A note from the author

The dramatic events of 2022 will shape the crypto landscape for years to come.

Yet, despite the uncertainty surrounding the potential fallout, there are important characteristics that distinguish this market from the previous crypto winter. For one, institutional crypto adoption remains firmly entrenched. Many investors take a long-term perspective and recognize the cyclical nature of these markets. Rather than stepping back, they are using this environment to hone their knowledge and build the infrastructure to prepare for the future.

But no one is arguing that digital assets haven’t faced an important setback. The total market capitalization of cryptocurrencies is currently around US$835 billion, down 62% from $2.2 trillion at the end of 2021, albeit still high relative to most of the asset class’ history. Comparatively, the Nasdaq is down 30% since the end of 2021 and the S&P 500 down 18%.

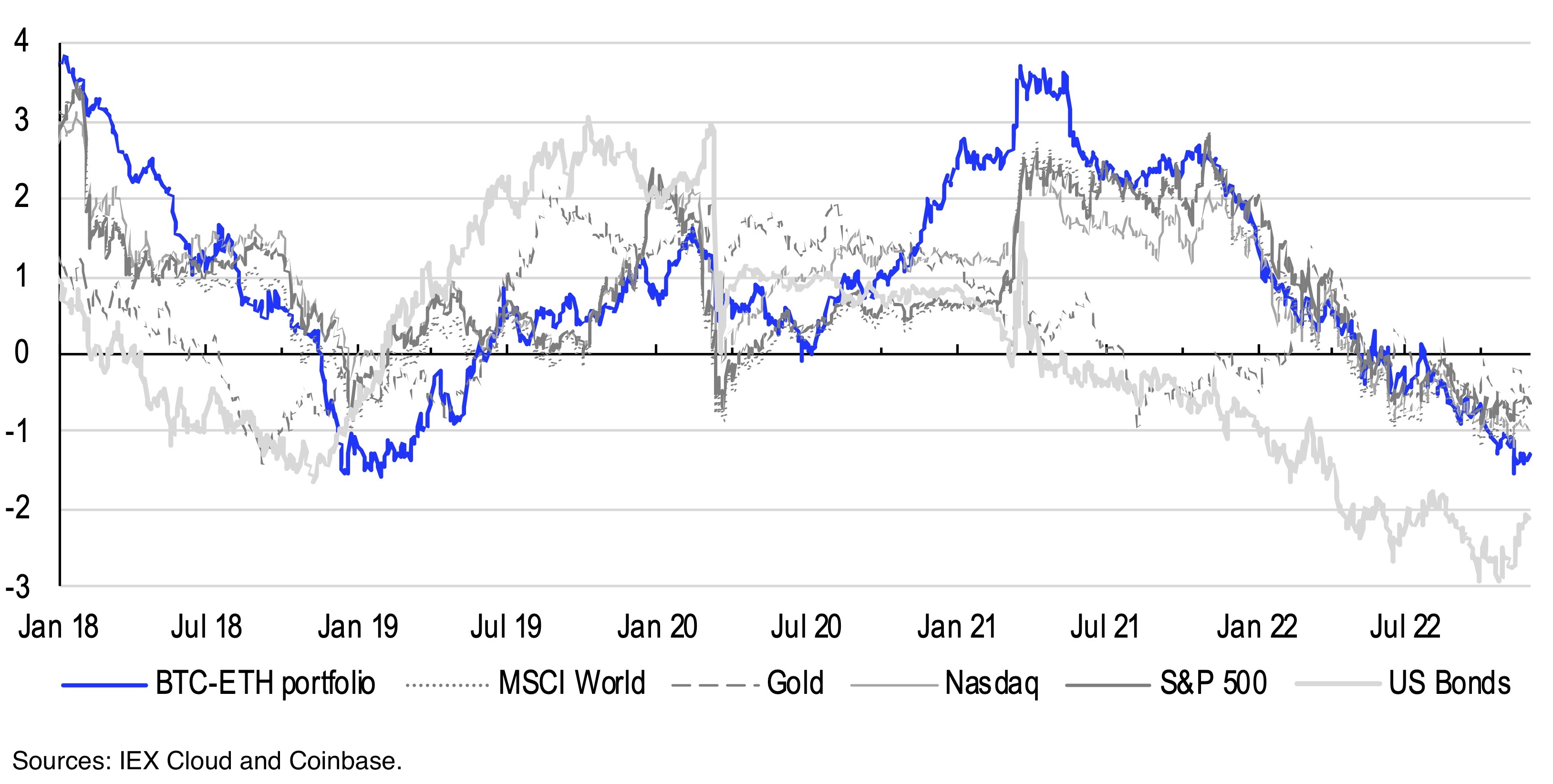

From a Sharpe ratio perspective however, crypto’s risk-adjusted return actually performed in line with US and global stock indices through 2022 and did much better than US bonds. Prior to the fallout in November, an equally-weighted basket of BTC and ETH offered a negative Sharpe ratio of 1.08 compared to an average negative return of 0.90 for US stocks. This is a significant deviation from the trend observed in the last crypto winter, when digital assets underperformed nearly all traditional risk assets for the duration of 2019 and into early 2020.

1. Rolling 1y Sharpe ratio

The differences between these periods may also be observed in the prospective fallout from the latest crypto downturn. For instance, we expect greater calls for regulatory clarity to emerge, as institutional investors push for better governance and standards to help make the asset class more accessible, safer, and easier for all to navigate. This will take time however, as the industry puts lessons about systemic deficiencies in the right context and applies the necessary risk controls to protect its customers.

