universe of the top 250 tokens by market capitalization and volume; however, larger funds may limit their activities to as few as the top 10 tokens due to liquidity constraints. They will then implement a few different trading strategies using their universe of tokens. Below is how those might break down inside a typical portfolio.

Trade strategy | Time horizon | Portion of typical portfolio |

|---|

Thematic | Long term (1-3 years) | Small |

Best idea | Medium term (3-6 months) | Majority |

Tactical trade | Short term (minutes to a day or few weeks) | Small |

Hedged strategies: Long/short, relative value, and market neutral strategies

Hedged strategies seek to capture returns within the crypto economy while having low or no directional risk. They are typically absolute-return oriented, are quant/systematic implementations, and seek to generate positive returns vs cash. Ideally a true market neutral strategy will avoid losing money in all market regimes.

Crypto market neutral strategies rose to prominence after Defi summer 2020 as they were able to capture substantial yield opportunities, many times north of 20% annualized returns through a combination of yield farming, staking, lending and long-short hedged strategies. The extremely healthy returns ended however once the excess and recursive leverage exited the crypto ecosystem after the collapse of firms like Celsius, BlockFi, 3AC, and the collapse of the Terra stablecoin.

Today, crypto market neutral still employs these strategies and can generate healthy returns that remain uncorrelated, however the depth of market is severely impacted and investors are wary of unregulated offshore exchanges. Liquidity deep in the alt coin universe is challenged, limiting the size of trades that can be done and limiting how much capital a market neutral strategy can actually manage. The largest truly market neutral strategies today remain less $50 million in AUM. Trading long-short which generally involves going long a spot token and selling a perp or futures contract across multiple exchanges is not without risk – as we saw from the collapse of FTX, which left a whole in many market neutral funds who were trading there.

The market infrastructure is healing and building redundancy and investor protections into their core model. Coinbase’ International Exchange just launched in Bermuda will be the first regulated perps exchange managed by a publicly traded company. We expect this new exchange to fill a major gap in the market today, making market neutral strategies once again a popular tool for investors. Another popular version of market neutral that does not require investors to use offshore exchanges would be offsetting a spot position with CFTC-regulated futures contracts, such as those available with CME Group or Coinbase Derivatives Exchange.

Multi-Strategy and fund of funds

The goal of multi-strat and fund of funds strategies is to blend specific exposures between hedged and directional strategies in order to diversify exposure, manage risk, and harvest a more diversified suite of returns.

For example, a fund of funds might combine 10-15 managers across traditional hedge fund and crypto hedge strategies or include only crypto strategies. A crypto only fund of funds would have multiple directional managers ranging from fundamental to systematic, with different focus areas on Web3 technology and sectors, and also have different levels of target volatility between them. A multi-strat would blend directional risk via spot and derivative tokens, mid frequency and high frequency trading, and market neutral type strategies such as cross-exchange arbitrage and long short. These fund offerings may even include opportunistic direct investments via side cars.

The fund of funds structure may be beneficial for Allocators for a few reasons. First, finding the top managers in this emerging asset class with the appropriate technical understanding is still quite challenging. The US has many great managers, but many are increasingly offshore due to the challenging US policy situation which makes finding them geographically even more difficult. Additionally, the fund of funds might also employ an active risk management strategy to hedge downside risk with futures or options, in turn dampening volatility and lowering correlations among different tokens.

One drawback to appreciate on fund of funds is the extra layer of fees that many allocators have shunned in the traditional hedge fund landscape. However, we expect this layer of excess fees to be warranted for crypto given the complexity and volatility of this new asset class. Another consideration with using a fund of fund model would be that it limits an allocator from placing their highest conviction bet on a single manager, which typically is a preferred approach for allocators who invest in the best.

Fund structures are evolving

Using Preqin data, we can see that roughly 25% of all funds reporting have a high watermark, and hurdle rates range from 4.5% to as high as 20%. Lock-up periods range from one month, hard or soft, to as high as 36 months hard. We have seen some hedge funds take a venture approach, with lockups in excess of five years, but this is rare. Redemption periods range from daily to annually, but most hedge funds have a one-month redemption policy.

Nearly all hedge funds have fee structures similar to the 2% management fee/20% performance fee model, with crystallization after a lock-up expiry. We are increasingly seeing hedge funds that have a “liquid venture” model. These strategies might employ a three-year lock up with crystallization at Year 3 and quarterly liquidity thereafter.

Many hedge funds, and most venture funds, regularly utilize side pockets to take advantage of the multitude of unique direct and coinvestment opportunities available in this emerging market. The use and timing of side pockets impact the performance of existing investors in a specific series. Given that so much of the crypto space remains an emerging technology, having a venture strategy attached to the hedge fund can be an important tool to capture one-off idiosyncratic opportunities.

Recently we have also seen the emergence of dedicated actively managed accounts, where large allocators can deploy meaningful capital directly in their accounts at Coinbase and have it actively managed on their behalf.

This affords allocators more transparency and control over the terms and allows them to invest a meaningful dollar amount for the time spent. Given the relatively small size of most crypto hedge funds today, the largest allocators would consume the overall allowable size of the fund with the standard minimums. Many of the largest crypto hedge fund managers with robust operations and investment teams are now ready to offer dedicated accounts for allocators looking to put more dollars to work.