Looking ahead, we believe the evolution of the crypto ecosystem is putting subjects like tokenization, permissioned DeFi, and web3 front and center. Meanwhile, bitcoin’s core investment thesis remains intact, and Ethereum seems to be outpacing its layer-1 competition in terms of network activity. We are seeing a greater variety of use cases for non-fungible tokens outside of art, like using NFTs to certify and authenticate real world assets or as ENS domain names. Stablecoins are now one of the largest sectors in the crypto ecosystem with an outsized role in storing and transferring wealth.

We discuss these trends and many more in the enclosed report, starting with the key themes we expect in 2023. If you have questions about our work or want to understand how Coinbase’s institutional practice can help your firm engage with the crypto markets, please contact us at institutional.coinbase.com.

David Duong, CFA

Head of Institutional Research

Key themes for 2023

The constant stop-and-start pattern of financial markets in recent months has made it difficult for allocators to deploy capital in a meaningful way for most asset classes. But for crypto in particular, the insolvencies and deleveraging events of 2022 have culminated in a confidence crunch that we believe could extend the downcycle for at least several more months. Constraints on liquidity may also disrupt normal market operations in the short-term as many institutional entities reckon with assets being locked up in FTX’s bankruptcy proceedings.

However, it is not all bad news. This environment has helped cryptocurrencies pull back from their speculative fervor and paves the way for new innovations in the asset class.

Against this backdrop, we expect three key themes to prevail in 2023:

1. A flight to quality among institutional investors

2. Creative destruction that will eventually lead to new opportunities

3. Foundational reforms that usher in the next cycle

Below, we outline those themes, as well as the trends that we expect will drive each of those ideas forward in the year ahead.

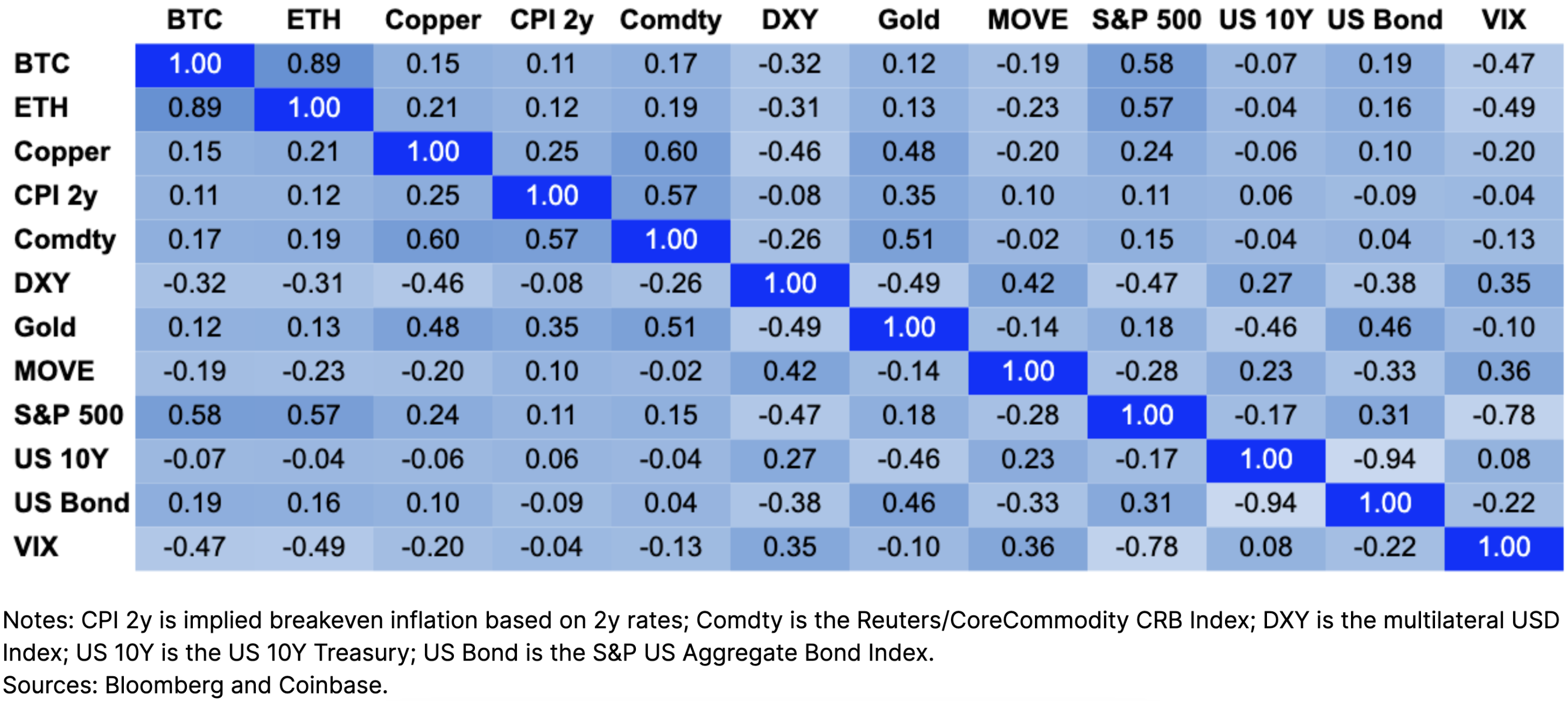

Correlation matrix (1y window)

Flight to quality

Digital asset selection to favor higher-quality tokens

Institutional investors have already scaled back their capital deployment to most risk assets in 2H22 due to rising interest rates, high inflation, and weak equity earnings. That retrenchment was happening even amid assumptions that a future recession in the United States (US) could be mild. Expectations on recession timing span from early 2Q23 to as late as 1Q24, as stimulus-backed reserve buffers and a still sizable number of job openings reinforce the economic data.

Within crypto, we expect digital asset selection will transition towards higher quality names like bitcoin and ether based on factors like sustainable tokenomics, the maturity of respective ecosystems, and relative market liquidity. Moreover, many traditional risk assets still seem rich, and the investment theses for cryptocurrencies like BTC and ETH have not fundamentally changed in our view, which could eventually open up some key value opportunities. That said, we assign a low probability that crypto performance will decouple from traditional risk assets in the first few months of 2023, particularly without a differentiated catalyst.

3. Long-term holders of BTC at 85%

Reinforcing the ETH narrative

With the recent proliferation of alternative layer-1 blockchains, the marketplace for L1s has become saturated, leading many in the crypto community to question the need for additional blockspace. Ethereum’s successful Merge of its consensus and execution layers in September 2022 has also strengthened the case for ambitious future upgrades, despite the trend towards long-term core protocol ossification. In our view, this supports the fundamental narrative for Ethereum as a leader in a multichain world, particularly since nearly all networks are competing for the same pool of users and capital. Some chains/ecosystems are doing better than others, and we believe user and developer activity will aggregate to a smaller number of chains in 2023 compared to 2022. However, Ethereum’s dominance could still be challenged in other ways, as the network relies on layer-2 scaling solutions to extend its blockspace, which have their own set of risks. This includes centralized sequencers, a lack of fraud proofs and a lack of cross L2 interoperability, to name a few.

Growth of a decentralized future

The movement towards self-custody and decentralized finance (DeFi) protocols (i.e. decentralized exchanges or DEXs) will likely accelerate after the developments in 4Q22. Many industry players believe that the transgressions in the crypto space in 2022 were concentrated among CeFi (centralized finance) or CeDeFi (a combination of both CeFi and DeFi) entities, such as Celsius, Three Arrows Capital (3AC), and FTX. Mainly, the actions of these bad actors come down to issues of trust and transparency, which DeFi has historically handled well given its on-chain, auditable properties. Of course, DeFi comes with its own risks like smart contract exploits, which could put more scrutiny on how different decentralized applications are managing their protocol risks. Also, rules-based margining embodied in smart contracts needs to account for the fact that the volatility of certain digital assets can be anywhere between 50-200%, while control of the token supply is not always clear, thus affecting their true liquidity.

4. Monthly volumes across all DEXs

More interest in permissioned DeFi

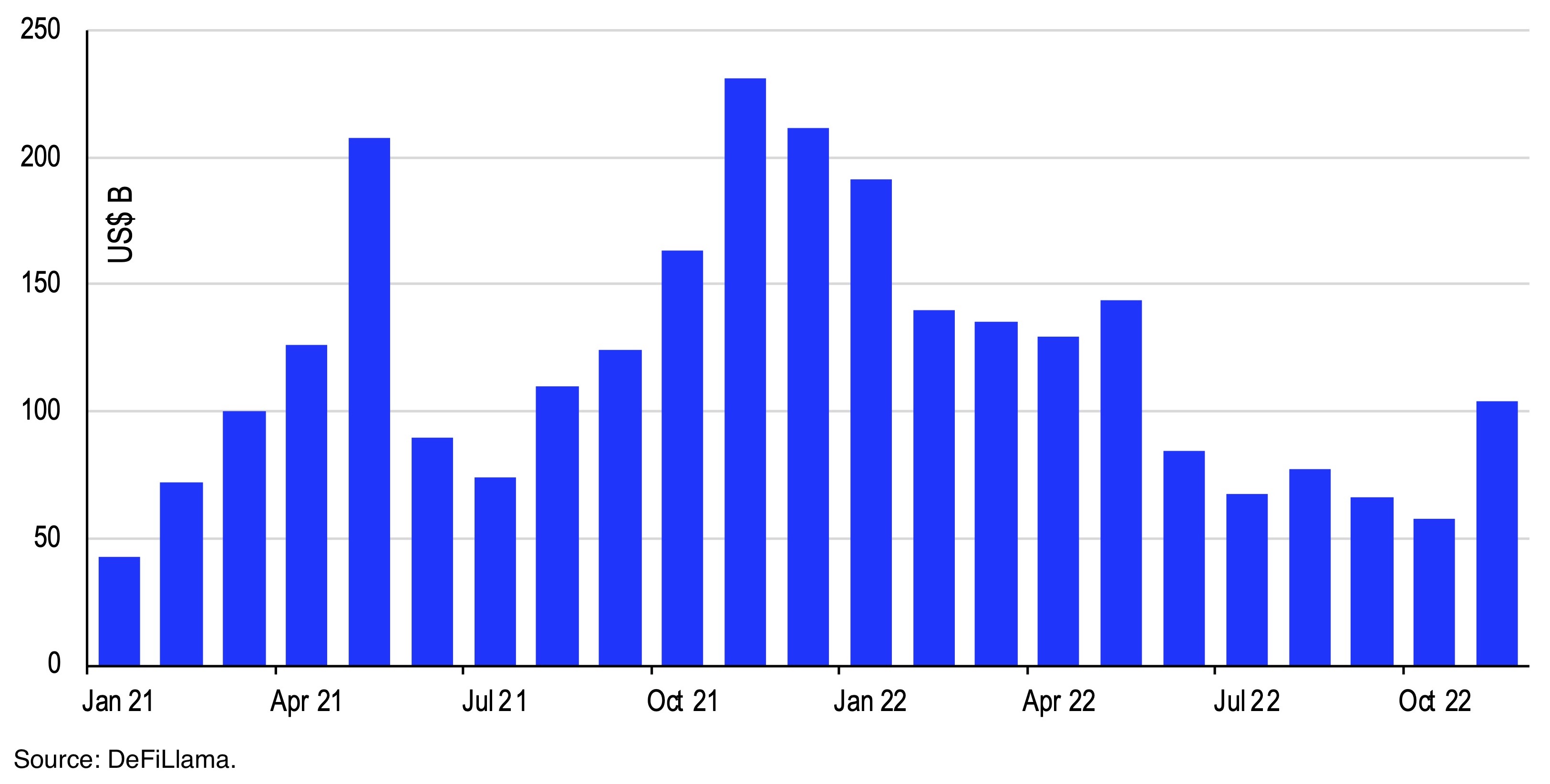

Overall activity in DeFi retreated from a peak of $180B in total value locked in December 2021 to $42B at the end of November 2022. Although this is primarily due to the deleveraging associated with the collapse of centralized crypto lenders like Celsius, relative yields in DeFi from borrowing and lending have fallen behind ostensibly risk-free rates in traditional finance (e.g. US Treasury bills). Consequently, we may have seen an end to the hyper optimization of yield seeking behavior by crypto native users, at least for now. In our view, this could be a precursor to seeing more decentralized applications (dapps) adapting their platforms for permissioned DeFi activity as regulated institutional entities seek more involvement in this sector.

We would expect to see greater demand for permissioned or “enhanced” DeFi that marries institutional grade compliance standards with code-enforced transparency. This could have compelling use cases for settlement and cross-border payments alongside innovations in the tokenization of real world assets. Permissioned DeFi would likely target different use cases and solve for different problems (like undercollateralized credit) compared to permissionless DeFi. In the short term, that could mean markets may price permissioned liquidity pools (that are compliant with anti-money laundering or AML/KYC regulations) differently from the permissionless liquidity pools used by non-institutional participants. However, over time, we believe that users and regulators may find ways to consolidate these via web3 primitives like decentralized identity to enable the best of both worlds.

5. Total Value Locked (TVL) in DeFi vs US 3m T-bill yield

Tokenization vs tokens

While the concept of tokenizing real world assets (RWA) is not new, it has gained significant traction in recent months among financial services providers as a means of resolving the inefficiencies inherent in traditional securities settlement. For some institutions, tokenization is a less risky way of having crypto exposure compared to investing directly in tokens. Whatever the reason, it’s important to note that tokenization lacked similar support among such entities in the previous 2018-19 crypto winter. Instead, banks are currently utilizing tokenized versions of financial instruments across several institutional DeFi use cases, often via public blockchains.

Societe Generale issued OFH tokens based on AAA-rated French home loans that can be used as collateral to borrow up to 30M DAI, while JP Morgan, DBS Bank, and SBI Digital Asset Holdings traded tokenized currencies and sovereign bonds in early November 2022 via Polygon. Other similar entities have pilots to tokenize wealth management products and other securities. That said, we think the scope of these efforts are unlikely to expand beyond financial instruments for the time being, as the RWA total value locked on Ethereum has declined to $612M after peaking at $1.75B in 2Q22. Part of the reason is that while issuers are resolving the financial and legal hurdles to tokenizing other less liquid real world assets like real estate, the market for these is still underdeveloped.

Areas for creative destruction

Lower liquidity spiral

Meanwhile, we think investors’ willingness to accumulate altcoins has been severely impacted by the deleveraging in 2022 and may take many months to fully recuperate. Newer projects have been hit particularly hard by recent events. In particular, some of these protocols loaned out their tokens to market makers who had used FTX as a liquidity pool. Overall, market depth has come down sharply across exchanges, according to Kaiko (November 14, 2022). Those projects must now wait until bankruptcy proceedings are finalized in order to recover their assets, meaning they may be unable to access a big part of their treasuries’ native tokens for several years. This could have important implications for developer retention and future application development.

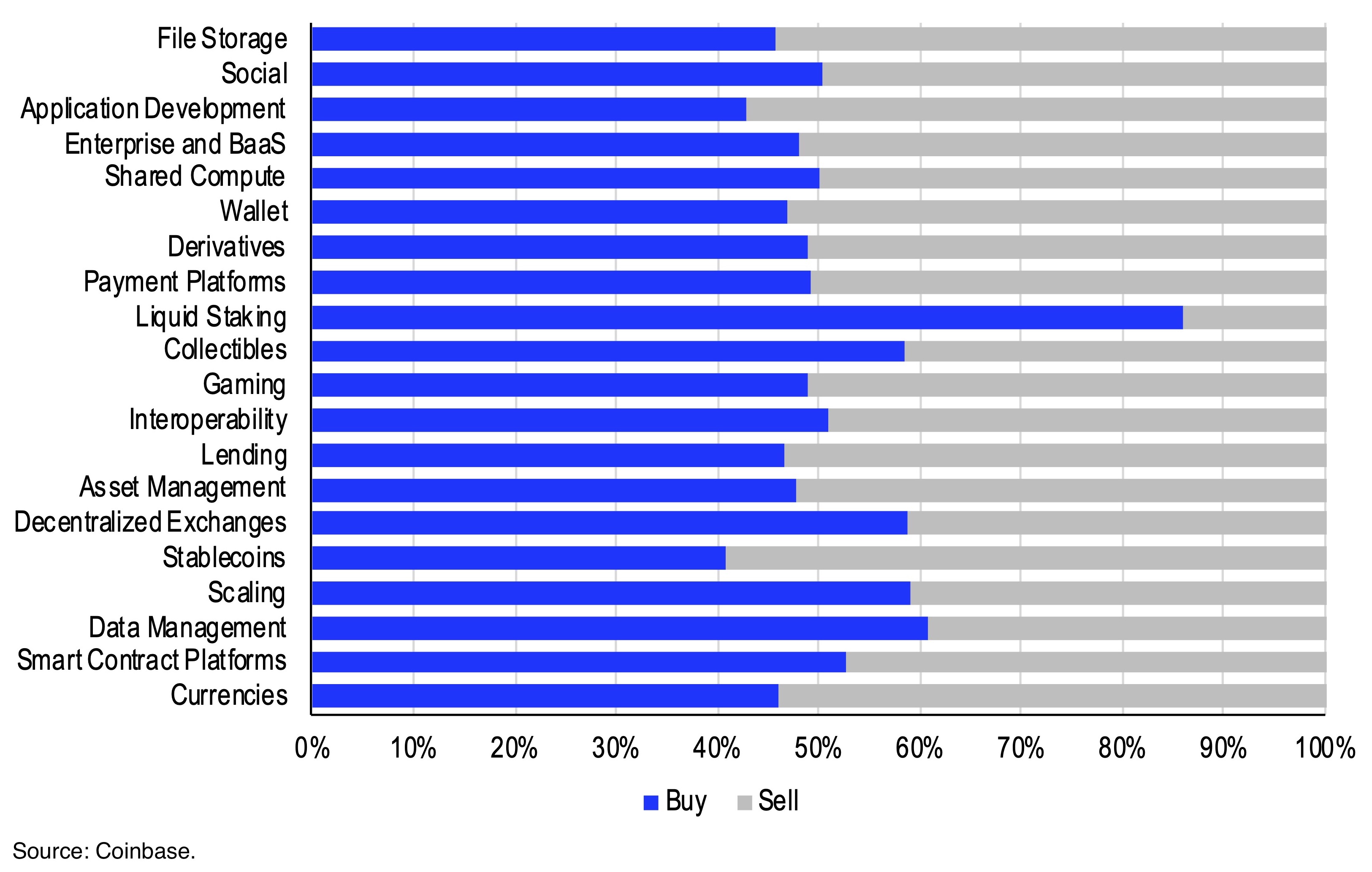

6. Sector flows on platform

Bitcoin miners’ capitulation

The precarious economic conditions for bitcoin miners appear unlikely to improve in the near term amidst continued weakness of broader crypto markets. Recent Glassnode data (November 18, 2022) suggests bitcoin miners are selling ~135% of coins mined per day, meaning miners are liquidating the entirety of their newly mined coins as well as portions of their BTC reserves. The events of early November prompted bitcoin miners to sell over ~8k BTC in the span of a week and aggregate miner reserves are back to levels last seen at the beginning of 2022 (~78k BTC). Outside of the continued pressure on bitcoin prices, elevated network hashrate and resultant mining difficulty are further complicating matters for miners.

Challenging conditions (such as higher input costs and lower output value), combined with elevated energy prices, have resulted in a highly stressed economic environment for bitcoin miners for the past several quarters. We’ve observed a number of signals of stress across the industry including Compute North filing for bankruptcy in September, Core Scientific indicating they were potentially heading towards bankruptcy and halting all debt financing payments in October and Iris Energy being forced to unplug a meaningful portion of their mining fleet after defaulting on a loan against their hardware in November. Should these conditions persist, we believe incremental uneconomical miners will eventually be forced to shut down and/or be acquired by more well capitalized players. For that reason, we would expect the bitcoin mining industry to consolidate even further in 2023.

7. Bitcoin Mean Hashrate (30 Day, EH/s)

Exploring new use cases for NFTs

It’s still early days for the NFT market, which has had its fair share of market volatility. Trading volumes are currently far below the peaks we saw at the start of 2022. But we believe that the technological underpinnings of NFTs represent important archetypes for how ownership and identity should function in the digital economy. Indeed, the community of builders, artists, collectors, gamers, and digitally-native consumers have started to broaden their scope towards the growing utility of NFTs. We believe the recent downtrends could be perceived as part of a healthy correction in the context of a broader trajectory of cyclical adoption.

Looking forward to 2023, the pressing question pertains to how subsequent waves of NFT adoption could manifest. There are no easy answers. It could be a resumption of the cultural relevance trends we saw in 2021 or an increase in global excess liquidity. More specifically, future participation could also be driven by new forms of utility outside of art/collectibles including digital identity, ticketing, memberships/subscriptions, tokenization of real world assets, and supply chain logistics. Of course, investing in NFTs comes with its own set of risks. The debate surrounding the enforcement of royalties at the token level may also pick up in 2023, as it is a hot button issue for the creator community. If royalties are increasingly ignored by market participants, we believe that it could threaten the adoption of the technology more broadly.

Foundational reforms to spur optimism

More urgency for regulatory clarity

We believe the next market cycle in digital assets will be shaped in significant part by the development of standards and frameworks for regulated entities. Clear guidance is necessary to avoid driving innovation to regions where regulatory requirements are weaker and customers may be at greater risk. In the US, we expect the new Congress to continue working on one or more of the current legislative proposals that had drawn bipartisan support, such as the Digital Commodities Consumer Protection Act (DCCPA), which would empower the CFTC to oversee spot markets in digital assets, and/or the McHenry-Waters draft bill on stablecoins.

The turmoil in crypto markets in 2022 has provided a sense of urgency among lawmakers to clarify which government agencies have oversight over what and to define the path forward on basic risk controls for crypto-asset activities. This will likely help resolve outstanding concerns over the less objectionable issues like collateral transparency in the wake of the FTX collapse. That said, we believe that policy makers should recognize that the problems faced this year were driven by human beings, not any unique aspect of crypto or blockchain technology. The regulatory framework should balance the need for reasonable standards for centralized entities with the need to protect the freedom to innovate at the base layer..

Reform of crypto lending practices

Borrowing in the crypto space has become incredibly challenging in 2022 as a result of all the credit that has been withdrawn from the system. Some of the historically largest digital asset lenders have gone bankrupt or are closed for business, as they face solvency risks if they are not rescued. We have previously commented on what we believe to be the proper approach to crypto financing including the first principles of managing credit risk. But also, many lenders were already impaired following the downfall of Celsius and 3AC in June 2022, so what’s happening in the post-FTX environment seems to be more of a continuation of that consolidation rather than renewed pressure on these entities.

More than likely, we will see a maturation of lending practices in the crypto space, including underwriting standards, appropriate collateralization, and asset / liability management. We expect lenders to perform more rigorous due diligence and stress test potential exposures in preparation for less turbulent markets in the future. Another theme for 2023 may be that the source of inventory in this space will move from a historically retail base to institutional investors. We believe it could take a few months for institutional credit to recover previous levels of activity, but borrowing will likely not be a challenge for credit-worthy, responsible borrowers. Notably, DeFi lending protocols such as Compound and Aave have remained fully operational in these conditions and defaulting institutions such as Celsius and 3AC repaid their DeFi loans ahead of all other creditors in order to withdraw their deposited collateral.

A path for institutional adoption

Despite widespread market volatility and lower trading volumes, we still witnessed broad institutional adoption of crypto in 2022 alongside the launch of many new partnerships. This isn’t to say that the market turmoil in 4Q22 hasn’t hit institutional involvement and confidence, which may continue into early next year. But a recent Institutional Investor survey (sponsored by Coinbase) suggests that investors believe crypto is here to stay, regardless of the poor price action in the short term or the unfortunate behavior of some bad actors.

Indeed, asset managers have continued to onboard crypto – albeit with added layers of due diligence on both the asset class and their counterparties – as they seek to have the infrastructure in place to transact digital assets in the future. Before that can happen, however, we still need to see a bottoming of the crypto markets, which may take time. It doesn't help that traditional financial markets haven't found their bottom yet either - they're still repricing on a downward trajectory, which may persist through 1Q23. On the upside, the stronger USD trend – a key constraint for holding many long duration assets – now appears more vulnerable than in early 4Q22, even if it’s not over.

8. Likely path of prices in next 12m?

Read the full 2023 Crypto Market Outlook here, or click the Download button at the top of the page.